ON–278: Derivatives

Jupiter Perps

👥 Soju | Website | Dashboard

📈 Jupiter Perps Facilitate $100B of Volume on Solana

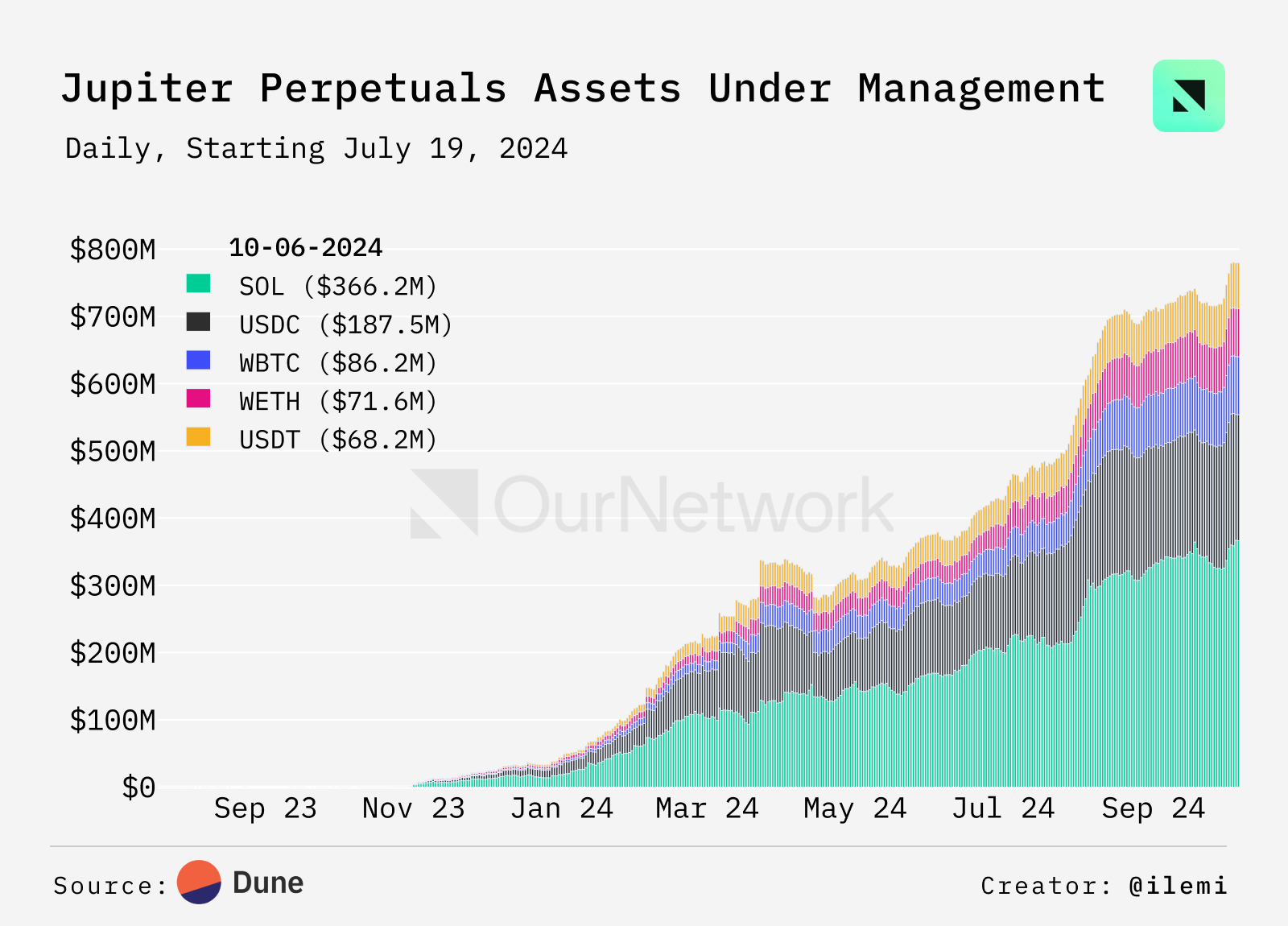

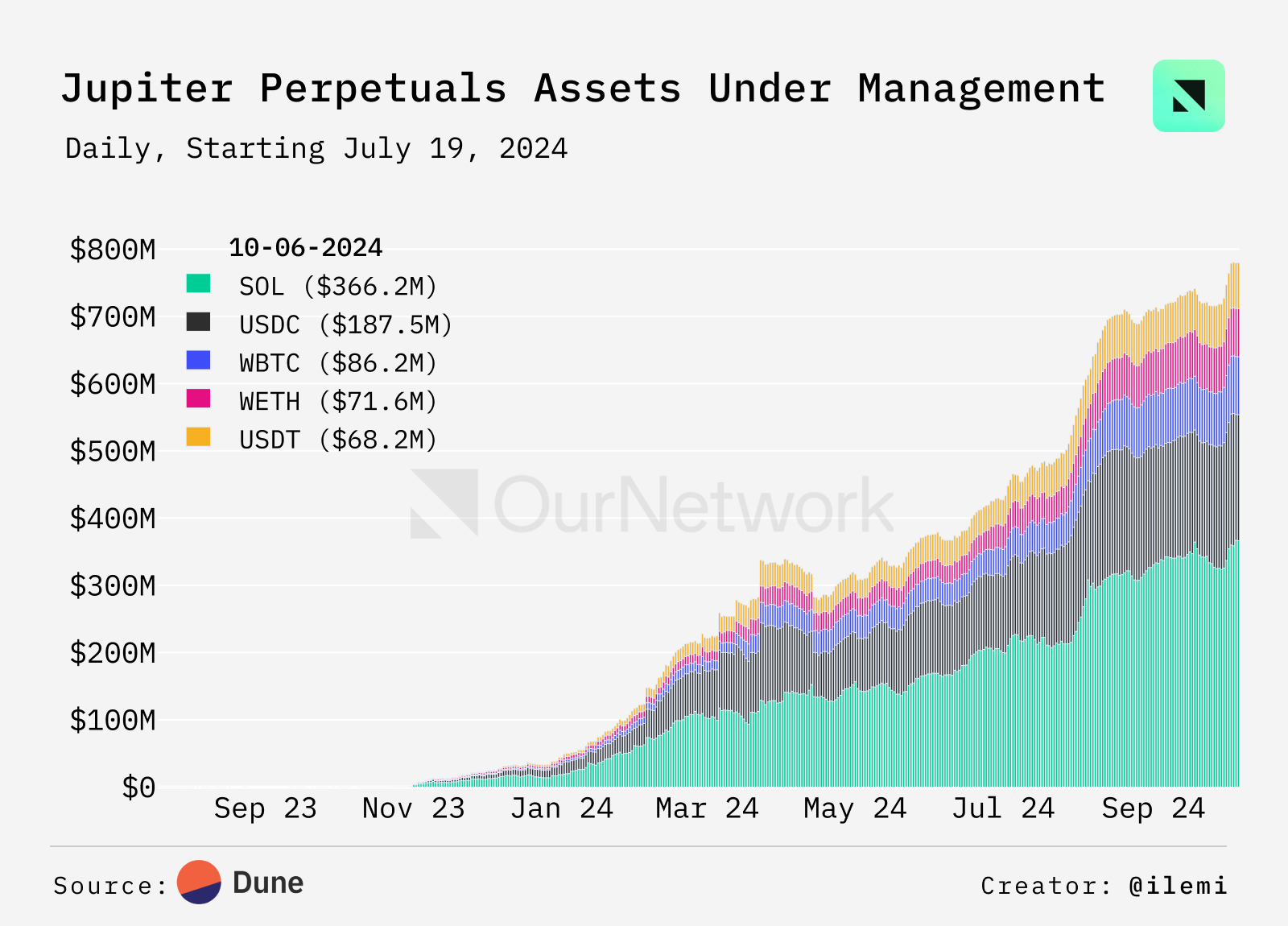

- Launched in early October 2023, Jupiter Perps is the deepest liquidity source on Solana for any perp trade. Jupiter Liquidity Pool (JLP), which acts as a counterparty to perps traders, the has grown from $0 to over $700M in TVL — this allows the protocol to facilitate large trade sizes via a peer-to-pool model.

