PANews_

My grandmother can also understand: what is the difference between Solana‘s programming model and ETH?

Solana is a high-performance Blockchain platform designed to support dApps, known for its speed and scalability, which is made possible by a unique Consensus Mechanism and architectural design. In this article, we will use Ethereum as a comparison object and briefly introduce the characteristics of the Solana smart contracts programming model.

Smart contracts, on-chain programs:

A program that runs on Ethereum is called a smart contract, and it is a series of codes (functions) and data (states) located at a specific address on Ethereum. Smart contracts are also Ethereum accounts, called contract accounts, which have balances and can be traded objects, but cannot be manipulated by humans and are deployed on the network to run as programs.

And run in Solana

By Foresight News, Alex Liu

Solana is a high-performance Blockchain platform designed to support dApps, known for its speed and scalability, which is made possible by a unique Consensus Mechanism and architectural design. In this article, we will use Ethereum as a comparison object and briefly introduce the characteristics of the Solana smart contracts programming model.

Smart contracts, on-chain programs:

A program that runs on Ethereum is called a smart contract, and it is a series of codes (functions) and data (states) located at a specific address on Ethereum. Smart contracts are also Ethereum accounts, called contract accounts, which have balances and can be traded objects, but cannot be manipulated by humans and are deployed on the network to run as programs.

The executable code that runs on Solana is called an on-chain program, and they interpret the instructions sent in each transaction. These programs can be deployed directly to the network core as native programs, or released as SPL programs by anyone.

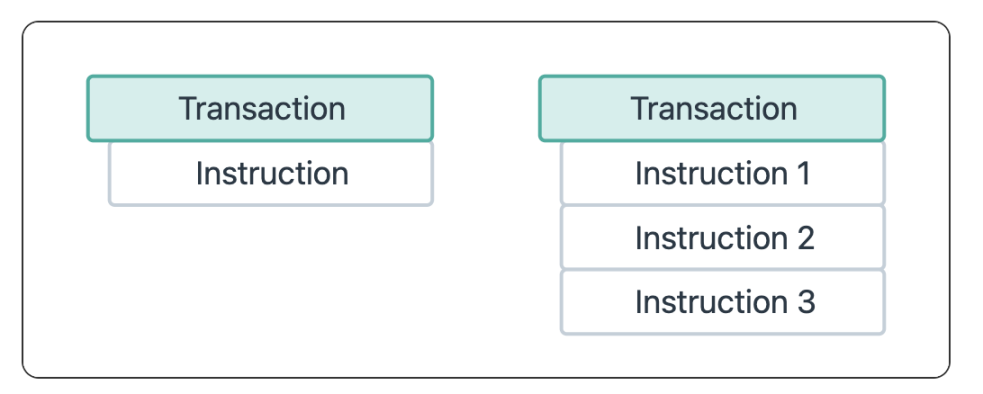

Instructions:* Instructions are a term specific to Solana on-chain programs. On-chain programs consist of instructions, the smallest unit in which a specific operation is performed: each Solana transaction contains one or longer instructions. Instructions specify the actions to be performed, including calling specific on-chain programs, passing accounts, entering lists, and providing byte arrays. Instructions have computational limitations, so on-chain programs should be optimized to use a small number of computational units, or split expensive operations into longer instructions.

Native Program: A native program that provides the functionality required to validate the Node. The most famous of these is the Program, which manages the creation of new accounts and the transfer of SOL between two accounts. SPL program: defines a series of on-chain activities, including token creation, exchange, lending, as well as the creation of staking pools, maintenance of on-chain domain name resolution services, etc. Among them, the SPL Token Program is used for Token operations, while the Associated Token Account Program is often used to write other custom programs.

You call it a smart contract, I call it an on-chain program, everyone says it differently, but they both refer to the code running on the Blockchain. Zhang San, Li Si, and Wang Mazi are all personal names, and other aspects have to be examined in terms of quality.

Account model, data decoupling:

Similar to Ethereum, Solana is also a Blockchain based on an account model, but Solana provides a different set of account models than Ethereum that stores data in different ways.

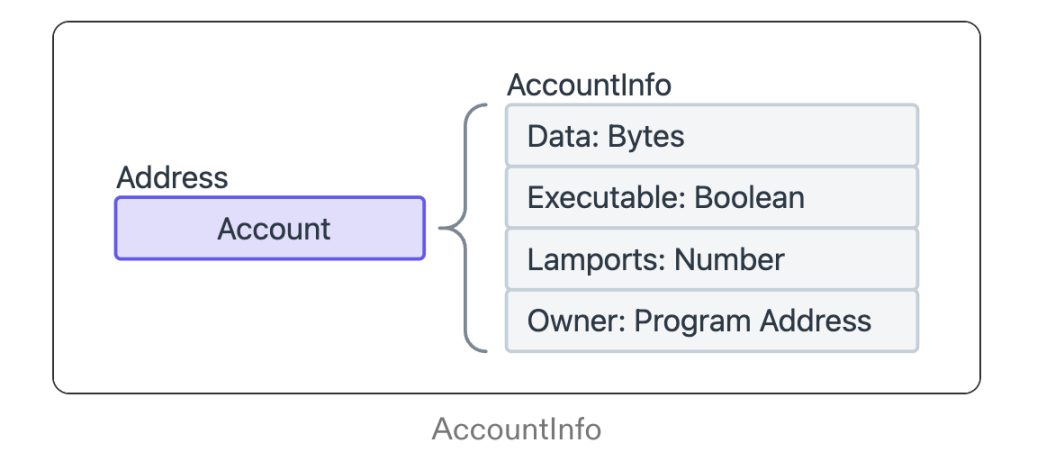

In Solana, accounts can hold wallet information and other data, and the fields defined by the account include Lamports (account balance), Owner (account owner), utable (executable account), and Data (data stored by the account). Each account designates a program as its owner to distinguish which program the account uses as a state store. These on-chain programs are read-only or stateless: the program account (executable account) only stores BPF bytecode and does not store any state, and the program stores the state in other independent accounts (non-executable accounts), that is, Solana's programming model decouples code and data.

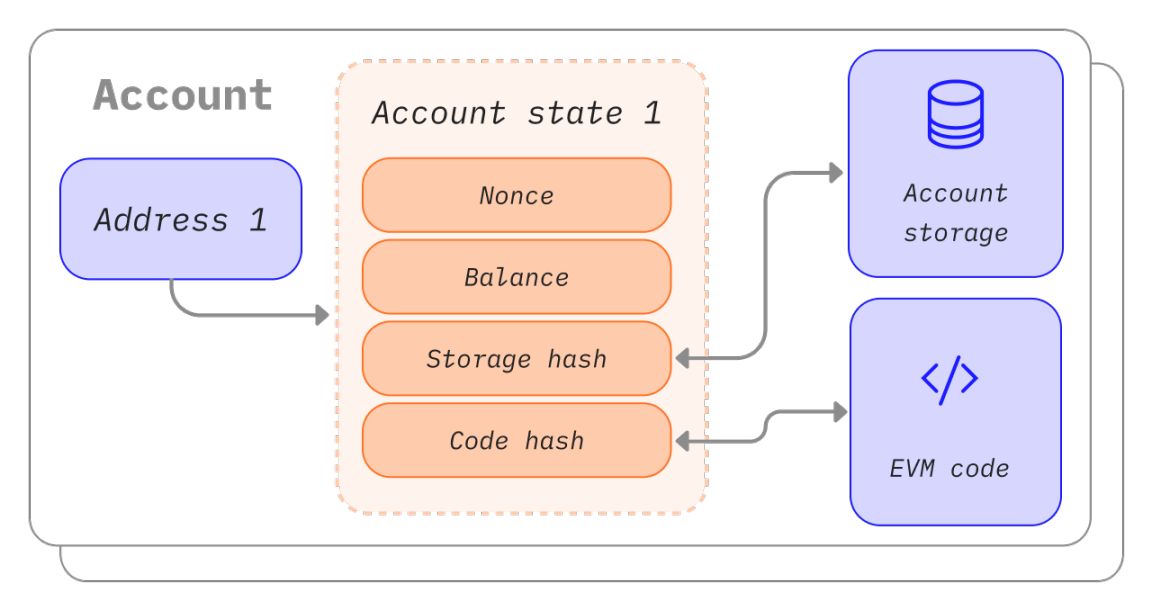

The Ethereum account is primarily a reference to the EVM state, which smart contracts both the code logic and the need to store the user's data. **This is often considered a design flaw left over from the EVM's history.

Don't underestimate the difference! Solana smart contracts are fundamentally harder to attack than Blockchain with a coupled programming model, such as Ethereum:

In Ethereum, the smart contracts "owner" is a global variable that corresponds one-to-one to the smart contracts. Therefore, calling a function may directly change the "owner" of the contract.

In Solana, the "owner" of a smart contract is the data associated with the account, not a global variable. An account can have longer owners instead of being linked one-to-one. To exploit the security vulnerabilities of smart contracts, attackers need to not only find the problematic function, but also prepare the "correct" account to call the function. This step is not easy, as Solana smart contracts typically involves long input account and manages the relationship between them through constraints such as account1.owner==account2.key. The process from "preparing the right accounts" to "launching an attack" is enough for security monitors to proactively detect suspicious transactions that create "fake" accounts related to smart contracts before an attack.

Ethereum's smart contracts are like a vault that uses a unique password, and as long as you get this password, you can get full ownership; Solana, on the other hand, is a vault with longest passwords, but to get permissions, you must not only find a way to get the password, but also figure out the corresponding number of the password before you can open the lock.

Programming Languages

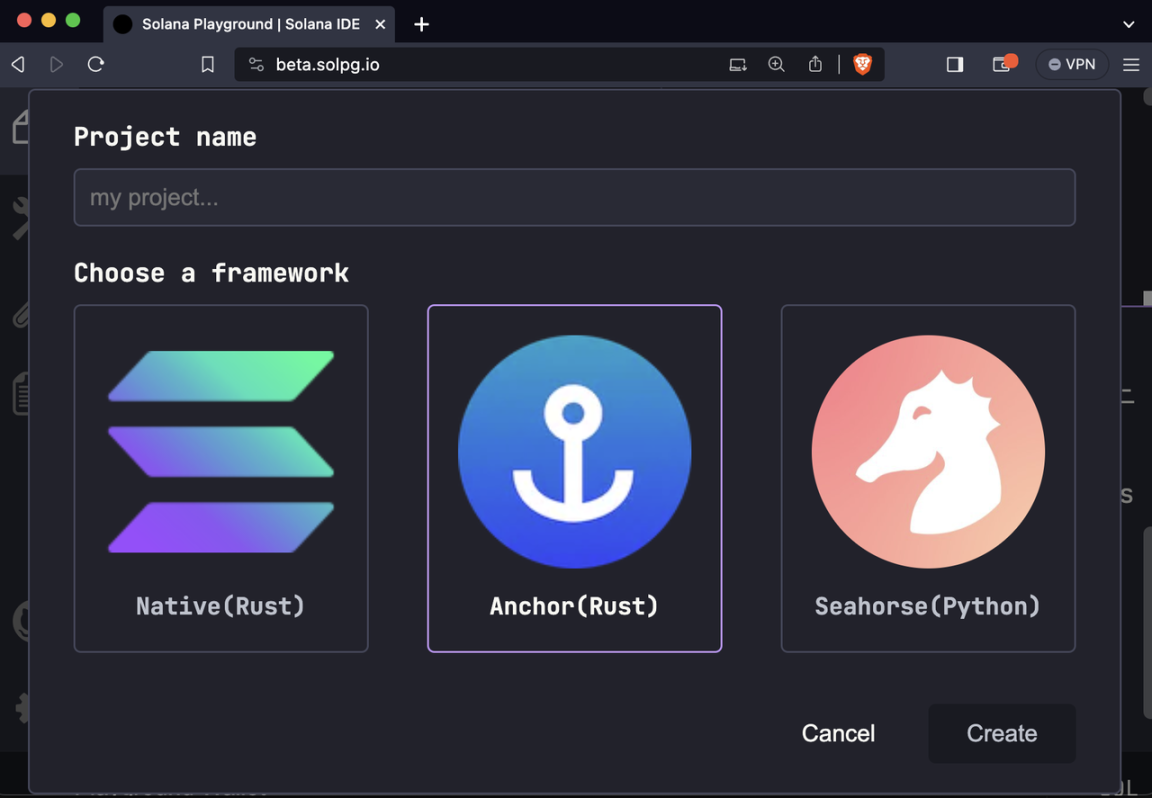

Rust is the primary programming language for developing smart contracts on Solana. Because of its performance and security features, it is suitable for high-risk environments of Blockchain and smart contracts. Solana also supports C, C++, and other (very uncommon) languages. SDKs for Rust and C are officially provided to support the development of on-chain programs. Developers can use tools to compile programs into Berkley Packet Filter (BPF) bytecode (files with .so extensions) and deploy them to Solana on-chain to execute the smart contracts logic through the Sealevel parallel smart contracts runtime.

Because the Rust language itself is difficult to get started with, and it is not customized for Blockchain development, long there are many requirements that require reinventing the wheel and code redundancy. Xu long long's newly created programming language dedicated to Blockchain development is based on Rust, such as Cairo (Starknet), Move (Sui, Aptos).

