- Topic

102k posts

64k posts

59k posts

56k posts

53k posts

46k posts

44k posts

43k posts

41k posts

- 10#NADA#

40k posts

- Pin

- What a night to remember at Gate.io’s #Private KOL Gathering# on the rooftop of W Hotel in Dubai! Crypto masterminds gathered for in-depth discussions and explored collaboration opportunities.

A big shoutout to everyone who joined us—thanks for making it an unforgettable evening! - 📢 Gate Post #TopContentChallenge# is coming! Post high-quality content and win exclusive rewards!

🌟 We will select outstanding posts for exposure, and help elevate your influence!

💡 How to Participate?

1.Add the #TopContentChallenge# tag to your post.

2.Posts must be over 60 characters and receiv

- 📣 Gate.io Post Crypto Observer Call to Action!

📈 Share crypto news & win great rewards daily!

💓 Don't hesitate, join now ⏬

1.Share daily crypto news, market trends, and insights into your post.

2.Include the #CryptoObservers# to successfully participate.

🎁 5 lucky "Crypto Observers" will be rewa

- 🔥 Join Gate Post Ambassador Points Task and Win Weekly $200 Rewards (11/11-11/17)!

👉️ Post to earn points and win a share of $200 based on your points, plus ambassador benefits!

👉 Sign up now: https://www.gate.io/questionnaire/5158 (Ends at Nov 11, 16:00 UTC)

🎁 Rewards:

Weekly Ranking Prizes:

🥇

- 🚀 The special episode of "Dr. Han, What Do You Think" is live!

🎙 Gate.io Founder & CEO Dr. Han takes on a rapid fire Q&A, covering work, life, and some truly tricky questions!

👀 How will he tackle these challenges?

🤩 Click to watch his real-time reactions, and join in the comments!

EMC Labs October report: monthly rise 10.89%, BTC may hit a new high after the chaotic U.S. election

The information, opinions, and judgments regarding the market, projects, currencies, etc. mentioned in this report are for reference only and do not constitute any investment advice.

Global macro finance reaches a turning point in turmoil in 2024.

With a significant decrease of 50 basis points in September, the US dollar has entered an interest rate cut cycle. However, with the US presidential election and global geopolitical conflicts, the US economic employment data has been 'distorted', leading to increased divergence among traders' judgments on the future market. The US dollar, US stocks, and US bonds have all experienced significant fluctuations, making short-term trading more difficult.

Divergence and concerns in the US stock market are reflected in the violent fluctuations of the three major indices without direction. On the other hand, BTC, which has a relatively lagging momentum, caught up in October, with a big pump of 10.89%, and made significant breakthroughs technically, taking down multiple important technical indicators and approaching the upper edge of the 'new high consolidation zone' again, once reaching $73,000.

BTC's internal structure remains perfect, ready for a thorough breakthrough. However, external factors are still being suppressed by the uncertain prospects of the US stock market before the election. But the election is only a short-term episode and will not change the cyclical trend. We predict that after the November election, through necessary conflicts and choices, the US stock market will recover and pump. If so, BTC will break through its historical high and start the bull run of encryption assets in the second half of the market.

Macro Finance: Dollar, US Stocks, US Bonds and Gold

In October, after a fall for 3 consecutive months, the US dollar index 'unexpectedly' rebounded by 3.12%, rising from 100.7497 to 103.8990, returning to the level of January last year. The reason behind this rebound is the 'Trump's victory', which traders believe will intensify the depeg between China and the US, push up inflation, and make it difficult to smoothly carry out interest rate cuts. We believe that this rebound has priced in the expectation of 'slowing down of interest rate cuts' beyond expectations, so it is difficult for the rebound of the US dollar index to continue.

Monthly Trend of the US Dollar Index

The expectation of "tax cuts" and "Sino-US depeg" in Trump's economic policy will inevitably lead to a further rise in the size of US bonds, with the increasing probability of Trump's victory, making the 2-year US Treasury yield rise by 14.48% and the 10-year Treasury yield by 13.36% after the fall of May. U.S. debt dumping is very serious.

Currently, the US stock market is trading based on two main themes: whether Trump or Harris is elected and the divergent asset trends that may be caused by their economic policies, as well as whether the US economy will experience a soft landing, hard landing, or no landing.

