What is Polymarket?

Introduction to Polymarket

Polymarket is a decentralized binary prediction market built on Polygon. Users can use USDC to make predictions and place bets on any future events that have not yet occurred. Topics for prediction include business, politics, pop culture, sports events, and more. When the outcome of an event is determined, the losing side forfeits all their stakes, which are distributed as rewards to the winning side. However, before the results are finalized, bettors may change their minds. To accommodate this, Polymarket also provides a trading market where users can freely trade their predictions. The probability of an event is reflected by the ratio of bets on both sides. Embracing the philosophy of “Put your money where your mouth is,” Polymarket uses economic incentives to encourage users to provide fact-based insights, delivering real-time and impartial prediction results.

Team Background

The Polymarket team brings extensive experience in finance, technology, and blockchain. Its founder and CEO, Shayne Coplan, is just 26 years old and studied computer science at New York University. He is reportedly the youngest participant in the Ethereum presale and has since played key roles in various blockchain projects. Coplan drew inspiration for Polymarket from Austrian economist Friedrich Hayek’s famous essay The Use of Knowledge in Society, where Hayek argued, “When economic incentives are introduced, people tend to access higher-quality information sources, think more deeply, and place their money on outcomes that are more likely to occur.” Coplan initially launched Union.market, the predecessor to Polymarket, to encourage people to link their money with their opinions.

Additionally, Rich Jaycobs, Polymarket’s Head of Market Development, previously served as the president of Cantor Futures Exchange. His extensive experience in operating financial derivatives exchanges is crucial for Polymarket’s strategic growth and market expansion.

Funding Situation

Polymarket has raised $74 million in funding across three rounds in 2020, 2022, and 2024. Investors include Polychain, General Catalyst, Founders Fund, and Dragonfly, as well as several angel investors, including Ethereum founder Vitalik Buterin.

Operational Mechanism

In Polymarket, “price = probability of the event occurring.” For example, in the 2024 U.S. presidential election, we can see that the probability of Donald Trump winning was 49%. If you predict Trump will win, you can buy a “Yes” share at 49.2 cents. Conversely, you can buy a “No” share at 50.9 cents. Once the election is over, if Trump wins, each “Yes” share can be redeemed for $1, earning a profit of 50.8 cents, while the “No” share becomes worthless, and vice versa. The price of each “Yes” and “No” share will dynamically adjust based on market conditions, and holders can freely trade in the market until the final result is confirmed.

Polymarket uses a hybrid on-chain order book mechanism for settlement. Users authorize trades via signatures, and the operator matches them off-chain, with the final interaction occurring on-chain through smart contracts. The prices of “Yes” and “No” tokens in the market are determined by supply and demand, so token prices may deviate (i.e., the sum of the two token prices may not equal 1). To address this, Polymarket encourages users to provide liquidity by placing limit orders, earning the spread between buy and sell prices, with additional USDC rewards. The closer the limit price is to the market price, the higher the reward.

For the final result of a predicted event, anyone can submit what they believe to be the correct outcome to the system, along with a deposit in USDC.e. The result will be verified by UMA oracles on Polygon. The verification process uses optimistic verification, assuming the submitted result is correct, with a two-hour challenge period. If there are disputes, a 24 to 48-hour debate period follows. During this time, both sides can discuss and present evidence on UMA’s Discord channel, and UMA token holders vote to decide on the predicted outcome.

Once the result is confirmed, the prediction market closes, and rewards for bettors are automatically transferred to their Polymarket wallet. Users can choose to withdraw or continue participating in other markets.

Business Model

Unlike other trading platforms, Polymarket does not charge users any transaction fees. According to Polymarket’s official documentation, the team has not disclosed any plans regarding token airdrops or issuance. Founder and CEO Shayne Coplan also stated in an interview with Forbes that Polymarket is focused on expanding the market and providing the best user experience, with a focus on profitability to come later. The team’s current revenue sources, aside from funds raised during financing rounds, come from providing liquidity to the market and capturing the spread between buy and sell prices. It is possible that Polymarket may introduce transaction fees or even issue a platform token in the future to generate more revenue.

Development Overview

Polymarket was first launched in the second half of 2020, coinciding with the U.S. presidential election, which attracted significant attention from the market, with monthly trading volume reaching as high as $32 million. However, as the crypto market shifted from a bull to a bear market, Polymarket went through a period of quiet. It wasn’t until the 2024 U.S. presidential election prediction market opened, along with the Bitcoin halving cycle and the approval of ETFs, that market sentiment began to improve. On May 14, Polymarket completed a $45 million Series B funding round, once again becoming the focus of attention.

According to DefiLlama statistics, Polymarket’s TVL in 2024 grew from $9.6 million to $339.5 million, a 35-fold increase. In October alone, it attracted over $200 million in funds, with active addresses exceeding 30,000. The most popular prediction market is the “Presidential Election Winner 2024,” or the U.S. presidential election prediction. Trading volume has been steadily rising as the election date approaches, and monthly trading volume has surpassed $1.3 billion, accounting for 62% of Polymarket’s total trading volume.

