A 5-minute quick look at the main content of the latest encryption bill in the United States, FIT21

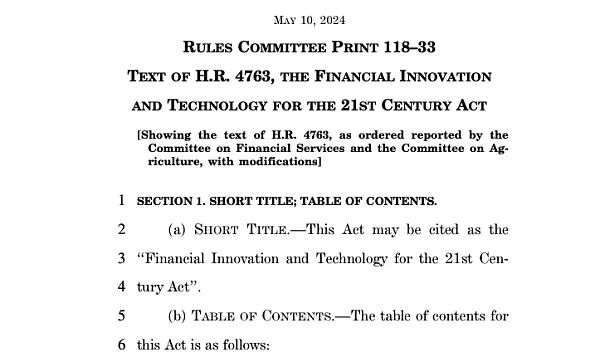

The U.S. Congress is about to vote on the latest encryption bill. On May 10, 2024, the U.S. House Rules Committee said that the U.S. House of Representatives will vote unanimously on the Financial Innovation and Technology for the 21st Century Act (FIT21) this month.

Dixon, partner of A16Z, said in a post on May 15, "In the next two weeks, the House of Representatives will vote on FIT21, the most important encryption bill to date." We have long called for clear regulation to protect consumers and innovation, FIT21

Written by 0xjs & kimi

The U.S. Congress is about to vote on the latest encryption bill. On May 10, 2024, the U.S. House Rules Committee said that the U.S. House of Representatives will vote unanimously on the Financial Innovation and Technology for the 21st Century Act (FIT21) this month.

Dixon, partner of A16Z, said in a post on May 15, "In the next two weeks, the House of Representatives will vote on FIT21, the most important encryption bill to date." We've long called for clear regulation to protect consumers and innovation, and the FIT21 bill will do just that. Americans have embraced digital assets, but current regulatory approaches often limit innovation and privacy without really addressing the solutions needed to protect consumers or combat illegal activity. FIT21 will help eradicate fraud, ensure oversight of Crypto Assets exchange, and protect U.S. consumers by imposing strict rules on Crypto Assets transactions. FIT21 has bipartisan support because it addresses these issues. I encourage everyone who believes in the power of Blockchain technology to support this legislation. ”

Background

On July 20, 2023, House Agriculture Committee Chairman Glenn "GT" Thompson, Rep. French Hill, Rep. Dusty Johnson, Whip Tom Emmer, and Rep. Warren Davidson sponsored H.R. 4763, the Financial Innovation and Technology Act for the 21st Century (FIT21). Patrick McHenry, chairman of the House Financial Services Committee, was one of the co-sponsors of the legislation.

FIT21 sets out clear and practical federal requirements for the digital asset market. It provides strong consumer protection and regulatory clarity for the digital asset ecosystem to thrive in the U.S., solidifying U.S. leadership in the future global financial system, while reinforcing our role as a hub for innovation.

The legislation gives the CFTC new jurisdiction over digital commodities and clarifies the SEC's jurisdiction over digital assets that are part of investment contracts. In addition, the bill establishes a process that allows digital goods to be traded in the secondary market if they are initially offered as part of an investment contract. Finally, FIT21 imposes comprehensive customer disclosure, asset protection, and operational requirements for all entities that are required to register with the CFTC and/or SEC.

A quick look at the main contents of the FIT21 bill

FIT21 is 253 pages long, and the golden financial reporter used Kimi to summarize the bill.

Financial Innovation and Technology Act for the 21st Century (H.R.) 4763) is a comprehensive legislation designed to regulate and promote the development of digital asset and Blockchain technology in the United States. Here's a detailed summary of what the bill says:

Part 1: Definitions, Rulemaking, and Registration Notices

- Definitions: Define terms such as "digital asset digital asset", "Blockchain blockchain", "Decentralization decentralized governance", etc.

- Rulemaking: The SEC and the Commodity Futures Trading Commission (CFTC) need to work together to develop rules to further clarify terminology and establish rules for hybrid trading of digital asset trading.

- Notice of Registration: Digital commodity exchanges, brokers, and trading system operators are required to submit notices of intent to register with the CFTC and comply with specific regulatory requirements.

Part II: Clarity of Investment Contract Assets

The short title can be called "Securities Clarity Act of 2024", indicating that the Act aims to provide clarity and clarity to certain assets in the securities market. It mainly revises the content of the U.S. federal securities-related Act, with a special focus on the definition and treatment of "investment contract asset".

(a) Amendments to the Securities Act of 1933: Two major amendments have been made to Section 2(a) of the Securities Act of 1933: The first is the explicit exclusion of "investment contract assets" from the definition of "security." This means that if an asset is classified as an investment contract asset, it will not be considered a security in the traditional sense and may be subject to different regulatory requirements. The second amendment is the addition of a definition of "investment contract assets" at the end of Section 2(a) of the Securities Act. This definition contains three main conditions: 1. The asset must be a transferable digital representation of value that can be securely disclosed on the Distributed Ledger through encryption without intermediaries. 2. The asset must be sold or otherwise transferred, or intended to be sold or otherwise transferred, as part of the investment contract. 3. The asset itself is not considered a security according to the first sentence of the Securities Law.

(b) Amendments to the Investment Advisers Act of 1940: Section 202(a)(18) of the Investment Advisers Act of 1940 was amended to make it clear that the term "securities" does not include investment contract assets.

(c) Amendments to the Investment Company Act of 1940: Section 2(a)(36) of the Investment Company Act of 1940 was amended to similarly state that the term "securities" does not include investment contract assets.

(d) Amendments to the Securities Exchange Act of 1934: Section 3(a)(10) of the Securities Exchange Act of 1934 was amended to clarify that the term "securities" does not include investment contract assets.

(e) Amendments to the Securities Investor Protection Act of 1970: Section 16(14) of the Securities Investor Protection Act of 1970 was amended to state that the term "securities" does not include investment contract assets.

The purpose of these amendments is to provide greater flexibility and clarity for digital assets within the existing securities legal framework, while ensuring investor protection. By excluding investment contract assets from the definition of traditional securities, the Act aims to promote innovation while maintaining appropriate protections for investors.

The provisions of the second part are important for digital asset issuance, investors and regulators. It provides legal clarity for issuance and transactions in digital asset, helping to reduce regulatory uncertainty and potentially encouraging more long investment and innovation to take place in digital asset sectors. At the same time, by excluding investment contract assets as securities, it also provides a new way for the regulation of such assets.

Part III: Offering and Sale of Digital Assets

- Exempt Transactions: Specific exemptions for digital asset transactions are specified.

- Requirements: Set requirements for the offering and sale of certain digital assets.

- Enhanced disclosure requirements: Require enhanced disclosure of digital assets.

- Authentication: Certify certain digital assets.

Part IV: SEC Registered digital asset intermediary

- Handling of digital goods and other digital assets: Sets out the SEC's regulatory authority over digital goods and other digital assets.

- Registration and requirements: Involves registration, requirements and rules related to digital asset brokers and dealers for digital asset trading systems.

Part V: digital asset intermediary registered with the CFTC

- CFTC Jurisdiction over Digital Commodity Trading: Clarifies the scope of the CFTC's supervision of digital commodity trading.

- Registration and regulation: Sets out registration and regulatory requirements for digital commodity exchanges, brokers, trading advisors, and commodity pool operators.

Part VI: Innovation and Technological Improvement

- Investigations and reports: Require the SEC and CFTC to conduct research and submit reports on fintech innovation, DeFi, non-fungible digital assets, financial literacy of digital asset holders, and financial market infrastructure improvements.

Other Important Terms & Regulations

- Date of entry into force of the law: Longest provisions will take effect 360 days after the enactment of the bill, or 60 days after the enactment of the rule, unless a rule is required.

- Coordination between the SEC and CFTC: The two agencies will work together to develop rules to promote the fair and orderly development of the digital asset market and protect investors.

- International harmonization: The SEC and CFTC will coordinate with foreign regulators to establish consistent regulatory standards for digital assets around the world.

- Bank Secrecy Law: Digital asset trading systems are considered financial institutions and are subject to bank secrecy laws.

Fees & Funding

- Fee Collection: The CFTC will charge registration fees, annual fees, and termination fees for entities that register digital commodity exchanges, brokers, and trading systems.

- Fee Adjustments: CFTC reserves the right to adjust fees as necessary to promote fair competition and innovation.

- Fee Usage: The fee collected will be used to cover the cost of implementing the CFTC's functions under this Act.

Research & Reports

- DeFi Research: The SEC and CFTC will jointly conduct research to analyze the nature, size, role, use, and degree of integration of DeFi with the TradFi market.

- Non-fungible digital asset research: study the nature, market and integration of non-fungible digital asset with traditional markets.

- Financial Literacy Research: Assessing ways to improve the financial literacy of digital asset holders.

- Financial Market Infrastructure Research: Assess whether additional guidance or rules are needed to facilitate the development of tokenization securities and derivatives.

Conclusion

H.R. 4763 provides a comprehensive framework to regulate and promote the development of digital asset and Blockchain technology in the United States. The bill lays the foundation for rise and innovation in the digital asset market by defining key terms, setting registration requirements, enhancing disclosure and transparency, and facilitating international regulatory harmonization. In addition, the bill emphasizes the importance of research into financial technology and the digital asset ecosystem, as well as increasing public awareness and understanding of these emerging technologies. Through these measures, the bill aims to protect investors, preserve market integrity, and harness the potential of digital assets and Blockchain technology to enhance the U.S. economy.