Many long projects in production use the Anchor framework

The Ethereum smart contracts is mainly developed in the Solidity language (the syntax is similar to java, and the code files are extended with .sol). Due to the relatively simple syntax and more mature development tools (Hardhat framework, Remix IDE...). Usually we think that Ethereum is a simpler and faster development experience, while Solana development is more difficult to get started. So despite the popularity of Solana right now, the number of developers in Ethereum is still far long than Solana.

In certain road conditions, top-of-the-line cars don't run as fast as modified cars. Rust is like a top-of-the-line racing car, which strongly guarantees the performance and safety of Solana, but instead of developing this track for on-chain programs, it has caused the difficulty of driving (development) to rise. Adopting a Rust-based public chain that develops a custom language for the on-chain is equivalent to modifying the car to make it more adaptable to road conditions. Solana is at a disadvantage at this point.

Summary

Solana's smart contracts programming model is innovative. It provides a stateless approach to smart contracts development, with Rust as the primary programming language, and an architecture that separates logic from state, providing a powerful environment for developers to build and deploy smart contracts, ensuring security and performance, but it is difficult to develop. With a focus on high throughput, low cost, and scalability, Solana remains the current choice for developers looking to create high-performance dApps.

Reference Link

- Reward

- like

- 1

- Share

Smart contracts, on-chain programs:

Programs running on Ethereum are called smart contracts. They are a series of code (functions) and data (state) located at a specific address on Ethereum. Smart contracts are also Ethereum accounts, known as contract accounts. They have balances and can be the subject of transactions, but cannot be manipulated by individuals. They are deployed on the network to run as programs.

Meanwhile, running on Solana

encryption prediction market the history of Polymarket‘s growth: The founder dropped out of school at the age of 22 to start a business and made a bet to understand the real world

Just a few days ago, on May 14, Polymarket announced that it had raised $70 million through two funding rounds, the most recent of which was by Peter Thiel‘s venture capital firm Founders

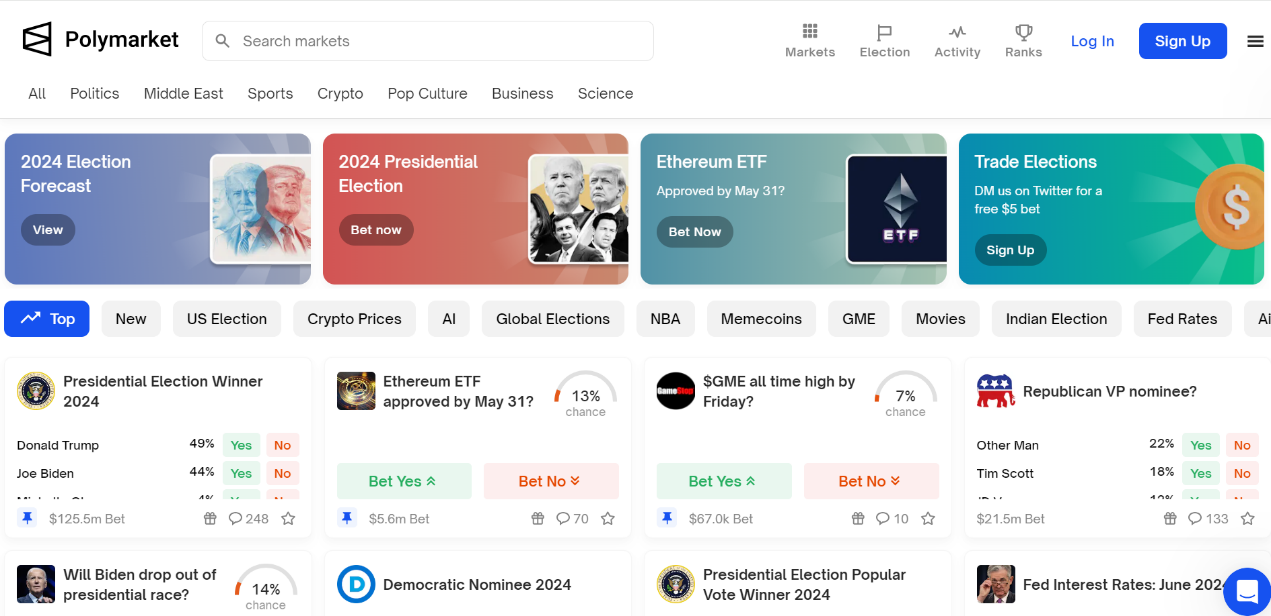

Attitudes towards Crypto Assets have become an important issue in the US election this November. Interestingly, users are not only seeing traditional pollsters continue to provide data, but also Polymarket, a prediction market platform based on Crypto Assets, gaining popularity. As of May 16, nearly $127 million has been bet on the topic of "winner of the 2024 presidential race", of which $15 million is betting on Trump, who has a 50% chance of winning, $14.55 million is betting on Biden, which has a 42% chance of winning, and none of the other three candidates has a win rate of no more than 3%.

Just a few days ago, on May 14, Polymarket announced that it had raised $70 million through two funding rounds, the most recent of which was led by Peter Thiel's venture capital firm Founders Fund, and Polymarket's investors also included Ethereum co-founder Vitalik Buterin.

Polymarket was launched in May 2020 in response to the widespread spread of misinformation during the pandemic, and the platform went live in mid-June of that year. Also in time for the 2020 and 2024 U.S. elections, the interweaving of major events has gradually brought this Crypto Assets-based prediction market platform into people's eyes and market hotspots.

NYU dropped out of the Department of Computer Science to start a business and admired Hayek

Polymarket founder Shayne Coplan, 26, once studied computer science at New York University, according to his LinkedIn page. According to public reports, in many longer ways, Coplan has the temperament of a new generation of entrepreneurs. He is an artist who is fascinated by P2P file sharing in an era when people love to share music. Since then, he has been exposed to Bitcoin and has easily understood the Intrinsic Value of a global peer-to-peer asset network.

When Ethereum was announced in 2014, Coplan became an early follower and is believed to be the youngest of the presale participants. Two years later, at the age of 18, Coplan began working on Blockchain projects, and in June 2016, he interned at Chronicled in the San Francisco Bay Area, where his role was to "follow the Chief Product Officer and help decide how the product interacts with the Ethereum Blockchain." ”

Since then, Coplan has also been obsessed with Crypto Assets, launching a series of startups and founding a Decentralized Finance startup called Union.market, which is directly the predecessor of Polymarket. Although he later dropped out of school, he has been thinking for a long time about some of the specific problems faced by the creation of prediction markets and decentralization markets over the past few years. He called Hayek's famous essay "The Use of Knowledge in Society" an early entrepreneurial inspiration, and Coplan also drew on longest years of academic research on prediction markets. Hayek's related idea is that people are more likely to accurately understand the likelihood of uncertainty when economic incentives are at work. People read longer and better sources of information, think deeper, and try to invest their money in actual outcomes that are more likely to happen.

"When COVID broke out, there was so long uncertainty and so long different perspectives, [I think] if there was only a free market on those topics, people could tie money to their opinions," Coplan once told the media.

On June 16, 2020, the beta version of encryption prediction market Polymarket was released, but at the time there was high friction for users, with only Metamask login support, high Ethereum Money Laundering, and limited Liquidity. Three months later, with the release of the second phase of Polymarket, Coplan's approach to building Polymarket became clearer. The platform was ported to Ethereum's second layer, Matic (now Polygon), to drop gas fees for betting. He also designed the system for users who did not have Ethereum Wallet. All bets are placed in USD-pegged stablecoin USDC and can be purchased via debit or credit card.

Just a few months after its initial launch, Polymarket managed to attract attention with a massive $4 million seed round led by prominent investors Polychain Capital and Naval Ravikant.

The 2020 U.S. election became a catalyst for Polymarket. On November 3 of that year, affected by the U.S. election, Polymarket's volume soared to $1.297 million, from unknown to up-and-coming.

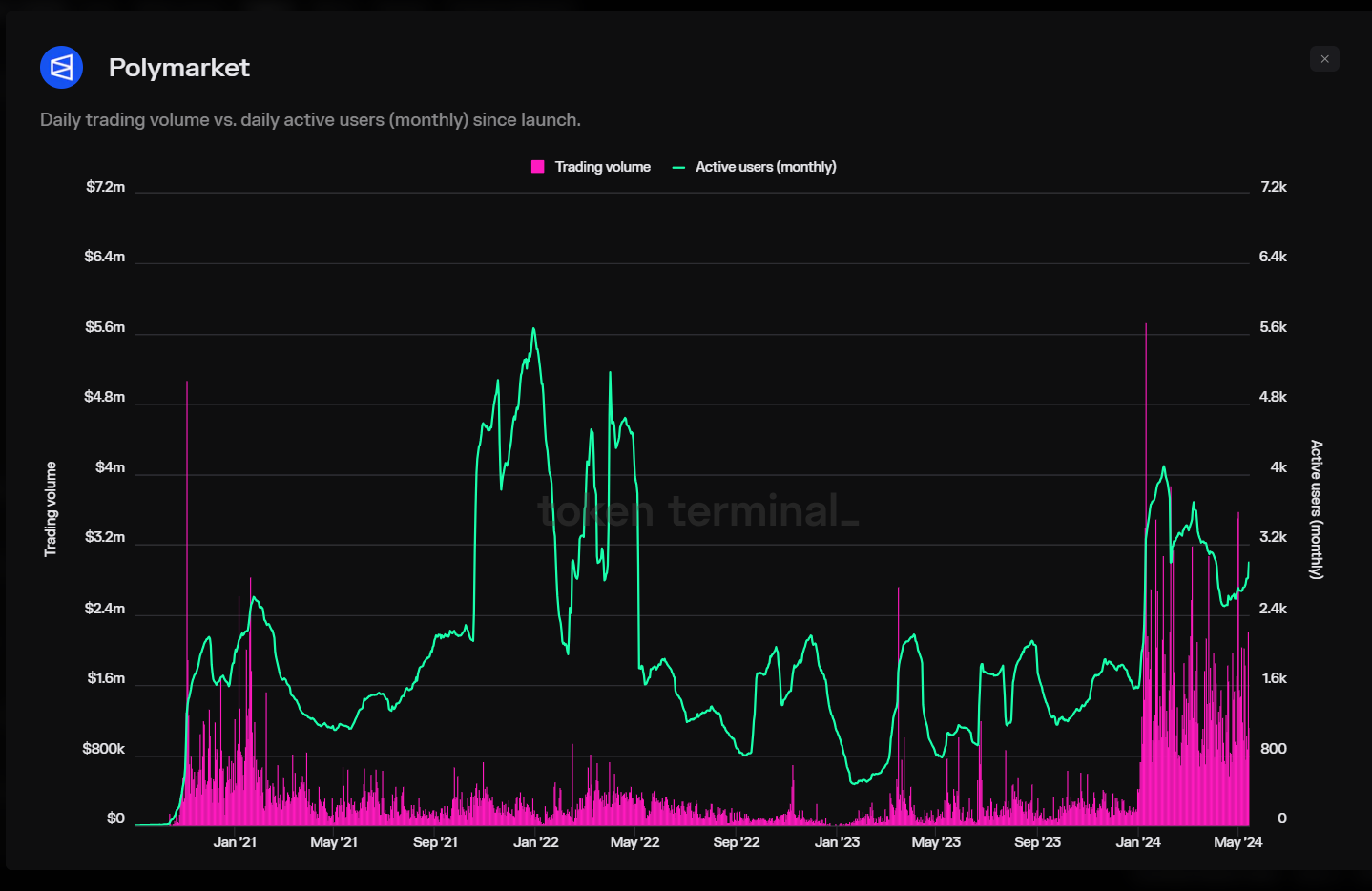

Polymarket's volume and monthly active population since its launch in 2020

With longer positive feedback from the community and market recognition, Polymarket later attracted Series A funding, where General Catalyst helped the company raise $25 million in Series A funding, with participation from Airbnb's Joe Gebbia and Polychain, among others.

Polymarket's volume and monthly active population since its launch in 2020

With longer positive feedback from the community and market recognition, Polymarket later attracted Series A funding, where General Catalyst helped the company raise $25 million in Series A funding, with participation from Airbnb's Joe Gebbia and Polychain, among others.

Most recently, Polymarket's Series B funding reached $45 million, led by Peter Thiel's Founders Fund and existing investors 1confirmation and ParaFi, with participation from Ethereum co-founder Vitalik Buterin and Dragonfly and Eventbrite co-founder Kevin Hartz.

Fined $1.4 million by the CFTC, the submarine prediction sparked controversy

Polymarket's development has not been without its challenges. In January 2022, Polymarket was fined $1.4 million by the Commodity Futures Trading Commission for violating regulations and received cease and desist orders, including for failing to register as a trading intermediary facility. Protocol to the settlement, Polymarket committed to reducing its service in the U.S. and continuing to operate overseas.

However, Polymarket has also stepped up its compliance efforts. In May 2022, Polymarket appointed former U.S. Commodity Futures Trading Commission member J. J. Christopher Giancarlo is Chairman of its Advisory Board.

In addition to this fine, in June 2023, according to Mother Jones, a tweet about the results of the Titan submersible went viral, causing quite a few negative consequences for Polymarket. There's a bet on Polymarket on whether the submersible will be found by a certain date, with users betting more than $300,000 on whether the missing submarine will be found "by June 23." This has sparked online discussion about the ethics of profiting from potentially fatal events.

"What stage of capitalism does betting on someone else's death belong to," one Twitter user asked, posting a screenshot showing the odds on Polymarket. The sentiment touched a nerve, and the post quickly went viral, garnering over 9,000 retweets and over 150,000 likes. "It's insane. Imagine making money by whether someone dies or not," replied another user, which was liked more than 1,000 times. Others began to directly criticize the prediction that Polymarket would open up.