Among the top ten prediction markets by trading volume, six are related to the U.S. election, three are sports events, including predictions for the Super Bowl, the UEFA Champions League, and the Premier League champion, and the remaining one predicts the U.S. Federal Reserve’s interest rate adjustments. This shows that political topics are currently the most popular on Polymarket, followed by sports, and finally, financial-related predictions. In the previous cycle, Polymarket gained market attention due to the U.S. election but did not maintain its momentum. With this year’s election date approaching, it remains to be seen whether Polymarket can sustain its popularity once the political focus fades and the election results are determined. The future development will need to be observed.

Advantages of Polymarket

As a decentralized prediction market, Polymarket stands out from its competitors, with its TVL accounting for 90% of the industry. Its total trading volume has reached $7.1 billion, while the second-largest competitor, Azuro, has only $250 million, representing a 28-fold difference. Polymarket’s dominance can mainly be attributed to its market positioning and user experience.

Market Positioning

A prediction market is essentially a gambling game where participants bet on the outcomes of events they believe are most likely to occur to earn rewards. As a result, many prediction markets are classified as gambling sites. However, Polymarket’s goal is to “explore the truth and credibility of events” by using economic incentives, allowing participants to invest real money to express their genuine opinions and thus reflect the true nature of events. Founder Shayne Coplan mentioned in an interview the reason behind creating Polymarket: “…During the COVID-19 pandemic, the internet was flooded with misinformation and a wide range of viewpoints, and the truth of the matter was uncertain. I thought that if there were a free market on these topics, people could tie their money to their opinions.” This shows that Polymarket’s intention is to present the truth of events and the most authentic public opinions, with money acting as a personal vote, and the reward for successful predictions encouraging more users to participate.

Therefore, when people talk about Polymarket, it is not viewed as a gambling website. In fact, upon visiting the site, it becomes evident that the prediction markets cover a wide range of topics, not limited to sports events or games typically found on gambling sites. There are no bizarre betting games. Because Polymarket’s development focus is not on “gambling,” it gives itself a certain level of legitimacy, attracting a broader user base and gaining recognition from major media outlets such as Bloomberg, CNBC, and The New York Times, who reference and use its data.

User’s Experience

In enhancing user experience, Polymarket has implemented the following solutions:

Using Probability Instead of Odds

Polymarket uses the probability of an event as the price for purchasing shares, which is more intuitive for users. By analyzing probability, users can infer the current market sentiment, and this method of calculation helps differentiate Polymarket from traditional gambling sites by avoiding direct association with odds-based betting.Built on Polygon, Using USDC as the Trading Currency

By leveraging the high performance of Polygon, Polymarket provides users with a seamless trading experience, using USDC as the trading token to avoid issues related to token price volatility during settlement.Hybrid Order Book Mechanism

Orders submitted by users are matched and placed off-chain by Polymarket’s operators, but the actual trade settlement is executed on-chain based on the signed message by users, offering a convenient and secure trading experience.Encouraging Users to Provide Liquidity

Polymarket rewards liquidity providers with additional USDC, encouraging users to place orders in various prediction markets to ensure each market maintains sufficient liquidity.Using External Oracles

Polymarket employs UMA’s optimistic oracle to quickly and reliably adjudicate event outcomes, rewarding users who submit honest results and penalizing those who provide incorrect reports.

In addition to these points, Polymarket differs from other Web3 projects by not rushing to launch a native token. Instead, it prioritizes enhancing user experience, simplifying the learning and operational complexity, and offering a fast, secure, and reliable trading environment to attract a large number of new users and capital.

Competitor Analysis

Next, we will analyze two decentralized prediction market projects: Augur and Azuro. The former is a pioneer in the blockchain-based prediction market space, while the latter is one of Polymarket’s main competitors. By introducing these two projects, we can compare the differences and similarities with Polymarket and gain a more comprehensive understanding of the development of decentralized prediction markets.

Augur

Polymarket is not the first prediction market built on blockchain technology. As early as 2015, a protocol called Augur raised $5.1 million through an Initial Coin Offering (ICO) and launched its V1 version in 2018. Its operational process is quite similar to that of Polymarket, where users can freely participate in prediction markets for various events and purchase corresponding shares based on their beliefs, ultimately earning rewards based on the event’s outcome. As one of the early use cases for prediction markets, Augur first implemented a decentralized, non-custodial binary futures market, allowing users to predict and bet on a wide range of events while leveraging the transparency of blockchain to eliminate manipulation risks. However, even though Augur initially attracted market attention due to its novel concept, it declined due to immature technology, with its official community account ceasing updates in 2021. The reasons for its failure can be attributed to the following factors:

Liquidity Issues

When Augur was launched, Uniswap V1 had not been deployed yet, meaning there were no stable on-chain liquidity solutions available. Due to the decentralized nature of prediction markets, smaller markets often struggled with a lack of liquidity, leading to large price fluctuations and low trading efficiency.Complex User Experience

Users had to download Augur’s client application to access the platform. Additionally, the platform’s user interface and operational mechanisms were quite complex, resulting in long connection times and poor user experience.Reporting Mechanism Issues

At the time, prediction markets’ oracle systems were still immature. Augur relied on holders of its native token, REP, to submit accurate results for events. However, the submission process was cumbersome, and in cases of disputes over event outcomes, multiple submissions and adjudications were required, causing delays in results and severely affecting user experience.High Gas Fees

Since Augur was built on Ethereum, transaction fees fluctuated based on on-chain activity. When there was high activity on the Ethereum network, users had to pay high gas fees and often faced significant network congestion, causing long delays before their transactions were confirmed.

