- Topic

106k posts

65k posts

62k posts

57k posts

54k posts

47k posts

44k posts

44k posts

42k posts

- 10#NADA#

40k posts

- Pin

- 🔥 Join "Suggested Topics" Campaign & Win a share of $200 Weekly Rewards

👉 How to Join:

1.Visit Gate Post APP page

2.Click any top 3 "Suggested Topics"

3.Users who post quality content under "Suggested Topics" will be selected to win rewards.

Example:

Post content related to trading strategies, ma

- 🎉 Thanksgiving Special: Chat & Win Exclusive Gate.io Merch!

Thanksgiving Exclusive Merch Giveaway!Join the Gate.io Chat Community, chat actively in the community to win exclusive prizes, more futures vouchers, Thanksgiving Lucky Grand Prizes, and tons of red packets waiting for you to grab!

🎁Benef

- 🧧 Join Gate.io Chat Community to grab red packet airdrops everyday!

⏰ Click the red packet icon as soon as the countdown ends. First come, first served.

🔥 Remember to claim your lucky red packet & do not miss out!

Join Gate.io Chat Community:

👉🏻 Open #Gateio# App - Click "Moments" - Find "Chat"

- 📚 #Postopedia# Gate Post Postopedia 4️⃣ is coming!

Expose more Gate Post rules to help you master it!

🧐 What are Gate Post Ambassadors? What exclusive benefits are offered?

Become a ''Gate Post Ambassador'' and enhance your influence! 🚀

Sign up now to easily enjoy exclusive benefits! 🎁

Get invol

- 🔥 $100M in #USDE# Rewards Up for Grabs!

🎁 Hold #USDE# and Enjoy 34% APR, Settled Daily with No Staking Required!

💰 Exclusive Bonus for New Users: 100,000,000 #PEPE# !

👉 Join Now: https://www.gate.io/campaigns/100-m-usde

⏰ Event Duration: Nov 18, 00:00 - Nov 28, 00:00 (UTC)

Details: https://www.g

A rare signal for Bitcoin: Rally is on the way!

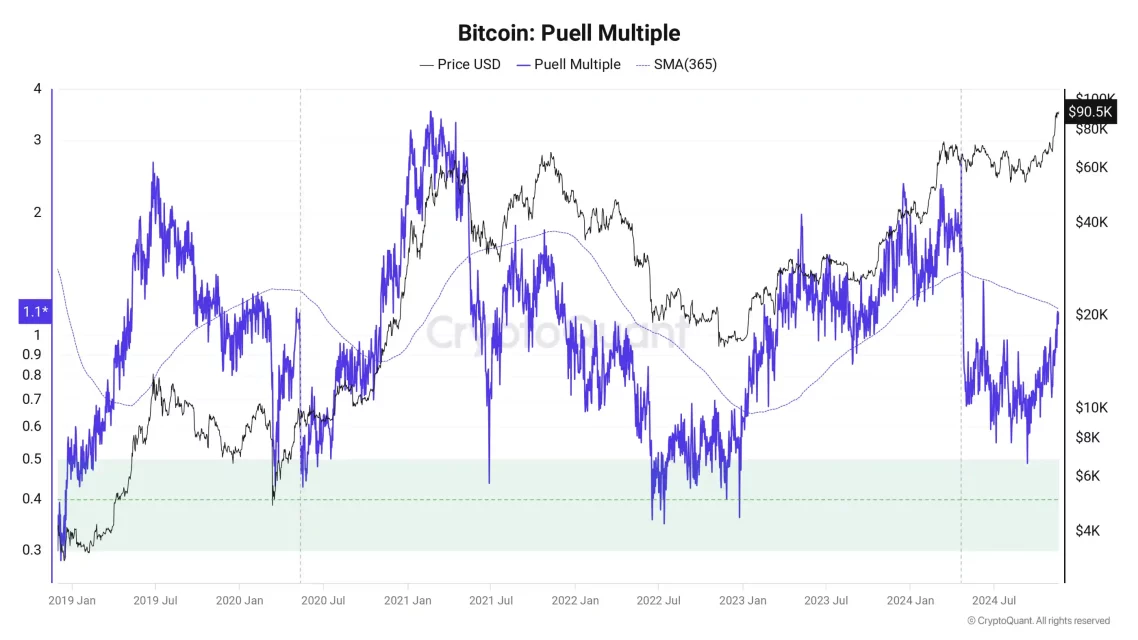

CryptoQuant, a chain analysis platform, claimed that Bitcoin (BTC) has formed a rarely seen bullish pattern.

Although the impact of the US elections is slowly fading, the BTC price is trading above $90,000. While Trump's takeover is expected on January 20th, the crypto market is predicted to remain positive during this period.

A rare breakthrough has emerged in BTC price chart measurements. CryptoQuant expressed that Bitcoin has hinted at a “strong rally” in its analysis published on November 18.

According to the analysis, the BTC price is approaching the breakout line in the 'Puel Multiple' indicator. If the mentioned breakout occurs, it is estimated that the price will increase by nearly 90%.

"Historic opportunity for Bitcoin"

CryptoQuant, analyzing the results of Puel Multiple in the last five years, discovered that the metric has only crossed its 365-day moving average three times. BTC experienced a significant increase in all three of these breakthroughs.

CryptoQuant analyst Burakkesmeci, who made statements about the subject, said the following;

"Puell Multiple helps us understand market cycles from a mining perspective."

According to the Puell Multiple metric, BTC recorded a 76% increase in January 2024, when the metric was last seen. In January 2020, when the metric exhibited an upward breakout, the BTC price also increased by 113%. The third and final data point occurred in March 2019. At that time, following the golden cross formed by the Puell Multiple, the BTC price increased by 83%.

The analysis touched upon the following;

All these data points and the macroeconomic framework indicate that a strong bull rally may be on the horizon

In the text, it is said.

This article does not contain investment advice or recommendations. Every investment and trading activity involves risks, and readers should conduct their own research when making decisions.