The developing Polymarket responded to ethical concerns, describing the submarine market as "irrelevant to any outcomes for passengers." "We understand that there has been some confusion due to the misunderstanding that our prediction market is related to the fate of passengers. We want to emphasize that this is not true," Polymarket wrote. "Our goal is not to profit from this unfortunate event. We didn't do that either. It's about helping people better understand the world around them. ”

"Break through" in the encryption prediction market track, when will it mature?

prediction market itself has a long history, but in the encryption space, the first Decentralization prediction market was Augur, which was launched at the Ethereum in July 2018. Augur was developed by the Forecast Foundation, which was founded in 2014 by Jack Peterson, Joey Krug, and Jeremy Gardner. The Forecast Foundation is advised by Ron Bernstein, founder of defunct company Intrade, and Vitalik Buterin, founder of Ethereum.

In addition to Augur, Polymarket is not the only prediction market in the market, but also Gnosis, Hedgehog, PlotX, Projection Finance, Sanr.app, Better.fan, Feel.market, etc. However, Gnosis turned to community management projects after failing to meet expectations. Other encryption prediction market, such as Veil, were simply shut down.

Early Crypto Assets-based prediction market experiments, such as Augur and Gnosis, have also been hit hard by Ethereum's long-standing scaling problem. In addition, they all initially used native tokens, adding friction to the user experience. Polymarket has learned from the mistakes of its predecessors.

After 4 years of development, Polymarke has now successfully "broken through", and will even be cited by media reports and industry research on some key issues as a reference for public opinion.

As of May 14, there are longing hot topics on Polymarket's website: Who will win the 2024 presidential election? Will the May 31 Ethereum ETF be passed? Will $GME reach all-time highs by Friday?

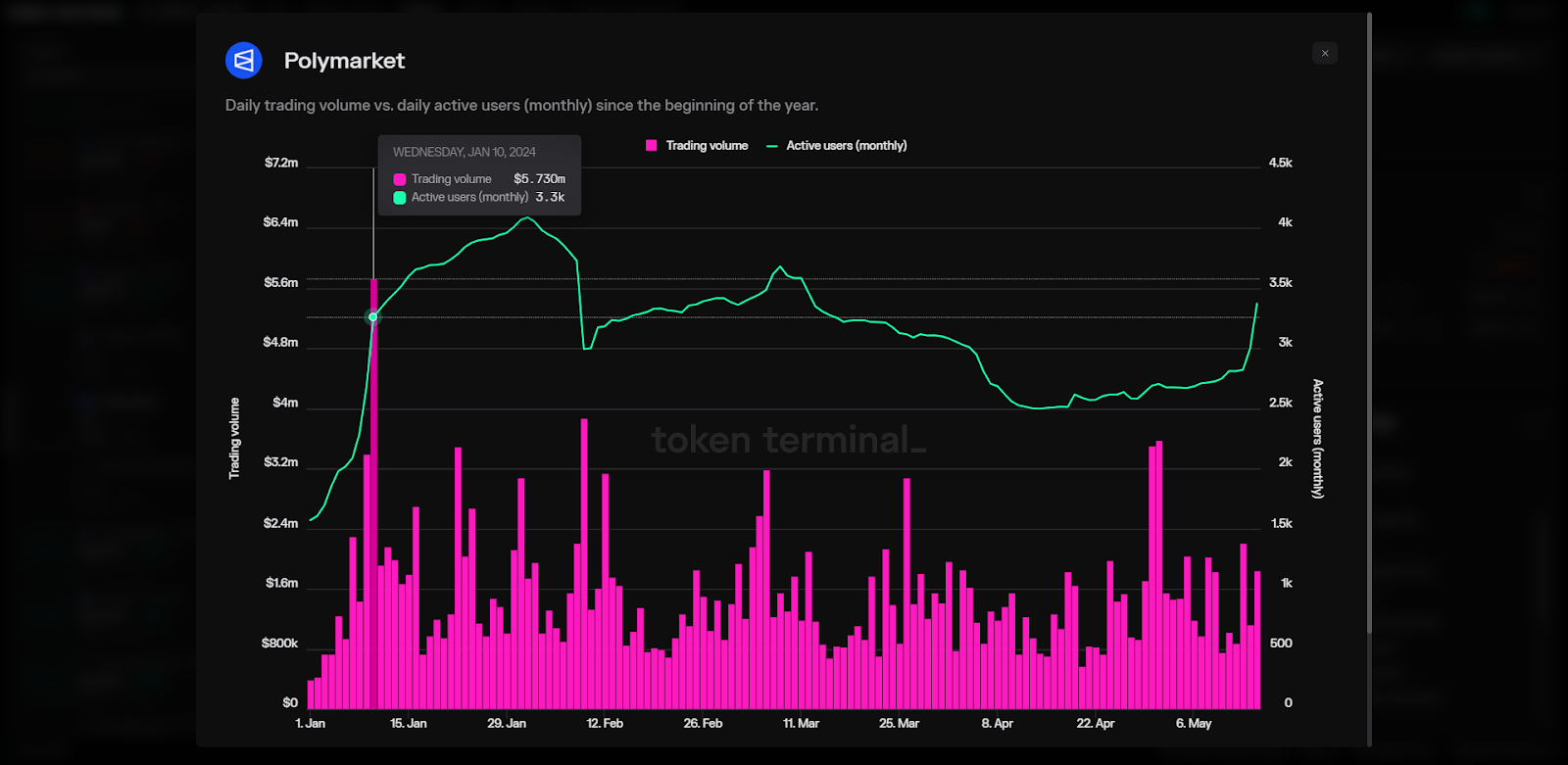

According to Token Terminal, Polymarket's highest volume so far this year came on January 10 at $5.73 million. The platform experienced a significant rise in the number of monthly active users in January, rise from 1,600 on January 1 to 4,100 on February 1, with a slowdown in monthly active users after April. As of May 15, the forecast on Polymarket has reached $202.7 million.

Following the recent funding round, Coplan said on LinkedIn that "the most gratifying thing is to see Polymarket being widely adopted as an alternative news source." The trend is clear: thanks to Polymarket, people are more aware of what is happening in the world. Fed up with the rhetoric of experts and Algorithm-generated news. In this age of rampant misinformation, Polymarket offers a new form of information driven by financial incentives to drive truth, rather than luring to get clicks. People want unbiased information. Polymarket is providing this. ”

As a firm believer in market theory, Coplan believes that forecasting platforms are a true way to better understand reality.

Polymarket has already attracted the attention of many long industry insiders. Vitalik used Polymarket to track Sam Altman's board out. Packy McCormick, an advisor at a16z Crypto, has also said that Polymarket's page is probably the best place on the internet to start the day.

Riding on the social hotspots, with the support of celebrity users, Polymarket has become the biggest encryption prediction market, however, to achieve its original intention, continuous optimization of the product experience and avoiding risks and ethical dilemmas is a crucial challenge for future development.

- Reward

- like

- 1

- Share

Sanctum: How to bring change to Solana Pos staking?

Compilation: LlamaC

"Testimonial: Sanctum has brought breakthrough changes to the Solana ecosystem, making staking more flexible and accessible. Its innovation not only improves the capital efficiency of LST, but also provides small validators with the opportunity to compete with larger projects, further promoting Solana‘s openness and inclusion. As more long individuals and projects begin to issuance custom LST, we‘ll see their community-driven, innovative energy. This article is designed to help you understand the Sanctum protocol, explore how it is redefining liquid staking, and think about how this innovation has brought new perspectives and opportunities to our Decentralized Finance journey. Pump knowledge together! enjoy!」

ORIGINAL AUTHOR: SHLOK KHEMANI

Compilation: LlamaC

"Testimonial: Sanctum has brought breakthrough changes to the Solana ecosystem, making staking more flexible and accessible. Its innovation not only improves the capital efficiency of LST, but also provides small validators with the opportunity to compete with larger projects, further promoting Solana's openness and inclusion. As more long individuals and projects begin to issuance custom LST, we'll see their community-driven, innovative energy. This article is designed to help you understand the Sanctum protocol, explore how it is redefining liquid staking, and think about how this innovation has brought new perspectives and opportunities to our Decentralized Finance journey. Pump knowledge together! enjoy!」

Body 👇

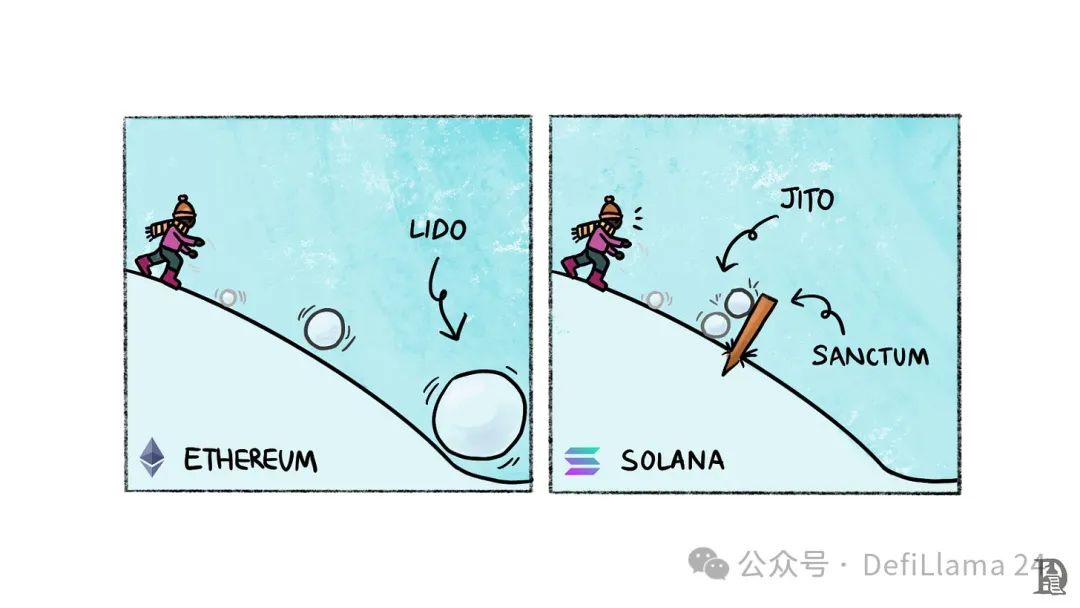

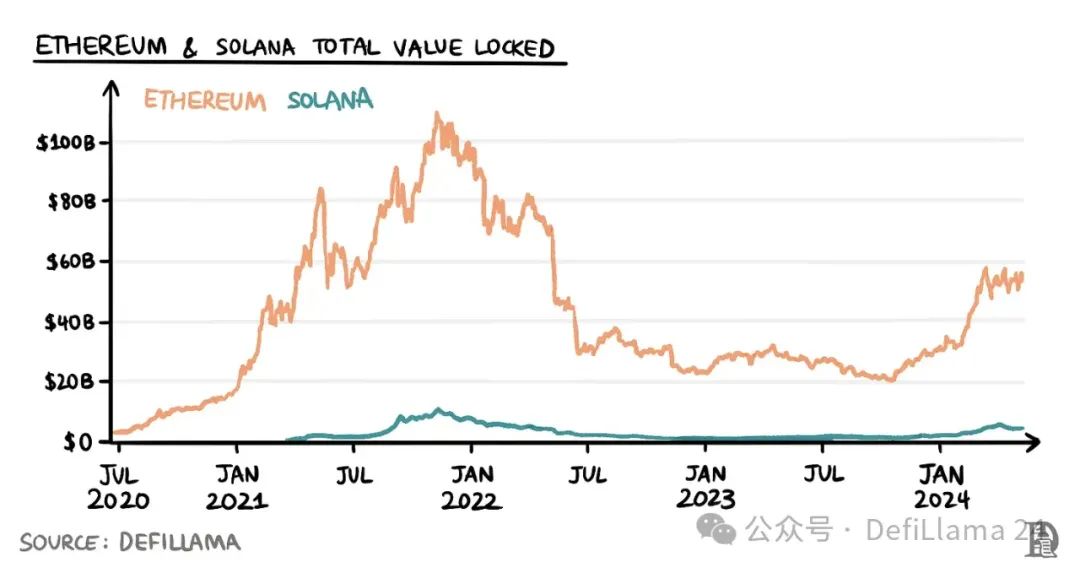

Tl; DR: liquid staking is one of the core security and Decentralized Finance primitives of any attestation (Proof-of-Stake, PoS) Blockchain. In this article, we compare the liquid staking landscape on Ethereum and Solana. One has a strong ecosystem, while the other is in a more nascent stage and is evolving in a different way.

We explain the different approaches taken by the two. Finally, we tear down Sanctum, a novel protocol that rethinks liquid staking on Solana.

Transaction networks require a high level of security to earn trust. If someone were able to change a SWIFT wire instruction or a Visa transaction, people would lose trustless in those systems. The same goes for Blockchain. Security determines how receptive users are to them. For example, there is the highest hashrate support behind the Bitcoin Blockchain.

Therefore, we have a basic understanding that once a transaction is recorded in the network, malicious actors cannot manipulate it. But the cost of trading on Bitcoin is very high.

In recent years, low-cost networks like Solana and Ethereum have transitioned to attestation (PoS) Consensus Mechanism. Unlike Bitcoin, which relies on computing power, these networks use stake capital to measure economic security.