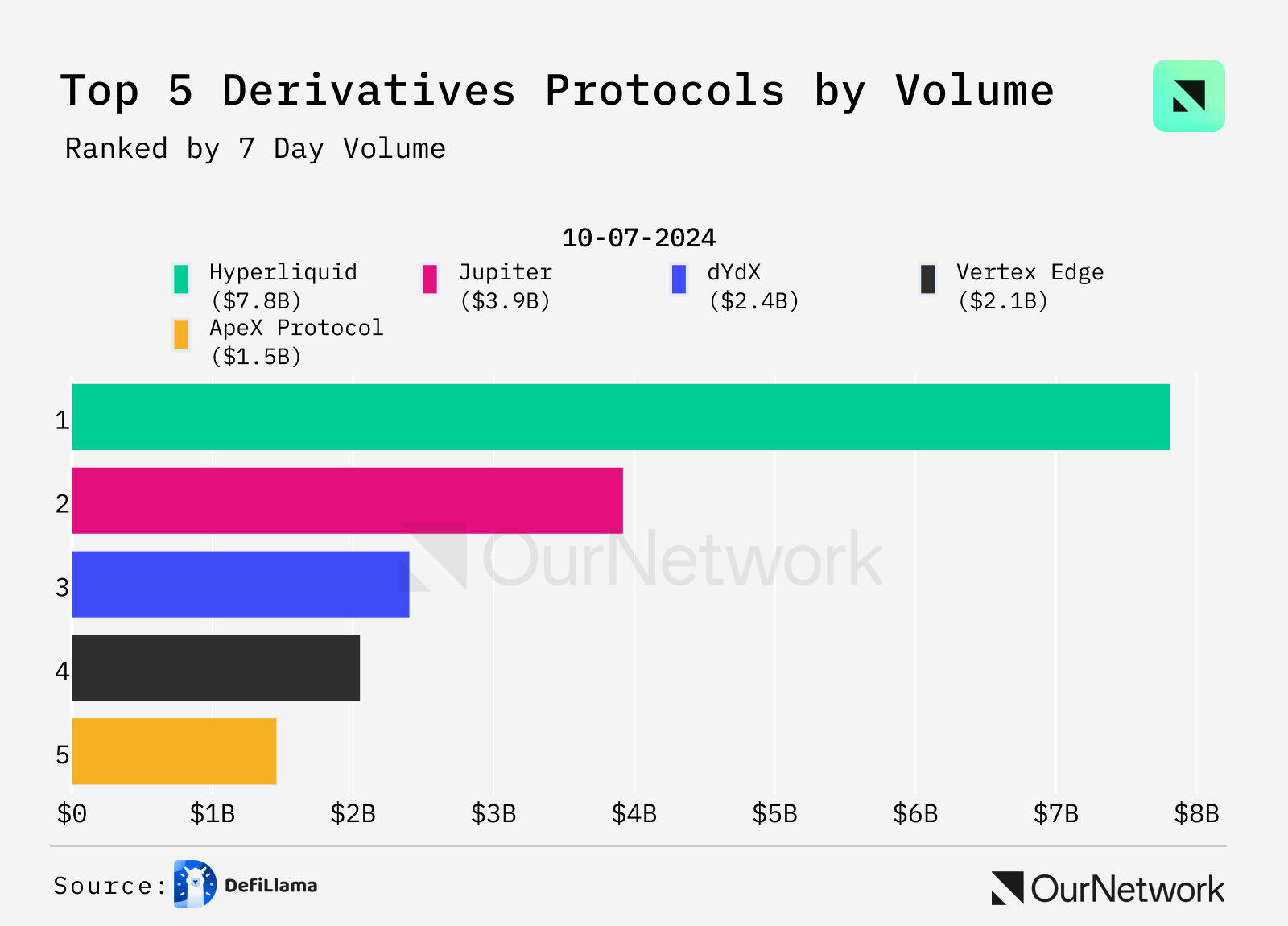

- Jupiter Perps is also #2 on DefiLlama’s derivatives volume ranking, edging out even orderbook-based competitors like Vertex and dYdX. Peer-to-pool models have a much higher percentage of non-toxic flow volume, leading to less volume compared to orderbooks.

- Leveraging a large retail pool of traders, deep liquidity and high volumes, Jupiter Perps generates $2-8M in fees a week for JLP holders, further fueling the growth of the platform.

Drift

👥 BigZ Pubkey | Website | Dashboard

📈 Drift Generates Over $900M in Trading Volume Over the Last Week

- Drift is the largest full-service DEX on Solana: combining perpetuals and spot trading, borrow-lend, staking, and now prediction markets under one cross margin engine to maximize capital efficiency. BET, the moniker for Drift’s prediction markets, lets users collateralize with a range of crypto assets without forgoing yield, avoiding mis-calibrated odds from opportunity cost. By doing so it has attracted the highest volume prediction markets on Solana (nearly $30M over 1.5 months)

- USDC DeFi lending rates on Solana have averaged 8.5% APR over the past 90 days. This is a non-trival ROI that can lead other prediction markets. Only when positions are in the red AND settled with counterparty (through periodic market-to-market settlement) does this interest become forgone.

The collateral composition shows a high demand from users to trade with non-stables, even when placing bets that ultimately settle in stables. As of October 1st, only 22% of Drift’s TVL is held in popular stablecoins like USDC, PYUSD, USDT, as well as others like USDe/sUSDe and USDY.

🔦

Transaction Spotlight:

One particular using put on a TRUMP victory bet (roughly $50k of notional) using only non-stables (JitoSOL, SOL, wBTC) as their collateral. Additionally, they’ve traded swings on BTC-PERP regularly, not compromising long hold prediction bets and crypto positions all while supporting their short term trading.

Synthetix

👥 Omer | Website | Dashboard

📈 Synthetix Sets the Stage for a Major Reboot with Big Gains in Open Interest and APR

