No new notifications

More

Rise/fall colour

Start-End Time of the Change

- Topic

122k posts

72k posts

67k posts

58k posts

56k posts

49k posts

45k posts

44k posts

44k posts

- 10#DOGE#

43k posts

- Pin

- 🎉 Share Your #2024 Annual Report# & Win $10,000 Sharing Rewards!

Reflect on your year with Gate.io and share your report for a chance to win prizes worth $10,000!

👇 How to Join:

⏺ Click to check your Annual Report: https://www.gate.io/your-year-in-review

⏺ After viewing, share it on social media or Gate Post using the "Share" button

⏺ Invite friends to like, comment, and share. More interactions, higher chances of winning!

🎁 Prizes:

1️⃣ Daily Lucky Winner Prize: $50 GT Airdrop, Bull Sculpture, and Gate.io Commemorative Medal for one lucky participant every day!

2️⃣ "Lucky Share" Prize: $10

- ⭐ Join Gate Post, Explore Industry Trends, and Share Insights and Strategies

💎 Become a Gate Post Ambassador and enjoy exclusive benefits

⛏️ Earn up to 10% yield with #Contentmining#

🎁 Participate in weekly events and win rewards

▶️ Join Now: https://www.gate.io/post

#GatePost#

- 💰 #USDE# Rewards for Dec 03-15 Have Been Distributed!

🤑 The $100M #USDE# Reward Pool is still open—don’t miss out!

Steps to Join:

1️⃣ Click "Join Now": https://www.gate.io/campaigns/190-usde-100-m

2️⃣ Hold at least 10 $USDE in your account

3️⃣ Enjoy 29% APR rewards, credited daily!

🗓 Event Ends on December 23 at 00:00 (UTC)

Details: https://www.gate.io/announcements/article/41257

- 📢 Gate.io Post Tag Challenge: #My Favorite Gate Post Feature# Post and WIN $100!

What feature do you use the most on Gate Post? Post? Subscribe? Chat? Honor Credits? Or Suggested topics? What new features or functionalities would you like to see? Share your experiences and insights, and let more people discover the charm of Gate Post!

💡How to participate

1️⃣ Follow Gate_Post

2️⃣ Open the Gate.io APP, click "Moments" at the bottom to enter the "Post-Square" page.

3️⃣ Click the Post button in the lower right corner, use the hashtag #My Favorite Gate Post Feature# and post about your insights

✍

- 🎅 #ChristmasWonderland# Warmup Party

🥳 Join to Unlock Game Chances Early—$50,000 in Christmas Gifts Await!

✔️ Submit UID & Win Free Tickets with Friends: https://www.gate.io/questionnaire/5732

⬇️ Christmas Wonderland Gameplay Tutorial

#Christmas2024#

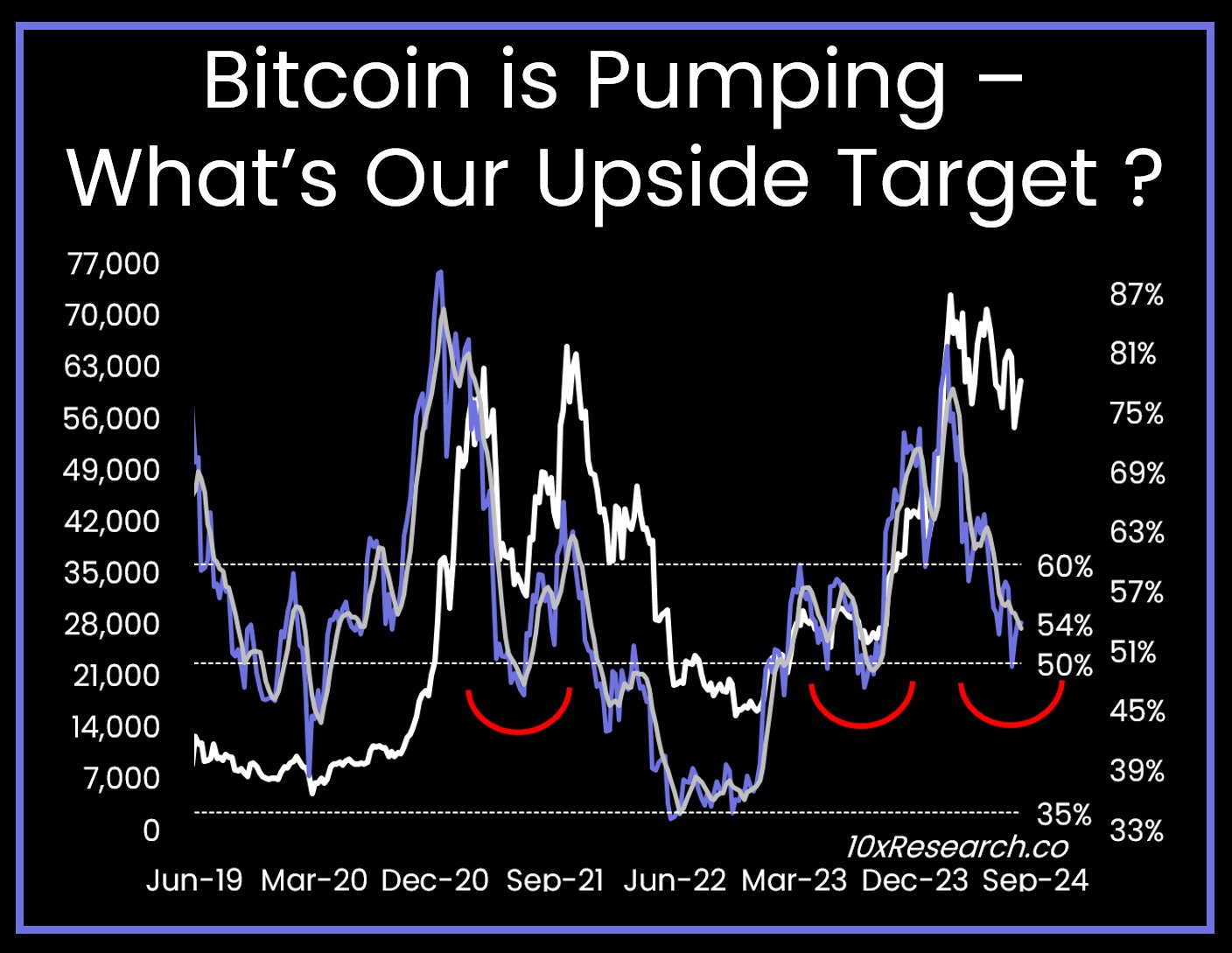

Bitcoin analysis: 10x Research revealed when Bitcoin will rise!

Bitcoin news: Bitcoin followed a volatile trend in August and traded in a narrow range between 58,000 and 60,000 dollars. As global economic tensions and the upcoming US elections push cryptocurrencies towards an uncertain future, 10x Research shared that Bitcoin is at a potential upward threshold. According to the latest analysis by 10x Research, BTC is moving within a triangle formation, and a new correction could occur towards the end of September.

Bitcoin (BTC) could recover by the end of 2024

10x Research, which summarizes its analysis in 6 points, stated that despite Bitcoin's inability to break out of the triangle formation after its recent rise, it has shown signs of recovery. It stated that the market is showing signs of improvement in technicals and that there may be a rise towards $65,000.

A report suggesting that the closing of short-term positions in Bitcoin after the August 5th crash could lead to a price movement, predicts that the BTC price could rise along with the momentum in the US stock markets on traditional exchanges.

Source: X 10x ResearchIn a report explaining how current events will affect the market-leading crypto, the effects of the FOCM meeting in September were discussed. Accordingly, the debate over the Fed's interest rate cuts may be triggered. Additionally, the Fed's interest rate cut could serve as a significant catalyst that could trigger a rally in the crypto market.

Potential Risks of the US Elections on Bitcoin

The most important technical detail in the 10x Research research report will be the impact of the upcoming US elections and the Kamala Harris and Trump debate planned before that on the market. The report reveals that after the Trump assassination, there was a recovery in the crypto markets, but it has been revealed that the strengthening of Harris' position currently raises uncertainty about how the markets could be affected by the election process.

10x Research warned investors to be prepared for a technical breakout that could occur in either direction. Technical data supports a recovery in BTC price, but highlights increased risks with institutional sell-offs and the possibility of a breakout in both directions in the triangle pattern.

August 22 Thursday: Current Bitcoin analysis

The cryptocurrency market rose back to $60,000 on Thursday, August 22. The price of Bitcoin is currently trading at $60,926 with a 2.70% increase, and the 30% increase in trading volume is supporting the price rise. Looking at the technical chart, the price is below the Ichimoku Cloud.

BTC technical chart MACD indicator signaling a possible improvement by crossing the signal line in the negative zone. The DMI index, which helps determine the direction of the trend, shows that +DI is below the -DI index. ADX is moving sideways, indicating that the current trend may continue for a while. Finally, the Relative Strength Index is in the neutral zone above the 50 level.

When looking at the current crypto market movements, the best altcoins are rising with general market optimism. In the meme coin sector, Floki price and Brett price lead meme coins with an increase of over 5%. Market leader Doge, on the other hand, rose by a more modest 1.65%. PlayDoge, which brings Doge meme coin to the P2E Gaming category, is approaching the final stage of the presale process.

PlayDoge launch is approaching

PlayDoge (PLAY), which will end its presale on August 26th, is a crypto game that requires taking care of a virtual pet in a Tamagotchi-style. To earn PLAY tokens in the project, it requires participating in in-game activities and ensuring the well-being of the pet. The PLAY tokens, which are in the final stage of the presale and can be purchased at lower prices before listing, are sold for $0.00531.

Visit PlayDoge Token

The play-to-win crypto project, which also has a staking mechanism, offers a 74% annual return according to the latest data. PLAY tokens can be purchased with Ethereum, USDT, and card, and can also be added to the wallet on the BNB network.

The information in the text is purely for informational purposes. It does not constitute any investment advice. The author and kriptoparahaber.com are not responsible for any profit or loss arising from your investments. Ultimately, investment is based on many factors such as knowledge, experience, research, and personal decisions.

Related News