Before we dive into how this works, here's a quick overview of some of the terms you might see in this article:

Validators: Users who protect the PoS chain.

Staking: Validators gain the right to create blocks, process transactions, and secure the network by locking a certain amount of the network's native coins as collateral. This Collateral is called their "equity". Some networks, such as Ethereum, stipulate a minimum stake amount, while others, such as Solana, do not.

Leader: The network chooses a validators, called a leader, to create the next Block. The probability of being chosen as a leader is directly proportional to the size of their stake and other network-specific factors. Once a leader creates a block, other validators in the network verify the validity of their transactions.

If the network accepts the block, the leader receives the block reward for the issuance of the network and the transaction fee paid by the user.

Slashing: If other validators deem a block invalid, the leader may lose a portion of the Token as a penalty in a process known as slashing. Validators often have significant economic exposure to the networks they help secure. As a result, they have little incentive to pass flawed data to the network. If they do, they will lose Token by slashing.

When a PoS Blockchain works as intended, the rewards earned by honest validators accumulate to form a steady return to the stake Token, usually expressed in APR (APY). On Ethereum, this yield is usually between 2-4%.

These returns from staking have three functions. First, they protect the network. Second, they incentivize long-term engagement within the ecosystem. Third, they help ensure that long-term participants are not diluted by Inflation.

If you think of the network as a city, staking is like building a house in that city. It keeps you there for a long time and appreciates in value over time.

Current dilemma

Staking has its advantages, but they are not cheap. Just like building a house in the real world, people may not have the time, energy, capital, and skills to set up a validators Node. Everyone wants yield, but expecting to run a validator for yield may not be feasible. This is where delegated staking comes in.

The concept is simple: users entrust their stake to a validators and then validators return the earned rewards to the user after deducting a percentage of the proceeds as a fee.

While delegating staking solves one problem for users, it also creates another.

When a user holds the chain's native coin, it is liquid. They can sell it at any time, or deploy it into Decentralized Finance protocol for additional income such as borrowing and liquidity pool. However, once the Token is natively staked, it becomes illiquid. Stakes must wait for the bonding period, after the cooling-off period has passed, before they can withdraw their stakes.

On some PoS on-chains, this can be up to 21 days. They also gave up the opportunity to earn extra yield when their tokens were staked. I guess you can't both hold your stake and eat (gains) in this game.

liquid staking is a solution that allows users to protocol stake their Token through a protocol minting that represents the liquid staking Token (LST) of the stake assets. These LSTs can be freely traded on exchanges and used in Decentralized Finance applications to provide users with liquidity. When a user wants to take it back, they can offer their LST to the stake protocol in exchange for this coin, and then protocol will destroy the LST.

If too long users are in a hurry to withdraw their liquid staking assets by trading on the exchange, it can lead to depeg. This was the case with Lido's Token last year, where the price of its liquid staking Token is lower than the price at which it can be redeemed – a kind of bank bank run.

Staking plays a central role in securing PoS Blockchains, and liquid staking has become one of the most important areas in the encryption space due to its fundamental utility of unlocking illiquid capital.

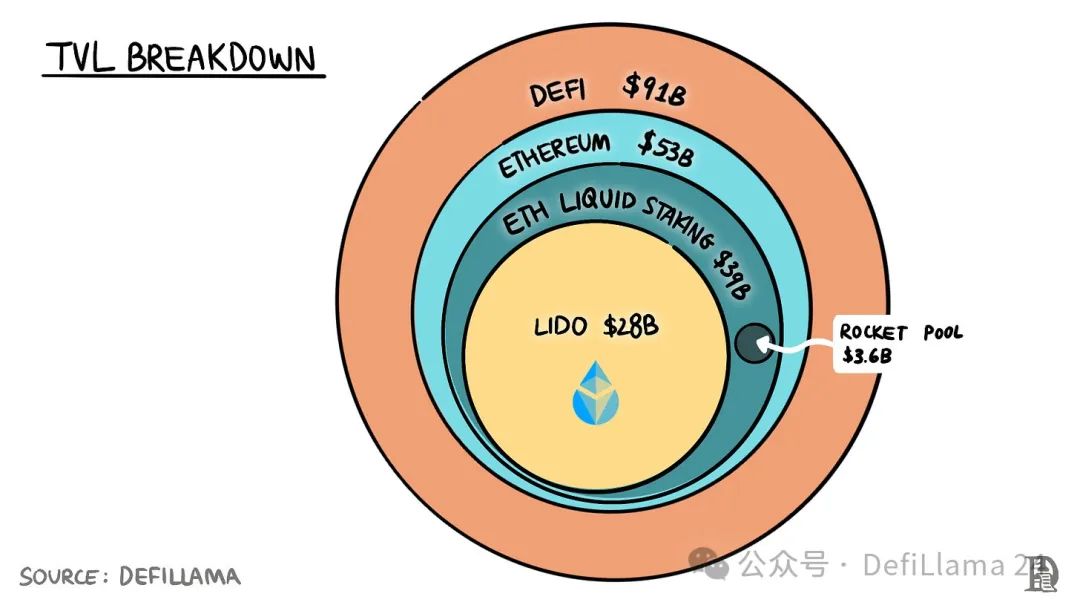

TVL in cross-chain liquid staking protocol account for more than 50% of all Decentralized Finance protocol TVLs. In that ecosystem, Lido holds about $28 billion in staked assets. But what does Lido do?

Becoming a validator on Ethereum requires at least 32 ETH (approximately $100,000 as of May 7, 2024) of staking, technical know-how, and comes with the risk of slashing. This makes solo staking (running your own validators) an unappealing option for a large longest number of users.

Ethereum does not support native stake delegation. This means that you can't directly stake your ETH with validators, but instead need an out-of-protocol service to facilitate delegation. Those with capital but lack the knowledge or intent can delegate node operations to stake-as-a-service offerings like P2P or stakefish, which charge a monthly service fee.

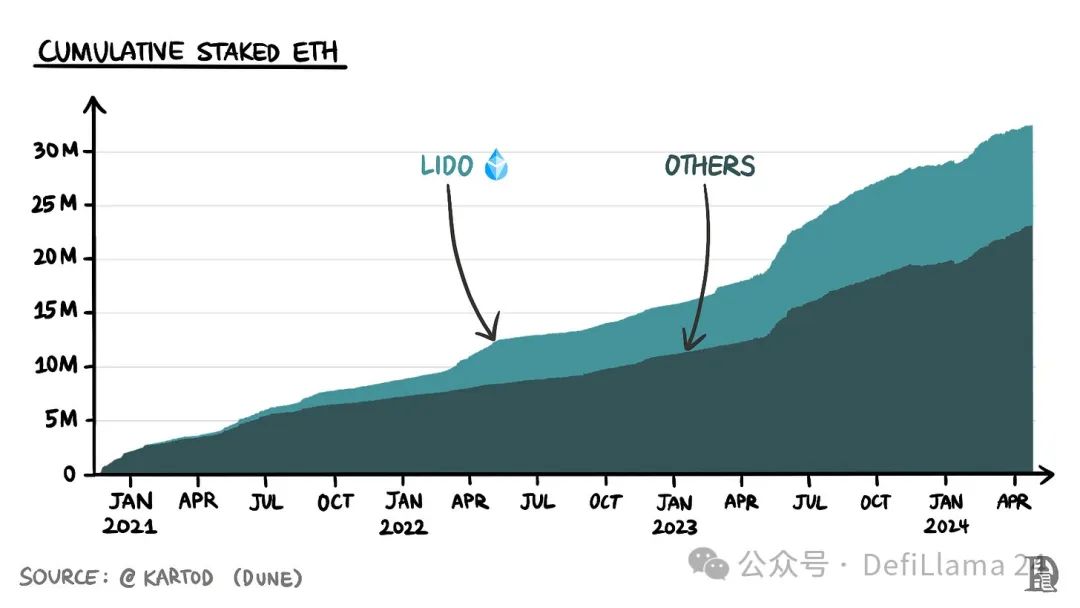

The dominance of the Lido has grown over time.

Those who don't have 32 ETH capital rely on platforms like Lido. Users can deposit ETH into Lido's staking pool in exchange for liquid staking Token stETH. The deposit pool is evenly distributed among 39 trusted and vetted Node operators. Lido charges a 10% fee on stake rewards, which is split equally between the Node Operator and the Lido DAO treasury.

Here are some numbers to help you understand Lido's scale:

- 27% of all ETH is staked. Of the ETH staked, nearly 30% is deposited into Lido.

- Lido's TVL is about $28.7 billion, more than 7 times that of on-chain's second-largest stake protocol ($3.71 billion for RocketPool).

- Lido accounts for more than half of Ethereum's total TVL and nearly one-third of all on-chain total Decentralized Finance TVL.

These numbers raise two questions.

- First of all, How did Lido become so dominant?

- Second, is this dominance healthy for Decentralization networks like Ethereum?

The answer to the first question lies in the interplay between Liquidity and Distribution.

The biggest value proposition of LST is instant liquidity. Users should be able to sell Tokens at the lowest possible Slippage (best price) at any time. Slippage is a function of the size of the Liquidity pair of LST with other assets (ETH, stablecoin) on the exchange.

The larger these pairs and the lower the slippage, the wider the adoption of LST.

Lido's stETH has the highest liquidity in LST. One can buy more than $7 million worth of stETH for less than 2% of the price impact (±2% Depth figure shown here) on ask price long exchange. For the second largest LST rETH, the same metric is less than $600,000.

The high Liquidity also helps to integrate into the lending protocol. Users often stake assets as collateral for loans. It has two functions. First, they can earn on the underlying asset. Second, it provides them with USD liquidity for their stake assets. These dollars can then be used for trading or increasing leverage by buying longer underlying assets (ETH or SOL) to stake and increase yield.

But when a user's long wick candle loan to an asset is liquidated, protocol need immediate Liquidity to prevent the Collateral from going bad (becoming undercollateralized). If the Liquidity of a LST is low, the likelihood of borrowing protocol accepting it as a Collateral will be drop. stETH is currently the largest lending asset on Ethereum protocol the most long supply on Aave.

The other half of the interaction is distribution. Users hold LST to earn additional yield or participate in the broader Decentralized Finance space. Therefore, the more long a protocol a LST can use, the more attractive it is to hold. Think of coins around the world. The more a regional coin is accepted, the greater its value.

Lido's LST (stETH) is like USD for stake assets. No LST in the Ethereum ecosystem is as widely accepted as Lido's stETH.

One can use stETH on the Synthetix perpetual marketplace on Optimism, on the Venus coin marketplace in BNB on-chain, or on Aave on Arbitrum. EtherFi, a stake protocol that owns about 4% of all stake ETH, only accepts ETH and stETH deposits. Similarly, even a new protocol like Morpheus, a peer-to-peer AI network, only accepts stETH deposits.

Liquidity and distribution reinforce each other. The higher the liquidity of LST, the more attractive it is to users. The long the number of users holding LST, the greater the incentive protocol integrate it. This, in turn, has led to wider adoption, with more long users depositing funds into Lido, generating higher Liquidity.

These compound network effects result in a centralized winner-takes-all market structure. Lido is a behemoth because it occupies this market on the Ethereum, which is the most long chain for Decentralized Finance activity.

Lido's network effect provides it with a huge moat. It's not easy to tear it apart (just ask the hundreds of Social Web upstarts who are trying to compete with Twitter or Instagram). New entrants need to have both deep pockets (to draw attention) and a unique value proposition if they want to compete with the behemoth of Lido.

But does this mean that Lido's dominance poses a threat to Ethereum's decentralization nature? Some, like the author of this article, think it is. As a Lido DAO that controls about 30% of the stake Ethereum, it may have too much influence on the network.

Given that Lido currently has only 39 node operators, there is a risk that operators will collude to carry out activities that are harmful to the health of the network. They can theoretically do transaction review and cross-block MEV extraction. If Lido continues to rise and takes up half of all stake ETH, they can start reviewing the entire Block. At two-thirds of the stake ETH, they will be able to finalize all Block.

LDO holders benefit from the 5% of the stake rewards retained by the DAO. Therefore, their motivation is to maximize the amount of stake held by Lido and the fees generated by their operators. Any decisions they make will serve that goal and not for the benefit of the broader Ethereum ecosystem.

This presents a basic principle - the problem of proxy. Lido is making changes to mitigate these risks.

- First, they are working to increase operators, make them more geographically dispersed, and eventually allow any validator to join without permission. Second, there is a proposal to introduce dual governance into the protocol. Both stETH and Lido holders will have a say in the direction of the project.

However, despite these changes, Lido itself is tending to form a monopoly on Ethereum stake. This brings with it the long-term risks that we discussed.

Solana

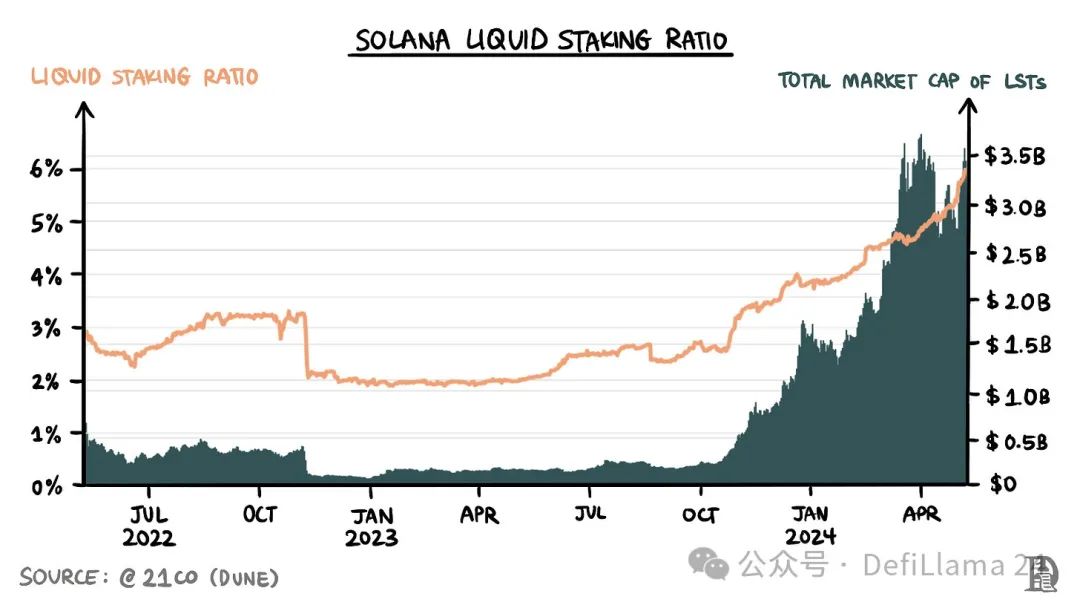

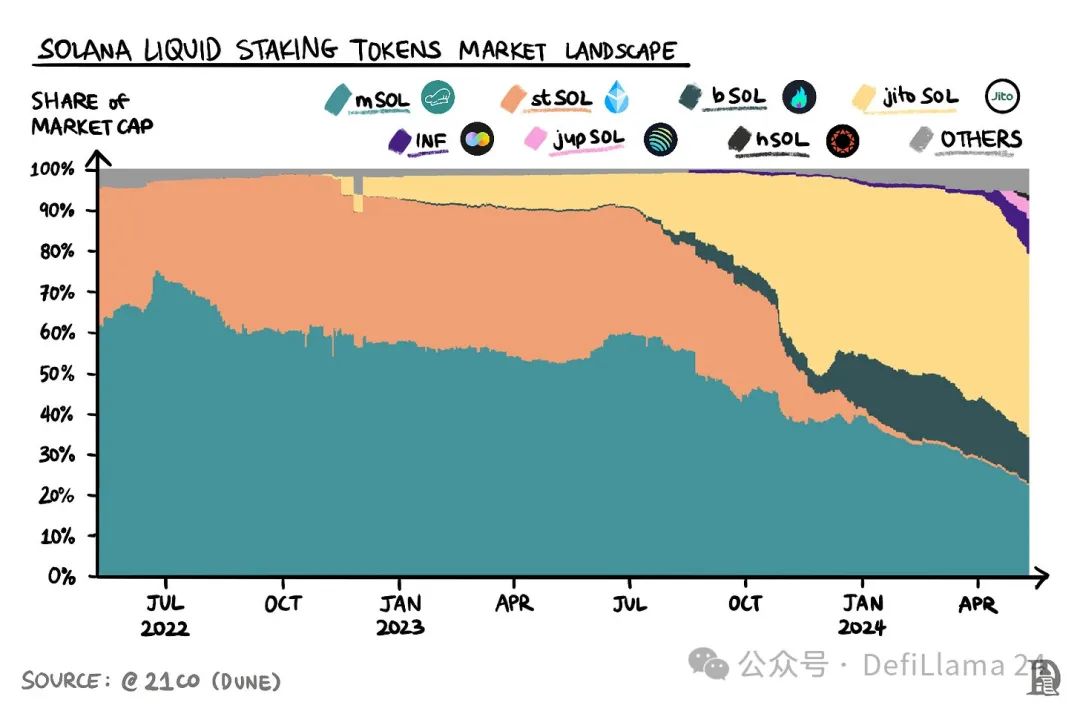

The staking and LST landscape on Solana is very different from Ethereum. Solana's stake ratio (the percentage of SOL stake in circulation) is over 70%, much higher than Ethereum's 27%. However, LST only accounts for 6% of the stake supply (compared to more than 40% on Ethereum).

It's valuable to explore the reasons behind this difference.

- First and foremost, staking on Solana works very differently than Ethereum. Unlike Ethereum, Solana supports delegated attestation. This means that users can stake any number of SOL, with no minimum requirements, directly with validators stake, without the need to use third-party protocol. In fact, large long Wallet (including popular Wallet like Phantom and Backpack) allow direct stake through Wallet interfaces.

This makes it easy for users to stake their SOL locally. In contrast, due to Ethereum's lack of delegated stake, using a staking pool like Lido is the only viable option for large long stake.

- Second, the cuts on Solana have not been activated. This means that the choice of validators is not a critical issue and one can validators stake with any one that offers returns without taking risks. However, on Ethereum, slashing is active, which makes it important for validators to choose a staking pool solution like Lido for execution.

This also means that the return of staking a staking pool that is distributed to longest validators on Solana is not significantly different from the return of staking directly with one of the top validators.

- Third, the Decentralized Finance ecosystem on Solana is not as mature as it is on Ethereum. This means that even if users stake their SOL for LST, there is no longest protocol to take advantage of. Why take extra risks, such as smart contracts being hacked, when there aren't longing opportunities to make a profit? Instead, choose the simple route to stake directly.

The first generation of Solana LST – Marinade's mSOL, Lido's stSOL, or SolBlaze's bSOL – mimicked the strategy of liquid staking protocol on Ethereum. The problem is that the problems that Lido and its peers solve on Ethereum simply don't exist on Solana.

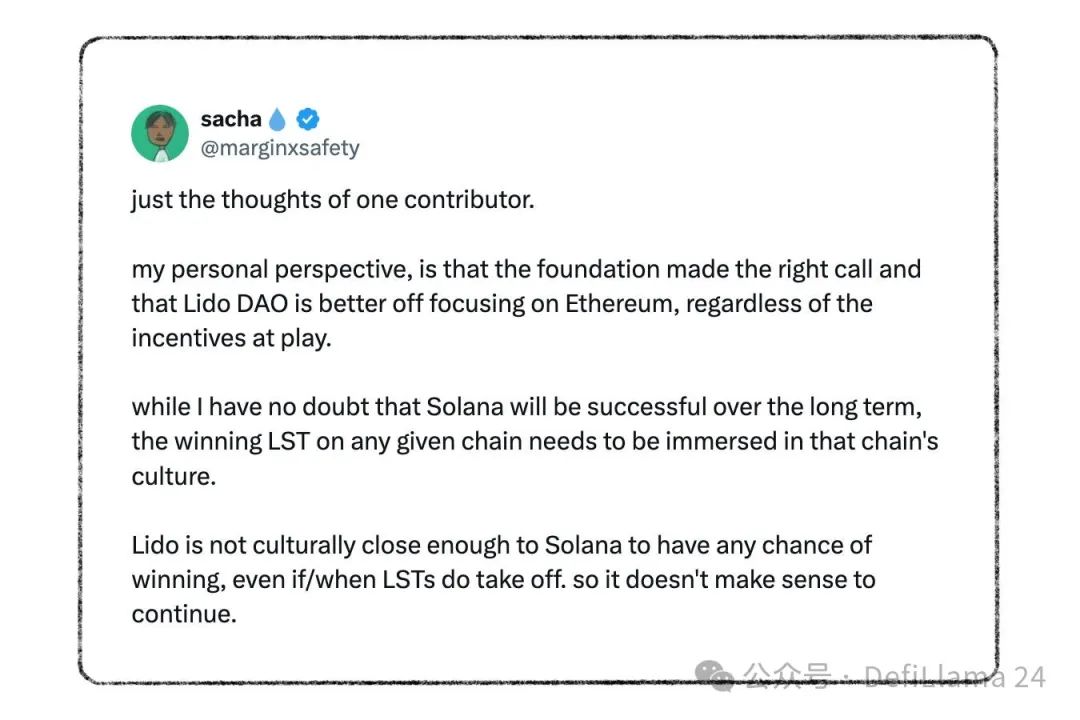

The best illustration of this is Lido's community vote after leaving Solana in 2023. The main reason is that the revenue generated is lower than the expenses (this is partly due to the fact that Solana is still in the post-FTX downturn). But I think another equally important reason is that Lido and Solana don't match culturally.

Going back to our discussion of Lido's dominance on Ethereum, one reason is that stETH is integrated into all major Decentralized Finance protocol and projects in the ecosystem. This does not happen automatically, but requires longest years of groundwork and building trust and goodwill within the ecosystem. Players within the Web3 industry will refer to these as business development (BD) efforts.

These networks cannot be easily replicated in new on-chain just because a protocol has been successful on-chain competition, especially given the tribal nature of Crypto Assets.

It is often assumed that technical standards are adopted purely on the basis of their efficiency. But the adoption at the bottom is often personal. This is clearly demonstrated by Marinade's dominance on the Solana stake, surpassing Lido.

In the first few months of Solana stake, there were two major players: Lido, a encryption unicorn backed by millions of venture capital, and Marinade, a self-funded project born out of Solana hackathon. However, Lido's stSOL has never surpassed Marinade's mSOL on TVL.

This is partly because Marinade's sole focus (and birthplace) is Solana. In contrast, Lido expands from its own network to another location.

Recently, with the revival of Solana, LST is making a comeback, spearheaded by Jito, the protocol we wrote about earlier.

Jito becomes the Solana native protocol as much as possible. Their 2023 Airdrop awakened Solana from its post-FTX slumber, creating a wealth effect and a resurgence of on-chain activity. With venture capital and the kind support of the community, Jito is following Lido's playbook and seeking to dominate LST on Solana.

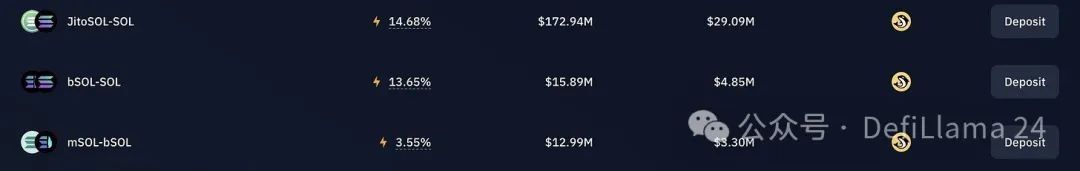

- Jito started using its governance token JTO to motivate JitoSOL Liquidity Liquidity on exchange. They have the highest APY, TVL, and volume of all LSTs on the Kamino Liquidity Bank.

- Second, Jito is working with other top protocol on Solana such as Solend, Drift, Jupiter, and marginfi to deeply integrate JitoSOL into the ecosystem.

- Third, it is expanding to Arbitrum by partnering with Wormhole, thereby enabling longest chaining and increasing the utility and attractiveness of JitoSOL.

Jito has the longest liquidity of any LST on Kanami

With Solana back in the game, JitoSOL's activities and Liquidity proliferated, and Jito perfectly scheduled the release and rise of JitoSOL. Not only did it become the dominant LST on the Solana, but it was also the protocol of the highest TVL in the on-chain.

By following Lido's playbook, there are early indications that Jito may also be copying Lido's results – completely dominant. If the current trajectory continues, it could be a very favorable outcome for Jito. However, given the debate surrounding Lido's impact on Ethereum's health, is Jito in a similar position, especially since they also have the most popular MEV solution on the on-chain, would it be beneficial for Solana? Maybe not.

Jito's ball is rolling, and given the complex nature of network effects, it's hard to stop once it's big enough. However, due to the debate over the final state of LST, which is still relatively early, a new force has emerged that could prevent Solana from reaching the same LST endpoint as Ethereum.

Dismantling Sanctum

The Sanctum team is the OG of the Solana liquid staking ecosystem. They first helped Solana create the first stake pool contract, which is now used by almost all LSTs (except mSOL). Before creating unstake.it (now Sanctum Reserve), they also ran a traditional stake pool called scnSOL.

Sanctum is fundamentally rethinking liquid staking with a mission to prevent Solana from going down the path of Lido's dominant stake protocol and to bring a vision with an infinite LST ecosystem.

At the heart of their product is unique insight. Sanctum's co-founders call it an open "secret" – LST is fungible. Let me explain what that means.

When you validators stake SOL, you create a stake account with SOL and then delegate it to validators. This way, validators don't have direct access to your SOL. This also means that staking is not instantaneous. stake account can only be activated at the beginning of epochs (and deactivated at the end of epochs).

Each epoch on Solana lasts about 2 days. Similarly, when you deposit SOL into a staking pool like Jito, a stake account is created and the stake is delegated to long validators determined by the protocol. In return, you get a liquid staking Token. Another way to look at this is that LST is a tokenization version of stake account.

This means that whether it's a stake account created directly to the validators stake SOL, or a stake account created when you deposit SOL into a staking pool, what's behind it is the same – locked SOL. This mechanism unique to Solana is the foundation of Sanctum's innovation in the liquid staking space.

Reserve and routing

Usually, when users want to redeem LST, they have two options.

- They can interact with issuance protocol, deactivate their stake account, and wait for the cooling-off period (2-4 days) to end to get their SOL, or

- They can trade through LST-SOL pairs on DEXs for instant liquidity.

Since users may hold LST first to reap the benefits of instant liquidity, they will prefer the second option. This means that LST without liquidity will be inefficient and unattractive to users. This benefits big players and makes it difficult for Newbies to create an attractive LST. Liquidity begets Liquidity.