- Reward

- like

- Comment

- Share

Planet Daily | The annual rate of non-seasonally adjusted CPI in the United States in April was 3.4%, expected to be 3.40%, and the previous value was 3.50% Swap market expects Fed rate cuts to accelerate in 2024 (May 16)

Headlines

US non-seasonally adjusted CPI in April was 3.4% y/y, expected 3.40%, previous 3.50%

The annual rate of non-seasonally adjusted CPI in the United States in April was 3.4%, with an expectation of 3.40% and a previous value of 3.50%.

The seasonally adjusted core CPI in April was 0.3% m/m, with an expectation of 0.30% and a previous value of 0.40%.

Non-seasonally adjusted core CPI y/y in April

Headlines

US non-seasonally adjusted CPI in April was 3.4% y/y, expected 3.40%, previous 3.50%

The annual rate of non-seasonally adjusted CPI in the United States in April was 3.4%, with an expectation of 3.40% and a previous value of 3.50%.

The seasonally adjusted core CPI in April was 0.3% m/m, with an expectation of 0.30% and a previous value of 0.40%.

The unseasonally adjusted core CPI in April was 3.6% y/y, with an expectation of 3.60% and a previous value of 3.80%. (Golden Ten)

Swap markets expect the Fed to cut interest rates at a faster pace in 2024

Analyst Steve Goldstein said the market's first reaction was positive — stocks were pumping and bonds were moving higher. S&P 500 futures pumped 0.5% from flat, and the yield on the 10-year Treasury note falls 11 basis points. Looking at the data, not only did the seasonally adjusted CPI in the United States record a lower than expected 0.3% month-on-month rate in April, but retail sales did not rise in April. After the release of the CPI data, the swap market expects the Fed to cut interest rates at a faster pace in 2024. (Golden Ten)

Fed's Kashkari: Intrerest rates may need to be maintained at current levels for a while longer

The Fed's Kashkari said Intrerest Rate may need to be maintained at current levels for a while longer to figure out where inflation is headed, and the Fed's balance sheet reduction is well underway and it is committed to meeting its 2% inflation target. (Golden Ten)

Industry News

JPMorgan Chase, BNP Paribas and Deutsche Bank have partnered with the European Central Bank to advance tokenization

JPMorgan Chase, Deutsche Bank and BNP Paribas are teaming up with the European Central Bank to advance tokenization, and the project is testing the use of Blockchain technology to Settlement Securities Transactions.

The Central Bank's tokenization experiment began in December last year and is still in its early stages and will continue until November this year. When the tokenization trial was first announced in December, Ulrich Bindseil, director of market infrastructure and payments at the Central Bank, said: "We are trying to look to the future and think about how the form of central bank coins can maintain its usefulness." ”

Fed Governor Bowman: States and the federal government need to cooperate in the stablecoin space

Fed Governor Michelle Bowman is urging state and federal partnerships to regulate stablecoins while lawmakers work on bills.

Asked Wednesday at the Digital Chamber's DC Blockchain summit what role the states and the federal government should play in addressing stablecoin issues, Bowman said states are more open to discussions about expansion in this area, "The important thing for me is to build partnerships." ”

"U.S. coins come with risks such as bank runs, which may require us to provide protections for the dollar," Bowman said. So from the Fed's perspective, it's important that we have the ability to engage and negotiate any framework that ultimately emerges, whether it's the current bill or other frameworks that emerge with the development of stablecoins in the U.S., the Fed should have a seat at the table in the negotiation process. ”(The Block)

The U.S. House of Representatives is scheduled to vote on the (FIT 21) market structure bill next week

All members of the U.S. House of Representatives are scheduled to vote next week on a market structure bill called FIT 21, which includes some new provisions, including regulations on when Crypto Assets should be treated as securities. The House of Representatives, which already has a group of pro-Crypto Assets representatives, (FIT 21) is likely to pass the House without a hitch, but it will face hurdles in the House of Lords.

The 21st Century Financial Innovation and Technology (FIT 21) Act aims to provide a clear regulatory framework for digital assets and address long-standing market regulation and consumer protection issues.

Project News

Sonne Finance, which lost more than $20 million in an attack, has suspended its Optimism marketplace

Protocol to Paidun, the Decentralized Finance lending protocol Sonne Finance was attacked by Hacker and needs to scrutinize its timelock contract, and has now lost more than $20 million.

Sonne Finance posted on platform X that all Optimism markets have been suspended. The marketplace on Base is safe and will provide more long information in a timely manner.

Blast: Airdrop will launch on June 26

Ethereum L2 network Blast posted that its Airdrop campaign will start on June 26, which has exceeded the initial expectation of May, sorry for the delay, for which the Airdrop allocation will be increased. Before the Airdrop, there will be two final Dapp Gold distributions.

Base on-chain NFT has volume reached $11.6 million in the past seven days, ranking first in L2

NFTScan data shows that Base on-chain NFT volume reached $11.6 million in the past seven days, ranking first in L2; In addition, zkSync Era on-chain NFT volume reached $9.9 million in the past 7 days, ranking second; Blast and Arbitrum one on-chain NFT volume in third place with $1.5 million in the last seven days.

Characters* Voices

Insider: BlockTower Capital's main hedging fund was attacked, and some of its funds were depleted

According to people familiar with the matter, BlockTower Capital's main hedging fund has been hacked by fraudsters and some of its funds have been depleted.

The funds remain unaccounted for and the Hacker has not yet been apprehended, one of the people said, but BlockTower Capital has hired Blockchain forensics analysts to determine how the funds were stolen and recently notified its limited partners of the theft.

BlockTower declined to comment on the Hacker attack.

According to data provider PitchBook, BlockTower Capital has $1.7 billion in Assets Under Management. [Bloomberg]

Insider: Lido co-creation and Paradigm are investing in re-stake project Symbiotic

According to people familiar with the matter, the re-stake project Symbiotic is not only backed by Lido co-founder Konstantin Lomashuk and Vasiliy Shapovalov's venture capital arm Cyber Fund, but also backed by venture capital firm Paradigm.

According to internal Symbiotic documentation obtained by CoinDesk, users are allowed to re-stake with Lido's stETH and other assets that are natively incompatible with EigenLayer. Developed by the stake services team formerly known as Stakemind, Symbiotic will be "a permissionless re-stake protocol that provides a flexible mechanism for Decentralization networks to coordinate Node operators and economic security providers". Several teams working in the emerging stake ecosystem say they are already discussing integration with Symbiotic, including AVS and building liquidity re-stake services on EigenLayer.

According to people familiar with the matter, Liquidity stake protocol Renzo is already in discussions about integrating with Symbiotic once it launches.

Representatives from Paradigm, Symbiotic and Cyber Fund declined to comment on the matter. (CoinDesk)

Investment and financing

Humanity Protocol closed a new $30 million funding round at a $1 billion valuation, with participation from Animoca Brands and others

Humanity Protocol announced the closing of a new $30 million funding round at a $1 billion valuation, led by Kingsway Capital, with participation from Animoca Brands, Blockchain.com, and Shima Capital, among others. Founder Terence Kwok said the company also raised about $1.5 million from influential encryption figures in "KOLs."

Kwok said the startup plans to launch its Testnet in the second quarter and currently has a waiting list of about 500,000 people. At the time of rolling out its technology, it was planned to start by releasing an app that could scan people's palm prints using their phone cameras to determine their identity.

It is reported that Humanity Protocol utilizes palm print recognition technology and zk-SNARKs to ensure users' privacy and security, aiming to provide an easily accessible and non-intrusive method for building human proofs in Web3 applications. [Bloomberg]

encryption prediction market Polymarket closed two rounds of funding totaling $70 million, led by Founders Fund and others

encryption prediction market Polymarket has closed two funding rounds totaling $70 million, the most recent of which was led by Founders Fund and others, Ethereum with participation from co-founder Vitalik Buterin and others. A Polymarket spokesperson said Founders Fund led a $45 million Series B funding round. General Catalyst earlier helped the company raise $25 million in a Series A funding round. (Bloomberg)

Tokenization reinsurance RWA platform Re closed a new $7 million funding round led by Electric Capital

Tokenization reinsurance RWA platform Re closed a new $7 million funding round led by Electric Capital, which reportedly closed a $14 million seed round at the end of 2022, and Re aims to support $200 million in premiums by the end of this year. (Coindesk)

Solana on-chain DEX Zeta Markets closed a $5 million funding round led by Electric Capital

Solana DEX Zeta Markets announced the closing of a new $5 million funding round led by Electric Capital, Digital Asset Capital Management, Selini Capital and Airtree Ventures, as well as Solana's Anatoly Yakovenko, Helius' Mert Mumtaz, Tensor Angel investors including Richard Wu of Pyth, Genia Mikhalchenko of Pyth, JMR Luna of Wintermute and Nom of Bonk participated. (TheBlock)

- Reward

- 1

- 1

- Share

Encryption Apocalypse: Challenging Wall Street, How Can a Super KOL Burst the Shorts and Make $40 Million?

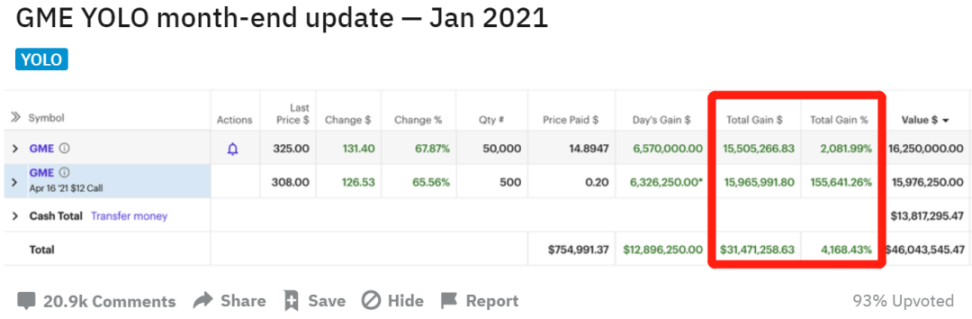

Roaring Kitty, one of the most bull retail traders of all time, turned $53,000 into more than $46 million on the $GME. After three years of seclusion, he came back and led a new round of MEME frenzy, whether it was the US stock market or the Crypto Assets, $GME reopened the moon landing mode, this is his story and revelation.

Roaring Kitty, whose real name is Keith Gill, was born in 1986 to a wealthy family that did not graduate from prestigious schools. In college, he was a track and field star. After graduating in 2009, I worked at a relative‘s startup that made stock analysis software, and then jumped a few jobs before starting a job for MassMutual in 2019.

2014

Author: Deep Tide TechFlow

Roaring Kitty, one of the most bull retail traders of all time, turned $53,000 into more than $46 million on the $GME. After three years of seclusion, he came back and led a new round of MEME frenzy, whether it was the US stock market or the Crypto Assets, $GME reopened the moon landing mode, this is his story and revelation.

Roaring Kitty, whose real name is Keith Gill, was born in 1986 to a wealthy family that did not graduate from prestigious schools. In college, he was a track and field star. After graduating in 2009, I worked at a relative's startup that made stock analysis software, and then jumped a few jobs before starting a job for MassMutual in 2019.

In 2014, he created his Twitter with the goal of "finding stocks and seizing investment opportunities." In 2015, he also joined YouTube, where he does regular live broadcasts showcasing his trading and market research. He also joined Reddit in 2019 under the username DFV (DeepFuckingValue).

In today's popular parlance, Keith Gill is a US stock KOL.

The twist in the saga came in 2019, when Gill started buying GME stock, allegedly because he felt that GME's stock was grossly undervalued.

At that time, he was also optimistic about GME, as well as Wall Street boss Michael Burry, who was the hero of "The Big Short", who single-handedly fought against Wall Street and shorted the US real estate subprime debt and finally made a lot of money. However, it was later learned that Burry had closed all positions before GME stock went crazy (Q4'20).

Initially Gill bought about $53,000 worth of GME, Build a Position at $5, and then began announcing his Holdings on the WallstreetBets subforum of the Reddit forum, and hyped it up on YouTube and Twitter, live-streaming his portfolio and investment strategy.

At the time, GameStop was still a "bad company" mired in finances: it lost more than $80 million in the quarter, sales falls 25% year-over-year, and even layoffs and store closures didn't help.

Someone left a comment under his post: "Dude, what made you invest $53,000 in GameStop?" Gill says he has always believed in the company's future potential.

In July 2020, Gill made a fateful discovery: GME's number of shorting shares was 150% of the outstanding shares.

Generally speaking, to shorting stocks, institutions borrow stocks and sell them, and then buy shares on a specified date to return them. If the stock price falls, the hedging fund can "sell high and buy low" to earn the difference. However, if the stock price rises and the shorts have to buy the shares back, it may push up the stock price, resulting in a "short squeeze". Players who Holdings these stocks will in turn earn income.

Gill sees an opportunity in which shorts may be at risk of short squeeze, and there is a chance to make money by going long.

He posted his findings on the WSB section and called on netizens to get involved, and GameStop also has a special meaning for Reddit users: it was a place where longest people bought games as children.

Their biggest rival is Melcin Capital, a Hedging Fund known for its short shorting.

In January 2021, Chewy, a well-known e-commerce company, announced that it would take a stake in GME, and co-founder Ryan Cohen joined the GME board of directors, stimulated by Favourable Information more and more long retail investors to buy GME shares, with the stock price rising by pump 50% long in a single day and nearly 700% pump in a single month.

Under the big pump, Melcin Capital was about to be overwhelmed, and the legendary shorting fund Citron came to the rescue, injected capital into Melcin Capital, and announced that they would shorting...... together

Wall Street's counterattack provoked more and more retail revolt, and it was also a war, and the slogan on the WSB was loud: Shorts must die!

On January 27, Melcin Capital announced that it would close position and abandon shorting, evaporating more than 50% of its asset size in a month, losing up to $6.8 billion, and becoming the craziest hedging fund with net value drawdown after the 2008 financial crisis.

At this point, retail investors won a phased victory, but suddenly Robinhood, a trading platform commonly used by retail investors, announced trading restrictions, and retail investors could not buy GME shares, and the stock price falls.

This was seen as Wall Street starting to play tricks and not following the rules, and the GME long short war gradually evolved into Wall Street VS Retail, a struggle between the two classes.

In this process, Gill was regarded as a leader, although it was later discovered that the GME was not a simple retail power, but GIill, who was pushed to the forefront by the times, became a banner, the leader of the retail movement, and he also reaped the biggest pot of gold in his life.

in 2019, $5 Build a Position $GME; In 2021, $GME peaked at $483. In January 2021, Gill posted a screenshot of its performance on WSB, showing that its GME stock and options combined earnings exceeded $31.47 million, with a cumulative Holdings of $46 million.

This legend is enough to become a lifetime of "bull" material.

This is the story of US stocks in the past, and in today's encryption world, is it familiar?

A large number of VC coin poured into the market, and retail investors became the exit Liquidity of VC, so not dumb buying each other became an unspoken rule, and not buying VC coin was like the collective short squeeze of retail investors in WSB a few years ago, which was a kind of class rebellion.

Retail investors have turned their attention to MEME, Ansem and other MEME KOLs have risen in this cycle, and his contribution to the "MLM" of $WIF is obvious to all.

Just as $GME has the support of financial predators behind it, the times and cycles still chose Gill as the spokesperson, and $WIF also chose Ansem as the spokesperson, and the two achieve each other.

In a market where MEME is the mainstream, powerful KOLs (or influencers) have the ability to influence the market, whether it is Musk, Keith Gill, or Ansem, are superstars in the MEME cycle.

Content and influence are leverage, and retail investors still have the opportunity to become super KOLs, stirring up the market and tossing new horizons.

- Reward

- like

- Comment

- Share

Brothers Arrested for Allegedly Exploiting Ethereum Blockchain to Steal $25 Million in 12 Seconds

Last updated:

May 15, 2024 22:03 EDT

| 2 min read

In a landmark case that has to be the first of its kind, two brothers, both graduates of the prestigious Massachusetts Institute of Technology (MIT), have been apprehended and charged with exploiting a vulnerability in the

Hassan Shittu

Last updated:

May 15, 2024 22:03 EDT | 2 min read

Their alleged actions resulted in a massive $25 million theft in 12 seconds. Anton Peraire-Bueno, 24, and James Peraire-Bueno, 28, face fraud and money laundering charges

A Well-Planned Exploit Of the Ethereum Blockchain By the Two Brothers

Two Brothers Arrested for Attacking Ethereum Blockchain and Stealing $25M in Cryptocurrency

🔗: pic.twitter.com/2Mlb3zIdpo

— U.S. Department of Justice (@TheJusticeDept) May 15, 2024

Federal prosecutors in Manhattan filed the charges, describing the scheme as meticulously planned and uted with the precision of a high-stakes digital heist

“The brothers, who studied computer science and math at one of the most prestigious universities in the world, allegedly used their specialized skills and education to tamper with and manipulate the protocols relied upon by millions of Ethereum users across the globe,” said Damian Williams, the U.S. attorney for the Southern District of New York.

The Peraire-Bueno brothers were arrested on Tuesday, with Anton being taken into custody in Boston and James in New York. They are expected to appear in federal court on Wednesday afternoon. The brothers’ lawyers have not yet commented on the charges.

According to the US Justice Department, the brothers set up validators on the Ethereum network, which are intended to help order transactions and facilitate profitable trades through bots However, they allegedly used their validators to deceive traders and secure access to pending transactions. This manipulation allowed them to alter the flow of electronic currency, effectively stealing the crypto. They then moved the stolen funds through complex transactions to obscure their origins.

Over several months, the brothers meticulously planned their operation. They studied the trading patterns of Ethereum bots and established shell companies and identified cryptocurrency exchanges with lax ‘know your customer’ (KYC) procedures to launder their illicit gains

Their thoroughness even extended to researching extradition procedures, highlighting the depth of their preparation.

Stolen Funds Going Up This Year

The heist is only the tip of the iceberg of ill-gotten crypto in recent years. United Nations sanctions monitors recently reported that North Korea laundered $147.5 million in stolen cryptocurrency through the Tornado Cash platform in March alone

A confidential document submitted to the U.N. Security Council sanctions committee revealed that North Korean suspects have been linked to 97 cyberattacks on crypto firms over the past seven years, amounting to approximately $3.6 billion

According to PeckShield, approximately $100 million of stolen cryptocurrency funds were successfully recovered in March, representing 52.8% of the total hacked amount Despite initial losses of $187.29 million across over 30 hacking incidents, the Munchables incident was particularly notable. Following negotiations, the hacker returned the stolen funds, significantly contributing to the recovered amount

Meanwhile, a recent $71 million wallet impersonation scam resulted in an investor transferring 97% of their assets to a bait wallet address. The hacker swiftly converted the stolen Wrapped Bitcoin (WBTC) into approximately 23,000 ETH and began distributing the funds across multiple wallets after six days

In the first quarter of 2024, total losses from hacking and fraudulent activities reached approximately $336.3 million, down from $437.5 million in the same period in 2023. The quarter saw 46 hacking incidents and 15 cases of fraudulent activities

Ethereum was the most targeted blockchain, followed by the BNB Chain, with both networks accounting for 73% of the total losses. Major incidents included the $81.7 million exploit on Orbit Bridge and the $62 million Munchables hack, with a notable recovery of $73.9 million (22%) from seven exploits. Hacking incidents accounted for 95.6% of the losses, while scams and rug pulls comprised 4.4%.

