- Topic

- Pin

- 🔥 Join "Suggested Topics" Campaign & Win Weekly Points Rewards

How to join:

1.Visit Gate Post APP page

2.Click any top 3 "Suggested Topics"

3.Users who post quality content under "Suggested Topics" will be selected to win rewards.

🎁 Lucky winners will receive $20 Points each

More: https://www.gate.io/article/33633

- 📢Gate.io trading robot community ambassador benefits upgrade!

📝 Easy tasks, happy points winning!

Achieve the required points to receive rewards on a monthly basis!

💰Individuals can receive up to 100 USDT per month!

If you: 👇

Familiar with trading robots and their operation mechanisms.

Frequently active in different communities. Have community management experience.

🚀 Immediately private message the administrator (https://t.me/Gate_CopyTrading) to sign up and win rewards!

- 💸Dive into Answer&Earn's Brand-New Chapter!

1️⃣Take the Quiz on Ether.Fi (ETHFI)

2️⃣Join Lucky Draw: Share 1,666 #ETHFI#

🌟Tips: Redeem Honor Credits to Participate!

🎁Answer to Win Now: https://www.gate.io/activities/answer-earn

Detail: https://www.gate.io/zh/announcements/article/38072

#Answer2Earn#

- 📢 #GateOpinionQuest# for #6# is online!

DYOR on the selected project, share your opinion, and win amazing rewards.🎉

💬 Task for #6# : Research Avail ($AVAIL) and post your opinions and insights.

🏆 Rewards: 5 winners will each receive $20 worth of $AVAIL and this week’s Opinion Badge!🏅

👉 How to participate:

Share your opinion and include the hashtags: #GateOpinionQuest# and #AVAIL# .

Make sure your post has at least 60 words and gets at least 3 likes.

Include the trading link of $AVAIL in the post: https://www.gate.io/trade/AVAIL_USDT

⏰ Time: End at 10:00 AM on July 26th (UTC)

- #交易机器人 # Strategy Trading # #TianDiDan # 新人奖励# #BTC # ETH#

🔥 Gate.io Earth Single Special Event Win 10,000 yuan prize!

📈 HoldingsBTC believers cannot miss!

🎁 New users' first order strategy enjoy 1,000 USDT welcome gift!

🏆 Trade and enjoy high bonuses + VIP upgrade vouchers and other rewards!

🔗 Join the registration: https://www.gate.io/zh/announcements/article/38059

Galaxy: With Bitcoin as a benchmark, explore the market size of Ethereum ETF

Original Author: Charles Yu

Original text translation: Luffy, Foresight News

Key Points

For months, observers and analysts have underestimated the possibility of the U.S. Securities and Exchange Commission (SEC) approving a spot Ethereum exchange-traded product (ETP). The pessimism stems from the SEC's reluctance to explicitly recognize ETH as a commodity, the lack of news regarding contact between the SEC and potential issuers, and the SEC's ongoing investigations and enforcement actions related to the Ethereum ecosystem. Bloomberg analysts Eric Balchunas and James Seyffart initially estimated a 25% chance of approval in May. However, on Monday, May 20, Bloomberg analysts suddenly raised the probability to 75% due to reports of the SEC contacting securities exchanges.

In fact, later in the week, all spot Ethereum ETP applications were approved by the SEC. We look forward to the launch of these tools after the effectiveness of the S-1 application (we expect to launch at some point in the summer of 2024). This report will reference the performance of Bitcoin spot ETPs to predict the demand for Ethereum ETPs after their launch. We estimate that spot Ethereum ETPs will see approximately $5 billion in net inflows in the first five months of trading (about 30% of the net inflows of Bitcoin ETPs).

Background

Currently, there are 9 issuers competing to launch 10 spot ETH exchange-traded products (ETPs). In the past few weeks, some issuers have withdrawn. ARK has chosen not to collaborate with 21 Shares to launch an Ethereum ETP, while Valkyrie, Hashdex, and WisdomTree have withdrawn their applications. The following chart shows the current status of applicants sorted by the 19 b-4 application date:

Grayscale is seeking to convert the Grayscale Ethereum Trust (ETHE) into an ETP, similar to what the company did with its Grayscale Bitcoin Investment Trust (GBTC), but Grayscale has also applied for a 'mini' version of the Ethereum ETP.