In October, the economic data shows that the CPI remains low, and the unemployment rate also stays low, making people increasingly believe that the economy is trending towards a soft landing. This has allowed the US stock market to maintain near its historical highs. However, the extremely low non-farm employment data, as well as the uncertainty caused by early pricing and the unsettled election, have led traders to lose their trading direction. The Q3 financial reports of the 'Big 7' have been successively released, with mixed performance. Against this backdrop, Nasdaq hit a new high in the middle of the month, but then fell, with a 0.52% decline for the month, while the Dow Jones fell by 1.34% for the month. Considering the substantial rebound of the US dollar index, this is not a bad result.

Only gold has received support from safe-haven funds, with London Gold pumping 4.15% monthly, rising to $2789.95 per ounce. The current strength of gold comes not only from safe-haven funds but also from the continued increase in holdings by Central Banks of various countries (replacing a portion of their US dollar holdings with their own currency as a value reserve).

Encryption assets: Effective breakthrough of two major technical indicators

In October, BTC opened at $63305.52 and closed at $70191.83, with a monthly pump of 10.89%, a volatility of 23.32%, and moderate volume expansion. For the first time since the adjustment in March, it achieved two consecutive months of increase.

BTC daily candlestick trend

From a technical indicator perspective, BTC has achieved multiple significant breakthroughs this month; it has successfully broken through the 200-day moving average resistance and the resistance of the downtrend line since March (the white line in the chart). The breakthrough of these two major technical indicators indicates an improvement in the long-term trend and temporarily dispels concerns about the crypto market turning bearish.

Currently, the market is in the stage of retracement after probing the upper edge of the "new high consolidation zone". Next, we will focus on following two technical indicators, one is the upper edge of the "new high consolidation zone" ($73,000) and the rise trend line (currently around $75,000). As mentioned in the previous report, a valid breakthrough of the "new high consolidation zone" signifies the end of the lengthy consolidation lasting for 8 months, while stepping onto the rise trend line signifies the arrival of a new market (the second wave of the Bull Market, namely the main uptrend).

BTC monthly trend

On the monthly chart, it can be observed that since August, the low price of BTC has been steadily rising. This turning point is based on two factors: the continuous improvement of global liquidity since the rate cuts by the Federal Reserve, the European Union, and China, as well as the internal adjustment of encryption assets, namely the shift from short to long-term holding structure.

Long and short game: Enhanced Liquidity may trigger the second wave of dumping

Long hands, short hands, CEX and Miner BTC holding distribution (monthly)

In the previous report, EMC Labs pointed out that with the development and adjustment of the encryption asset bull market, the long hand will experience two rounds of dumping, thereby throwing back the chips accumulated during the market downturn period.

In this cycle, the first wave of dumping by the longs started in January and lasted until May this year, and then turned to re-accumulation until October. The Fed cut interest rates for the first time in September, improving liquidity in the crypto market, and the longs began dumping again to promote the shift of coin holding structure from long to short. The scale of dumping this month is close to 140,000 coins.

This is the result of the Fed's interest rate cut improving Liquidity, and it is also a necessary stage of the cyclical operation. Of course, we need more time to confirm the sustainability of this dumping, and overall we tend to think that the second wave of dumping has already begun. Unless there is a turnaround in the Fed's interest rate cut, this process will continue in the medium to long term.

Along with it comes the continuous strengthening of market Liquidity.

Liquidity Strengthened: Buying Power Comes from BTC ETF Channel

For the encryption market, the start of an interest rate cut cycle is of great significance. To some extent, last year's BTC pump was driven by expectations of interest rate cuts and the early pricing of the BTC ETF channel opening. The adjustment since March can also be understood as a market correction before the start of the interest rate cut.

