- Topic

82k posts

60k posts

53k posts

51k posts

49k posts

45k posts

43k posts

42k posts

39k posts

38k posts

- Pin

- 🚀 Gate.io Newcomer Perks is in full swing!

Join now: https://www.gate.io/questionnaire/5225

🎁 $20,000 in Rewards, VIP Privileges & Free Airdrops! 🎁

Details:https://www.gate.io/announcements/article/39631

- Security Knowledge Quiz 1️⃣ 5️⃣ to Win Weekly Rewards!

🌟 How to Join?

1. Follow Gate_Post

2. Comment below with your answer

Tips: Gate.io is diligently working to guarantee users' assets through advanced technological solutions

🎁 4 lucky users will be randomly selected to receive $5 in tokens each

🗓️ Ends by 16:00 PM, October 5th (UTC)

- 🔥 Gate.io #EIGEN# Limited-Time Listing Campaign is On Fire, Share $20,000 Rewards!

Deposit #EIGEN# to Split $13,000

Trade #EIGEN# to Split Extra $4,000

New Users Exclusive: Share a $3,000 Prize Pool

🚀 Join Now: https://www.gate.io/questionnaire/5209

Detail: https://www.gate.io/announcements/article/39599

- 🎉 Gate.io Honor Credits Grand Draw Round 3️⃣ is Now Live!

How to Join?

1️⃣ Head to the Gate Post ‘Credits Center’ and complete tasks

2️⃣ Earn Honor Credits and hit ‘Draw Now’ for your chance to win!

➠ Every 500 credits gives you a shot!

🎁 MacBook Air, exclusive merch, and more awesome prizes await!

⏰ Event Time: September 26th 00:00 - October 6th 16:00 (UTC)

Draw Now 👉 https://www.gate.io/activities/creditprize?now_period=3

Learn more: https://www.gate.io/announcements/article/39517

#HonorCredits#

- 🔥 Exciting News: Answer & Earn is Live!

✨ Take the Quiz on BOBO (BOBO) and Share Massive: Share 2,238,805,970 #BOBO#

🎁 Answer Correctly, Win Big: https://www.gate.io/activities/answer-earn?period_num=220

Details: https://www.gate.io/announcements/article/39644

#Answer2Earn#

Famous analyst spoke about Bitcoin: These 3 data are very important!

Capriole Investments founder Charles Edwards stated that multiple metrics indicate a bearish signal in Bitcoin (BTC).

Bitcoin (BTC) price has lost 2.25% in the last 24 hours. BTC is currently trading at 16% below its all-time high of $73,835, reached on March 14. Bitcoin has experienced a 8.75% decrease in the past month and a 5.5% decrease in the past three months. BTC price has been weak in June, leading market analysts to comment on whether the 'cycle peak' for the leading cryptocurrency has been seen.

Why do analysts think the main peak is seen in BTC?

The inflation rate of long-term BTC holders is at a critical threshold

Charles Edwards, the founder of Capriole Investments, believes that numerous on-chain metrics indicate that Bitcoin's failure to reach new highs after two attempts is a 'weakness signal'.

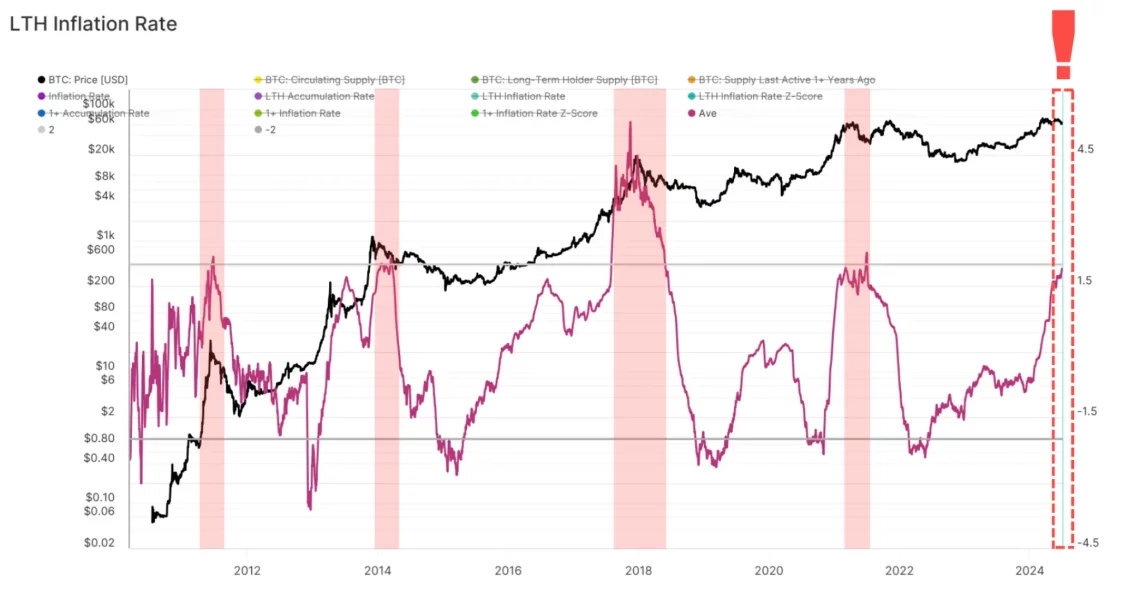

In its latest bulletin, Edwards explained that the inflation rate has been steadily increasing over the past two years for Bitcoin long-term holders (LTH).

