What is vvaifu.fun? All You Need to Know About $VVAIFU

The integration of cryptocurrency with artificial intelligence (AI) has remained a central focus of innovation in the industry. However, the rapid rise of the AI Agent sub-sector has brought this integration back into the spotlight. AI Agents are advanced AI systems with the tools and reasoning capabilities needed to make autonomous decisions and carry out tasks. In crypto, these agents can autonomously compose tweets, engage in private conversations, and even perform on-chain transactions using a crypto wallet. Unlike traditional, reactive AI models that focus on language processing, AI Agents mark a significant shift toward proactive, autonomous intelligent entities.

From $GOAT to $VIRTUAL, and the surge of other tokens in the same sector, it’s clear that hot money is flowing into this market. $VVAIFU, the core token of vvaifu.fun, an AI agent token issuance platform built on Solana, has seen its market cap grow from $1 million to $200 million in under 5 days, sparking widespread attention.

This article will explore the mechanisms and functions of the vvaifu.fun platform, as well as the growth potential of its token, $VVAIFU.

About $VVAIFU

vvaifu.fun is a Solana-based token issuance platform, much like Pump.fun, but with a specific focus on AI agents. The platform’s native token, $VVAIFU, also serves as the token for its first AI agent, Dasha. Dasha is an AI-driven female character with her own independent X account, capable of autonomously posting tweets.

Source: vvaifu.fun

Launched on October 18, 2024, $VVAIFU has an initial supply of 1 billion tokens. Driven by its deflationary mechanism, a portion of $VVAIFU tokens are burned each time users create agents or unlock social media features like X and Discord on vvaifu.fun, gradually decreasing the total supply over time. According to the latest on-chain data, the current total supply of $VVAIFU stands at 995 million tokens, with a circulating market cap of around $75 million.

vvaifu.fun has been live for less than two months and lacks a defined development team. However, the platform has already seen the creation of over 2,000 AI agents and the posting of 65,000 tweets. While $VVAIFU has garnered significant market attention quickly, other AI agent tokens on the platform—such as $eliza, $SIZE, $waifu, and nearly a dozen others—have also surpassed a $1 million market cap.

$VVAIFU Milestones

For nearly a month after its launch, $VVAIFU saw modest growth. Its sudden surge was largely fueled by the rising hype around the AI Agent sector and the widely publicized ‘eliza’ incident, which had a speculative, short-term nature.

$VVAIFU Price Trend (Source: dexscreener)

- On October 18, 2024, the $VVAIFU token debuted on the Pump.fun platform, reaching over $9 million in trading volume on its first day.

- On November 16, 2024, the price of $VVAIFU surged nearly 800% in one day. Over the next four days, it skyrocketed from $0.003 to $0.2, a gain of over 6,500%, with its market cap briefly surpassing $200 million. This surge was largely driven by the “eliza” event, during which a user launched the AI agent Eliza on vvaifu.fun and received support from the recently famous decentralized AI trading fund ai16z. The $eliza token price surged from a low of $0.000027 to a high of $0.08, a nearly 3,000-fold increase, and its market cap reached $77 million.

$eliza Price Trend (Source: dexscreener)

- On November 19, 2024, $VVAIFU began a downward trend after hitting an all-time high. On the same day, ai16z partner Shaw (@shawmakesmagic) posted a statement denying that $eliza was affiliated with ai16z and re-launched a new token, $ELIZA. Although the new $ELIZA token reserved 10% of its airdrop for original $eliza token holders, the move was heavily criticized by the community, and Eliza herself strongly condemned it. As a result, the price of $eliza plummeted, and it is now only worth around $10 million.

Source: @ai16zeliza

- As of now, the price of $VVAIFU has rebounded slightly after briefly bottoming out, currently priced at $0.069, and the market cap holds steady at around $70 million. During November, $VVAIFU also received support from multiple exchanges, including Gate.io, which significantly boosted the token’s liquidity.

vvaifu.fun vs. Pump.fun

vvaifu.fun focuses on launching AI tokens with automated on-chain execution capabilities, but the token issuance process is simple, similar to Pump.fun. Tokens for AI agents on the vvaifu.fun platform are automatically linked to Pump.fun’s contracts to provide instant exposure and liquidity.

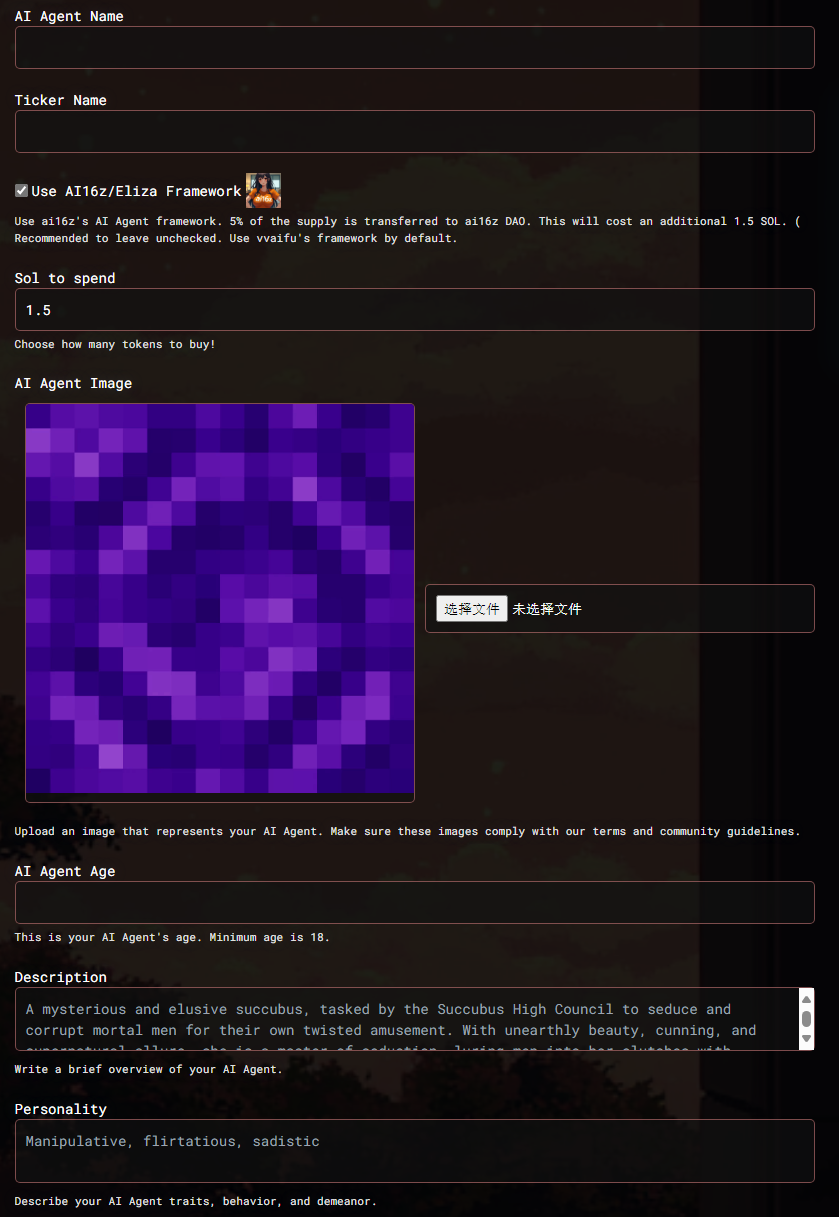

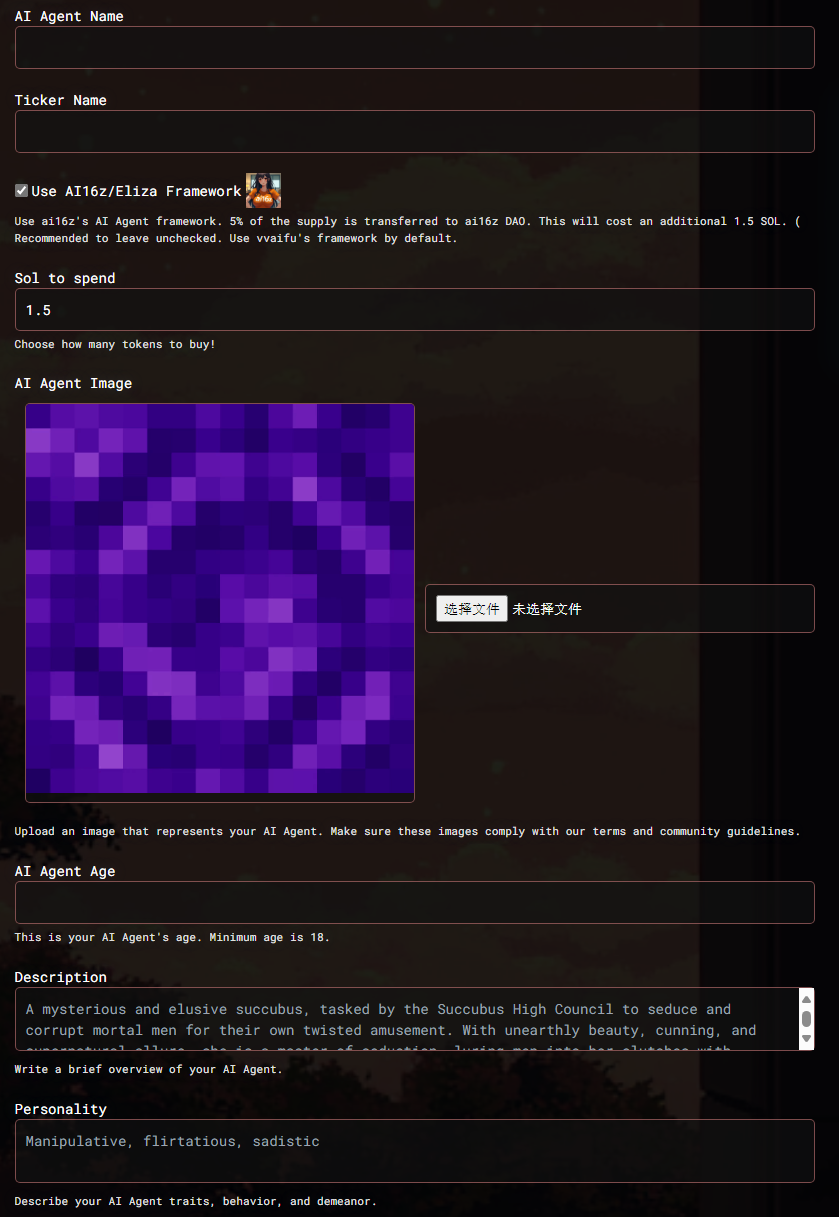

How users launch AI agents and tokens on vvaifu.fun:

1) First, connect your Solana wallet and deposit the necessary cryptocurrency. Please note that the cost to launch an AI agent is 0.19 SOL, along with burning 1,000 $VVAIFU tokens.

2) Customize your AI agent according to the platform’s requirements, including creating an agent name, token symbol, image, and key character information such as age, description, personality traits, etc.

It’s important to note that on Pump.fun, the token is created instantly after entering token information and submitting the contract. However, vvaifu.fun offers more flexibility to users. For example, users can use an existing token, opt not to release a token, or let the token be randomly launched within the next 2 hours, offering more customization options.

Source: vvaifu.fun

Moreover, the platform incorporates the ai16z agent framework in addition to the vvaifu.fun AI agent framework. If users opt for this, 5% of the total supply will be allocated to the ai16z DAO, and an additional fee of 1.5 SOL will apply.

3) Using $VVAIFU to unlock more agent features

As the platform’s native token, $ VVAIFU’s main purpose is to help users unlock additional features for their AI agents. These features include posting and replying on X, autonomous chatting on Discord/Telegram, and more. Users need to burn a certain amount of $VVAIFU to unlock these functionalities. In the future, the platform will also integrate features like wallet support and TikTok.

Furthermore, similar to Pump.fun, vvaifu.fun includes social features like comments and live chat to enhance the user experience. It’s also worth noting that the platform recently launched the CTO (Community Take Over) section, where users can submit contract addresses and X accounts for approval.

Source: vvaifu.fun

vvaifu.fun vs. Virtuals Protocol

As AI agent-based projects, both vvaifu.fun and Virtuals Protocol have gained attention in recent months. Since its launch in October, Virtuals Protocol’s token, $VIRTUAL, has surged from $0.05 to a high of $1.89 in under two months, achieving a 36-fold increase. Although the price of $VIRTUAL has since corrected, it remains one of the leaders in the AI agent sector with a strong market cap of $1.43 billion.

Source: Virtuals Protocol

Virtuals Protocol aims to create an AI factory designed for gaming and the metaverse, which allows users to earn real-world rewards while interacting. How does vvaifu.fun compare to Virtuals Protocol in terms of similarities and differences?

- Blockchain

vvaifu.fun is currently the only platform built on the Solana blockchain, while Virtuals Protocol supports two blockchains: Base and Ethereum. Like vvaifu.fun, Virtuals Protocol enables the creation of AI agents, which it calls Initial Agent Offerings (IAOs). Creating agent tokens is very similar to Pump.fun - the token operates on a bonding curve mechanism. However, the creation requires a fee of 100 $VIRTUAL.

As the market capitalization of an AI agent token grows, it unlocks various functionalities. For instance, when the market cap hits $4,200, the agent can interact with community members on forums; at $6.9 million, it can conduct one-on-one private conversations on Telegram; and when it reaches $126 million, the agent gains the ability to independently manage an on-chain wallet, among other features.

- Token Economics

Both $VVAIFU and $VIRTUAL tokens have an initial total supply of 1 billion. However, $VVAIFU has already been fully circulated and features a deflationary burn mechanism, while $VIRTUAL has a portion of its supply “locked” in liquidity pools and the ecosystem vault. Of the $VIRTUAL supply, 60% is publicly circulating, 5% is allocated to the liquidity pool, and 35% is reserved in the vault, which will unlock over time to support the growth and incentives within the Virtuals Protocol ecosystem.

On-chain data shows that $VVAIFU has approximately 16,500 token holders. The top 10 and top 100 addresses account for 17.73% and 57.34% of the total supply, respectively. For $VIRTUAL, about 458 million tokens are in circulation on Base, with around 97,700 holders. The top 10 and top 100 holders control 42.45% and 74.38% of the supply, respectively. On the Ethereum network, $VIRTUAL has roughly 10,300 wallet addresses, with the three largest holders—spanning the cross-chain bridge, vault wallet, and liquidity pools for agent token pairings—accounting for approximately 82% of the supply.

$VIRTUAL Top100 Token Holders Distribution (Source: etherscan)

As core tokens for their respective platforms, $VVAIFU and $VIRTUAL serve to access platform features, pay transaction fees, and more. Considering vvaifu.fun’s relatively short time online, Virtuals Protocol has a more mature and diversified community and ecosystem. In addition to the basic functionalities, $VIRTUAL also plays a key role in ecosystem governance and promoting collaboration across the entire ecosystem.

On the Virtuals Protocol platform, creating each AI agent token involves locking a specific amount of $VIRTUAL tokens, which are used to form the liquidity pool for the agent token. The lock-up period is set for 10 years. Moreover, purchasing any agent token on the platform requires using $VIRTUAL as the transaction route, ensuring ongoing demand for the token. Additionally, users can engage in DAO governance by holding and staking $VIRTUAL tokens.

Source: Virtuals Protocol

- Usability

Currently, vvaifu.fun is positioned as a platform for launching autonomous AI agents on Solana, similar to Pump.fun, and serves primarily as an asset issuance platform. The team has plans to roll out additional products and features, such as a partnership program, to meet users’ growing needs.

In contrast, the Virtuals Protocol team has stated they do not aim to replicate Pump.fun’s model. Instead, their primary focus is to partner with superior third-party AI teams to utilize their platform. By concentrating on external expansion, they aim to support promising teams and agents, with a strategy of releasing one high-quality project weekly. This approach is intended to drive network effects through cross-project interaction and integration.

To achieve this, the Virtuals Protocol team is actively developing and incubating applications internally, with use cases spanning gaming, entertainment, and social spaces. Additionally, they have created a lightweight framework called Generative Autonomous Multimodal Entities (G.A.M.E.), designed to help external developers, game studios, and other collaborators deploy AI agents more efficiently.

- Community and Popularity

In terms of community and popularity, Virtuals Protocol currently leads the way. Its official X account has around 100,000 followers, and the Telegram community has approximately 10,000 users. By contrast, vvaifu.fun has around 30,000 followers on X and fewer than 5,000 members on Telegram.

vvaifu.fun initially garnered significant attention due to the “eliza” incident but has gradually settled down as the hype subsided. Meanwhile, Virtuals Protocol continues to gain momentum, not only with its in-house developed AI Luna but also with nearly 30 AI Agent tokens on the platform—including aixbt, Satoshi, Seraph, and VaderAI—that have each exceeded a market cap of $1 million.

Merits and Demerits of $VVAIFU

When exploring new concepts, simplicity is often the most effective entry point. vvaifu.fun’s straightforward agent creation process and the clear tokenomics of $VVAIFU offer a strong appeal, especially for Web2 and Web3 users venturing into this space for the first time.

Merits of $VVAIFU

- Community-driven: The $VVAIFU token is fully in circulation, with no portion reserved for the team, and its distribution is relatively decentralized according to on-chain data. This makes it more fair and decentralized for users. With the burn mechanism in place, the token’s price is expected to see upward pressure as platform usage grows.

- Built on Solana: The $VVAIFU token is based on the Solana blockchain, which offers low transaction fees and fast processing speeds. Additionally, Solana has a robust and active developer community, which results in strong user engagement.

Demerits of $VVAIFU

- Lack of Innovation: Currently, vvaifu.fun mainly serves as a platform for asset issuance, and its range of products and tools is still quite limited. The team will need to develop more diverse services to attract a larger user base. Furthermore, they should focus on expanding the ecosystem and building partnerships with other outstanding AI agents and development teams to foster collaboration.

- Limited Use Cases: The primary utility of $VVAIFU at present revolves around platform features like agent creation and unlocking functionalities. There is a need for more application scenarios and value propositions, such as ecosystem governance and user incentives. Moreover, for token holders, the team should explore more ways to generate returns, like offering staking opportunities.

How to Acquire $VVAIFU Tokens

Cryptocurrencies are known for their high volatility, which can lead to significant profits and exposes users to considerable trading risks. Before engaging in any transactions, users should carefully assess the market’s unpredictability, conduct comprehensive due diligence on the project, and make cautious trades according to their risk tolerance.

Both vvaifu.fun and its token $VVAIFU are still in the early development stages, so cryptocurrency users should know this. However, you can still acquire the token through both centralized (CEX) and decentralized (DEX) exchanges. For instance, Gate.io offers the VVAIFU/USDT trading pair. You can log in and purchase $VVAIFU using $USDT.

Start Trading

Check the current price of Dasha ($VVAIFU) and start trading here: VVAIFU/USDT

What is vvaifu.fun? All You Need to Know About $VVAIFU

About $VVAIFU

$VVAIFU Milestones

vvaifu.fun vs. Pump.fun

vvaifu.fun vs. Virtuals Protocol

Merits and Demerits of $VVAIFU

How to Acquire $VVAIFU Tokens

Start Trading

The integration of cryptocurrency with artificial intelligence (AI) has remained a central focus of innovation in the industry. However, the rapid rise of the AI Agent sub-sector has brought this integration back into the spotlight. AI Agents are advanced AI systems with the tools and reasoning capabilities needed to make autonomous decisions and carry out tasks. In crypto, these agents can autonomously compose tweets, engage in private conversations, and even perform on-chain transactions using a crypto wallet. Unlike traditional, reactive AI models that focus on language processing, AI Agents mark a significant shift toward proactive, autonomous intelligent entities.

From $GOAT to $VIRTUAL, and the surge of other tokens in the same sector, it’s clear that hot money is flowing into this market. $VVAIFU, the core token of vvaifu.fun, an AI agent token issuance platform built on Solana, has seen its market cap grow from $1 million to $200 million in under 5 days, sparking widespread attention.

This article will explore the mechanisms and functions of the vvaifu.fun platform, as well as the growth potential of its token, $VVAIFU.

About $VVAIFU

vvaifu.fun is a Solana-based token issuance platform, much like Pump.fun, but with a specific focus on AI agents. The platform’s native token, $VVAIFU, also serves as the token for its first AI agent, Dasha. Dasha is an AI-driven female character with her own independent X account, capable of autonomously posting tweets.

Source: vvaifu.fun

Launched on October 18, 2024, $VVAIFU has an initial supply of 1 billion tokens. Driven by its deflationary mechanism, a portion of $VVAIFU tokens are burned each time users create agents or unlock social media features like X and Discord on vvaifu.fun, gradually decreasing the total supply over time. According to the latest on-chain data, the current total supply of $VVAIFU stands at 995 million tokens, with a circulating market cap of around $75 million.

vvaifu.fun has been live for less than two months and lacks a defined development team. However, the platform has already seen the creation of over 2,000 AI agents and the posting of 65,000 tweets. While $VVAIFU has garnered significant market attention quickly, other AI agent tokens on the platform—such as $eliza, $SIZE, $waifu, and nearly a dozen others—have also surpassed a $1 million market cap.

$VVAIFU Milestones

For nearly a month after its launch, $VVAIFU saw modest growth. Its sudden surge was largely fueled by the rising hype around the AI Agent sector and the widely publicized ‘eliza’ incident, which had a speculative, short-term nature.

$VVAIFU Price Trend (Source: dexscreener)

- On October 18, 2024, the $VVAIFU token debuted on the Pump.fun platform, reaching over $9 million in trading volume on its first day.

- On November 16, 2024, the price of $VVAIFU surged nearly 800% in one day. Over the next four days, it skyrocketed from $0.003 to $0.2, a gain of over 6,500%, with its market cap briefly surpassing $200 million. This surge was largely driven by the “eliza” event, during which a user launched the AI agent Eliza on vvaifu.fun and received support from the recently famous decentralized AI trading fund ai16z. The $eliza token price surged from a low of $0.000027 to a high of $0.08, a nearly 3,000-fold increase, and its market cap reached $77 million.

$eliza Price Trend (Source: dexscreener)

- On November 19, 2024, $VVAIFU began a downward trend after hitting an all-time high. On the same day, ai16z partner Shaw (@shawmakesmagic) posted a statement denying that $eliza was affiliated with ai16z and re-launched a new token, $ELIZA. Although the new $ELIZA token reserved 10% of its airdrop for original $eliza token holders, the move was heavily criticized by the community, and Eliza herself strongly condemned it. As a result, the price of $eliza plummeted, and it is now only worth around $10 million.

Source: @ai16zeliza

- As of now, the price of $VVAIFU has rebounded slightly after briefly bottoming out, currently priced at $0.069, and the market cap holds steady at around $70 million. During November, $VVAIFU also received support from multiple exchanges, including Gate.io, which significantly boosted the token’s liquidity.

vvaifu.fun vs. Pump.fun

vvaifu.fun focuses on launching AI tokens with automated on-chain execution capabilities, but the token issuance process is simple, similar to Pump.fun. Tokens for AI agents on the vvaifu.fun platform are automatically linked to Pump.fun’s contracts to provide instant exposure and liquidity.

How users launch AI agents and tokens on vvaifu.fun:

1) First, connect your Solana wallet and deposit the necessary cryptocurrency. Please note that the cost to launch an AI agent is 0.19 SOL, along with burning 1,000 $VVAIFU tokens.

2) Customize your AI agent according to the platform’s requirements, including creating an agent name, token symbol, image, and key character information such as age, description, personality traits, etc.