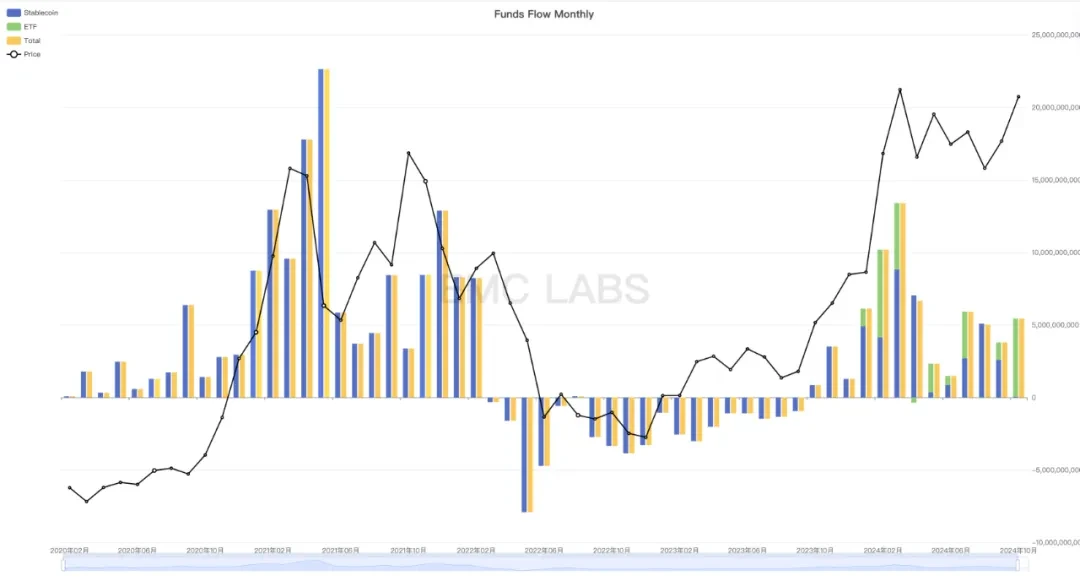

Asset market fund inflow and outflow monthly statistics (Stablecoins+BTC ETF)

This judgment is based on our analysis of the inflow and outflow of funds in the BTC ETF channel. As shown in the above chart, the fund inflows in this channel slowed down or even flowed out after March. However, this trend improved in October.

EMC Labs monitoring shows that in October, a total of 11 BTC ETFs in the United States recorded a total inflow of USD 5.394 billion, the second largest inflow month on record, second only to February of this year with USD 6.039 billion. This large inflow provides fundamental support for BTC price to challenge its previous high.

The stablecoin channel funds performed very poorly in October, with only $0.47 billion inflows for the entire month, marking the worst monthly performance so far this year.

Stablecoins Monthly Inflow and Outflow Statistics

Stablecoin channel funds are weak, which can be used to explain that although BTC is challenging its previous high, the performance of Altcoins is very poor. The funds in the BTC ETF channel cannot benefit Altcoins, which is one of the significant changes in the structure of the encryption asset market and worthy of close follow.

Among them, the dramatic increase in BTC ETF channel funds includes the "Trump trade" component. Because of Trump's enthusiasm for Crypto, people speculate and buy in hopes of short-term profit. This is worth following. With the U.S. presidential election on November 4th, there may be dramatic fluctuations in the market in the short term before and after the election.

Conclusion

According to the 13 F reports submitted by US institutional investors, there were 1015 institutions holding BTC ETF in Q1 2024, with a total holding of $11.72 billion; in Q2, the number of institutions holding BTC ETF exceeded 1900, with a total holding of $13.3 billion, and 44% of institutions chose to increase their holdings. Currently, the BTC scale managed by BTC ETF has exceeded 5% of the total supply, which is a noteworthy breakthrough.

The BTC ETF channel has already gained control over the medium and long-term pricing power of BTC. In the long run, funds from the BTC ETF channel are expected to continue flowing in during the interest rate reduction cycle, providing substantial support for the long-term trend of BTC prices. However, there are still many uncertainties in the short and medium term.

Based on the comprehensive internal structure and macro financial trends, EMC Labs maintains its previous judgment that BTC is likely to break through the previous high and start the second half of the Bull Market in Q4. In the crypto market, the start of the second half of the Altcoin Bull Market is based on the premise of the recovery of stablecoin channel fund inflows.

The greatest risks come from the results of the US presidential election, whether the interest rate cuts can proceed smoothly as expected by all parties in the market, and the stability of the US financial system.

EMC Labs was founded in April 2023 by encryption asset investors and data scientists. It focuses on research in the blockchain industry and investments in the Crypto Secondary Market. With industry foresight, insights, and data mining as its core competitiveness, EMC Labs is committed to participating in the thriving blockchain industry through research and investment, and promoting the well-being of humanity through blockchain and encryption assets.

For more information, please visit: