- Topic

106k posts

65k posts

62k posts

57k posts

54k posts

46k posts

44k posts

44k posts

42k posts

- 10#NADA#

40k posts

- Pin

- 🎉 Thanksgiving Special: Chat & Win Exclusive Gate.io Merch!

Thanksgiving Exclusive Merch Giveaway!Join the Gate.io Chat Community, chat actively in the community to win exclusive prizes, more futures vouchers, Thanksgiving Lucky Grand Prizes, and tons of red packets waiting for you to grab!

🎁Benef

- 🧧 Join Gate.io Chat Community to grab red packet airdrops everyday!

⏰ Click the red packet icon as soon as the countdown ends. First come, first served.

🔥 Remember to claim your lucky red packet & do not miss out!

Join Gate.io Chat Community:

👉🏻 Open #Gateio# App - Click "Moments" - Find "Chat"

- 📚 #Postopedia# Gate Post Postopedia 4️⃣ is coming!

Expose more Gate Post rules to help you master it!

🧐 What are Gate Post Ambassadors? What exclusive benefits are offered?

Become a ''Gate Post Ambassador'' and enhance your influence! 🚀

Sign up now to easily enjoy exclusive benefits! 🎁

Get invol

- 🔥 $100M in #USDE# Rewards Up for Grabs!

🎁 Hold #USDE# and Enjoy 34% APR, Settled Daily with No Staking Required!

💰 Exclusive Bonus for New Users: 100,000,000 #PEPE# !

👉 Join Now: https://www.gate.io/campaigns/100-m-usde

⏰ Event Duration: Nov 18, 00:00 - Nov 28, 00:00 (UTC)

Details: https://www.g

- 🔥 Join Gate Post Ambassador Points Task and Win Weekly $200 Rewards (11/18-11/24)!

👉️ Post to earn points and win a share of $200 based on your points, plus ambassador benefits!

Sign up now: https://www.gate.io/questionnaire/5158 (Ends at Nov 18, 16:00 UTC)

🎁 Rewards:

Weekly Ranking Prizes:

🥇1st

Time is running out for Ethereum (ETH): Will it rise?

Will Ethereum (ETH), which has been crushed in the face of Bitcoin's rise, be able to put an end to the bad trend?

Bitcoin, which has been hovering above $90,000 for a few days, continues to inspire confidence in the crypto market. However, the weak performance of ETH has begun to disappoint altcoin investors. Despite BTC breaking new highs every day, ETH has yet to surpass $3,500. So, can Ethereum, the leader of altcoins, recover from this situation?

Investors Are Keeping Their Distance from ETH

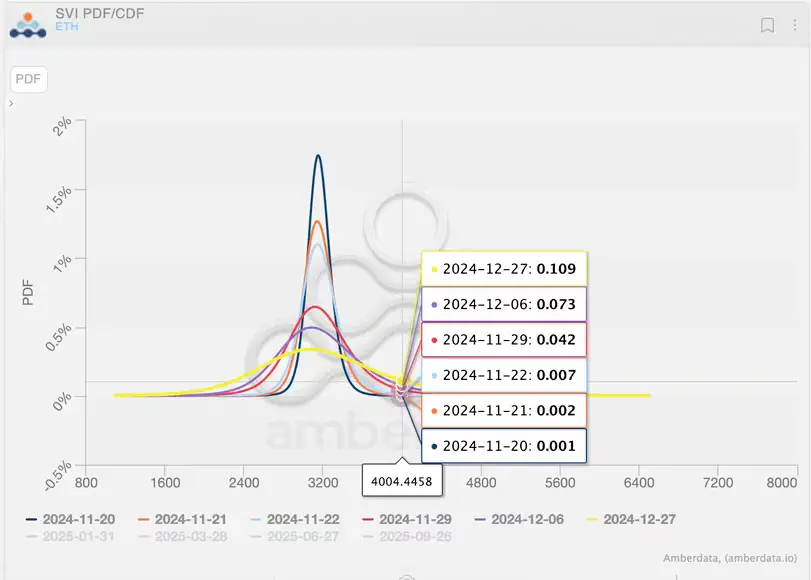

According to the research conducted by the crypto analysis platform Amberdata, there is a 10% chance of ETH exceeding $4,000 in the short term. Investors predict that while Bitcoin is expected to reach new highs by surpassing $100,000, ETH will continue to lag behind. According to Amberdata, the probability of the price exceeding $4,000 before the expiration of the December 27 options for ETH is only 10%.

According to the company, the bad outlook for ETH is based on weak economic fundamentals. Greg Magadini, Director of Derivatives at Amberdata, said, “ETH is facing inflationary supply due to heavy transactions on Layer-2s. This situation is putting pressure on the ETH price.”

In addition, data from spot ETFs does not provide much hope for Ethereum. While things are going well for Bitcoin, net inflows into Ethereum are currently insufficient for a substantial increase in volume. If this situation reverses, a rise in ETH can be expected when the price surpasses $3500 or if BTC dominance decreases. The critical level will be $4000. Weekly closings above this level can pave the way for ATH.

This article does not contain investment advice or recommendations. Every investment and trading activity carries risk, and readers should conduct their own research when making decisions.