Follow Us on Google News

- Reward

- like

- Comment

- Share

Daily active users surpass Solana, Arbitrum becomes the biggest beneficiary of Dencun upgrade?

Original compilation: Luccy, BlockBeats

Editor‘s note: After the Dencun upgrade, the Transaction Cost drop on the second tier Blockchain Ethereum increased by up to 99%. Among them, Arbitrum reached a new high in daily active users and total volume on Monday, surpassing Solana. However, the total value, volume and coin price of encryption assets on Arbitrum are all falling, DLNews reporter Ryan Celaj analyzed the data, and the original text is compiled as follows:

On Monday, Arbitrum reached new highs in daily active users and total volume.

However, Arbitrum‘s governance token has fall 58% since ATH at the beginning of the year.

Arbitrum

Original article by Ryan Celaj, DLNews

Original compilation: Luccy, BlockBeats

Editor's note: After the Dencun upgrade, the Transaction Cost drop on the second tier Blockchain Ethereum increased by up to 99%. Among them, Arbitrum reached a new high in daily active users and total volume on Monday, surpassing Solana. However, the total value, volume and coin price of encryption assets on Arbitrum are all falling, DLNews reporter Ryan Celaj analyzed the data, and the original text is compiled as follows:

- On Monday, Arbitrum reached new highs in daily active users and total volume.

- However, Arbitrum's governance token has fall by 58% since ATH at the beginning of the year.

- Arbitrum remains the leader in total value of encryption assets, daily volume, and number of daily active users in Ethereum's Layer 2 Blockchain.

With Money Laundering at its lowest level in Ethereum long years, Arbitrum, a layer-2 network built on top of Ethereum, has seen an all-time high in activity.

On Monday, Arbitrum's daily active Address surged to an all-time high of 856, 000, rise 150% from the 341, 000 recorded in early May. This surge has brought Arbitrum to more than Solana's 833, 000 daily active users, although Solana has recently gained popularity due to the memecoin trading frenzy.

This happened with the Dencun upgrade Ethereum on March 15, which Ethereum up to 99% of the Transaction Cost drop on the second layer Blockchain.

Arbitrum's Daily Active Address and Number of Transactions (Growthepie)

In the week before the upgrade, the number of transactions on Arbitrum was just 747, 000, and in the week after the upgrade, that number jumped to 1.5 million before reaching a high on Monday.

Arbitrum DAO also recently unveiled its plans to invest 35 million ARB Token in stable, liquid assets. This has led to the launch of potential products by longest companies, including heavyweight Franklin Templeton, a trillion-dollar asset manager, and Securitize, the company that helped BlackRock tokenize its assets.

Despite these significant developments, the total value of encryption assets on Arbitrum has fallen 22% from its all-time high of $20 billion on April 1 to $15.7 billion. VOLUME on Arbitrum's DEX exchange has fallen 82% from its March 4 high of $2.2 billion to $404 million. Arbitrum's governance token ARB is also underperforming in price.

ARB Daily Token Price

ARB hit an all-time high of $2.26 on January 11 and approached again on March 7 at $2.17. However, the Token has fallen 58% since January and is currently trading at $0.94. At the same time, Ethereum pumped about 10% over the same period.

One reason for the ARB price lag may be the massive Token unlocking carried out by Offchain Labs, the development team behind Arbitrum, and its investors. On March 15, about $1.2 billion worth of ARB Token was unlocked and distributed to these groups, and the Token were locked up for a year.

Still, Arbitrum remains the preferred Tier 2 Blockchain for overall bridge Ethereum. According to data as of April 28, just over 1.7 million Ether coin were moved to Arbitrum, while Arbitrum's 14 largest Tier 2 competitors saw only about 1.5 million Ether coin bridge to their Blockchain.

Link to original article

- Reward

- 1

- 2

- Share

Detail EIP-7706 and sort out the latest Ethereum Gas mechanics

Introduction: Vitalik released the EIP-7706 proposal on May 13, 2024, proposing a supplement to the existing gas model, separating the gas computation of calldata, and customizing a base fee pricing mechanism similar to Blob gas to further drop the operating cost of L2. The related proposal also needs to be traced back to EIP-4844 proposed in February 2022, which is a long time ago, so check out the relevant materials to make an overview of the latest Ethereum Gas mechanism for everyone to quickly understand.

Ethereum is currently supported

Author: @Web3Mario

Introduction: Vitalik released the EIP-7706 proposal on May 13, 2024, proposing a complementary scheme to the existing gas model, dropping out the gas calculation of calldata, and customizing a base fee pricing mechanism similar to Blob gas to further reduce the running cost of L2. The related proposal also needs to be traced back to EIP-4844 proposed in February 2022, which is a long time ago, so check out the relevant materials to make an overview of the latest Ethereum Gas mechanism for everyone to quickly understand.

Currently supported Ethereum Gas models - EIP-1559 and EIP-4844

In the initial design, Ethereum uses a simple auction mechanism to price Money Laundering, which requires users to actively bid for their own transactions, that is, to set a gas price, usually, because the transaction fee paid by the user will be vesting than the Miner, so the Miner will determine the order of transaction packaging according to the principle of economic optimization, according to the bidding level, note that this is in the case of ignoring MEV. In the eyes of the core developers at the time, this mechanism faced the following four problems:

There is a mismatch between the Fluctuation of the Money Laundering level and the cost of the transaction Consensus:* For active Blockchain, the packaging demand for the transaction is sufficient, which means that the Block can be easily filled, but it also often means that the overall cost is extremely Fluctuation. For example, when the average gas price is 10 Gwei, the marginal cost of the network to accept another transaction in a block is 10 times that of the average gas price of 1 Gwei, which is unacceptable. Unnecessary latency for users: Due to the hard limit of gaslimit per Block, coupled with the natural Fluctuation of historical volume, transactions often wait a few Block before being packaged, but this is inefficient for the overall network; That is, there is no "slack" mechanism that allows one Block to be larger and the next Block smaller to meet the differences in needs that are Block on a case-by-case basis. Inefficient pricing: The use of a simple auction mechanism leads to inefficient fair price discovery, which means that it will be difficult for users to give a reasonable price, which means that in very long cases, users pay high fees. A Blockchain without Block Reward will be unstable: When the Block Reward brought by the Mining is removed and a pure fee model is adopted, it can lead to very long instability, such as incentivizing mining to steal the "sister block" of the Money Laundering, opening a more powerful selfish mining Attack Vector, etc.

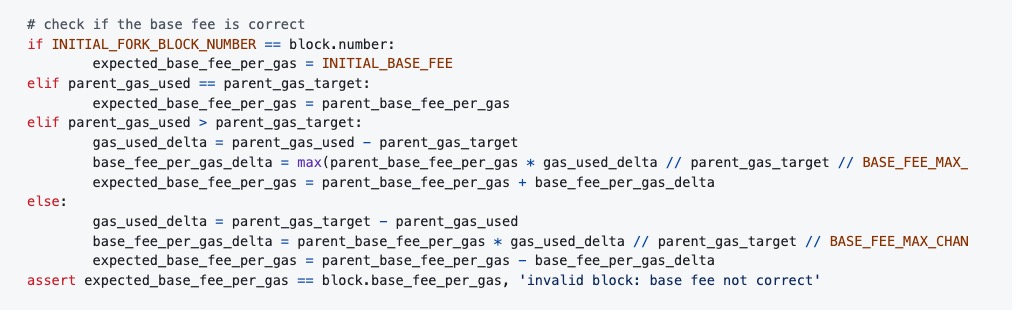

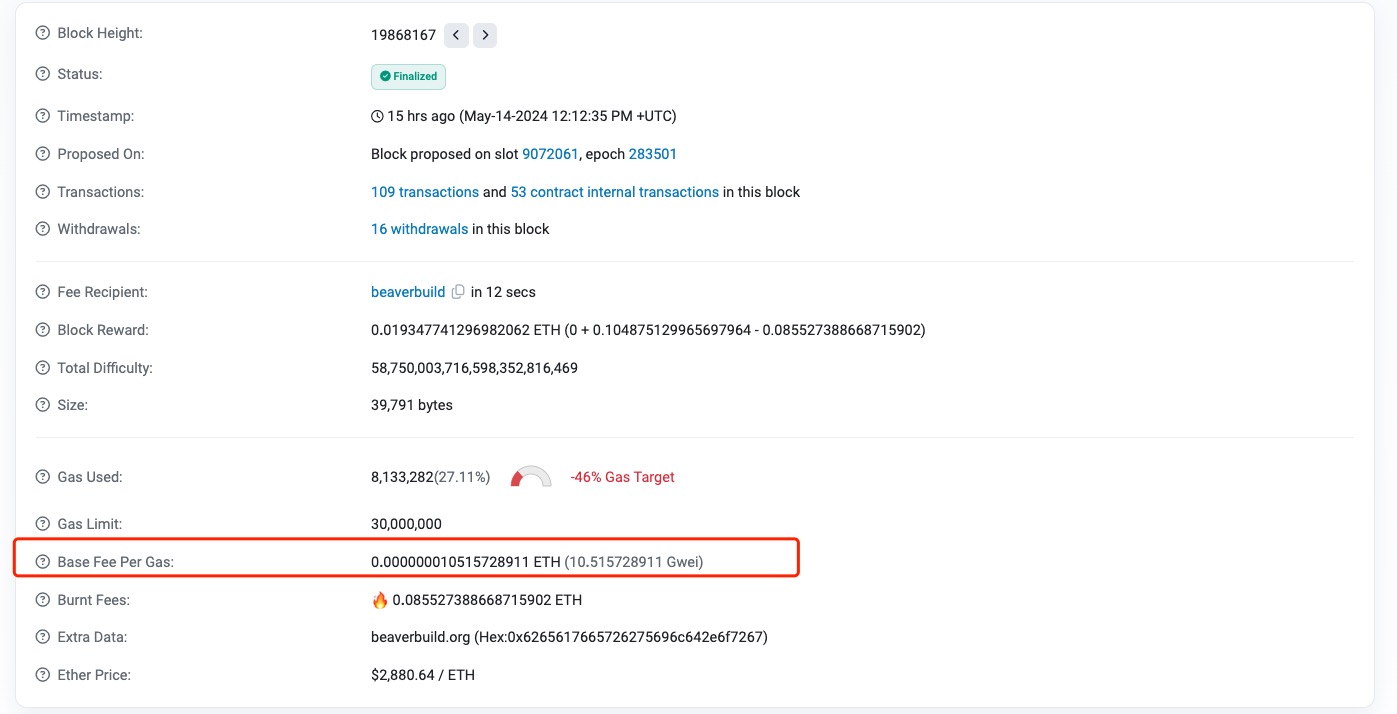

Until EIP-1559 was proposed and executed, there was a first iteration of the Gas model, EIP-1559 was proposed by Vitalik and other core developers on April 13, 2019, and adopted in the London upgrade on August 5, 2021 fee will be based on the gas consumption generated in the parent Block and a floating and recursive gas The relationship between the target is quantitatively calculated through an established mathematical model, and the intuitive effect is that if the gas usage in the previous Block exceeds the predetermined gas target, the base fee will be increased, and if it is less than gas target, the base fee will be lowered, which can better reflect the relationship between supply and demand. It can also make the prediction of reasonable gas more accurate, and there will be no sky-high gas price caused by misoperation, because the calculation of base fee is directly determined by the system rather than freely specified by the user. The specific code is as follows:

It can be seen that when parent_gas_used is greater than parent_gas_target, then the base fee of the current Block will be compared with the base fee of the previous Block plus an offset value, and the offset value is taken as parent_base_fee multiplied by the offset of the total usage of the previous Block gas relative to the gas target, and the maximum value of the remainder and 1 of the gas target and a constant. The reverse logic is similar.

In addition, the base fee will no longer be distributed to Miners as a reward, but will be directly burned, so that the economic model of ETH is in a deflationary state, which is conducive to the stability of value. On the other hand, Priority fee is equivalent to the user's tip to the Miner, which can be freely priced, which can allow the sorting Algorithm of the Miner to be reused to a certain extent.

With the advancement of time to 2021, when the development of Rollup gradually entered a better situation, we know that both OP Rollup and ZK Rollup mean that some proof data after compression of L2 data needs to be uploaded to the on-chain through calldata to achieve data availability or directly handed over to the on-chain for verification. As a result, these rollup solutions face large gas costs when maintaining L2 finality, and these costs will eventually be passed on to users, so most L2 protocol usage costs are not as low as imagined.

At the same time, Ethereum is also facing the dilemma of competition between Block short, we know that there is a gas limit for each Block, which means that the total gas consumption of all transactions in the current Block cannot exceed this value, based on the current gas limit of 300000000, there is a theoretical limit of 30,000,000 / 16 = 1,875,000 bytes, where 16 refers to the EVM processing each calldata Bytes consume 16 units of gas, which means that a single Block can carry about 1.79 MB of data long. The rollup-related data generated by the L2 sequencer usually has a large data scale, which makes it compete with other mainchain users' transaction confirmations, resulting in a smaller volume of transactions that can be packaged in a single block, which in turn affects the TPS of the mainchain.

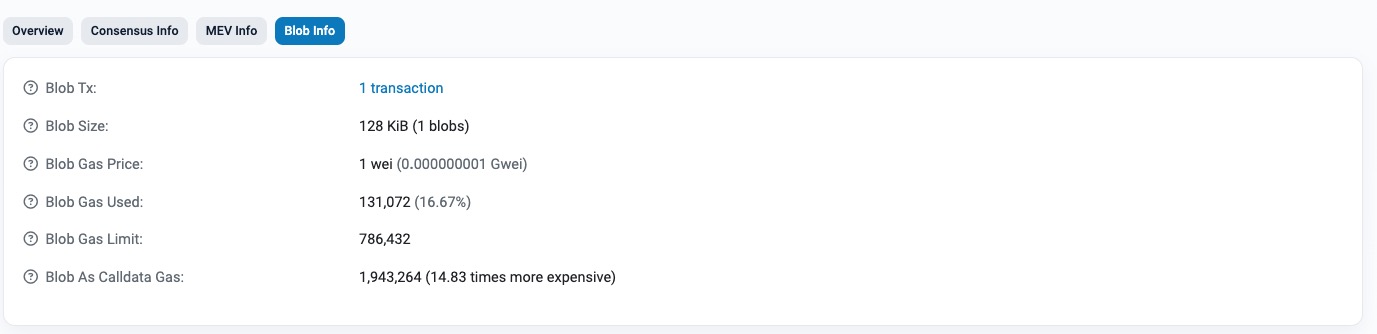

To address this dilemma, core developers submitted a proposal for EIP-4844 on February 5, 2022, which was implemented after the Dencun upgrade at the beginning of Q2 2024. The proposal proposes a new transaction type called Blob Transaction, which is supplemented with a new data type, Blob data, compared to the traditional type of Transaction. Unlike the calldata type, blob data cannot be directly accessed by the EVM, but only its hash, also known as VersionedHash. In addition, there are two accompanying designs, one is that compared with ordinary transactions, the GC period of blob transaction is shorter, so as to ensure that the Block data is not too bloated, and the other is that blob data has a native Gas mechanism, and the overall effect is similar to EIP-1559, but the natural exponential function is selected in the mathematical model, so that it performs better in terms of stability in response to transaction size Fluctuations, because the slope of the natural exponential function is also a natural exponential function, This means that no matter what state the network transaction size is in at this time, when the transaction size soars rapidly, the base fee of the blob gas responds more fully, thereby effectively curbing transaction activity, and the function also has an important feature, when the abscissa is 0, the function value is 1.

base_fee_per_blob_gas = MIN_BASE_FEE_PER_BLOB_GAS * e**(excess_blob_gas / BLOB_BASE_FEE_UPDATE_FRACTION)

where MIN_BASE_FEE_PER_BLOB_GAS and BLOB_BASE_FEE_UPDATE_FRACTION are two constants, and excess_blob_gas is determined by the difference between the total blobs in the parent Block gas consumed by one TARGET_BLOB_GAS_PER_BLOCK constant, when the total blobs gas consumption exceeds the target value, that is, when the difference is positive, e**(excess_blob_gas / BLOB_BASE_FEE_UPDATE_FRACTION) is greater than 1, then base_fee_per_blob__gas becomes larger, and vice versa.

In this way, for some scenarios that only want to use Ethereum's consensus ability to store some large-scale data to ensure availability, it can be executed at low cost, and will not crowd out the transaction packaging capacity of the block. Taking the Rollup sequencer as an example, the key information of L2 can be encapsulated into blob data through blob transaction, and the logic of on-chain verification can be realized by using versionedHash through ingenious design in the EVM.

It should be added that the current TARGET_BLOB_GAS_PER_BLOCK and MAX_BLOB_GAS_PER_BLOCK settings introduce a limit of Mainnet of 3 blobs (0.375 MB) per Block and a maximum of 6 blobs (0.75 MB) per long. These initial limits are designed to minimize the strain on the network from this EIP and are expected to increase in future upgrades as the network demonstrates reliability at larger blocks.

Re-refinement of the execution environment gas consumption model - EIP-7706

Now that the current Ethereum Gas model has been clarified, let's take a look at the goals and implementation details of the EIP-7706 proposal. The proposal was presented by Vitalik on May 13, 2024. Similar to blob data, this proposal strips the gas model corresponding to another special data field, which is calldata. And the corresponding code implementation logic has been optimized.

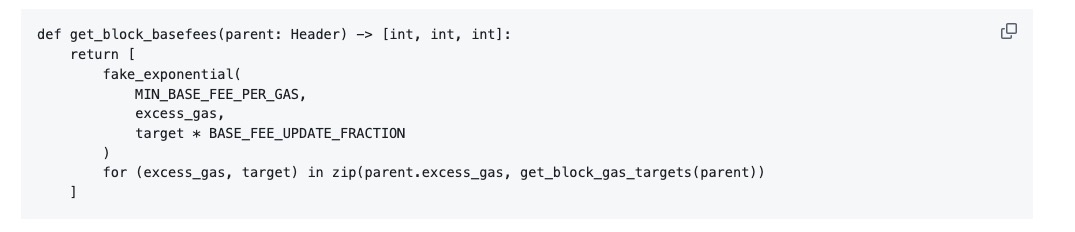

In principle, the base fee calculation logic of calldata is the same as that of base fee for blob data in EIP-4844, which uses an exponential function and calculates the scaling of the current base fee based on the deviation between the actual gas consumption value and the target value in the parent block.

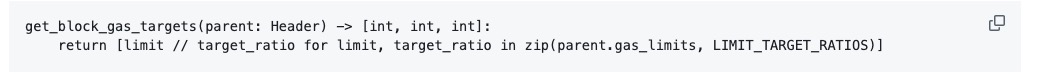

It is worth noting a new parametric design, LIMIT_TARGET_RATIOS=[2,2,4], where LIMIT_TARGET_RATIOS[0][1]Indicates the target ratio of the operation gas, LIMIT_TARGET_RATIOS[2]Indicates the target ratio of the blob data class Gas, which is LIMIT_TARGET_RATIOSThis vector is used to calculate the gas target value corresponding to the three classes of gas in the parent Block, and the calculation logic is as follows, that is, LIMIT_TARGET_RATIOS is used to divide the gas limit by dividing the limit:

The logic of setting gas_limits is as follows:

gas_limits[0]The existing adjustment formula must be followed

gas_limits[1]Must be equal to MAX_BLOB_GAS_PER_BLOCK

gas_limits[2][0]Must be equal to gas_limits // CALLDATA_GAS_LIMIT_RATIO

We know the current gas_limits[0]is 30000000, CALLDATA_GAS_LIMIT_RATIO is preset to 4, which means that the current calldata gas target is about 300000000 // 4 // 4 = 1875000, and because according to the current calldata gas calculation logic, each non-zero Bytes consumes 16 Gas, and zero Bytes consumes 4 Gas. For example, if the distribution of non-zero and zero bytes in a certain segment of calldata accounts for 50% each, the average processing of 1 byte of calldata consumes 10 gas. Therefore, the current calldata gas target should cope with 187,500 bytes of calldata data, which is about twice the current average usage.

The advantage of this is that the probability of calldata reaching the gas limit is greatly reduced, and the usage of calldata is kept in a more consistent state through economic modeling, and the abuse of calldata is also eliminated. The reason for this design is to drop the development of L2, and with blob data, the sequencer cost is further reduced.

- Reward

- like

- Comment

- Share

MakerDAO‘s endgame program "Endgame" welcomes new progress: the first SubDAO and new Token will be launched, and the first phase is planned to be launched this summer

The veteran Decentralized Finance protocol MakerDAO is accelerating the implementation of the endgame plan "Endgame". Shortly after announcing plans to launch a new stablecoin, NewStable (NST), and a new governance token, NewGovToken (NGT), MakerDAO today announced the upcoming launch of its first SubDAO Spark and its native Token, SPK.

By Nancy, PANews

The veteran Decentralized Finance protocol MakerDAO is accelerating the implementation of the endgame plan "Endgame". Shortly after announcing plans to launch a new stablecoin, NewStable (NST), and a new governance token, NewGovToken (NGT), MakerDAO today announced the upcoming launch of its first SubDAO Spark and its native Token, SPK.

The first SubDAO will be launched soon, and the community governance mechanism will be adopted

As an important shift for MakerDAO, Endgame is able to scale the supply of DAI to 100 billion or long more by improving efficiency, resiliency, and accessibility. In order to create a more fair, transparent and effective governance system, MakerDAO has introduced a popular new model of DAO governance, subDAO, and set specific applications or responsibilities for each subDAO.

As MakerDAO's first subDAO, SparkDAO is built around Spark, a lending protocol. According to the official introduction, Spark's main products include SparkLend and Cash & Savings, the former allows users to borrow DAI on a large scale with high liquidity assets, and the latter provides similar on-chain banking products, combining the functions of cash and savings accounts with the Dai savings Intrerest Rate (DSR), and supporting assets include DAI, USDT and USDC. Protocol to DefiLlama, Spark Protocol's TVL was nearly $2.19 billion as of May 15, making it the fourth largest lending protocol and accounting for 7.3% of the lending market.

Officially, SparkDAO will also launch its own native Token SPK and long SPK Token Mining plans. The total Token of SPK is 4 billion, and it is planned to be distributed over a period of 10 years, with 1 billion Token distributed annually for the first 2 years, and then the distribution rate will be Halving every 2 years, and new Token NewStable and stake protocol Lockstake Engine users will receive 70% (700 million) and 30% (300 million) of SPK Token, respectively.

Once SparkDAO is launched, its Token SPK can be Mining through Liquidity Mining, and SPK Token holders will have the opportunity to immediately Mine NewGovToken (NGT) to participate in the governance of the MakerDAO ecosystem, which is officially estimated to be Liquidity Mining at a rate of 80 million NGT per year. At present, MakerDAO has opened the pre-mine activity of Token SPK on SparkLend for users, and the mined Token will be distributed when SparkDAO is launched.

In addition, SparkDAO advocates a community-driven governance mechanism supported by SPK Token votes, and will be rolled out in a gradual manner, initially allowing Token holders to guide community marketing, etc., and will achieve full autonomy in all aspects of SparkDAO governance over time and seamlessly integrate into the Maker SubDAO ecosystem.

Protocol to MakerDAO, the protocol plans to launch six SubDAOs in the second phase of Endgame, each of which will cater to different market segments and community interests, such as RWA-focused or gaming-focused SubDAOs, and the implementation of SubDAO governance will be complemented by an effective user interface and AI-powered tools to help and simplify governance decisions.

The first phase of Endgame is planned to be launched this summer, and longest features will be released one after another

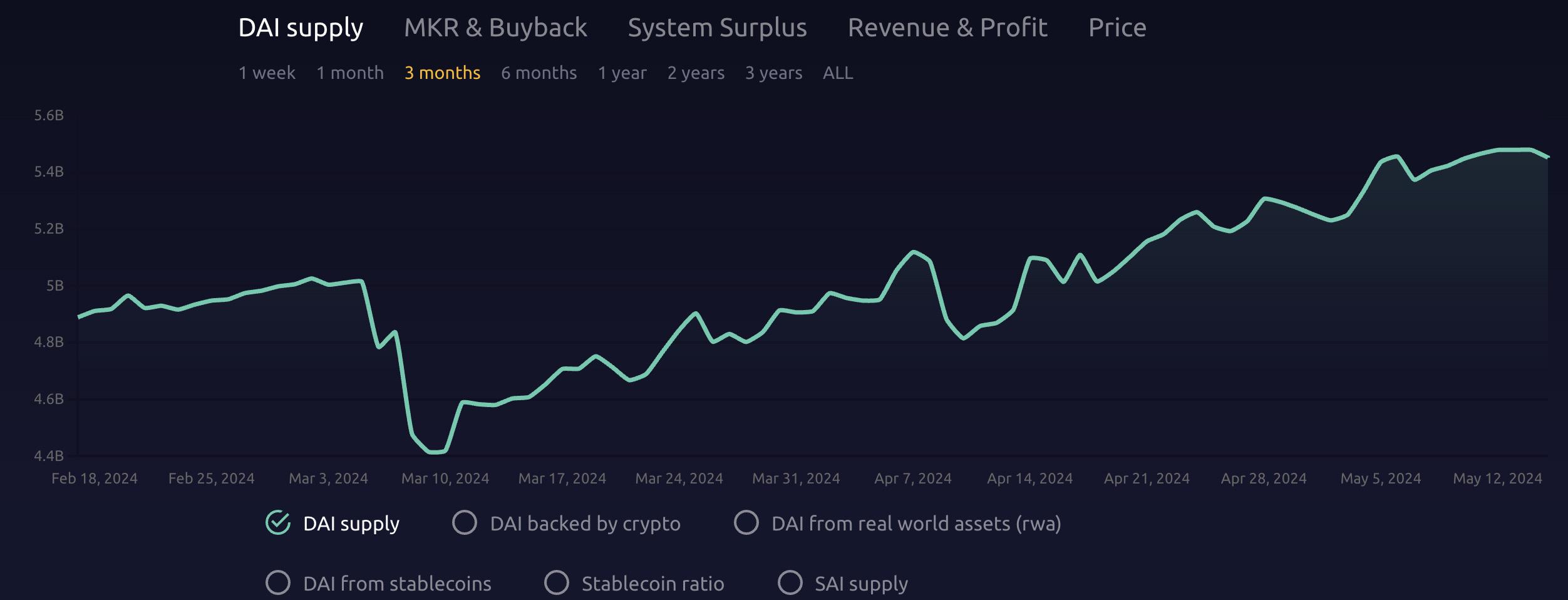

As a "veteran" in the Decentralized Finance field with more than $5 billion TVL, MakerDAO, which has been developing for long years, has been in a dominant position for a long time. As of May 15, the total supply of DAI had pump to 5.45 billion, having rise more than 850 million in the past two months alone, the highest since October last year, according to Maker Burn data. At the same time, Maker's annualized profit reached $65.405 million, annualized fee income was $330 million, and PE was estimated to be 38.35.

According to the MakerDAO study released in April by Ryan Watkins, co-founder of Syncracy Capital, MakerDAO has accounted for nearly 40% of the Decentralized Finance profits on Ethereum in the past six months, and the secret of its success is the stablecoin DAI with a coin premium. At the same time, the report also pointed out that although Maker's annual revenue exceeds that of all encryption projects except Ethereum, Tron and Solana, and although its price-to-earnings ratio has been suppressed, the launch of "Endgame" could turn that around, or give Maker a multi-billion dollar fee opportunity and a $40 billion project valuation.

And Endgame's reform plan has also ushered in new progress this year. In March 2024, Rune Christensen, founder of MakerDAO, officially announced that it will launch the first phase of Endgame this summer, the "Launch Season", which will successively launch features including new tokens, SubDAO, NewBridge and Lockstake Engine, thereby achieving exponential rise in DAI usage.

At present, in addition to the above-mentioned subDAO, MakerDAO also recently announced that it will launch two new Tokens to replace DAI and MKR, NewStable and NewGovToken, of which NewStable will serve as an upgraded Token of DAI, designed for wider adoption and with enhanced stability features; NewGovToken represents a well-established governance approach within the ecosystem, with each MKR converted to 24,000 NGT to encourage broader participation and more dynamic decision-making, and the final name of the two will be shared through brand unveiling.

In short, with the continuous advancement of Endgame, the large-scale restructuring battle of MakerDAO has slowly begun.

- Reward

- like

- Comment

- Share

Detail EIP-7706 and sort out the latest Ethereum Gas mechanics

Introduction: On May 13, 2024, Vitalik released the EIP-7706 proposal, proposing a complementary solution to the existing gas model, dropping out the gas computation of calldata, and customizing a base fee pricing mechanism similar to blob gas to further reduce the running cost of L2. The related proposal also needs to be traced back to EIP-4844 proposed in February 2022, which is a long time ago, so check out the relevant materials to provide an overview of the latest Ethereum Gas mechanism for you to quickly understand.

Currently supported Ethereum Gas models - EIP-1559 and

Original Author: @Web3 Mario

Introduction: On May 13, 2024, Vitalik released the EIP-7706 proposal, proposing a complementary solution to the existing gas model, separating the gas computation of calldata, and customizing a base fee pricing mechanism similar to Blob gas to further drop the running cost of L2. The related proposal also needs to be traced back to EIP-4844 proposed in February 2022, which is a long time ago, so check out the relevant materials to provide an overview of the latest Ethereum Gas mechanism for you to quickly understand.

The currently supported Ethereum Gas models - EIP-1559 and EIP-4844

In the original design, Ethereum uses a simple auction mechanism to price Money Laundering, which requires users to actively bid for their own transactions, that is, to set a gas price, normally, because the transaction fee paid by users will be vesting than Miner, so the Miner will determine the order of transaction packaging according to the principle of economic optimality, according to the bidding level, note that this is in the case of ignoring MEV. In the eyes of the core developers at the time, this mechanism faced the following four problems:

- Fluctuation in the level of Money Laundering and the consensus cost of transactions: In an active Blockchain, there is sufficient demand for transaction packaging, which means that blocks can be easily filled, but this often also means that the overall fee Fluctuation is extremely high. For example, when the average gas price is 10 Gwei, the marginal cost of the network to accept one more transaction in a block is 10 times that of the average gas price of 1 Gwei, which is unacceptable.

- Unnecessary latency for users: Due to the hard gas limit of each block, coupled with the natural fluctuation of historical volume, transactions usually wait for several blocks to be packaged, but this is inefficient for the overall network; That is, there is no "slack" mechanism that allows one Block to be larger and the next Block smaller to meet the differences in needs that are Block on a case-by-case basis.

- Inefficient pricing: The use of a simple auction mechanism leads to inefficient fair price discovery, which means that it will be difficult for users to give a reasonable price, which means that in very long cases, users pay high fees.

- Block Reward-free Blockchain will be unstable: When the Block Reward brought by Mining is removed and a pure fee model is adopted, it can lead to very long instability, such as incentivizing mining to steal Money Laundering "sister blocks", opening more powerful selfish mining Attack Vector, etc.

It wasn't until EIP-1559 was proposed and implemented that there was a first iteration of the Gas model, which was proposed by core developers such as Vitalik on April 13, 2019, and adopted in the London upgrade on August 5, 2021, which abandoned the auction mechanism in favor of a dual pricing model of base fee and priority fee, where the base fee would be based on the gas already generated in the parent Block The relationship between consumption and a floating and recursive gas target is quantitatively calculated through an established mathematical model, and the intuitive effect is that if the usage of gas in the previous Block exceeds the predetermined gas target, the base fee will be increased, and if it is less than the gas target, the base fee will be lowered, which can not only better reflect the relationship between supply and demand, but also make the prediction of reasonable gas more accurate. There will be no sky-high gas price due to misoperation, because the calculation of base fee is directly determined by the system rather than freely specified by the user. The specific code is as follows:

It can be seen that when parent\gas_used is greater than parent_gas_target, then the base fee of the current Block will be compared with the base fee of the previous Block plus an offset value, and the offset value is taken as parent_base_fee multiplied by the offset of the total usage of the previous Block gas relative to gas target, and the maximum value of the remainder of 1 with gas target and a constant. The reverse logic is similar.

In addition, the base fee will no longer be distributed to Miners as a reward, but will be burned directly, so that the economic model of ETH is in a deflationary state, which is conducive to the stability of value. On the other hand, Priority fee is equivalent to the user's tip to the Miner, and the price can be set freely, which can allow the sorting Algorithm of the Miner to be reused to a certain extent.

As time progresses to 2021, when the development of Rollup gradually enters a better state, we know that both OP Rollup and ZK Rollup mean that some proof data after compression of L2 data needs to be uploaded to the on-chain through calldata to achieve data availability or directly handed over to the on-chain for verification. As a result, these rollup solutions face significant gas costs when maintaining L2 finality, and these costs are ultimately passed on to users, so most L2 protocol usage costs are not as low as imagined.

At the same time, Ethereum is also facing the dilemma of competition between Block short, we know that there is a gas limit for each Block, which means that the total gas consumption of all transactions in the current Block cannot exceed this value, based on the current gas limit of 300000000, there is a theoretical limit of 30, 000, 000 / 16 = 1, 875, 000 bytes, where 16 refers to the consumption of 16 per calldata byte processed by the EVM This means that the maximum long of a single Block can carry data is about 1.79 MB. The rollup-related data generated by the L2 sequencer is usually large-scale, which makes it compete with other mainchain users' transaction confirmations, resulting in a smaller volume that can be packed in a single block, which in turn affects the TPS of the mainchain.

To address this dilemma, the core developers proposed EIP-4844 on February 5, 2022, which was implemented after the Dencun upgrade at the beginning of Q2 2024. The proposal proposes a new type of transaction called Blob Transaction, which is based on a new data type, Blob data, which is a new data type, Blob data, compared to the traditional type of Transaction. Unlike the calldata type, blob data cannot be directly accessed by the EVM, but only its hash, also known as VersionedHash. In addition, there are two accompanying designs, one is that compared with ordinary transactions, the GC period of blob transactions is shorter, so as to ensure that the block data is not too bloated, and the second is that blob data has a native gas mechanism, which generally presents a similar effect to EIP-1559, but chooses the natural exponential function in the mathematical model, so that it can perform better in stability when dealing with transaction size fluctuations, because the slope of the natural exponential function is also a natural exponential function, This means that no matter what state the network transaction size is in at this time, when the transaction size spikes rapidly, the base fee of the blob gas responds more fully, thereby effectively curbing transaction activity, and the function also has an important feature, when the abscissa is 0, the function value is 1.

base_fee_per_blob_gas = MIN_BASE_FEE_PER_BLOB_GAS * e**(excess_blob_gas / BLOB_BASE_FEE_UPDATE_FRACTION)

where MIN_BASE_FEE_PER_BLOB_GAS and BLOB_BASE_FEE_UPDATE_FRACTION are two constants, while excess_blob_gas is determined by the difference between the total blobs in the parent Block gas and one TARGET_BLOB_GAS_PER_BLOCK constant, when the total blobs gas When the consumption exceeds the target value, that is, when the difference is positive, e**(excess_blob_gas / BLOB_BASE_FEE_UPDATE_FRACTION) is greater than 1, then base_fee_per_blob_gas becomes larger, and vice versa becomes smaller.

In this way, for some scenarios that only want to use Ethereum's consensus ability to store some large-scale data to ensure availability, it can be executed at low cost without crowding out the transaction packaging capacity of the block. Taking the rollup sequencer as an example, the key information of L2 can be encapsulated into blob data through blob transaction, and the logic of on-chain verification can be implemented by using versionedHash through clever design in the EVM.

It should be added that the current TARGET_BLOB_GAS_PER_BLOCK and MAX_BLOB_GAS_PER_BLOCK settings introduce a limit of Mainnet of 3 blobs (0.375 MB) per Block and a maximum of 6 blobs (0.75 MB) per long. These initial limits are designed to minimize the strain on the network from this EIP and are expected to increase in future upgrades as the network demonstrates reliability at larger blocks.

Refines the gas consumption model for the execution environment - EIP-7706

Now that the current Ethereum gas model has been clarified, let's take a look at the goals and implementation details of the EIP-7706 proposal. The proposal was presented by Vitalik on May 13, 2024. Similar to blob data, this proposal strips the gas model for another special data field, which is calldata. And the corresponding code implementation logic has been optimized.

In principle, the base fee calculation logic of calldata is the same as that of base fee for blob data in EIP-4844, which uses an exponential function and calculates the scaling of the current base fee based on the deviation value of the actual gas consumption value in the parent block from the target value.

It is worth noting a new parameter design, LIMIT_TARGET_RATIOS=[ 2, 2, 4 ], where LIMIT_TARGET_RATIOS[ 0 ] represents the target ratio of the operation class Gas, LIMIT_TARGET_RATIOS[ 1 ] represents the target ratio of the Blob data class Gas, and LIMIT_TARGET_RATIOS [ 2 ] represents the calldata The target ratio of the class Gas, this vector is used to calculate the gas target values corresponding to the three classes of gas in the parent Block, and the calculation logic is as follows, that is, the gas limit is divisible by LIMIT_TARGET_RATIOS respectively:

The logic of gas_limits is as follows:

gas_limits[ 0 ] must follow the existing adjustment formula

gas_limits[ 1 ] must be equal to MAX_BLOB_GAS_PER_BLOCK

gas_limits[ 2 ] must be equal to gas_limits[ 0 ] // CALLDATA_GAS_LIMIT_RATIO

We know that the current gas_limits[ 0 ] is 30000000, and CALLDATA_GAS_LIMIT_RATIO is preset to 4, which means that the current calldata gas target is about 300000000 // 4 // 4 = 1875000, and because according to the current calldata gas calculation logic, each non-zero bytes consumes 16 gas, and zero bytes consumes 4 gas. Assuming that the distribution of non-zero and zero bytes in a certain segment of calldata accounts for 50% each, it takes an average of 10 gas to process 1 bytes of calldata. Therefore, the current calldata gas target should cope with 187500 bytes of calldata data, which is about 2 times the current average usage.