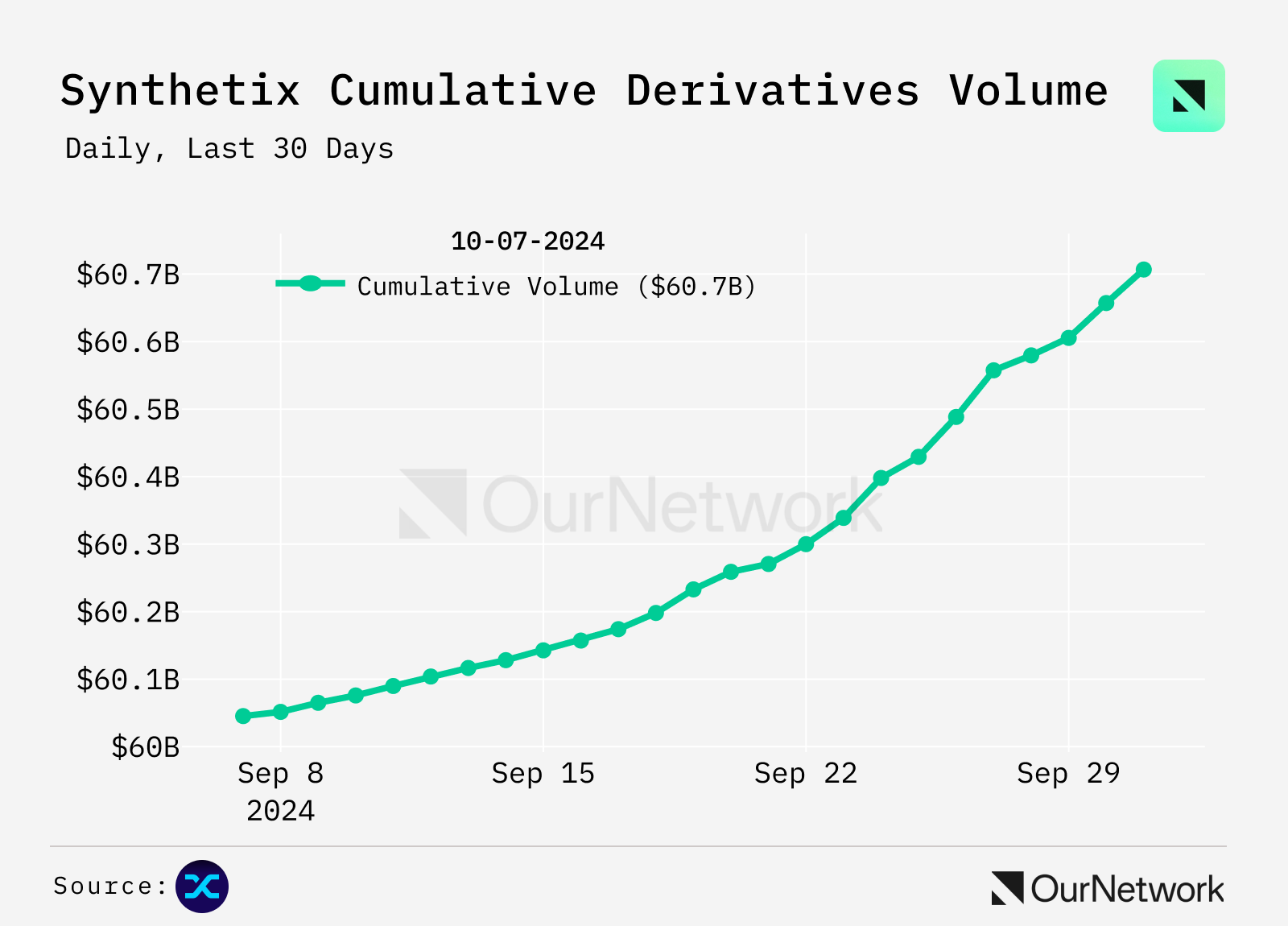

- Synthetix is a DeFi OG for perpetual derivatives trading — the protocol offers a wide range of synthetic assets and derivatives including perpetual futures, options, and spot trading products. To date, Synthetix has driven more than $63B in Derivatives Volume across Optimism ($60.74B), Base ($3.6B), and Arbitrum ($1.2M). Synthetix is in the midst of a rebooting with SR-2, a Governance referendum aimed at helping Synthetix reclaim its place at the forefront of the DeFi ecosystem.