On May 23, the U.S. Securities and Exchange Commission approved all 19 b-4 documents (allowing the final listing rule change of ETH spot ETP on the stock exchange), but now each issuer needs to discuss its registration statement with the regulatory agency repeatedly. The product itself can only truly begin trading when the U.S. Securities and Exchange Commission allows these S-1 documents (or ETHE's S-3 documents) to take effect. Based on our research and Bloomberg's report, we believe that the Ethereum spot ETP may start trading as early as the week of July 11, 2024.

Experience of Bitcoin ETF

The Bitcoin ETF has been launched for nearly 6 months, which can serve as a benchmark for predicting the potential popularity of the Ethereum Spot ETF.

Source: Bloomberg

Here are some observations from the past few months of Bitcoin spot ETP trading:

ETF demand is mainly driven by retail investors, while institutional demand is recovering. According to 13F filings, as of March 31, 2024, over 900 U.S. investment firms held Bitcoin ETFs with a total value of approximately $11 billion, accounting for approximately 20% of the total Bitcoin ETF holdings. This indicates that most of the demand is driven by retail investors. The list of institutional buyers includes major banks such as JPMorgan, Morgan Stanley, and Wells Fargo, hedge funds such as Millennium, Point 72, Citadel, and even pension funds such as the Wisconsin Investment Board.

The wealth management platform has not yet started buying Bitcoin ETFs for clients. The largest wealth management platform has not yet allowed its brokers to recommend Bitcoin ETFs, but according to reports, Morgan Stanley is exploring allowing its brokers to solicit clients to purchase them. In our report on the market size of Bitcoin ETFs, we wrote that it may take several years for wealth management platforms (including brokerages, banks, and RIAs) to help clients purchase Bitcoin ETFs. So far, there has been little inflow of funds from wealth management platforms, but we believe it will be an important catalyst for Bitcoin adoption in the near to medium term.

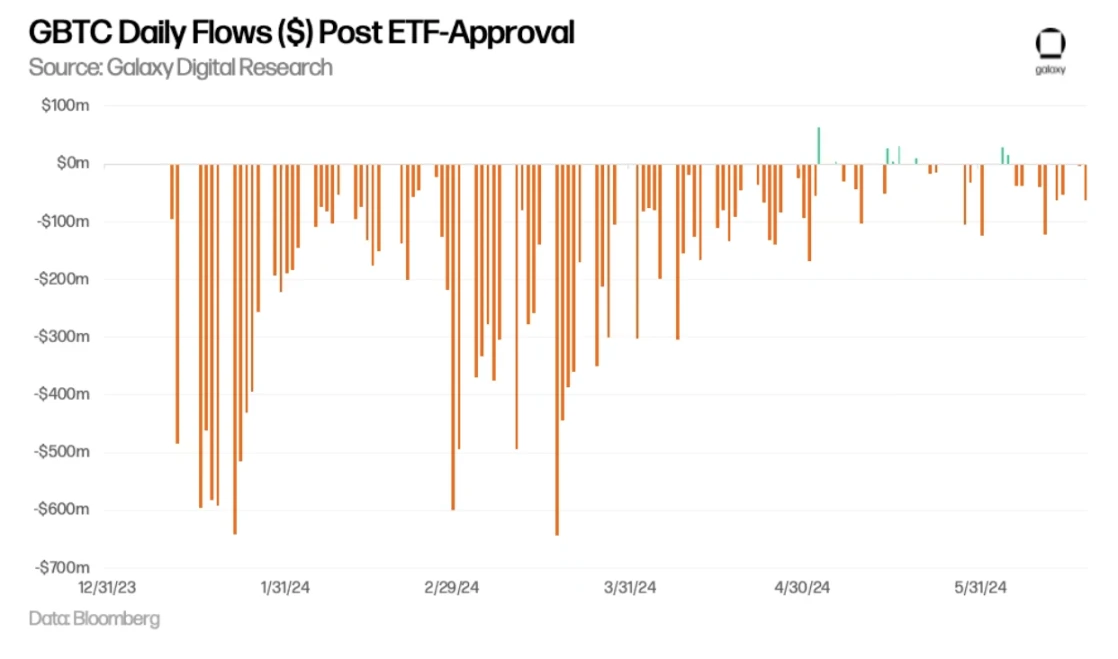

After the ETF is approved, the daily flow of GBTC (in USD)

Estimating Potential Inflows of Ethereum ETF

Referring to the situation of Bitcoin ETP, we can roughly estimate the potential demand for Ethereum ETP in the market.