Although Augur launched V2 in 2020 with a peer-to-peer order book design and decentralized stablecoin DAI as the base currency to improve efficiency and stability, data from DappRadar shows that Augur’s trading volume did not rebound. Users were not convinced by these improvements.

Although Augur ultimately ended in failure, as the first real-world example of a decentralized prediction market, it served as a valuable demonstration for subsequent products like Polymarket, Azuro, and Drift. Augur’s shortcomings highlighted areas for improvement, and as blockchain technology matured, these newer platforms were able to address these issues and refine their own offerings.

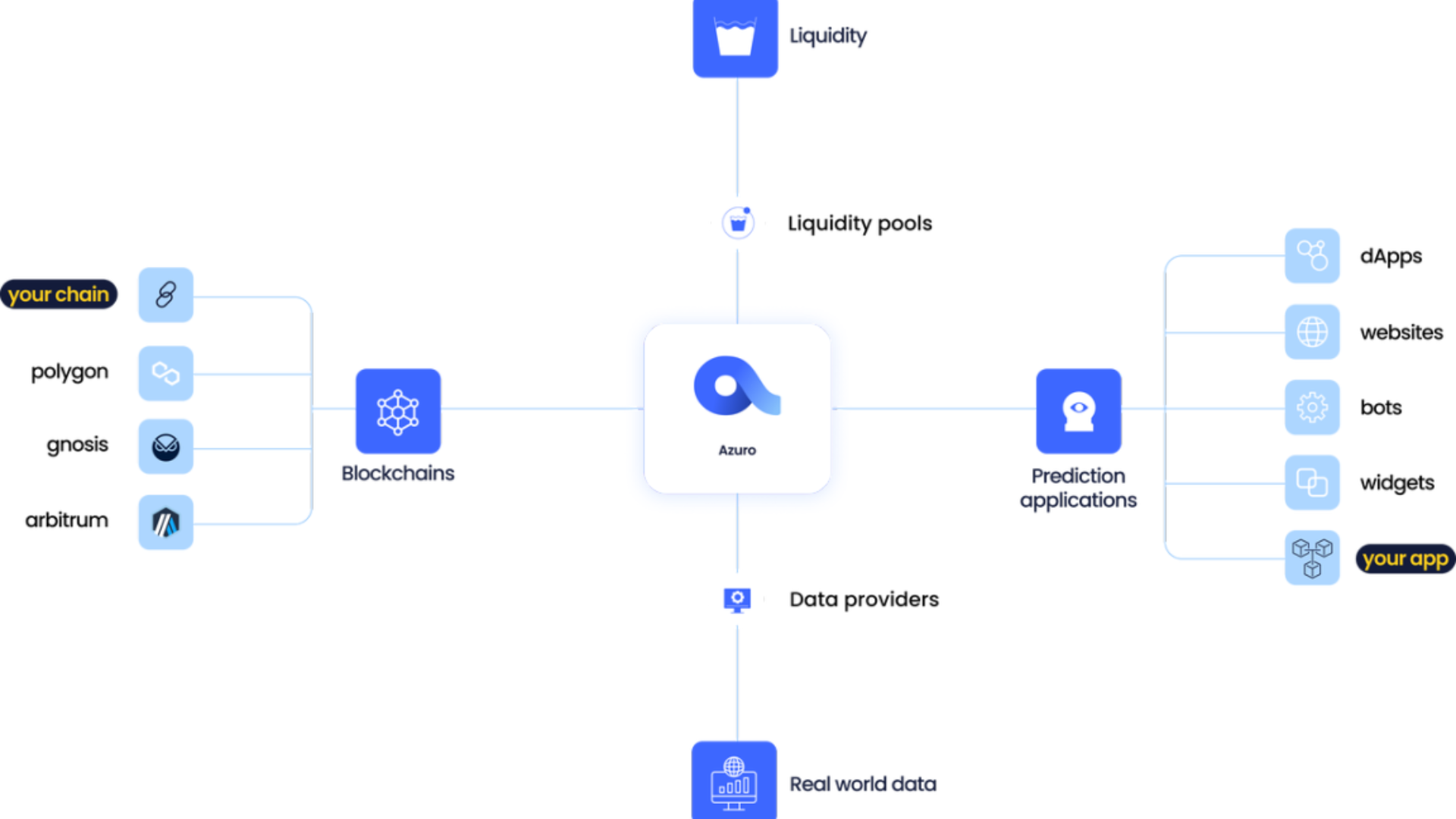

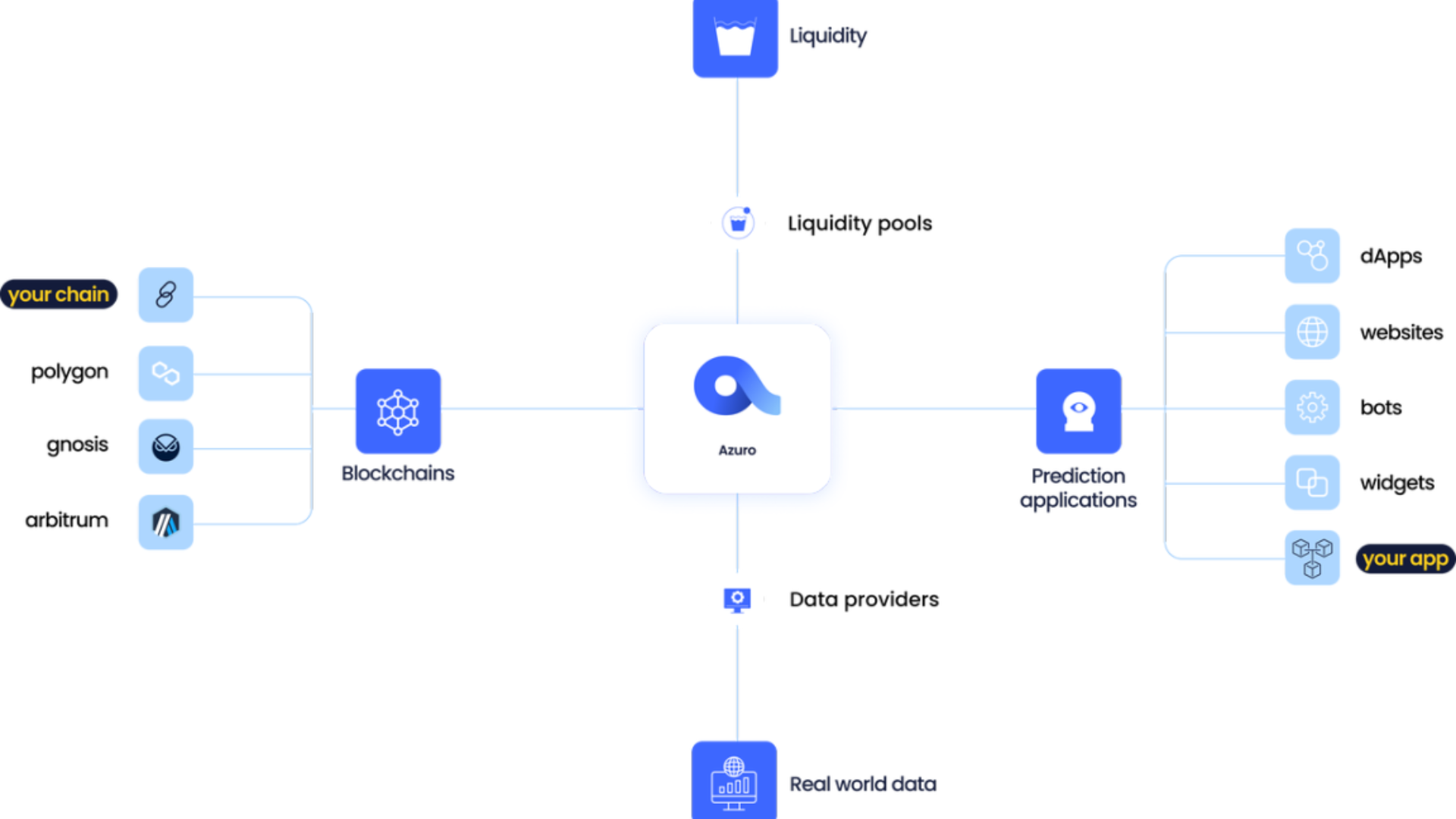

Azuro

Azuro itself is not a prediction market but rather a liquidity layer designed specifically for prediction markets. It serves multiple front-end applications, providing liquidity to the markets within these applications. This design structure is called a “liquidity tree,” which differs from Polymarket’s model where liquidity is distributed across various markets. In Azuro, liquidity is centralized and shared across all markets, allowing liquidity providers to act as counterparties for all markets. This approach helps diversify the risks for liquidity providers, supports more small-scale prediction events, improves the platform’s capital efficiency, and enhances the real returns for liquidity providers.

For developers, Azuro’s support significantly reduces the effort spent on backend technologies and addresses the issue of liquidity provision, allowing them to focus on building the front-end user experience, designing personalized user journeys, and launching creative features. These include betting bots for Telegram, GambleFi aggregators, and market data dashboards, providing more application potential and flexibility compared to Polymarket.

In addition to the differences in design, Azuro’s market focus is also distinctly different from Polymarket’s. According to data from Dune, the majority of active prediction markets on Azuro are related to sports events, with American football making up 70%, basketball 12%, ice hockey 6%, and baseball 3%. On the other hand, Polymarket has been heavily influenced by the U.S. presidential election recently, with most trades centered around political topics. Moreover, the most active prediction markets on Azuro account for only 0.6% of total transaction volume, while Polymarket sees 49% of its total trading volume concentrated in political-related markets. This indicates that Azuro’s markets are more evenly distributed, while Polymarket’s market size is heavily skewed by the popularity of the U.S. election.

In terms of user composition, Polymarket attracted a large number of new users in a short span of six months, largely driven by the U.S. presidential election. While Azuro did not experience such a sudden surge in popularity as Polymarket, it has managed to maintain a steady user base, with a significant portion of repeat users. This indicates that Azuro has successfully cultivated a loyal customer base over time.