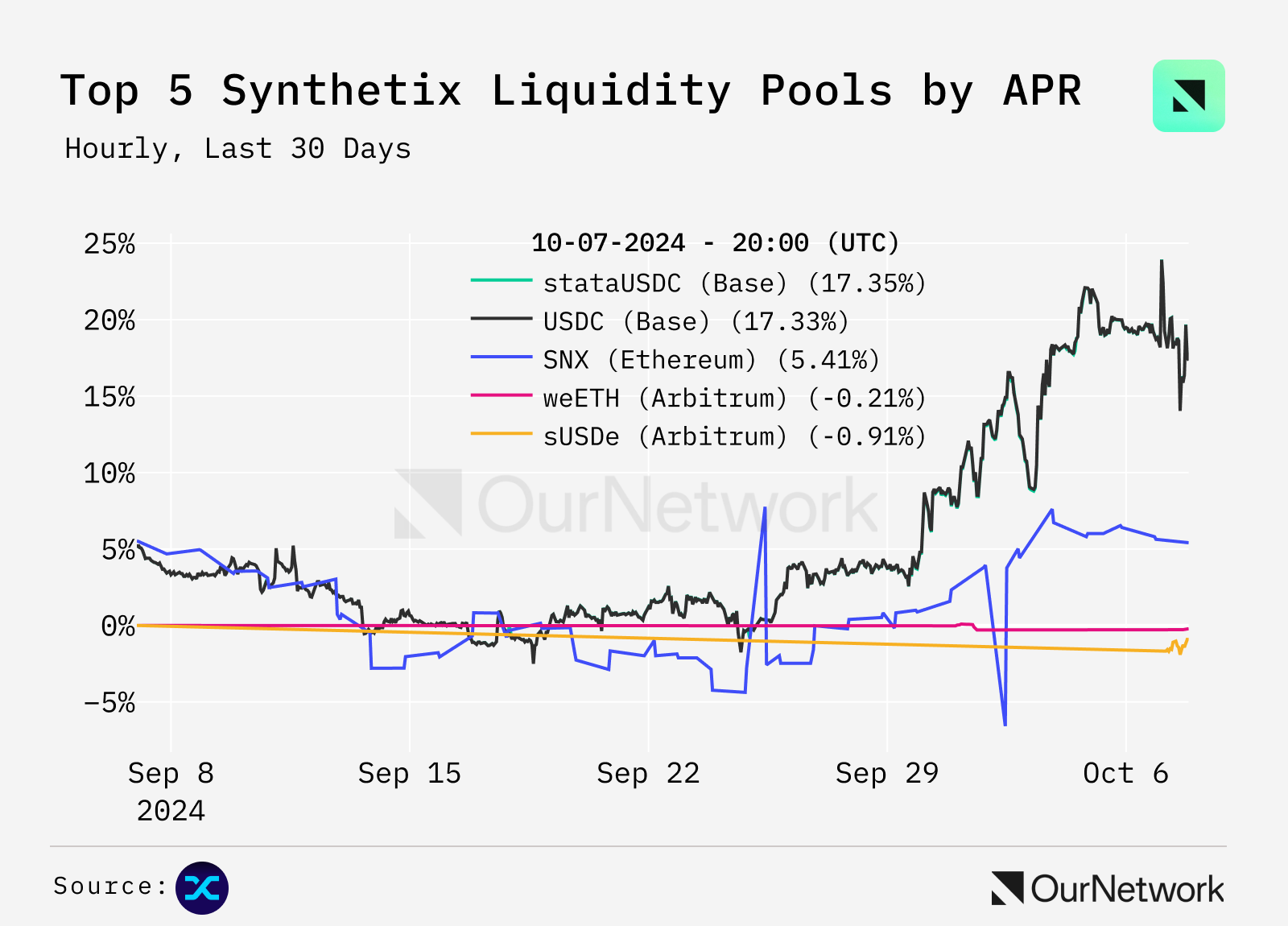

- The 7-day average APR for USDC liquidity has increased by 300% this September, soaring from 5% to over 20% in just a few weeks. This boost underscores the growing demand for stable yield within Synthetix’s ecosystem.

- Open interest in sBTC and sETH has expanded from $50M to over $150M, reflecting a 200% increase in leveraged positions. This rise aligns with gains in volume from SNX integrators and anticipated product launches like Multi-Collateral Perps.

🔦

Transaction Spotlight:

In what may be the biggest governance overhaul for Synthetix to date - SR-2 A Synthetix Reboot, was approved with a staggering 104 million SNX tokens ($150M+ in value), achieving a near-unanimous consensus of 99.94%. The Reboot brings with it a complete governance overhaul, a growth-focused 2025 roadmap, and new optimism on the back of anticipated product releases like the launch of multi-collateral Perps on Synthetix V3.

