- Topic

102k posts

64k posts

59k posts

56k posts

53k posts

46k posts

44k posts

43k posts

41k posts

- 10#NADA#

40k posts

- Pin

- 📣 Gate.io Post Crypto Observer Call to Action!

📈 Share crypto news & win great rewards daily!

💓 Don't hesitate, join now ⏬

1.Share daily crypto news, market trends, and insights into your post.

2.Include the #CryptoObservers# to successfully participate.

🎁 5 lucky "Crypto Observers" will be rewa

- 🔥 Join Gate Post Ambassador Points Task and Win Weekly $200 Rewards (11/11-11/17)!

👉️ Post to earn points and win a share of $200 based on your points, plus ambassador benefits!

👉 Sign up now: https://www.gate.io/questionnaire/5158 (Ends at Nov 11, 16:00 UTC)

🎁 Rewards:

Weekly Ranking Prizes:

🥇

- 🚀 The special episode of "Dr. Han, What Do You Think" is live!

🎙 Gate.io Founder & CEO Dr. Han takes on a rapid fire Q&A, covering work, life, and some truly tricky questions!

👀 How will he tackle these challenges?

🤩 Click to watch his real-time reactions, and join in the comments! - 📢 Gate.io Post Tag Challenge: #MyFavoriteToken# Post and WIN $100!

Have a favorite token you're excited about? Whether it’s for technical innovation, community support, or market potential, join #MyFavoriteToken# event and share your insights with us!

💡 How to Participate:

1️⃣ Follow Gate_Post

2️⃣

- 📢 Countdown: Just 1 Week Left! Are You Ready?

🗓 On November 14, @Gate_Ventures and @HackQuest_ are joining forces for the #WEB3 DEV HUDDLE# side event at Gaysorn Tower in Bangkok, Thailand!

🔥We’re excited to have @ZKcandyHQ, @iGAM3_ai, @flow_blockchain, @botanika_sol and @kol4u_xyz as our gold sp

Time is up for Bitcoin (BTC): Fed interest rate decision is imminent

The Fed interest rate decision on September 18th seems to determine the fate of Bitcoin (BTC).

Bitcoin may rise towards $65,000 this week following the expected interest rate cuts. However, analysts believe that the uncertainty of the US election will have a negative impact on cryptocurrencies. According to Australian crypto trading company Zerocap, Bitcoin could test $53,000 following the Fed's interest decision on September 18, or make a sharp rise to $65,000.

Even Fed interest rate forecasts pushed cryptocurrencies higher

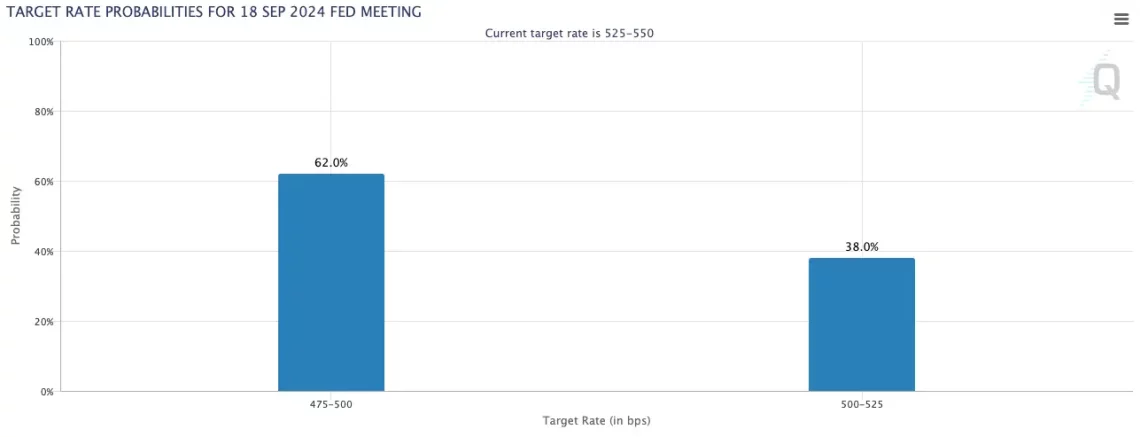

Jonathan de Wet, Chief Investment Officer of Zerocap, stated in an interview with Cointelegraph that the market currently predicts a 62% chance of the Fed cutting interest rates by at least 50 basis points. The change in expectations caused the Bitcoin price to move towards $60,000 on September 13th.

Wet thinks that predicting price movements is difficult due to uncertainty about the impact of interest rate cuts and that the November US elections have further complicated things. Considering that the Fed waited so long for the first cut, Wet said that Zerocap is expecting 50 basis points instead of 25 basis points.

Analysts are divided

The latest data from CME Group's FedWatch Tool shows a 62 percent chance of a 50 basis point rate cut on September 18. The upcoming rate cuts have sparked heated debates in the market, and many analysts are divided on whether the upcoming rates will lead to a rise or fall for risky assets such as cryptocurrencies.

Historically, following interest rate cuts, it is expected that investors will turn to more risky assets due to the reduced cost of financing. However, some analysts believe that if the economic contraction that followed similar rate cut cycles in 2001 and 2007 were to occur today, the opposite effect could be seen. Experts are much more concerned about the recession turning into a financial crisis.

This article does not contain any investment advice or recommendation. Every investment and trading action involves risks and readers should conduct their own research when making decisions.