From the design architecture, market types, transaction volume distribution, and user composition, it is clear that Polymarket and Azuro are quite different from each other. Both have found their respective market entry points and positions, and the challenges they will face in the future are distinct. Azuro’s primary focus is to expand into more diverse market categories and find ways to attract new users, while Polymarket needs to consider how to retain users on the platform after the dust settles from the presidential election, avoiding a repeat of the fleeting popularity it saw in 2020. However, regardless of how things develop in the future, compared to the early days of Augur, both Azuro and Polymarket are more mature products. They have also undergone a market trial, proving that decentralized prediction markets are achievable.

Future Challenges

Although Polymarket became the market’s focal point due to the presidential election, in the long run, many potential challenges remain that need to be addressed.

Compliance

Polymarket operates as a binary options trading platform, facing compliance challenges, particularly in the United States. Binary options trading is legal but heavily regulated by the Commodity Futures Trading Commission (CFTC). This means that trades can only occur through licensed brokers and exchanges that protect users’ interests, with the North American Derivatives Exchange (Nadex) being the most well-known.

In 2022, Polymarket was charged by the CFTC for violating the Commodity Exchange Act (CEA) for not being registered as a designated contract market (DCM) or swap execution facility (SEF). As a result, Polymarket paid a $1.4 million fine and agreed to reduce its operations in the U.S. Although Polymarket claims to be progressing in addressing regulatory issues, recent ongoing litigation involving another prediction market, Kalshi, indicates that the CFTC still considers some prediction markets as “gambling” activities. The CFTC asserts that it has the authority to regulate them, making Polymarket’s path to full compliance uncertain.

Dispute Resolution

In addition, Polymarket has some flaws in its operational mechanism, particularly regarding the final decision on event outcomes being determined by UMA token holders. This introduces a certain level of centralization risk and raises concerns about the potential manipulation of market results. For example, in the prediction market regarding whether the Ethereum spot ETF would be approved, the U.S. Securities and Exchange Commission (SEC) approved the 19b-4 form for multiple Ethereum spot ETFs on May 24 this year. However, this approval does not mean the ETFs are officially approved, as the issuing entities still need to obtain an S-1 registration statement approval before the ETFs can be launched.

Nevertheless, some proposers submitted the event result to the prediction market when the 19b-4 form was passed. Despite some challenges against the result, the “Yes” outcome was overwhelmingly approved with 99% of the votes. Polymarket did not respond to the matter. Since most event results occur off-chain and cannot be automatically determined by smart contracts, similar situations could arise in the future. How Polymarket addresses and reduces such disputes is a key issue it must consider moving forward, as failing could lead to a loss of user trust.

Ethics and Morality

In June 2023, a viral post on X (formerly Twitter) about the disappearance of the Titan submarine sparked widespread attention. At the time, there was a prediction market on Polymarket regarding whether the submarine would be found before June 23, with over $300,000 wagered. This drew significant public outcry, with one user even asking on X: “What stage of capitalism is it when you bet on someone else’s death?” This post quickly went viral, leading to ethical criticism towards Polymarket, which was forced to respond and clarify the situation.

Although the original purpose of decentralized prediction markets was to allow anyone to express their views on a wide range of topics, betting on the death of others appears to have crossed a moral line for many people. While Polymarket has control over the initiation of market topics, it should carefully consider whether a market will attract sufficient traffic and whether the subject matter aligns with ethical standards and social norms. This situation highlights the need for platforms like Polymarket to take responsibility for curating markets that balance freedom of expression with respect for sensitive topics.

Conclusion

Polymarket, as a decentralized prediction market, utilizes economic incentives to leverage the collective intelligence of the public for more in-depth predictions on various topics, reflecting the crowd’s opinions relatively accurately. This year, the prediction markets regarding the presidential election have been repeatedly reported by mainstream media and even used as a reference for public opinion, demonstrating the platform’s significant influence. Although many issues still need to be addressed, Polymarket has already provided a glimpse into the enormous potential of decentralized prediction markets, and its future development is certainly worth ongoing attention.

What is Polymarket?

Introduction to Polymarket

Operational Mechanism

Business Model

Development Overview

Advantages of Polymarket

Competitor Analysis

Future Challenges

Conclusion

Introduction to Polymarket

Polymarket is a decentralized binary prediction market built on Polygon. Users can use USDC to make predictions and place bets on any future events that have not yet occurred. Topics for prediction include business, politics, pop culture, sports events, and more. When the outcome of an event is determined, the losing side forfeits all their stakes, which are distributed as rewards to the winning side. However, before the results are finalized, bettors may change their minds. To accommodate this, Polymarket also provides a trading market where users can freely trade their predictions. The probability of an event is reflected by the ratio of bets on both sides. Embracing the philosophy of “Put your money where your mouth is,” Polymarket uses economic incentives to encourage users to provide fact-based insights, delivering real-time and impartial prediction results.

Team Background

The Polymarket team brings extensive experience in finance, technology, and blockchain. Its founder and CEO, Shayne Coplan, is just 26 years old and studied computer science at New York University. He is reportedly the youngest participant in the Ethereum presale and has since played key roles in various blockchain projects. Coplan drew inspiration for Polymarket from Austrian economist Friedrich Hayek’s famous essay The Use of Knowledge in Society, where Hayek argued, “When economic incentives are introduced, people tend to access higher-quality information sources, think more deeply, and place their money on outcomes that are more likely to occur.” Coplan initially launched Union.market, the predecessor to Polymarket, to encourage people to link their money with their opinions.