GMX

👥 Shogun | Website | Dashboard

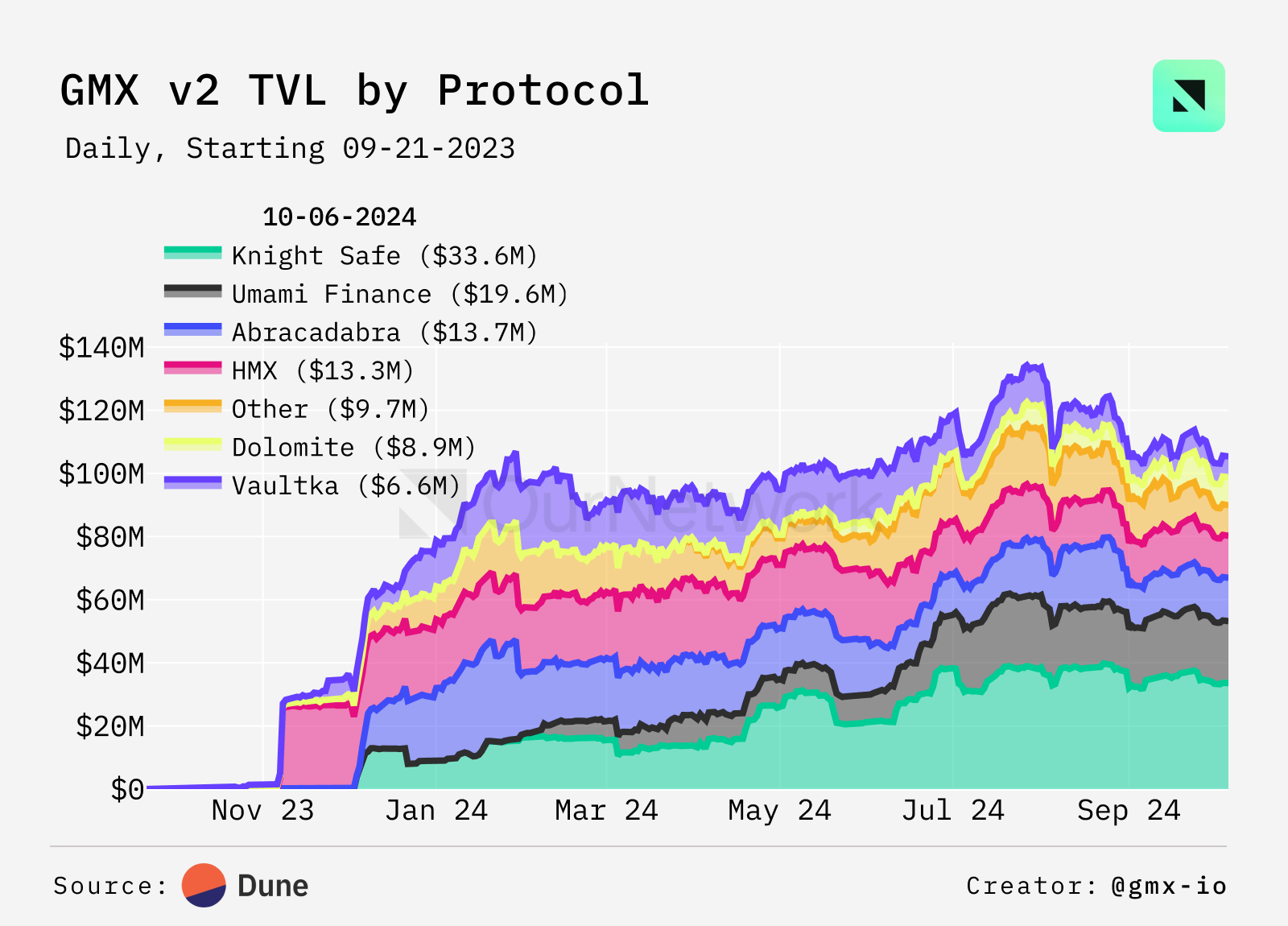

📈 GMX Partnered Protocols TVL surges to 41% of GMX V2 TVL

- GMX is a protocol whose primary offering is a perpetuals exchange. Since GMX’s V2 launch in 2023, partnerships with other protocols have driven a significant share of the perpetuals exchange’s TVL. These protocols have developed creative yield strategies, sourcing liquidity from GMX’s pools to enhance their respective platforms. GMX V2’s $109M in TVL shows its success in providing good yields to bluechip assets, long-tail assets, and soon, more exotic pairs.

- With the launch of many GM pools, most liquidity providers have seen positive yield growth. The best GM pools in the past 3 months, compared to their benchmark —holding the underlying asset— include AVAX/USD, PEPE/USD, WIF/USD who are up 10%, 18%, and 11% respectively compared to their benchmark.

- Over its timespan GMX V2 has produced close to $66M in revenues in either ETH or AVAX for the protocol. In the future this will change with buybacks of GMX and distribution of GMX, as a part of a snapshot vote in July which outlined a new tokenomics geared towards benefiting tokenholders and stakers.

🔦

Transaction Spotlight:

A large trader on GMX V2 recently locked in $100,865 in profit from their ETH long. They currently are still long BTC at $60,894.9 with a P&L of $118,996. The trader generally has a high hit rate — achieving an all-time net P&L of $790k.

Vertex

👥 Honz | Website | Dashboard

📈 Vertex Reaches $130B in All-Time Generated Volume

- Vertex is a platform offering both perpetuals and spot trading. Despite reaching a new milestone of $130B in total volume on the platform, Vertex appears to be struggling to capture further business. Indeed, the chart of monthly produced volumes shows a drop beginning in December 2023. This is particularly concerning given that Vertex has lately expanded its operations to other chains such as Base, Mantle, and Sei, after initially focusing on Arbitrum.