Sanctum Reserve changes this equation by offering a completely new LST redemption method. Recall that LST is nothing more than a wrapper around the stake account that contains locked SOL. This means that LST can always be redeemed for its value in SOL, just not immediately.

Sanctum Reserve is a pool with over 200,000 SOL worth over $30 million. When users want to redeem LST, they exchange their stake account with Sanctum reserves in exchange for instant liquid SOL. Subsequently, Sanctum deactivated the stake account and received the SOL paid at the end of the cooling-off period.

As a result, SanctumReserve temporarily faces a shortfall in SOL for the duration of the cooling-off period and will eventually be recovered. Sanctum charges a dynamic fee based on the percentage of SOL remaining in the reserve pool. This ensures the effective use of SOL during periods of high liquidity demand.

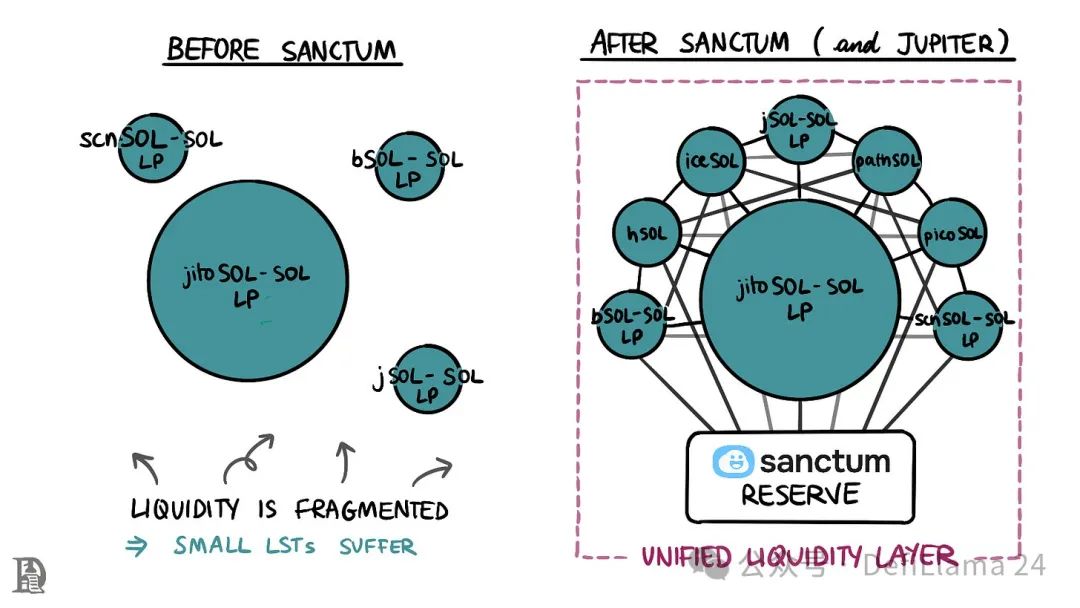

Compared to traditional liquidity pools, Sanctum Reserve is a significantly more capital-efficient LST clearing method. In traditional pools, the SOL in the LST-SOL pair is deposited by users who would otherwise earn yield by staking it. In addition, each LST needs its own liquidity pool, which disperses liquidity across the ecosystem. The Sanctum Reserve frees up SOL in swap pairs to stake by providing a universal pool to liquidate any LST, while unifying Liquidity across LSTs – all with minimal slippage. In simple terms, all the liquid stake Token on the Solana benefit from Sanctum's reserves. But how do they get stake protocol to integrate them? This is where the router comes into play.

Sanctum's second product is the Sanctum Router, developed in collaboration with Jupiter. As you might guess from its name, it provides a mechanism to easily and efficiently swap between any two LSTs on Solana. When a user wants to exchange a LST, let's say JitoSOL for hSOL validators issuance by Helius, here's what happens behind the scenes:

- Withdraw accounts from JitoSOL to a new account

- Destroy JitoSOL

- Deposit the new account into the Helius validator's account

- Minting hSOL

- Transfer the minting hSOL to the user's Wallet

All of this happens in a single transaction and benefits from the insight that behind the different LSTs are fungible accounts. The Sanctum Router combines Jupiter's routing system to ensure that any LST, regardless of its liquidity, can be exchanged for any other LST.

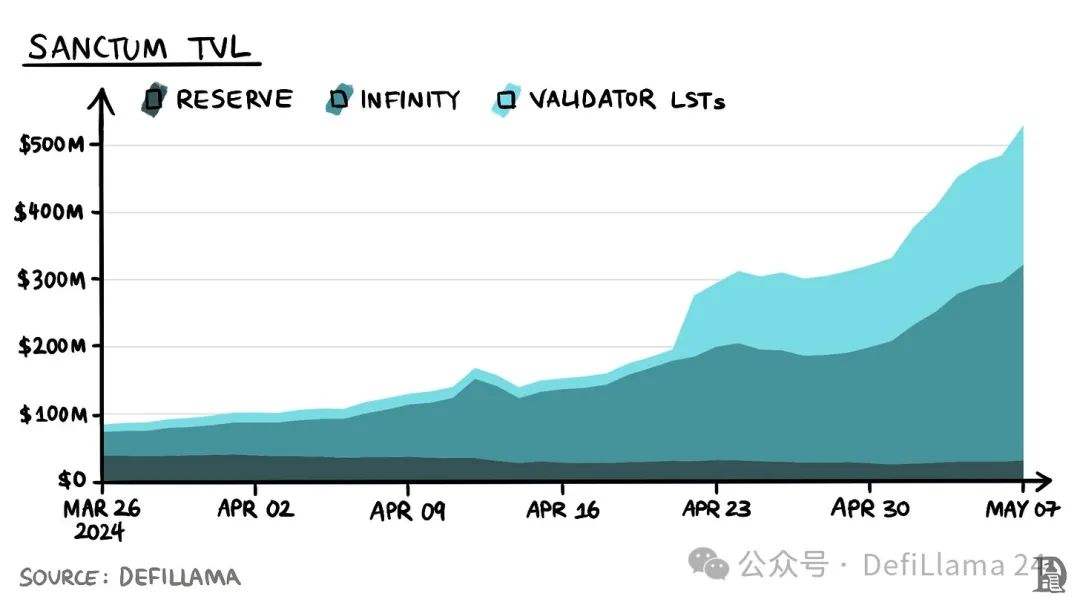

Together, Router and Reserve have exchanged more than 2.2 million SOL to date.

The existence of these two products has changed the landscape of small LSTs. They no longer need to rely on Depth liquidity pool to entice users to buy LST. Instead, they guarantee instant redemption and liquidity for holders, or a frictionless swap with low slippage between any two LSTs. This also makes LST more useful in the Decentralized Finance ecosystem. For example, borrowing protocol can rely on Sanctum Reserve to settle long wick candle loan to any LST.

Significant drop barriers to establishing a LST have sparked an innovation boom in Solana liquid staking areas.

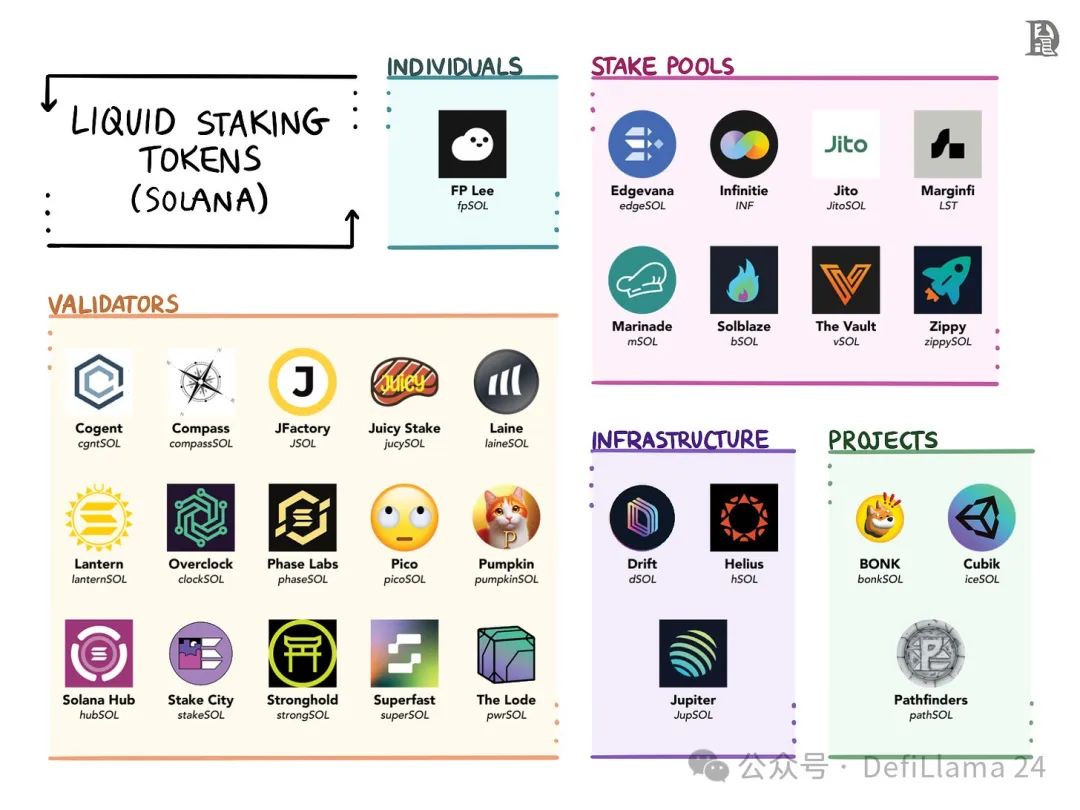

Single validator LST

Since LST is just a stake account package, each validators can have its own LST. But what's the point? When stake locally, the APY of a large long validators is more or long less the same, which means that validators have no way to distinguish themselves. Earlier this year, as I delved deeper into the world of Solana validators, long validators told me that their biggest challenge was to attract more long stake.

LST, backed by Sanctum's Router and Reserve, provides them with a way to do just that. Issuance your own Token allows stakers to participate in the broader Decentralized Finance space and come up with additional ways to reward holders of staked assets.

Laine, one of the top validators on Solana, rewards laineSOL holders with additional block rewards (beyond the composition of APY), allowing holders to earn more than twice the local stake yield. Similarly, validators Juicy Stake recently issued a SOL to all Wallet Airdrop who hold at least 1 jucySOL.

Throughout the article, I've been mentioning that liquid staking is a tough start for small players. Japan's independent validators issuance's LST picoSOL went from $0 stake rise to $8.5 million in less than 30 days by becoming an active community member and sharing above-average rewards with holders. Recently, picoSOL has been integrated into marginfi, one of the top lending protocol on Solana.

By removing the burden of creating liquidity pools, LST allows small, newly formed, troubled, or ambitious validators to compete with big players. This makes the Solana validators set more decentralized and competitive. Ultimately, it also provides users with a more long validators option without giving up Liquidity and high APY selectivity.

Infrastructure releases LST

Infrastructure projects, such as Solana RPC providers Helius and Jupiter, have also released their own LSTs, but for slightly different reasons.

Solana recently transitioned to a stake-weighted implementation feature that "allows leaders (Block producers) to identify and prioritize transactions through stake validators agents as an additional Sybil resistance mechanism." This means that validators with 0.5% of the stake will have the right to transmit 0.5% of the packets to the leader.

As an RPC provider, Helius' main goal is to read and write transactions on-chain as quickly as possible. Given these network changes, the quickest way is for them to run their own validators. Helius validators do not charge commissions and pass all rewards to their stakes. For them, running a validator is an operational expense, not their core business. With hSOL LST and the right partnerships, they can more easily attract stake volume (Helius can also experiment with programs like RPC credit discounts to hSOL holders.) )

Jupiter runs a validator for very similar reasons and releases JupSOL. The more long Jupiter's validators have stake, the easier it will be for them to send successful transactions to the Solana network, resulting in faster fulfillment of user orders. Like Helius, Jupiter passes all fees to stakes.

In fact, to attract more long stake, they commissioned an additional 100,000 SOL to increase JupSOL's earnings, making it one of the highest-yielding LST on Solana. Although JupSOL has been launched for less than a month, it has already attracted more than $150 million in TVL.

Project LST

We've also seen some experiments with Solana projects issuance their own LSTs.

For example, Cubik, a public funding protocol on Solana (similar to Gitcoin), recently released iceSOL LST with the help of Sanctum. All stake returns from iceSOL are used entirely to fund public goods on Solana. Therefore, for any Solana believer who holds native SOL, they can convert it to iceSOL without incurring any loss of coins while supporting public goods on the network.

Pathfinders, an NFT project on Solana, has its own LST called pathSOL. pathSOL holders will not only receive NFT minting Allowlist, but the LST will be locked in the NFT forever. If users wish to receive a refund of their minting price, they can redeem their SOL back by burning the NFT. At the same time, the Pathfinders team earns on all locked SOLs.

Finally, Bonk, one of the top memecoins on Solana, recently released their own validator and LST called bonkSOL. What are the benefits of holding? In addition to receiving stake earnings, holders can also receive $BONK Token as rewards.

It is conceivable that this trend will continue. For example, Tensor, where long SOL is idle in the bid, can launch tensorSOL and accept the Token as an offer as a way for users to earn more long (or add a gamification layer to give away the accumulated earnings as a lottery ticket).

SocialFi x LST

One of the most interesting emerging trends in the Solana LST landscape is the possibility for individuals to issuance their own LST.