Additionally, Rich Jaycobs, Polymarket’s Head of Market Development, previously served as the president of Cantor Futures Exchange. His extensive experience in operating financial derivatives exchanges is crucial for Polymarket’s strategic growth and market expansion.

Funding Situation

Polymarket has raised $74 million in funding across three rounds in 2020, 2022, and 2024. Investors include Polychain, General Catalyst, Founders Fund, and Dragonfly, as well as several angel investors, including Ethereum founder Vitalik Buterin.

Operational Mechanism

In Polymarket, “price = probability of the event occurring.” For example, in the 2024 U.S. presidential election, we can see that the probability of Donald Trump winning was 49%. If you predict Trump will win, you can buy a “Yes” share at 49.2 cents. Conversely, you can buy a “No” share at 50.9 cents. Once the election is over, if Trump wins, each “Yes” share can be redeemed for $1, earning a profit of 50.8 cents, while the “No” share becomes worthless, and vice versa. The price of each “Yes” and “No” share will dynamically adjust based on market conditions, and holders can freely trade in the market until the final result is confirmed.

Polymarket uses a hybrid on-chain order book mechanism for settlement. Users authorize trades via signatures, and the operator matches them off-chain, with the final interaction occurring on-chain through smart contracts. The prices of “Yes” and “No” tokens in the market are determined by supply and demand, so token prices may deviate (i.e., the sum of the two token prices may not equal 1). To address this, Polymarket encourages users to provide liquidity by placing limit orders, earning the spread between buy and sell prices, with additional USDC rewards. The closer the limit price is to the market price, the higher the reward.

For the final result of a predicted event, anyone can submit what they believe to be the correct outcome to the system, along with a deposit in USDC.e. The result will be verified by UMA oracles on Polygon. The verification process uses optimistic verification, assuming the submitted result is correct, with a two-hour challenge period. If there are disputes, a 24 to 48-hour debate period follows. During this time, both sides can discuss and present evidence on UMA’s Discord channel, and UMA token holders vote to decide on the predicted outcome.

Once the result is confirmed, the prediction market closes, and rewards for bettors are automatically transferred to their Polymarket wallet. Users can choose to withdraw or continue participating in other markets.

Business Model

Unlike other trading platforms, Polymarket does not charge users any transaction fees. According to Polymarket’s official documentation, the team has not disclosed any plans regarding token airdrops or issuance. Founder and CEO Shayne Coplan also stated in an interview with Forbes that Polymarket is focused on expanding the market and providing the best user experience, with a focus on profitability to come later. The team’s current revenue sources, aside from funds raised during financing rounds, come from providing liquidity to the market and capturing the spread between buy and sell prices. It is possible that Polymarket may introduce transaction fees or even issue a platform token in the future to generate more revenue.

Development Overview

Polymarket was first launched in the second half of 2020, coinciding with the U.S. presidential election, which attracted significant attention from the market, with monthly trading volume reaching as high as $32 million. However, as the crypto market shifted from a bull to a bear market, Polymarket went through a period of quiet. It wasn’t until the 2024 U.S. presidential election prediction market opened, along with the Bitcoin halving cycle and the approval of ETFs, that market sentiment began to improve. On May 14, Polymarket completed a $45 million Series B funding round, once again becoming the focus of attention.

According to DefiLlama statistics, Polymarket’s TVL in 2024 grew from $9.6 million to $339.5 million, a 35-fold increase. In October alone, it attracted over $200 million in funds, with active addresses exceeding 30,000. The most popular prediction market is the “Presidential Election Winner 2024,” or the U.S. presidential election prediction. Trading volume has been steadily rising as the election date approaches, and monthly trading volume has surpassed $1.3 billion, accounting for 62% of Polymarket’s total trading volume.

Among the top ten prediction markets by trading volume, six are related to the U.S. election, three are sports events, including predictions for the Super Bowl, the UEFA Champions League, and the Premier League champion, and the remaining one predicts the U.S. Federal Reserve’s interest rate adjustments. This shows that political topics are currently the most popular on Polymarket, followed by sports, and finally, financial-related predictions. In the previous cycle, Polymarket gained market attention due to the U.S. election but did not maintain its momentum. With this year’s election date approaching, it remains to be seen whether Polymarket can sustain its popularity once the political focus fades and the election results are determined. The future development will need to be observed.

Advantages of Polymarket

As a decentralized prediction market, Polymarket stands out from its competitors, with its TVL accounting for 90% of the industry. Its total trading volume has reached $7.1 billion, while the second-largest competitor, Azuro, has only $250 million, representing a 28-fold difference. Polymarket’s dominance can mainly be attributed to its market positioning and user experience.

Market Positioning

A prediction market is essentially a gambling game where participants bet on the outcomes of events they believe are most likely to occur to earn rewards. As a result, many prediction markets are classified as gambling sites. However, Polymarket’s goal is to “explore the truth and credibility of events” by using economic incentives, allowing participants to invest real money to express their genuine opinions and thus reflect the true nature of events. Founder Shayne Coplan mentioned in an interview the reason behind creating Polymarket: “…During the COVID-19 pandemic, the internet was flooded with misinformation and a wide range of viewpoints, and the truth of the matter was uncertain. I thought that if there were a free market on these topics, people could tie their money to their opinions.” This shows that Polymarket’s intention is to present the truth of events and the most authentic public opinions, with money acting as a personal vote, and the reward for successful predictions encouraging more users to participate.