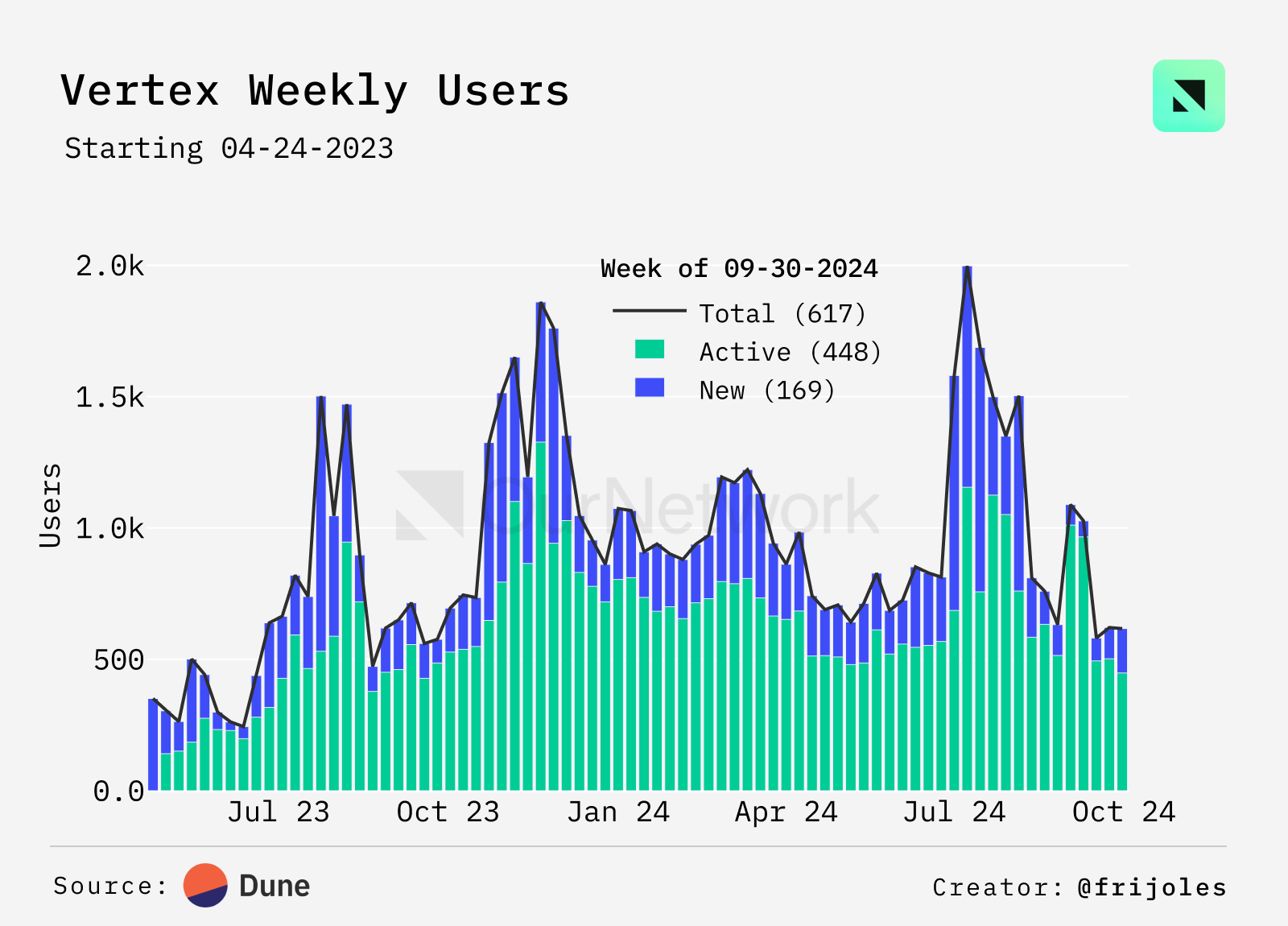

- The Dune chart below shows that Vertex has been at a steady state in terms of users. After an all-time high in July 2024 —thanks to an expansion to Mantle, the Layer 2— new user metrics have then returned to prior lows.

- While trading metrics are not in favor of Vertex, at least for now, token metrics seems more encouraging —with 42% of the platform’s $VRTX token staked, users are showing a strong degree of engagement with the platform.

Perennial

👥 Lucas | Website | Dashboard

📈 Perennial Average Daily Volume Reaches $44M+

- Perennial provides perpetual exchange infrastructure that partnered frontends plug into, sharing liquidity and order-flow. When Perennial integrates a new app, there’s an increase in volume as a new user-base joins the network of trades. Perennial recently reached an all-time-high daily volumes following their integration with leading perps aggregator Kwenta on Arbitrum. During the mid-July ETH ETF news, Perennial’s daily volume spiked above $44M as market makers hedged the delta of their volatile bets.

- One of Perennial’s most distinct features is its leveraged market making. Over the past few months, Perennial has seen it’s average maker leverage rise 229%, indicating a confidence and understanding of the protocol and the capital efficiency it offers.

- Perennial’s funding rate mechanism balances demand between longs and shorts, helping reduce exposure and risk for market makers. Over the past few months, funding rates have dropped from as high as 5% to now ~0.01%, as arbitrageurs have entered the game.

Disclaimer:

This article is reprinted from [ournetwork], Forward the Original Title‘ON–278: Derivatives ’, If there are objections to this reprint, please contact the Gate Learn team, and they will handle it promptly.

Liability Disclaimer: The views and opinions expressed in this article are solely those of the author and do not constitute any investment advice.

Translations of the article into other languages are done by the Gate Learn team. Unless mentioned, copying, distributing, or plagiarizing the translated articles is prohibited.

ON–278: Derivatives

Jupiter Perps

👥 Soju | Website | Dashboard

📈 Jupiter Perps Facilitate $100B of Volume on Solana

- Launched in early October 2023, Jupiter Perps is the deepest liquidity source on Solana for any perp trade. Jupiter Liquidity Pool (JLP), which acts as a counterparty to perps traders, the has grown from $0 to over $700M in TVL — this allows the protocol to facilitate large trade sizes via a peer-to-pool model.

- Jupiter Perps is also #2 on DefiLlama’s derivatives volume ranking, edging out even orderbook-based competitors like Vertex and dYdX. Peer-to-pool models have a much higher percentage of non-toxic flow volume, leading to less volume compared to orderbooks.

- Leveraging a large retail pool of traders, deep liquidity and high volumes, Jupiter Perps generates $2-8M in fees a week for JLP holders, further fueling the growth of the platform.

Drift

👥 BigZ Pubkey | Website | Dashboard

📈 Drift Generates Over $900M in Trading Volume Over the Last Week

- Drift is the largest full-service DEX on Solana: combining perpetuals and spot trading, borrow-lend, staking, and now prediction markets under one cross margin engine to maximize capital efficiency. BET, the moniker for Drift’s prediction markets, lets users collateralize with a range of crypto assets without forgoing yield, avoiding mis-calibrated odds from opportunity cost. By doing so it has attracted the highest volume prediction markets on Solana (nearly $30M over 1.5 months)

- USDC DeFi lending rates on Solana have averaged 8.5% APR over the past 90 days. This is a non-trival ROI that can lead other prediction markets. Only when positions are in the red AND settled with counterparty (through periodic market-to-market settlement) does this interest become forgone.

The collateral composition shows a high demand from users to trade with non-stables, even when placing bets that ultimately settle in stables. As of October 1st, only 22% of Drift’s TVL is held in popular stablecoins like USDC, PYUSD, USDT, as well as others like USDe/sUSDe and USDY.

🔦

Transaction Spotlight:

One particular using put on a TRUMP victory bet (roughly $50k of notional) using only non-stables (JitoSOL, SOL, wBTC) as their collateral. Additionally, they’ve traded swings on BTC-PERP regularly, not compromising long hold prediction bets and crypto positions all while supporting their short term trading.