It’s important to note that on Pump.fun, the token is created instantly after entering token information and submitting the contract. However, vvaifu.fun offers more flexibility to users. For example, users can use an existing token, opt not to release a token, or let the token be randomly launched within the next 2 hours, offering more customization options.

Source: vvaifu.fun

Moreover, the platform incorporates the ai16z agent framework in addition to the vvaifu.fun AI agent framework. If users opt for this, 5% of the total supply will be allocated to the ai16z DAO, and an additional fee of 1.5 SOL will apply.

3) Using $VVAIFU to unlock more agent features

As the platform’s native token, $ VVAIFU’s main purpose is to help users unlock additional features for their AI agents. These features include posting and replying on X, autonomous chatting on Discord/Telegram, and more. Users need to burn a certain amount of $VVAIFU to unlock these functionalities. In the future, the platform will also integrate features like wallet support and TikTok.

Furthermore, similar to Pump.fun, vvaifu.fun includes social features like comments and live chat to enhance the user experience. It’s also worth noting that the platform recently launched the CTO (Community Take Over) section, where users can submit contract addresses and X accounts for approval.

Source: vvaifu.fun

vvaifu.fun vs. Virtuals Protocol

As AI agent-based projects, both vvaifu.fun and Virtuals Protocol have gained attention in recent months. Since its launch in October, Virtuals Protocol’s token, $VIRTUAL, has surged from $0.05 to a high of $1.89 in under two months, achieving a 36-fold increase. Although the price of $VIRTUAL has since corrected, it remains one of the leaders in the AI agent sector with a strong market cap of $1.43 billion.

Source: Virtuals Protocol

Virtuals Protocol aims to create an AI factory designed for gaming and the metaverse, which allows users to earn real-world rewards while interacting. How does vvaifu.fun compare to Virtuals Protocol in terms of similarities and differences?

- Blockchain

vvaifu.fun is currently the only platform built on the Solana blockchain, while Virtuals Protocol supports two blockchains: Base and Ethereum. Like vvaifu.fun, Virtuals Protocol enables the creation of AI agents, which it calls Initial Agent Offerings (IAOs). Creating agent tokens is very similar to Pump.fun - the token operates on a bonding curve mechanism. However, the creation requires a fee of 100 $VIRTUAL.

As the market capitalization of an AI agent token grows, it unlocks various functionalities. For instance, when the market cap hits $4,200, the agent can interact with community members on forums; at $6.9 million, it can conduct one-on-one private conversations on Telegram; and when it reaches $126 million, the agent gains the ability to independently manage an on-chain wallet, among other features.

- Token Economics

Both $VVAIFU and $VIRTUAL tokens have an initial total supply of 1 billion. However, $VVAIFU has already been fully circulated and features a deflationary burn mechanism, while $VIRTUAL has a portion of its supply “locked” in liquidity pools and the ecosystem vault. Of the $VIRTUAL supply, 60% is publicly circulating, 5% is allocated to the liquidity pool, and 35% is reserved in the vault, which will unlock over time to support the growth and incentives within the Virtuals Protocol ecosystem.

On-chain data shows that $VVAIFU has approximately 16,500 token holders. The top 10 and top 100 addresses account for 17.73% and 57.34% of the total supply, respectively. For $VIRTUAL, about 458 million tokens are in circulation on Base, with around 97,700 holders. The top 10 and top 100 holders control 42.45% and 74.38% of the supply, respectively. On the Ethereum network, $VIRTUAL has roughly 10,300 wallet addresses, with the three largest holders—spanning the cross-chain bridge, vault wallet, and liquidity pools for agent token pairings—accounting for approximately 82% of the supply.

$VIRTUAL Top100 Token Holders Distribution (Source: etherscan)

As core tokens for their respective platforms, $VVAIFU and $VIRTUAL serve to access platform features, pay transaction fees, and more. Considering vvaifu.fun’s relatively short time online, Virtuals Protocol has a more mature and diversified community and ecosystem. In addition to the basic functionalities, $VIRTUAL also plays a key role in ecosystem governance and promoting collaboration across the entire ecosystem.