The advantage of this is that the probability of calldata reaching the gas limit is greatly reduced, and the usage of calldata is kept in a more consistent state through economic modeling, and the abuse of calldata is also eliminated. The reason for this design is to clear the way for the development of L2, and with blob data, the sequencer cost is further dropped.

- Reward

- like

- Comment

- Share

Trump and Biden, start the battle of the "encryption election".

On the one hand, against the backdrop of increasing political polarization, the lingering shadow of economic recession, and the serious rift in public opinion, the choice of the next president of the United States will have a crucial impact on the direction of the country‘s political situation. On the other hand, the transmission of high inflation, the intensifying trade war and the development of economies, the future of the global economy also needs to be watched by the US election.

On November 5, the 2024 U.S. presidential election will be held as scheduled. Judging from the current situation, it is not surprising that this year‘s US president will be chosen between Biden, the 81-year-old representative of the Democratic Party, and Trump, the representative of the Republican Party, who is known for his crazy words. In order to win votes, both will chant and make speeches to articulate their political intentions and electoral commitments, including economic, demographic, gender, educational, and military issues.

But unlike in the past,

Since the beginning of this year, people all over the world have been paying attention to the U.S. election.

On the one hand, against the backdrop of increasing political polarization, the lingering shadow of economic recession, and the serious rift in public opinion, the choice of the next president of the United States will have a crucial impact on the direction of the country's political situation. On the other hand, the transmission of high inflation, the intensifying trade war and the development of economies, the future of the global economy also needs to be watched by the US election.

On November 5, the 2024 U.S. presidential election will be held as scheduled. Judging from the current situation, it is not surprising that this year's US president will be chosen between Biden, the 81-year-old representative of the Democratic Party, and Trump, the representative of the Republican Party, who is known for his crazy words. In order to win votes, both will chant and make speeches to articulate their political intentions and electoral commitments, including economic, demographic, gender, educational, and military issues.

But unlike in the past, encryption has also been included in the agenda of this presidential war this year. **

Not long ago, Trump suddenly said he would accept Crypto Assets as campaign contributions and encouraged voters who support Crypto Assets to vote for him, "President Joe Biden doesn't even know what Crypto Assets are, if you like any form of Crypto Assets, if you support Crypto Assets, you'd better vote for Trump." ”

This is not the first time Trump has shown his support for encryption. **As early as December 15, 22, Trump announced the issuance of 45,000 NFTs through the social media site he founded, TruthSocial, with a starting price of $99 each, and the purchase of 45 digital trading cards will give you a ticket to dinner with Trump.

Judging from the design of the NFT, each card in the series has an illustration of Trump's personal image, perhaps to satisfy the individual's desire to perform, the NFT series is designed as a Trump version of the image of a superhero, bullboy or astronaut, full of personal characteristics. Interestingly, on the eve of the launch, Trump had posted on Truth Social that "America needs a superhero" and also emphasized that there were "important announcements" to be announced. In response, Biden quipped Trump, saying, "I've had some big announcements over the past few weeks..... too. ”

Trump's NFT collection, source: public information

At the beginning of this year, it released its third "Mugshot" NFT collection. Despite the suspicion of being played for suckers, Trump still kept his promise. On May 8, Trump flew back to Florida after a court appearance to have dinner with buyers who purchased more than 47 Mugshot Edition NFT trading cards. At the dinner, Trump once again said wildly, "We have done it (big selling) before NFT is popular." We're going to make NFTs hot again. ”

Trump claims to make NFTs hot again, source: X platform

It should be emphasized that in addition to the Bitcoin NFT that is still in the residual temperature, the current NFT field can be called a scenery that is not there. In terms of Ethereum, not only the blue-chip NFT series, which is a price support, fell by more than 20% overall, but the volume and market capitalization also fell sharply, according to CryptoSlam, the Ethereum of the once NFT base had sales of $241 million in April, almost 50% Slump compared to $489 million in sales in March, setting the worst monthly NFT performance since October 2023.

It is unknown whether Trump can really make NFTs great again, after all, the United States is not great again under its leadership, but in this move, encryption has really been brought to the election by Trump.

**From the current partisan attitude towards encryption, longest Democrats led by Biden tend to be cautious about encryption, especially after the collapse of FTX, the Democratic Party has firmly established the direction of strict regulation. A clear sign is that Gary Gensler, the chairman of the US SEC who is longest criticized by encryption people today, is a long-time donor to the Democratic Party, who previously served as the chief financial officer of Hillary Clinton's 2016 presidential campaign, and the Democratic Party has a strong banner. The longest Republican Party, led by Trump, may have shown a rare tolerance towards encryption in order to show that political differences attract votes. **

In fact, looking at the election as a whole, although encryption is only a very small part, this does not mean that it is not important, on the contrary, small topics with large differences will affect voter support longest. **

According to an online survey of long,000 voters in each state commissioned by DCG in early April, Crypto Assets has a strong presence in several swing-key states — Arizona, Michigan, Montana, Nevada, Ohio and Pennsylvania — with data showing that about 18 percent of voters — or 3.4 million people — hold digital asset in those states. And in 2020, Trump narrowly lost three swing states.

Perhaps for this reason, since the official start of the election in January this year, longing candidates have expressed their support for encryption. In addition to Trump, US presidential candidate Robert F. Kennedy Jr. (nephew of former President John F. Kennedy) is also a staunch supporter of encryption, "Crypto assets are our outlet for the Fed's addiction, which is the best hedge against inflation." It stripped the government and monopoly banking system of control, which used money printing to transfer wealth to billionaire Oligopoly while impoverishing ordinary Americans. If you agree that crypto equals freedom, please help me advance this vision as president. ”

** It seems that there has been a surge in partisan support, however, if you are careful to observe, there are not a few presidential candidates who oppose water in the election. ** Take Trump as an example, in 2019, his attitude towards Bitcoin was still very different, saying on platform X, "I am not a fan of Bitcoin and other Crypto Assets, Crypto Assets are not coins, and the value Fluctuation is large, there is no physical object, it comes out of shorts, it is not regulated, and these factors make Crypto Assets available for illegal activities, including drug trading and other illegal activities." In 2021, Trump once again reiterated his personal opinion, saying that "Bitcoin looks like a scam." I don't like it because it's another coin that competes with the dollar. ”

But just a few years later, Trump has become a supporter and follower of encryption, trying to make NFTs great again, and even insinuating that an 80-year-old man is not proficient in using encryption software.

The reason for this is that the rapid development of the encryption industry in the United States has become an important reason. In 2022, 9.6% of U.S. adults owned Crypto Assets, up from 0.6% in 2015. After the passage of the ETF, more long Wall Street institutions have also entered the encryption world, and according to the data, 11 ETF have absorbed $52 billion in assets. If you observe the United States, the US government has more than 200,000 BTC custody on the on-chain, worth more than $6 billion, becoming the first mainstream government Holdings in the world. In addition, encryption itself expresses the separation of censorship and control, which is highly consistent with the current American society with ideological detachment and a huge gap between rich and poor. Due to its natural financial advantages, even in some third world countries, such as Nigeria and Ethiopia, Crypto Assets have surpassed fiat currencies. **

SDCPC survey of encryption holders in the United States, source: SDCPC

Of course, even so, the young people who actually occupy the votes are still in the minority, which may be the reason why Biden's party is not interested in them. From a deeper analysis, the establishment behind the Biden Party is longest conservative and traditional, and party supporters themselves have expressed strong opposition to Crypto Assets that threaten the hegemony of their country's fiat currency. However, in order to show independence, other parties will automatically choose the opposite political position, and the call for freedom and equality has become an important means of partisan competition.

If you look closely, neither the Democratic Party nor the Republican Party has actually studied and paid attention to the encryption field. **For candidates, the encryption industry is just a tool, a basis for representing votes, and it is enough to show an appropriate attitude when necessary, and even candidates who claim to support in advance may face other pressures to fight back after taking office, after all, Crypto Assets is only 1% of the financial volume compared to the traditional world, and it is far less important than the welfare and education issues that affect the people. From this perspective, all partisan attention to encryption is only temporary. **

Sadly, partisan support is particularly important in the encryption space. In recent times, the SEC's regulatory tentacles on encryption have gradually extended from centralized institutions to decentralization projects, and Metamask, Uniswap, and self-hosted wallets have become regulatory targets, which undoubtedly makes the encryption market panic. If Decentralization projects are considered to violate securities laws, other projects can only be played people for suckers.

In the run-up to the election, frequent law enforcement activities have also created a sense of conspiracy theories in the market, and the SEC seems to be taking sides. In this context, the encryption industry can only fight for its rights and interests through the general election. According to a report by Public Citizen, external lobbying teams related to the Crypto Assets industry have raised more than $102 million to lobby for upcoming U.S. congressional elections to support digital asset-friendly candidates. David Bailey, president of marketing at Azteco, tweeted that they have been working with the Trump campaign over the past month to set the Bitcoin and Crypto Assets policy agenda.