According to Glassnode, LTH market inflation rate measures the annual accumulation or distribution rates above daily exports to miners. Higher values indicate that LTHs contribute to selling pressure as their Bitcoin assets decrease.

Edwards pointed out that at the peaks of a bull market, market inflation exceeds nominal inflation (the threshold of 2.0), indicating a high probability of the cycle being at its peak.

“Bitcoin lethargy” has been on the rise for three months

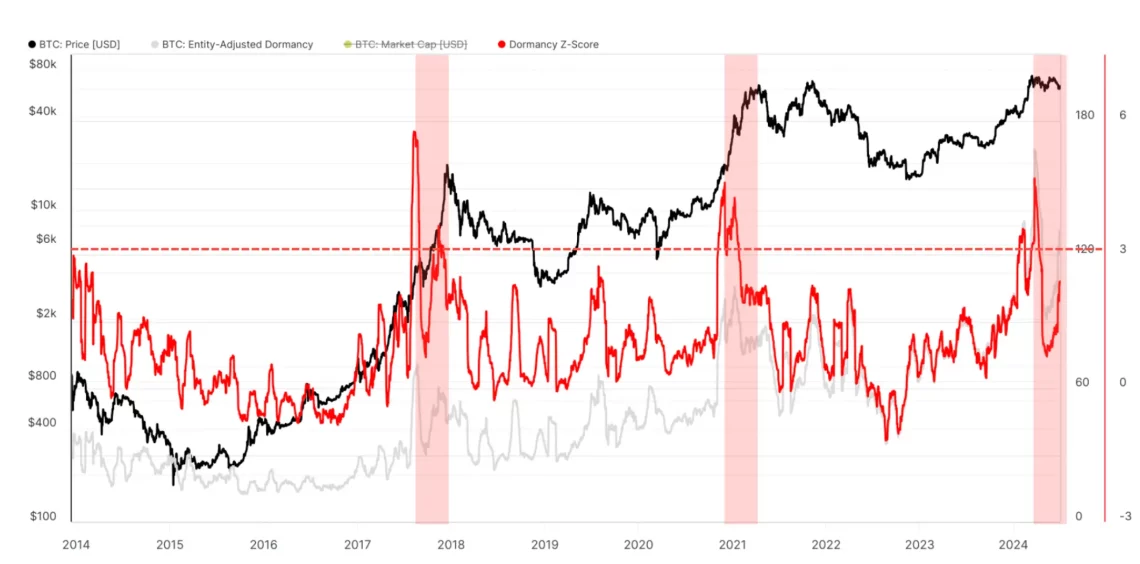

Another metric that is useful in determining market cycles and evaluating whether Bitcoin is on the rise or fall is Dormancy Flow, which can be translated into Turkish as “uyuşukluk akışı”. This is an on-chain metric used to measure the number of coins sold according to the general trend.

Additional data from Glassnode reveals a sharp increase in Bitcoin Dormancy Z-Score over the last 90 days.

Edwards argued that this metric peaked significantly in April and claimed that the average age of sold cryptocurrencies would be significantly higher in 2024. The analyst said, 'Typically, only three months after peaks in this metric (z-score), we see a peak in rallies'.

With its current value, Dormancy Flow Z-score indicates that the coins in a transaction that is not supported by the transaction volume of Bitcoin are overvalued in total. This suggests that the price of Bitcoin may have reached a cycle peak, which could mean a decline for the overall crypto market.

The other side of the coin in BTC

On the other hand, Spent Volume, which calculates the total volume of sold digital assets and provides a comprehensive view of overall market activity, stands out as an important metric. Sudden increases in this volume can be an indication of a peak. The sudden growth in Bitcoin's 7-10 year spent volume is interpreted by analysts as a cycle peak.

Mt. Gox anxiety dominating the market

Edwards also noted that Bitcoin worth more than $9 billion has been moved by addresses that are over 10 years old. He attributed this distribution to the final move of the now-defunct crypto exchange Mt. Gox, which is preparing to repay its creditors in July.

A financial services company like Swan also shared a similar idea, expressing concerns about the impact of the 142,000 bitcoins (approximately $9 billion at current rates) that Mt. Gox creditors will release soon, 10 years later.

Swan said, “although long-term investors with multiple payment options for creditors, corporate ownership and tax issues indicate a gradual pressure rather than a sudden sale, even if all cryptocurrencies are returned at once.”

The company added in a subsequent post that ongoing sales by governments contributed to the supply-side pressure on Bitcoin.