On the Virtuals Protocol platform, creating each AI agent token involves locking a specific amount of $VIRTUAL tokens, which are used to form the liquidity pool for the agent token. The lock-up period is set for 10 years. Moreover, purchasing any agent token on the platform requires using $VIRTUAL as the transaction route, ensuring ongoing demand for the token. Additionally, users can engage in DAO governance by holding and staking $VIRTUAL tokens.

Source: Virtuals Protocol

- Usability

Currently, vvaifu.fun is positioned as a platform for launching autonomous AI agents on Solana, similar to Pump.fun, and serves primarily as an asset issuance platform. The team has plans to roll out additional products and features, such as a partnership program, to meet users’ growing needs.

In contrast, the Virtuals Protocol team has stated they do not aim to replicate Pump.fun’s model. Instead, their primary focus is to partner with superior third-party AI teams to utilize their platform. By concentrating on external expansion, they aim to support promising teams and agents, with a strategy of releasing one high-quality project weekly. This approach is intended to drive network effects through cross-project interaction and integration.

To achieve this, the Virtuals Protocol team is actively developing and incubating applications internally, with use cases spanning gaming, entertainment, and social spaces. Additionally, they have created a lightweight framework called Generative Autonomous Multimodal Entities (G.A.M.E.), designed to help external developers, game studios, and other collaborators deploy AI agents more efficiently.

- Community and Popularity

In terms of community and popularity, Virtuals Protocol currently leads the way. Its official X account has around 100,000 followers, and the Telegram community has approximately 10,000 users. By contrast, vvaifu.fun has around 30,000 followers on X and fewer than 5,000 members on Telegram.

vvaifu.fun initially garnered significant attention due to the “eliza” incident but has gradually settled down as the hype subsided. Meanwhile, Virtuals Protocol continues to gain momentum, not only with its in-house developed AI Luna but also with nearly 30 AI Agent tokens on the platform—including aixbt, Satoshi, Seraph, and VaderAI—that have each exceeded a market cap of $1 million.

Merits and Demerits of $VVAIFU

When exploring new concepts, simplicity is often the most effective entry point. vvaifu.fun’s straightforward agent creation process and the clear tokenomics of $VVAIFU offer a strong appeal, especially for Web2 and Web3 users venturing into this space for the first time.

Merits of $VVAIFU

- Community-driven: The $VVAIFU token is fully in circulation, with no portion reserved for the team, and its distribution is relatively decentralized according to on-chain data. This makes it more fair and decentralized for users. With the burn mechanism in place, the token’s price is expected to see upward pressure as platform usage grows.

- Built on Solana: The $VVAIFU token is based on the Solana blockchain, which offers low transaction fees and fast processing speeds. Additionally, Solana has a robust and active developer community, which results in strong user engagement.

Demerits of $VVAIFU

- Lack of Innovation: Currently, vvaifu.fun mainly serves as a platform for asset issuance, and its range of products and tools is still quite limited. The team will need to develop more diverse services to attract a larger user base. Furthermore, they should focus on expanding the ecosystem and building partnerships with other outstanding AI agents and development teams to foster collaboration.

- Limited Use Cases: The primary utility of $VVAIFU at present revolves around platform features like agent creation and unlocking functionalities. There is a need for more application scenarios and value propositions, such as ecosystem governance and user incentives. Moreover, for token holders, the team should explore more ways to generate returns, like offering staking opportunities.

How to Acquire $VVAIFU Tokens

Cryptocurrencies are known for their high volatility, which can lead to significant profits and exposes users to considerable trading risks. Before engaging in any transactions, users should carefully assess the market’s unpredictability, conduct comprehensive due diligence on the project, and make cautious trades according to their risk tolerance.

Both vvaifu.fun and its token $VVAIFU are still in the early development stages, so cryptocurrency users should know this. However, you can still acquire the token through both centralized (CEX) and decentralized (DEX) exchanges. For instance, Gate.io offers the VVAIFU/USDT trading pair. You can log in and purchase $VVAIFU using $USDT.

Start Trading

Check the current price of Dasha ($VVAIFU) and start trading here: VVAIFU/USDT