The relative size of the BTC and ETH ETP markets

To estimate the potential inflow of Ethereum ETF, we applied the BTC/ETH ratio to the inflow of US Bitcoin spot ETF based on the relative asset size of BTC and ETH transactions in multiple markets. As of May 31st:

Based on the above, we believe that the inflow of Ethereum spot ETF will be about one-third of the inflow of Bitcoin spot ETF (estimated range 20%-50%).

Applying this data to the 15 billion U.S. dollar Bitcoin spot ETF inflows before June 15th means that in the first five months after the launch of the Ethereum ETF, the monthly inflow is estimated to be around 1 billion U.S. dollars (estimated range: 600 million to 1.5 billion dollars per month).

Estimated inflow of US Spot Ethereum ETF

Due to several factors, we see some valuations lower than our forecasts. That being said, our previous report predicted a first-year inflow of $14 billion for Bitcoin ETF, assuming the entry of wealth management platforms, but there has already been a significant inflow into Bitcoin ETF before the entry of these platforms. Therefore, we recommend caution when predicting low demand for Ethereum ETF.

Some structural/market differences between BTC and ETH will affect the liquidity of ETFs:

Due to the lack of staking rewards, the demand for Spot Ethereum ETF may be affected. The opportunity cost of non-staking ETH includes (i) the inflationary rewards paid to validators, (ii) the priority fees paid to validators, and the MEV income paid to validators through relayers. Based on data from September 15, 2022 to June 15, 2024, we estimate that the annual opportunity cost of giving up staking rewards for Spot ETH holders is 5.6% (4.4% if calculated using year-to-date data), which is a significant difference. This will reduce the attractiveness of Spot Ethereum ETF to potential buyers. Please note that ETPs offered outside the US (e.g., in Canada) provide additional returns to holders through staking.

The source of income for non-staked and staked ETH holders

Grayscale's ETHE may drag down the inflow of Ethereum ETF. Just as GBTC Grayscale Trust experienced a significant outflow of funds during the ETF conversion, the conversion of ETHE Grayscale Trust to ETF will also result in fund outflows. Assuming the outflow rate of ETHE matches the outflow rate of GBTC in the first 150 days (i.e., 54.2% of trust supply is redeemed), we estimate that the outflow of ETHE will be approximately 319,000 ETH per month. Based on the current price of $3,400, this would amount to a monthly outflow of $1.1 billion or a daily average of $36 million. Please note that the percentage of tokens held by these trusts in their respective total supplies is: BTC 3.2%, ETH 2.4%. This indicates that the pressure on ETH price from ETHE ETF conversion is lower than that of GBTC. Furthermore, unlike GBTC, ETHE will not face forced selling due to bankruptcy cases (e.g., 3AC or Genesis), which further supports the view that the selling pressure related to Grayscale Trusts is relatively smaller for ETH than BTC.

Net flow of GBTC and ETHE (forecast)

Basis trading may drive the demand for Bitcoin ETFs from hedge funds. Basis trading may drive the demand for Bitcoin ETFs from hedge funds, which seek to arbitrage the differences between Bitcoin spot and futures prices. As mentioned earlier, 13F filings show that as of March 31, 2024, over 900 U.S. investment firms held Bitcoin ETFs, including some well-known hedge funds such as Millennium and Schonfeld. Throughout 2024, the financing rate for ETH on various exchanges averaged higher than that of BTC, indicating (i) relatively greater demand for going long on ETH, and (ii) the potential for a spot Ethereum ETF to bring more demand from hedge funds looking to utilize basis trading.