One of the early proofs was fpSOL, issuance by Sanctum founder FP Lee. Those who hold at least 1 fpSOL can enter a private chat group with FP Lee (similar to Friend.tech Secret Key) while stake rewards for charity.

It's not hard to imagine that this will become more common, with influential individuals issuance LST as a safer option for their followers than NFT or memecoin. They can get distribution through social media (as in the PicoSOL example, it doesn't take long to attract staking), provide holders with exclusive benefits, and earn money by keeping some or all of the proceeds.

Sanctum Infinity

Sanctum's third product is Sanctum Infinity. It is a long LST liquidity pool that supports swapping between all LST in the pool. The team claims that Infinity has the most capital-efficient Automated Market Maker (AMM) design possible. Let's see how it works.

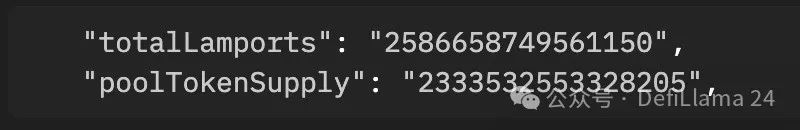

Whenever you want to buy 1 SOL worth of LST, you will always get less than 1 unit of LST. This is because LST accumulates stake rewards over its lifetime, and these rewards are reflected in its price relative to SOL. As of May 8, JitoSOL was valued at $162, while SOL was trading at $146. The JitoSOL/SOL ratio is 1.109, which means that it has provided about 11% return for SOL since JitoSOL's release. This rate will continue to increase over time.

Each LST has a staking pool account with two parameters: poolTokenSupply (total SOL deposited) and totalLamports (deposited SOL + accumulated rewards). Lamports are to Solana what sats to Bitcoin – the smallest unit of measurement. Dividing these two parameters gives us the stake ratio.

How Solana stores stake pool information

Sanctum Infinity uses this in-protocol information as an infallible on-chain Oracle Machine to provide perfect pricing data for every LST in the pool. Traditional AMMs rely on the ratio of asset pairs in their pool for pricing. This can be inefficient if liquidity is low or if there is a temporary imbalance caused by block trading. staking pool account information allows the Infinity AMM to price each LST perfectly, regardless of its Liquidity.

The Infinity Pool is currently an LST basket licensed by Sanctum. Users can deposit allowed LST into the pool in exchange for INF Tokens. INF accumulates stake rewards for all deposited LSTs as well as transaction fees for exchanges conducted within the AMM. Therefore, the INF itself is an LST but has an additional source of income.

Sanctum attempts to maintain the target distribution of different LST within the pool by dynamically changing the interchange fees from one LST to another LST in order to achieve good yields for INF holders, while also providing Liquidity for smaller LST startups. To do this, 20% of the pool is allocated to new LSTs, while the remainder is TVL-weighted to all other LSTs. Over time, the team's goal is to add more long parameters to the assignment strategy.

Infinity maintains the target allocation by dynamically adjusting the interchange fee from one LST to another LST until the target ratio is reached. The fee for each LST is divided into two parts: the input fee, which is the fee paid when exchanging the LST; The output fee, that is, the fee paid when exchanging into the LST. The total cost is the sum of both.

If I want to exchange JitoSOL (0.02% input fee, 0.03% output fee) for JupSOL (0.04% input fee, 0.05% output fee), I will have to pay JitoSOL's input fee plus JupSOL's output fee, for a total of 0.07%. By dynamically adjusting the input and output charges of the LST, Sanctum maintains the target allocation of the AMM pool.

Since its launch last year, Sanctum's product, TVL, has risen to more than $500 million, making it the fifth-largest protocol on Solana.

Future

The term "democratization" is often used in tech circles to describe how a process that would otherwise have a high barrier to entry becomes open to those who historically had no access to it. Sanctum has largely democratized liquid staking. A natural extension of this argument is often that Solana's staking ecosystem is more innovative than Ethereum's. I think there are longest nuances in this.

While Lido was growing, Decentralized Finance was still a junior division, and Ethereum itself, at the time, was transitioning from PoW (PoW) to PoS (attestation). There are too long variables and too few precedents. In contrast, Solana's staking ecosystem was built after Lido existed for longest years. As we've seen, Solana's developers did try to copy Ethereum's playbook. So, it's safe to say that they took inspiration from it.

But replication does not provide any competitive advantage. In this article, the story we see between Lido, Jito, and Sanctum is the story of how an existing player (from Ethereum) competes and is outpaced by a smaller, more flexible, and more localized protocol participant. Can Sanctum's advantage over Solana be sustained? We don't know. As with large longest innovation cycles, new players will emerge to compete with Sanctum's position in staking.

But one thing is clear: between Sanctum's reserves ($30 million worth of SOL) and their routers (integrated into Jupiter), Sanctum is growing into an entity outside of "yet another stake provider." There's value in that.

- Reward

- like

- Comment

- Share

The identity track unicorn is questioned: Worldcoin faces longest challenges, and the founder of Humanity is exposed to the history of failed entrepreneurship

Recently, after the Blockchain identity platform Humanity Protocol announced that it had received $30 million in financing at a valuation of $1 billion, the CEO was revealed to have founded a unicorn company Tink Labs and went bankrupt, causing hundreds of millions of dollars of investors‘ funds to be lost. At the same time, Worldcoin, which also belongs to the DID track, is controversial due to the upcoming huge Token unlock, global regulatory setbacks, and the failure of OpenAI‘s blessing effect.

The new unicorn Humanity Protocol is off to a bad start, Worldcoin is mired in word-of-mouth and business development difficulties, and the two major $1 billion market capitalization unicorns in the DID track are facing a new test.

Protocol DID using palm recognition technology, CEO Zeng Zhi founded the former unicorn company bankrupt

Humanity

By Nancy, PANews

Recently, after the Blockchain identity platform Humanity Protocol announced that it had received $30 million in financing at a valuation of $1 billion, the CEO was revealed to have founded a unicorn company Tink Labs and went bankrupt, causing hundreds of millions of dollars of investors' funds to be lost. At the same time, Worldcoin, which also belongs to the DID track, is controversial due to the upcoming huge Token unlock, global regulatory setbacks, and the failure of OpenAI's blessing effect.

The new unicorn Humanity Protocol is off to a bad start, Worldcoin is mired in word-of-mouth and business development difficulties, and the two major $1 billion market capitalization unicorns in the DID track are facing a new test.

**DID protocol using ** palm recognition technology, CEO Zeng Zhi founded a former unicorn company bankrupt **

Humanity Protocol is considered to be the same track project as Worldcoin.

Established in 2023 as a Polygon CDK-based identity system, Humanity Protocol was developed by the Human Institute, Animoca Brands, and Polygon Labs to provide an accessible and non-intrusive way to build human proofs in Web3 applications. Humanity Protocol plans to launch a testnet in the second quarter of this year, and its waiting list has exceeded 510,000 people.

In terms of biometrics, unlike Worldcoin, which uses iris scanning, Humanity Protocol uses palmprint recognition, which is considered a less intrusive authentication scheme. However, iris recognition has the advantages of uniqueness, stability and non-replicability of identity recognition compared with palmprints, and has more advantages than other biometric technologies in terms of comprehensive security performance, and due to the high requirements for the accuracy and stability of this technology, the difficulty of development and the cost of research and development are also large.

In terms of complete ownership of user data and identity, Humanity Protocol, like Worldcoin, has introduced zk-SNARKs technology; In terms of financing background, Worldcoin has completed longing rounds of luxury financing, but its valuation of 1 billion has been realized in Series A financing, and Humanity Protocol has also completed longing rounds of financing. At present, Humanity Protocol has officially announced that it has received a $30 million seed round led by Kingsway Capital and participated by long 200 institutions including Animoca Brands, Blockchain.com and Shima Capital, and has raised about $1.5 million among a group of KOLs, according to PANews, the KOL round is valued at $60 million.

Not only that, but Humanity Protocol is just as easy to access on smartphones as Worldcoin. The project will release an app that uses a phone camera to scan palm prints for identity verification, and will later introduce another layer of security, using a network of palm veins and a small infrared camera for identification. In the future, this system is expected to be applied to the KYC process of financial platforms, and even to enter physical places such as hotels and office buildings through palm prints. In addition, Humanity Protocol plans to issue tokens to pay for verification fees.

Commenting on the launch of the project, Polygon co-founder Sandeep Nailwal commented that Humanity Protocol is not only truly resistant to Sybil attacks, but also natively integrates verifiable credentials into a network of Decentralization validator Nodes, laying the foundation for building a wider range of Blockchain and real-world applications.

After attracting market attention due to its high valuation, Terence Kwok, CEO of Humanity Protocol, was later reported by foreign media Protos to reveal that the smartphone company that had almost bankrupted its $1.5 billion valuation and burned $170 million of investors' funds.

It is understood that Terence Kwok founded Tink Labs, headquartered in Hong Kong in 2012, with 12 million users worldwide, and has received joint investment from FIH Group (a subsidiary of Foxconn Technology Group), Kai-Fu Lee's Innovation Factory and Meitu Chairman Cai Wensheng, mainly to provide hotels with smartphones for guests to use during their stay, with the goal of providing guests with an alternative to roaming fees to improve their hotel experience and sell the collected customer preference data. Interestingly, one of the reasons behind Tink Labs' acquisition of heavyweight shareholders is that Terence Kwok's father, Guo Desheng, is a former Goldman Sachs star private banker, and his major clients include Lee Shau Kee, Kwok Henian and other super-wealthy.

According to the Financial Times, Terence Kwok began to lose money for longest reasons, including aggressive expansion policies, roaming fees becoming cheaper and more popular, and hotels not wanting to pay for the phones he gave away, with losses of nearly $200 million in 2017 and 2018 alone, and then a liquidity crisis. SoftBank, an investor in Tink Labs, was concerned that the company was "moving funds from the Japanese joint venture to other regions to maintain operations," forcing the company to abruptly halt a major project, according to a former employee. Kwok allegedly struggled to pay its employees and contractors and eventually made mass layoffs before closing Tink Labs on August 1 of that year. In January 2020, Tink Labs' European division began liquidation, followed by bankruptcy proceedings.

The former head of HR operations at Tink Labs said, "I never thought it would last, but I didn't expect it to close so soon, Kwok only cares about 'making money.'" According to a previous report by Fortune Insight, Terence Kwok also said during the startup of Tink Labs, "Once the business fails, you can return to school, the opportunity cost is the lowest, and starting a business for three months is like studying an MBA." ”

Worldcoin** is about to unlock large Tokens, facing regulatory investigations in longest countries**

While Humanity Protocol is being hotly debated in the market, Worldcoin is in dire straits due to issues such as Token unlocking, regulation, and insider cash-outs.

According to the analysis released by Decentralized Finance researcher @DefiSquared on the X platform recently, Worldcoin may become the largest wealth transfer event in this cycle, and Worldcoin has a serious inflation problem, with a fully diluted market capitalization of Token WLD as high as $60 billion, which depreciates by 0.6% per day due to the token issuance of issuance and operator claims, and the unlocking volume of WLD will increase significantly in the next few months, which may lead to a large-scale sell-off.

According to @DefiSquared analysis, on the one hand, the supply of WLD will increase by 4% every day once Worldcoin's VC and the team's Token start unlocking. According to Token Unlocks data, WLD will face $31.5 million per day selling pressure starting July 24 (based on May 16 prices).

At the same time, not long ago, Worldcoin revealed on its blog that World Assets, a subsidiary of the foundation responsible for token issuance of the project, will sell 500,000 to 1.5 million WLD per week for private sale for the next six months, with a maximum value of $179 million at current value. @DefiSquared pointed out that this portion of the Token is equivalent to 16.7% of the existing circulating supply (based on 210 million Circulating Supply on May 16) and is sold at a discount, with this portion of the WLD Token supply being used to sell to counterparties for the benefit of the Foundation.

"Worldcoin's Token Economics model was designed from the start to be predatory to benefit teams and early investors. In December last year, the foundation even deliberately terminated the market maker contract (note: Worldcoin previously announced that it would terminate the protocol with 5 market makers on December 15, 2023), allowing the price to be squeezed up at a low Circulating Supply. "According to CoinGecko's latest research data, WLD is one of the four encryption projects with the lowest circulating supply among the top 300 market capitalization**. In this regard, @DefiSquared believes that this manipulative design of low liquidity and high valuation directly benefits insiders, as they can lock in shares through contracts and OTC Trading Hedging high valuations before unlocking.

In addition, @DefiSquared also noted that most long retail investors may not even know that Sam Altman (CEO of OpenAI) is no longer actively involved in Worldcoin and that the project has no relationship with OpenAI. According to a Bloomberg report in April this year, at that time, Worldcoin was looking for cooperation with tech giants such as OpenAI.

It is worth mentioning that Worldcoin is also facing regulatory bans or investigations in longest places around the world such as Spain, Portugal, South Korea and Hong Kong due to user data privacy issues, so Worldcoin's main supporters not only met with relevant governments to improve government relations, but also open source iris recognition inference system this year to enhance transparency and implement a new personal data self-custody strategy, and recently open source the new SMPC system and securely delete old iris code to help improve biometric data security. Similarly, for Humanity Protocol, it may also face regulatory issues arising from the collection of user data.