Therefore, when people talk about Polymarket, it is not viewed as a gambling website. In fact, upon visiting the site, it becomes evident that the prediction markets cover a wide range of topics, not limited to sports events or games typically found on gambling sites. There are no bizarre betting games. Because Polymarket’s development focus is not on “gambling,” it gives itself a certain level of legitimacy, attracting a broader user base and gaining recognition from major media outlets such as Bloomberg, CNBC, and The New York Times, who reference and use its data.

User’s Experience

In enhancing user experience, Polymarket has implemented the following solutions:

Using Probability Instead of Odds

Polymarket uses the probability of an event as the price for purchasing shares, which is more intuitive for users. By analyzing probability, users can infer the current market sentiment, and this method of calculation helps differentiate Polymarket from traditional gambling sites by avoiding direct association with odds-based betting.Built on Polygon, Using USDC as the Trading Currency

By leveraging the high performance of Polygon, Polymarket provides users with a seamless trading experience, using USDC as the trading token to avoid issues related to token price volatility during settlement.Hybrid Order Book Mechanism

Orders submitted by users are matched and placed off-chain by Polymarket’s operators, but the actual trade settlement is executed on-chain based on the signed message by users, offering a convenient and secure trading experience.Encouraging Users to Provide Liquidity

Polymarket rewards liquidity providers with additional USDC, encouraging users to place orders in various prediction markets to ensure each market maintains sufficient liquidity.Using External Oracles

Polymarket employs UMA’s optimistic oracle to quickly and reliably adjudicate event outcomes, rewarding users who submit honest results and penalizing those who provide incorrect reports.

In addition to these points, Polymarket differs from other Web3 projects by not rushing to launch a native token. Instead, it prioritizes enhancing user experience, simplifying the learning and operational complexity, and offering a fast, secure, and reliable trading environment to attract a large number of new users and capital.

Competitor Analysis

Next, we will analyze two decentralized prediction market projects: Augur and Azuro. The former is a pioneer in the blockchain-based prediction market space, while the latter is one of Polymarket’s main competitors. By introducing these two projects, we can compare the differences and similarities with Polymarket and gain a more comprehensive understanding of the development of decentralized prediction markets.

Augur

Polymarket is not the first prediction market built on blockchain technology. As early as 2015, a protocol called Augur raised $5.1 million through an Initial Coin Offering (ICO) and launched its V1 version in 2018. Its operational process is quite similar to that of Polymarket, where users can freely participate in prediction markets for various events and purchase corresponding shares based on their beliefs, ultimately earning rewards based on the event’s outcome. As one of the early use cases for prediction markets, Augur first implemented a decentralized, non-custodial binary futures market, allowing users to predict and bet on a wide range of events while leveraging the transparency of blockchain to eliminate manipulation risks. However, even though Augur initially attracted market attention due to its novel concept, it declined due to immature technology, with its official community account ceasing updates in 2021. The reasons for its failure can be attributed to the following factors:

Liquidity Issues

When Augur was launched, Uniswap V1 had not been deployed yet, meaning there were no stable on-chain liquidity solutions available. Due to the decentralized nature of prediction markets, smaller markets often struggled with a lack of liquidity, leading to large price fluctuations and low trading efficiency.Complex User Experience

Users had to download Augur’s client application to access the platform. Additionally, the platform’s user interface and operational mechanisms were quite complex, resulting in long connection times and poor user experience.Reporting Mechanism Issues

At the time, prediction markets’ oracle systems were still immature. Augur relied on holders of its native token, REP, to submit accurate results for events. However, the submission process was cumbersome, and in cases of disputes over event outcomes, multiple submissions and adjudications were required, causing delays in results and severely affecting user experience.High Gas Fees

Since Augur was built on Ethereum, transaction fees fluctuated based on on-chain activity. When there was high activity on the Ethereum network, users had to pay high gas fees and often faced significant network congestion, causing long delays before their transactions were confirmed.

Although Augur launched V2 in 2020 with a peer-to-peer order book design and decentralized stablecoin DAI as the base currency to improve efficiency and stability, data from DappRadar shows that Augur’s trading volume did not rebound. Users were not convinced by these improvements.

Although Augur ultimately ended in failure, as the first real-world example of a decentralized prediction market, it served as a valuable demonstration for subsequent products like Polymarket, Azuro, and Drift. Augur’s shortcomings highlighted areas for improvement, and as blockchain technology matured, these newer platforms were able to address these issues and refine their own offerings.

Azuro

Azuro itself is not a prediction market but rather a liquidity layer designed specifically for prediction markets. It serves multiple front-end applications, providing liquidity to the markets within these applications. This design structure is called a “liquidity tree,” which differs from Polymarket’s model where liquidity is distributed across various markets. In Azuro, liquidity is centralized and shared across all markets, allowing liquidity providers to act as counterparties for all markets. This approach helps diversify the risks for liquidity providers, supports more small-scale prediction events, improves the platform’s capital efficiency, and enhances the real returns for liquidity providers.