BTC and ETH financing interest rate

Factors Affecting the Price Sensitivity of ETH and BTC

Since we estimate that the ratio of Ethereum ETF inflows to market capitalization is roughly equal to the ratio of Bitcoin flows to market capitalization, we expect the price impact to be roughly the same under all other conditions being equal. However, there are several key differences in the supply and demand of these two assets, which may lead to Ethereum prices being more sensitive to ETF flows:

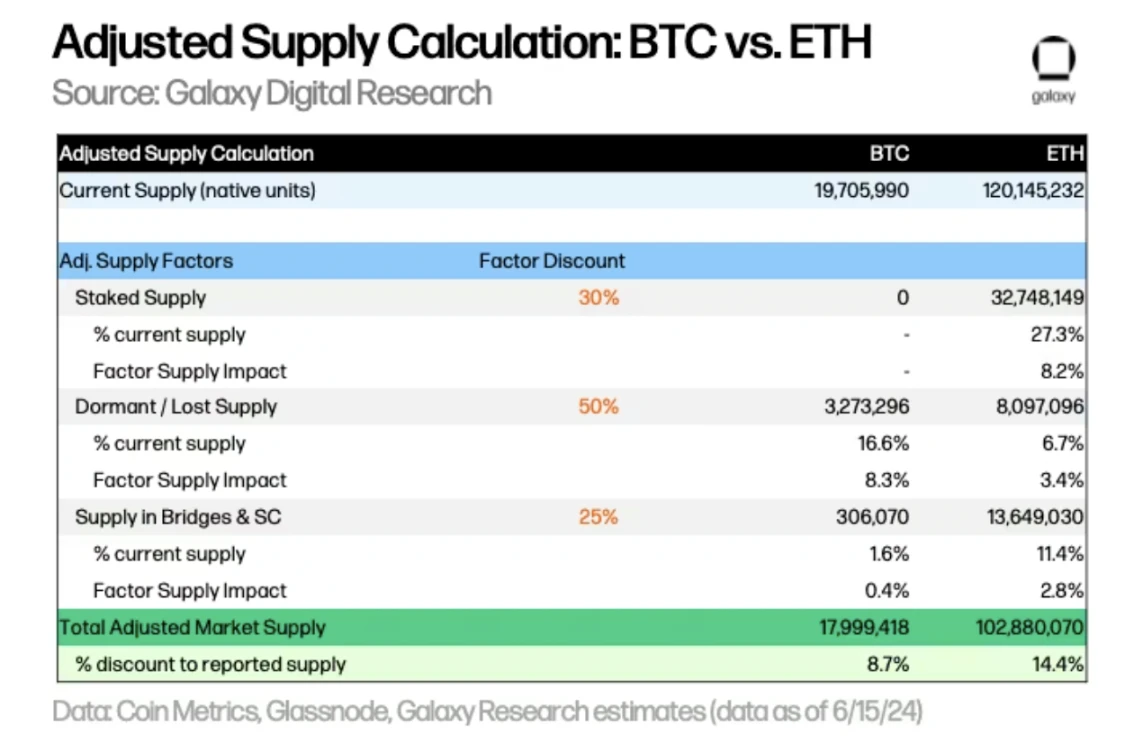

However, the actual market liquidity available for purchase is far lower than the reported current supply. We believe that a better representation of the available market supply for each asset in the ETF would include adjustments for staked supply, dormant/lost supply, as well as supply held in cross-chain bridges and smart contracts.

Adjusted supply calculation for BTC and ETH

The adjusted supply of BTC and ETH is calculated by applying discount weights to each factor. We estimate that the available supply of BTC and ETH is 8.7% and 14.4% less than the reported current supply.

Overall, the price sensitivity of ETH to relative market capitalization-weighted inflows should be higher than that of BTC, for the following reasons: (i) the available market supply is lower based on adjusted supply factors, (ii) the percentage of supply from exchanges is lower, and (iii) the inflation rate is lower. Each of these factors should have a multiplier effect on price sensitivity (rather than an additive effect), with prices often being more sensitive to significant changes in market supply and liquidity.

Looking Ahead

Looking ahead, we still face several issues in adopting and second-order effects.

Overall, we believe the launch of the Spot Ethereum ETF will have a significant positive impact on the adoption of Ethereum and the broader cryptocurrency market for two main reasons: (i) expanding the reach of cryptocurrencies, (ii) gaining greater recognition for cryptocurrencies through regulatory agencies and trusted financial service brands. ETFs can broaden the coverage of retail investors and institutions, provide wider distribution through more investment channels, and support Ethereum for a wider range of investment strategies in portfolios. In addition, financial professionals' further understanding of Ethereum will accelerate its investment and adoption.