Synthetix

👥 Omer | Website | Dashboard

📈 Synthetix Sets the Stage for a Major Reboot with Big Gains in Open Interest and APR

- Synthetix is a DeFi OG for perpetual derivatives trading — the protocol offers a wide range of synthetic assets and derivatives including perpetual futures, options, and spot trading products. To date, Synthetix has driven more than $63B in Derivatives Volume across Optimism ($60.74B), Base ($3.6B), and Arbitrum ($1.2M). Synthetix is in the midst of a rebooting with SR-2, a Governance referendum aimed at helping Synthetix reclaim its place at the forefront of the DeFi ecosystem.

- The 7-day average APR for USDC liquidity has increased by 300% this September, soaring from 5% to over 20% in just a few weeks. This boost underscores the growing demand for stable yield within Synthetix’s ecosystem.

- Open interest in sBTC and sETH has expanded from $50M to over $150M, reflecting a 200% increase in leveraged positions. This rise aligns with gains in volume from SNX integrators and anticipated product launches like Multi-Collateral Perps.

🔦

Transaction Spotlight:

In what may be the biggest governance overhaul for Synthetix to date - SR-2 A Synthetix Reboot, was approved with a staggering 104 million SNX tokens ($150M+ in value), achieving a near-unanimous consensus of 99.94%. The Reboot brings with it a complete governance overhaul, a growth-focused 2025 roadmap, and new optimism on the back of anticipated product releases like the launch of multi-collateral Perps on Synthetix V3.

GMX

👥 Shogun | Website | Dashboard

📈 GMX Partnered Protocols TVL surges to 41% of GMX V2 TVL

- GMX is a protocol whose primary offering is a perpetuals exchange. Since GMX’s V2 launch in 2023, partnerships with other protocols have driven a significant share of the perpetuals exchange’s TVL. These protocols have developed creative yield strategies, sourcing liquidity from GMX’s pools to enhance their respective platforms. GMX V2’s $109M in TVL shows its success in providing good yields to bluechip assets, long-tail assets, and soon, more exotic pairs.

- With the launch of many GM pools, most liquidity providers have seen positive yield growth. The best GM pools in the past 3 months, compared to their benchmark —holding the underlying asset— include AVAX/USD, PEPE/USD, WIF/USD who are up 10%, 18%, and 11% respectively compared to their benchmark.

- Over its timespan GMX V2 has produced close to $66M in revenues in either ETH or AVAX for the protocol. In the future this will change with buybacks of GMX and distribution of GMX, as a part of a snapshot vote in July which outlined a new tokenomics geared towards benefiting tokenholders and stakers.

🔦

Transaction Spotlight:

A large trader on GMX V2 recently locked in $100,865 in profit from their ETH long. They currently are still long BTC at $60,894.9 with a P&L of $118,996. The trader generally has a high hit rate — achieving an all-time net P&L of $790k.

Vertex

👥 Honz | Website | Dashboard

📈 Vertex Reaches $130B in All-Time Generated Volume

- Vertex is a platform offering both perpetuals and spot trading. Despite reaching a new milestone of $130B in total volume on the platform, Vertex appears to be struggling to capture further business. Indeed, the chart of monthly produced volumes shows a drop beginning in December 2023. This is particularly concerning given that Vertex has lately expanded its operations to other chains such as Base, Mantle, and Sei, after initially focusing on Arbitrum.

- The Dune chart below shows that Vertex has been at a steady state in terms of users. After an all-time high in July 2024 —thanks to an expansion to Mantle, the Layer 2— new user metrics have then returned to prior lows.

- While trading metrics are not in favor of Vertex, at least for now, token metrics seems more encouraging —with 42% of the platform’s $VRTX token staked, users are showing a strong degree of engagement with the platform.

Perennial

👥 Lucas | Website | Dashboard

📈 Perennial Average Daily Volume Reaches $44M+

- Perennial provides perpetual exchange infrastructure that partnered frontends plug into, sharing liquidity and order-flow. When Perennial integrates a new app, there’s an increase in volume as a new user-base joins the network of trades. Perennial recently reached an all-time-high daily volumes following their integration with leading perps aggregator Kwenta on Arbitrum. During the mid-July ETH ETF news, Perennial’s daily volume spiked above $44M as market makers hedged the delta of their volatile bets.

- One of Perennial’s most distinct features is its leveraged market making. Over the past few months, Perennial has seen it’s average maker leverage rise 229%, indicating a confidence and understanding of the protocol and the capital efficiency it offers.

- Perennial’s funding rate mechanism balances demand between longs and shorts, helping reduce exposure and risk for market makers. Over the past few months, funding rates have dropped from as high as 5% to now ~0.01%, as arbitrageurs have entered the game.

Disclaimer:

This article is reprinted from [ournetwork], Forward the Original Title‘ON–278: Derivatives ’, If there are objections to this reprint, please contact the Gate Learn team, and they will handle it promptly.

Liability Disclaimer: The views and opinions expressed in this article are solely those of the author and do not constitute any investment advice.

Translations of the article into other languages are done by the Gate Learn team. Unless mentioned, copying, distributing, or plagiarizing the translated articles is prohibited.