For developers, Azuro’s support significantly reduces the effort spent on backend technologies and addresses the issue of liquidity provision, allowing them to focus on building the front-end user experience, designing personalized user journeys, and launching creative features. These include betting bots for Telegram, GambleFi aggregators, and market data dashboards, providing more application potential and flexibility compared to Polymarket.

In addition to the differences in design, Azuro’s market focus is also distinctly different from Polymarket’s. According to data from Dune, the majority of active prediction markets on Azuro are related to sports events, with American football making up 70%, basketball 12%, ice hockey 6%, and baseball 3%. On the other hand, Polymarket has been heavily influenced by the U.S. presidential election recently, with most trades centered around political topics. Moreover, the most active prediction markets on Azuro account for only 0.6% of total transaction volume, while Polymarket sees 49% of its total trading volume concentrated in political-related markets. This indicates that Azuro’s markets are more evenly distributed, while Polymarket’s market size is heavily skewed by the popularity of the U.S. election.

In terms of user composition, Polymarket attracted a large number of new users in a short span of six months, largely driven by the U.S. presidential election. While Azuro did not experience such a sudden surge in popularity as Polymarket, it has managed to maintain a steady user base, with a significant portion of repeat users. This indicates that Azuro has successfully cultivated a loyal customer base over time.

From the design architecture, market types, transaction volume distribution, and user composition, it is clear that Polymarket and Azuro are quite different from each other. Both have found their respective market entry points and positions, and the challenges they will face in the future are distinct. Azuro’s primary focus is to expand into more diverse market categories and find ways to attract new users, while Polymarket needs to consider how to retain users on the platform after the dust settles from the presidential election, avoiding a repeat of the fleeting popularity it saw in 2020. However, regardless of how things develop in the future, compared to the early days of Augur, both Azuro and Polymarket are more mature products. They have also undergone a market trial, proving that decentralized prediction markets are achievable.

Future Challenges

Although Polymarket became the market’s focal point due to the presidential election, in the long run, many potential challenges remain that need to be addressed.

Compliance

Polymarket operates as a binary options trading platform, facing compliance challenges, particularly in the United States. Binary options trading is legal but heavily regulated by the Commodity Futures Trading Commission (CFTC). This means that trades can only occur through licensed brokers and exchanges that protect users’ interests, with the North American Derivatives Exchange (Nadex) being the most well-known.

In 2022, Polymarket was charged by the CFTC for violating the Commodity Exchange Act (CEA) for not being registered as a designated contract market (DCM) or swap execution facility (SEF). As a result, Polymarket paid a $1.4 million fine and agreed to reduce its operations in the U.S. Although Polymarket claims to be progressing in addressing regulatory issues, recent ongoing litigation involving another prediction market, Kalshi, indicates that the CFTC still considers some prediction markets as “gambling” activities. The CFTC asserts that it has the authority to regulate them, making Polymarket’s path to full compliance uncertain.

Dispute Resolution

In addition, Polymarket has some flaws in its operational mechanism, particularly regarding the final decision on event outcomes being determined by UMA token holders. This introduces a certain level of centralization risk and raises concerns about the potential manipulation of market results. For example, in the prediction market regarding whether the Ethereum spot ETF would be approved, the U.S. Securities and Exchange Commission (SEC) approved the 19b-4 form for multiple Ethereum spot ETFs on May 24 this year. However, this approval does not mean the ETFs are officially approved, as the issuing entities still need to obtain an S-1 registration statement approval before the ETFs can be launched.

Nevertheless, some proposers submitted the event result to the prediction market when the 19b-4 form was passed. Despite some challenges against the result, the “Yes” outcome was overwhelmingly approved with 99% of the votes. Polymarket did not respond to the matter. Since most event results occur off-chain and cannot be automatically determined by smart contracts, similar situations could arise in the future. How Polymarket addresses and reduces such disputes is a key issue it must consider moving forward, as failing could lead to a loss of user trust.

Ethics and Morality

In June 2023, a viral post on X (formerly Twitter) about the disappearance of the Titan submarine sparked widespread attention. At the time, there was a prediction market on Polymarket regarding whether the submarine would be found before June 23, with over $300,000 wagered. This drew significant public outcry, with one user even asking on X: “What stage of capitalism is it when you bet on someone else’s death?” This post quickly went viral, leading to ethical criticism towards Polymarket, which was forced to respond and clarify the situation.

Although the original purpose of decentralized prediction markets was to allow anyone to express their views on a wide range of topics, betting on the death of others appears to have crossed a moral line for many people. While Polymarket has control over the initiation of market topics, it should carefully consider whether a market will attract sufficient traffic and whether the subject matter aligns with ethical standards and social norms. This situation highlights the need for platforms like Polymarket to take responsibility for curating markets that balance freedom of expression with respect for sensitive topics.

Conclusion

Polymarket, as a decentralized prediction market, utilizes economic incentives to leverage the collective intelligence of the public for more in-depth predictions on various topics, reflecting the crowd’s opinions relatively accurately. This year, the prediction markets regarding the presidential election have been repeatedly reported by mainstream media and even used as a reference for public opinion, demonstrating the platform’s significant influence. Although many issues still need to be addressed, Polymarket has already provided a glimpse into the enormous potential of decentralized prediction markets, and its future development is certainly worth ongoing attention.