- Reward

- like

- Comment

- Share

Starting from the "wealth creation effect" of the secondary market, the core competitiveness of the AI public chain Bittensor is analyzed

1/n (continuous update) Open a post to record the secondary idea of Crypto & AI Web3 & AI Sector layering is similar to Web2, the data layer/Computing Power layer is the lowest infrastructure, then to the model layer, the service layer/agent layer, and finally to the application layer.

2/n Narrative From a narrative point of view, the lower the degree of standardization/homogeneity of the track, the greater the probability of alpha. For example, the Computing Power layer and GPU are homogeneous, so the Computing Power project side is mainly in the volume gameplay/GTM/Computing Power asset derivatives. The least standardized segments are: model layer, data layer, and agent layer.

3/n Model Layer The model layer is a track with very large variables, and the emergence of a new model can quickly change the market landscape. For example, OpenAI‘s GPT-4o

Author: Minta

1/n (continuous update) Open a post to record the secondary idea of Crypto & AI Web3 & AI Sector layering is similar to Web2, the data layer/Computing Power layer is the lowest infrastructure, then to the model layer, the service layer/agent layer, and finally to the application layer.

2/n Narrative From a narrative point of view, the lower the degree of standardization/homogeneity of the track, the greater the probability of alpha. For example, the Computing Power layer and GPU are homogeneous, so the Computing Power project side is mainly in the volume gameplay/GTM/Computing Power asset derivatives. The least standardized segments are: model layer, data layer, and agent layer.

3/n Model Layer The model layer is a track with very large variables, and the emergence of a new model can quickly change the market landscape. For example, OpenAI's GPT-4o opens up endless possibilities for new ways of human-computer interaction. Microsoft's release of Phi-3 and Apple's release of OpenELM on Hugging Face have both fast-tracked the process of mobile training. From a second-level perspective, large variables = high chance of non-consensus = high chance of alpha.

4/n Model Layer A good model platform has at least the following characteristics: 1. Model composability: support for longing large model rotation, rather than a single large model; 2. Need to understand/be compatible with the business logic of Computing Power resources; 3. Supervised Calculation/Model Scoring In summary, supporting the call of hybrid model libraries and Tools APIs, and being compatible with Computing Power resources, is the model platform that can cross the bull and bear.

5/n The current Top1 of the Bittensor Case model layer is undoubtedly Bittensor, in order to create an Incentive Layer, what exactly did Bittensor do right? A brief recap of Bittensor's Timeline (incomplete statistics): 1. Before October 23: Precipitating the community during the testnet; 2. Gradually open subnet registration in October 23: from the first batch of 9 subnets to 32 subnets; Gradually expanded to 64 subnets in May 24;

6/n Bittensor Case 3. Follow the ecological adjustment incentive model: from the universality of incentives to the survival of the fittest through incentives, such as: (1) The Halving time is advanced, and the first Halving is adjusted from 25 years to 23 years; (2) Tokenomics adjustment, the direct incentive distribution ratio of the subnet is completely left to the market to decide, adding more longer dimensions of the game; 4. Slowly form a flywheel effect

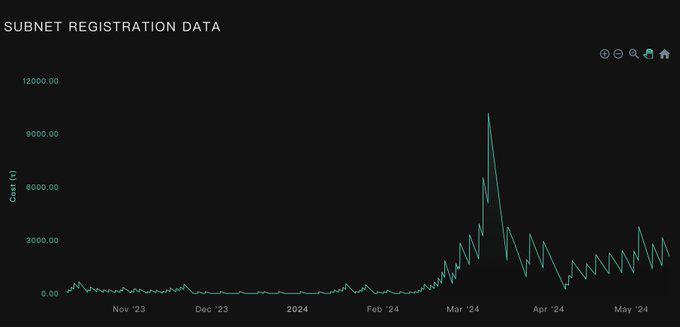

7/n Bittensor Case From a second-level perspective, the "wealth creation effect" that Bittensor has successfully created is very crucial. Several of Bittensor's decision-making inflection points have stepped on the Node of the time when liquidity surged. Successively expanding the number of subnets during Sep-Nov '23 to provide a large number of buys; At the same time, combined with its special stake mechanism, it has quickly promoted the pump of Token prices, and then attracted more long projects to register as subnet, forming a virtuous circle. Therefore, you will find that the subnet registration fee is the best weather vane for the $TAO price, and the subnet registration peak and the price peak always appear one after another.

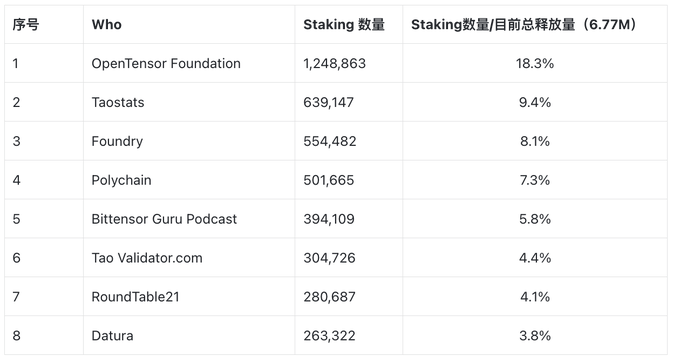

8/n Bittensor Case As of this writing, the top 8 Bittensor staking are shown in the figure. The top 8 stakers have a combined Staking Rate of 61.2%, and the total Staking Rate of the projects is 84.61%. At present, MC is 2.5B, and it is estimated that MC can reach 10B+, and only need to predict the staking situation of large investors to complete the price estimate.

9/n Bittensor competitors For Bittensor's competitors of the same type, the problem of high entry barriers needs to be solved, and the current subnet registration fee of TAO is still not low; And it is necessary to rely on strong BD capabilities to roll out a large number of models in a short period of time, and do a good job of market capitalization management at the same time. Some of the early projects are:

@communeaidotorg, @zero1_labs, @arbius_ai, etc., are doing similar things, and if their ecology expands rapidly, it may be a good entry point.

10/n Bittensor competitors Take Commune as an example, which is the entrepreneurial project of the core builder of the TAO ecosystem, compared with TAO: 1. Commune has a lower barrier to entry, making it easier for Dev to register modules; 2. Commune's incentive system is greatly simplified/deleted, and decision-making relies on a simpler voting system; Overall, there are currently no projects in the second tier that can compete with Bittensor in the short term.

The 11/n model layer is not coin the project alternative @Nimble_Network a global orchestration layer is built to achieve general artificial intelligence operation and full-link access; @Gatling_X launched an EVM that supports computing scenarios; @ritualnet long a holistic approach, from incentivizing the network, to linking distributed computing devices, model hosting, sharing, inference, optimization, etc., to accessing the model's API layer, as well as censorship resistance and privacy.

- Reward

- like

- Comment

- Share

The wind of rune innovation is blowing to the NFT market, and Blob has become the most pumped project?

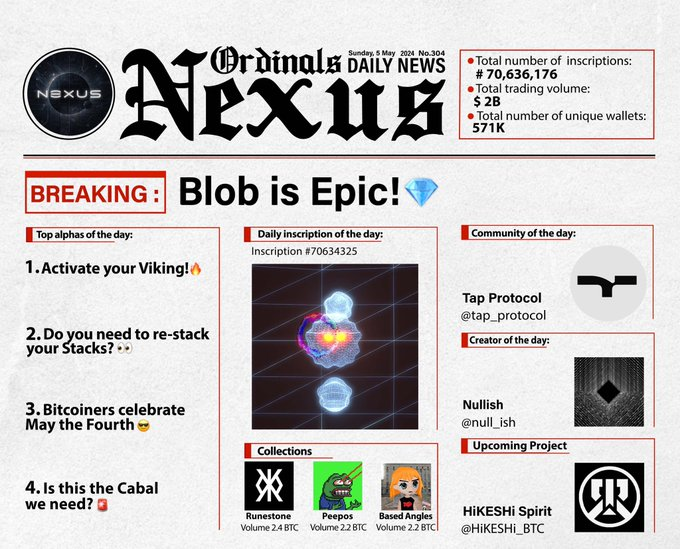

At the beginning of May, the Blob team successfully inscribed the rune "EPIC•EPIC•EPIC•EPIC" on the fourth Halving Block of the Bitcoin, which caused the Floor Price of the Blob NFT to soar to BTC.0699 in a short period of time. According to Magic Eden data on May 5, the floor price of the blob has reached an all-time high of 0.07555

In the wave of longing of digital assets, the NFT market has been at the forefront of innovation and change. Especially on the Solana network, an NFT marketplace called Blob is quickly attracting a lot of attention from the industry.

At the beginning of May, the Blob team successfully inscribed the rune "EPIC•EPIC•EPIC•EPIC" on the fourth Halving Block of the Bitcoin, which caused the Floor Price of the Blob NFT to soar to BTC.0699 in a short period of time. According to Magic Eden data on May 5, the floor price of the blob has reached an all-time high, reaching 0.07555 BTC (about $4807).

How BLOB, an NTF with its unique art style, gained popularity on Solana is what we will try to explore next.

If you're a regular Twitter user, you may have noticed a unique phenomenon these days: your timeline is occupied by a series of images adorned with explosive symbols 💥💥. These eye-catching images are often accompanied by short labels, such as #SendBlob or #BlobArmy, as if a mysterious force is rapidly spreading online, but the meaning behind these images remains a mystery to outsiders.

The images represent an NFT project that has gained a lot of attention on the Bitcoin network – BLOB, short for "Bitcoiners Love Bitcoiners." In the technical world, "BLOB" refers to "Binary Large Object", a term used to describe how large strings of data are processed and stored. More than just a digital collectible, the BLOB project was co-founded by @Elocremarc and @nurorealm, veteran members of the Ordinals community, to create a long community of scientists, artists, digital punks, and developer community leaders.

The highlight of the project is its free inscription strategy and unique approach to community engagement. Early on, the project team prioritized Ordinals OG members, artists, developers, and OG collectors in the Allowlist allocation, encouraging them to create and tweet BLOB artworks, so the wide spread of these works was one of the main reasons why BLOB quickly became popular. Many users have already received Airdrops from BLOB, and those who have not received them are also paying close attention, looking forward to the opportunity to publicly inscribe.

Each BLOB creation is not a simple static image, but achieves a unique dynamic effect by embedding HTML, CSS, and Java code directly on the Blockchain. This design allows BLOB artworks to dynamically retrieve inscription IDs and Metadata through recursive endpoints as they acquire and process Blockchain data in real time, bringing these artworks to life.

What's more worth mentioning is that BLOB is extremely interactive. The complex script allows these artworks to respond to the audience's participation, constantly changing and evolving, not only as a visual pleasure, but also as a new interactive experience. This is further confirmed by feedback from the community and longing media effects, making BLOB not just an NFT project, but an all-encompassing art and technology revolution.

BLOB has risen not only because of its novelty, but also because of the technological innovation and strong community support behind it. With the proliferation of NFT projects in the Bitcoin ecosystem, BLOB has broken through with its unique "grotesque" charm and innovative technology, indicating that it may become one of the most high-profile projects this year.

With the rapid evolution of the NFT market, projects such as Blob have become more than just collectibles of digital art, but also a fusion of community, technological innovation and cultural expression. The Blob project's success on the Bitcoin network, along with its unique interactive artwork, is a prime example of this integration.

Just as global tech giants are laying out the Metaverse and seeking to occupy a place in the next generation of the Internet, NFTs also play an important role in this process. As an emerging symbol of encryption culture, NFT is not only an object of investment, but also an expression of personality and identity.

In the future, as more long people begin to recognize and appreciate the unique value of this new digital asset, we can expect projects like Blob to not only compete with NFT projects in top markets, but also drive the growth and development of the entire market while providing more long value to users. Globally, as technology advances and communities expand, Blob and other NFT projects are expected to continue to demonstrate their unique charm and potential to lead us into a richer and more long digital future.

- Reward

- like

- 1

- Share

Is the carnival of memes over for all? Understand the causes and consequences of Pump.fun attacks in one minute

Compilation: Encryption Wei 馱

Pump theft incident lazy bag, thanks to the @0x\_charlemagne brother for the wonderful analysis of the cause of the accident, here is the translation and add a little personal speculation of mine.

How is the attack carried out?

First of all, the attacker @STACCoverflow is not a bull Hacker god, but a former employee of @pumpdotfun. He has the Wallet account that Pump uses to create permissions for this feature for each Raydium transaction pair, which we call "hacked account". All Bonding Curve LP pots created on Pump before reaching the Raydium standard are called "reserve accounts".

The attacker gets past the @marginfi

Author: Charlemagne

Compilation: Encryption Weibao

Pump theft incident lazy bag, thanks to the @0x_charlemagne brother for the wonderful analysis of the cause of the accident, here is the translation and add a little personal speculation of mine.

How does the attack work?

First of all, the attacker @STACCoverflow is not a bull Hacker god, but a former employee of @pumpdotfun. He has the Wallet account that Pump uses to create permissions for this feature for each Raydium transaction pair, which we call "hacked account". All Bonding Curve LP pots created on Pump before reaching the Raydium standard are called "reserve accounts".

An attacker borrowed a Flash Loans through @marginfi to fill up all the pools that had been created but were not filled enough to be in the Raydium state. Originally, the operation that would have occurred at this time was originally stored in the virtual pool "Preparatory account$Sol because it met the criteria of Raydium and would be transferred to this "hacked account". But at this point, the attacker siphons off the $Sol that comes in, so that none of the memecoins that are supposed to be on Raydium and locked the pool can go to Raydium (because the pool has no money)

So, whose money did the attackers hack?

To this @0x_charlemagne brother explained: