Crypto Pulse-BTC Spot Inflows Reach Monthly Peak

Preface:

Bitcoin and Ethereum have risen by 3.64% and 6.22%, respectively, in the past 24 hours, with the ETH/BTC exchange rate holding steady at 0.05. The Crypto Market Fear & Greed Index has dropped to 27, indicating fear in the market.

Recent Spotlight

The best performer recently is TIA, with a 24-hour increase of 21.73%, currently priced at $204.12 and a market cap of $1.206 billion.

Celestia is a modular data availability network that decouples the consensus layer from the application execution layer. It segments blockchain protocols into different layers, each focused on specific functionalities, and these layers can be recombined to build applications. It serves as the data availability and consensus layer for other blockchains, allowing them to securely publish transactions and maintain efficient nodes. TIA, Celestia’s native token, is used for paying blobspace fees, proof-of-stake rewards, and project governance, playing a crucial role in the Celestia network. The upcoming Modular Summit 3.0, hosted by Celestia and Maven11 from July 11 to 13, 2024, in Brussels, Belgium, has driven up the token’s price, which peaked at $208.

Check Out the Latest Prices, Charts, and Data of TIA/USDT Spot and TIAUSDT Perp!

The Word on the Street

Nate Geraci, President of The ETF Store, commented that Cboe has filed 19b-4 documents on behalf of VanEck and 21Shares Solana ETFs. Once the SEC acknowledges these filings, the decision clock will start ticking. Previously, these companies submitted S-1 filings in June, initiating a 240-day review period pending the SEC’s approval. Cboe already offers several Bitcoin ETFs and is preparing for Ethereum ETFs. With growing investor interest in Solana, the exchange plans to expand its product range. The approval of these ETFs will mark another significant step for traditional exchanges in crypto-based investment products.

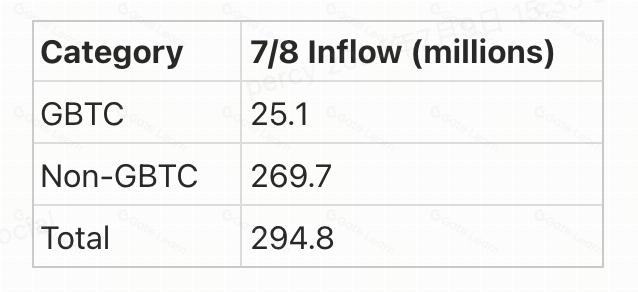

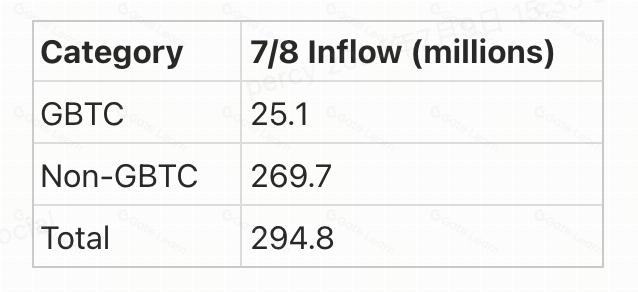

Spot Bitcoin ETF Flows

](https://s3.ap-northeast-1.amazonaws.com/gimg.gateimg.com/learn/f55dc6fccc14df125ce836da5aa01267aa572b39.jpeg)

Despite Bitcoin’s price dropping to around $54,000, US Bitcoin spot ETFs have seen substantial inflows, reaching a monthly high of $294.9 million. Grayscale’s GBTC saw net inflows of $25.08 million, while BlackRock’s IBIT had the highest single-day net inflow of $187.21 million. Bitcoin prices have been negatively impacted by the Mt. Gox repayment and German sell-off news. Yesterday, Germany reached its peak daily sell-off, temporarily halting the market rebound. In this scenario, the large inflows into BTC spot ETFs highlight strong institutional interest, viewed as a buying opportunity, and reflect confidence in Bitcoin’s future growth.

Check Out the Latest Prices, Charts, and Data of BTC/USDT Spot and BTCUSDT Perp!

Project Upgarde

On July 7, UniSat announced a significant update to its Swap product. After a year and a half of extensive testing, the team has preliminarily verified that the product can operate normally on the Bitcoin mainnet. Most of the engineering work for the Swap module is complete, with remaining tasks mainly involving assisting non-UniSat indexers in effectively identifying and calculating inscriptions related to the Swap module. UniSat expects to launch Fractal Bitcoin in September, providing Fractal Swap with the same functionality as the mainnet Swap module and supporting BTC and other assets as BRC-20 wrapped assets. The protocol will use BRC-20 sats as gas fees.

Check Out the Latest Prices, Charts, and Data of SATS/USDT Spot and SATSUSDT Perp!

Crypto Pulse-BTC Spot Inflows Reach Monthly Peak

Preface:

Bitcoin and Ethereum have risen by 3.64% and 6.22%, respectively, in the past 24 hours, with the ETH/BTC exchange rate holding steady at 0.05. The Crypto Market Fear & Greed Index has dropped to 27, indicating fear in the market.

Recent Spotlight

The best performer recently is TIA, with a 24-hour increase of 21.73%, currently priced at $204.12 and a market cap of $1.206 billion.

Celestia is a modular data availability network that decouples the consensus layer from the application execution layer. It segments blockchain protocols into different layers, each focused on specific functionalities, and these layers can be recombined to build applications. It serves as the data availability and consensus layer for other blockchains, allowing them to securely publish transactions and maintain efficient nodes. TIA, Celestia’s native token, is used for paying blobspace fees, proof-of-stake rewards, and project governance, playing a crucial role in the Celestia network. The upcoming Modular Summit 3.0, hosted by Celestia and Maven11 from July 11 to 13, 2024, in Brussels, Belgium, has driven up the token’s price, which peaked at $208.

Check Out the Latest Prices, Charts, and Data of TIA/USDT Spot and TIAUSDT Perp!

The Word on the Street

Nate Geraci, President of The ETF Store, commented that Cboe has filed 19b-4 documents on behalf of VanEck and 21Shares Solana ETFs. Once the SEC acknowledges these filings, the decision clock will start ticking. Previously, these companies submitted S-1 filings in June, initiating a 240-day review period pending the SEC’s approval. Cboe already offers several Bitcoin ETFs and is preparing for Ethereum ETFs. With growing investor interest in Solana, the exchange plans to expand its product range. The approval of these ETFs will mark another significant step for traditional exchanges in crypto-based investment products.

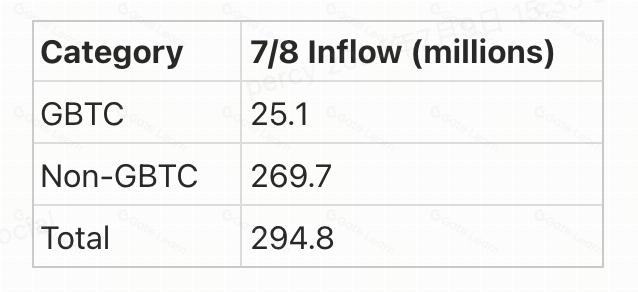

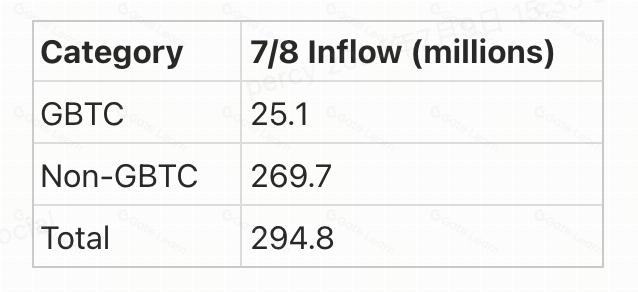

Spot Bitcoin ETF Flows

](https://s3.ap-northeast-1.amazonaws.com/gimg.gateimg.com/learn/f55dc6fccc14df125ce836da5aa01267aa572b39.jpeg)

Despite Bitcoin’s price dropping to around $54,000, US Bitcoin spot ETFs have seen substantial inflows, reaching a monthly high of $294.9 million. Grayscale’s GBTC saw net inflows of $25.08 million, while BlackRock’s IBIT had the highest single-day net inflow of $187.21 million. Bitcoin prices have been negatively impacted by the Mt. Gox repayment and German sell-off news. Yesterday, Germany reached its peak daily sell-off, temporarily halting the market rebound. In this scenario, the large inflows into BTC spot ETFs highlight strong institutional interest, viewed as a buying opportunity, and reflect confidence in Bitcoin’s future growth.

Check Out the Latest Prices, Charts, and Data of BTC/USDT Spot and BTCUSDT Perp!

Project Upgarde

On July 7, UniSat announced a significant update to its Swap product. After a year and a half of extensive testing, the team has preliminarily verified that the product can operate normally on the Bitcoin mainnet. Most of the engineering work for the Swap module is complete, with remaining tasks mainly involving assisting non-UniSat indexers in effectively identifying and calculating inscriptions related to the Swap module. UniSat expects to launch Fractal Bitcoin in September, providing Fractal Swap with the same functionality as the mainnet Swap module and supporting BTC and other assets as BRC-20 wrapped assets. The protocol will use BRC-20 sats as gas fees.

Check Out the Latest Prices, Charts, and Data of SATS/USDT Spot and SATSUSDT Perp!