- Topic

106k posts

65k posts

62k posts

57k posts

54k posts

47k posts

44k posts

44k posts

42k posts

- 10#NADA#

40k posts

- Pin

- 🔥 Join "Suggested Topics" Campaign & Win a share of $200 Weekly Rewards

👉 How to Join:

1.Visit Gate Post APP page

2.Click any top 3 "Suggested Topics"

3.Users who post quality content under "Suggested Topics" will be selected to win rewards.

Example:

Post content related to trading strategies, ma

- 🎉 Thanksgiving Special: Chat & Win Exclusive Gate.io Merch!

Thanksgiving Exclusive Merch Giveaway!Join the Gate.io Chat Community, chat actively in the community to win exclusive prizes, more futures vouchers, Thanksgiving Lucky Grand Prizes, and tons of red packets waiting for you to grab!

🎁Benef

- 🧧 Join Gate.io Chat Community to grab red packet airdrops everyday!

⏰ Click the red packet icon as soon as the countdown ends. First come, first served.

🔥 Remember to claim your lucky red packet & do not miss out!

Join Gate.io Chat Community:

👉🏻 Open #Gateio# App - Click "Moments" - Find "Chat"

- 📚 #Postopedia# Gate Post Postopedia 4️⃣ is coming!

Expose more Gate Post rules to help you master it!

🧐 What are Gate Post Ambassadors? What exclusive benefits are offered?

Become a ''Gate Post Ambassador'' and enhance your influence! 🚀

Sign up now to easily enjoy exclusive benefits! 🎁

Get invol

- 🔥 $100M in #USDE# Rewards Up for Grabs!

🎁 Hold #USDE# and Enjoy 34% APR, Settled Daily with No Staking Required!

💰 Exclusive Bonus for New Users: 100,000,000 #PEPE# !

👉 Join Now: https://www.gate.io/campaigns/100-m-usde

⏰ Event Duration: Nov 18, 00:00 - Nov 28, 00:00 (UTC)

Details: https://www.g

Bitcoin (BTC) received a $3 billion sell-off: Is it a signal of decline?

According to on-chain data, there has been a significant change in the activities of Bitcoin's long-term investors (LTH).

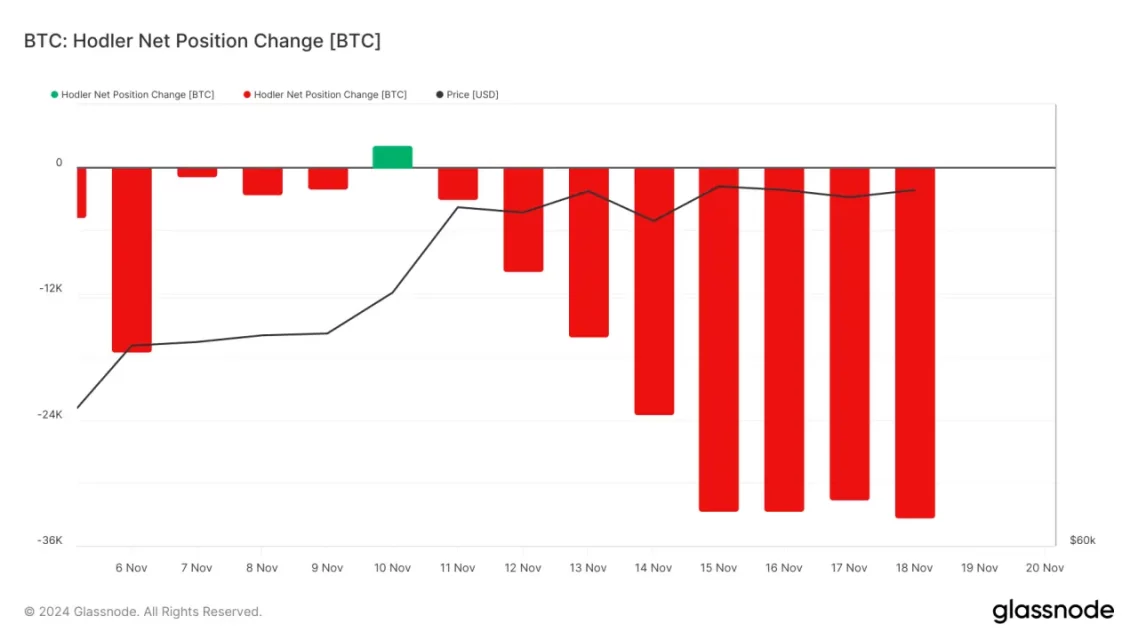

LTHs are generally defined as investors who hold their coins for more than 155 days. According to Glassnode data, Bitcoin's "Hodler Net Position Change" dropped to the lowest level in five months on Tuesday.

This metric reflects the overall buying and selling activities of long-term Bitcoin investors. This decline indicates that the group sold more than 3 billion BTC on that day. The sales on November 18th were the highest amount recorded since June 26th.

Onchain data shows Bitcoin (BTC) is heating up

According to Santiment data, Bitcoin's market value to realized value ratio (MVRV) indicates that the pair may be overvalued. BTC's current MVRV ratio is at 182.06 percent level. This ratio shows that the current market value of Bitcoin is significantly higher than the realized value. If all Bitcoin holders sell, on average they will make a profit of 182.06 percent.

In recent weeks, transactions in Bitcoin have been largely profitable. As of November 20th, the profit-loss ratio in BTC's daily transaction volume (evaluated using a 30-day moving average) is at 2.01. This indicates that for every losing BTC transaction, there are 2.01 transactions resulting in profit.

If long-term investors continue to sell profits, the price of Bitcoin could retreat to support levels below $90,000. According to the Fibonacci indicator, the next critical support level is at $83,983. However, if selling pressure decreases and positive news continues, new highs could be seen in Bitcoin.

This article does not contain investment advice or recommendation. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.