Lumoz Research Report: Modular Blockchains Greatly Reduce ZKP Computation Costs

Summary

Since its inception, Ethereum has continuously faced scalability issues. Scaling remains a crucial technology for achieving Web3 mass adoption. Rollup is a mainstream Layer 2 scaling solution, and its core idea is to publish “packaged” transaction data blocks on-chain, thereby reducing the difficulty of transaction validity verification. Based on different data validity verification methods, Rollups can be further divided into Optimistic Rollups and ZK Rollups.

Currently, the ZK Rollups field faces three main pain points: the high cost of computing ZKPs, the reliance on centralized Provers by most zk rollups, and the complexity of zero-knowledge technology making it difficult to build ZK-rollups compatible with the EVM. Additionally, many ZK Rollups use third-party bridging projects for interactions, posing certain security risks.

Lumoz’s co-founder and CEO, NanFeng, graduated from Tsinghua University. The core team has been investing nearly five years in ZK technology since 2018. From the beginning, Lumoz has been committed to making zero-knowledge computation more efficient and accessible.

Lumoz has completed two rounds of incentivized testnets, with a total of 282K participants, 28,137 Validators, 145 PoW miners, and over 60 deployed ecosystem projects. In May 2024, Lumoz announced the completion of a new round of strategic financing, valuing the company at $300 million. To date, Lumoz has raised a total of $14 million, with investors including OKX Venture, Hashkey Capital, Polygon, Kucoin Ventures, IDG Blockchain, Gate Ventures, SevenUpDAO, and Sweep Ventures.

Lumoz provides a modular computation layer for ZK Rollup, utilizing a hybrid consensus mechanism of PoS and PoW. The ZK-PoW algorithm network significantly reduces ZKP computation costs while addressing the issue of centralized Provers. It also introduces zkVerifier to validate ZKPs generated by zkProver. The hardware requirements for zkVerifier nodes are relatively low, and the upcoming Node Sale will enhance the decentralization and censorship resistance of the verification network.

Lumoz RaaS Launch Base is highly compatible with mainstream ZK Rollups technology stacks, including Polygon zkEVM, zkSync, Scroll, and Starknet. It is currently the project with the broadest compatibility with ZK Rollups technology stacks, effectively addressing the compatibility issues between ZK technology and EVM in the ZK Rollup field. It provides customized ZK Rollup solutions with one-click chain deployment. Current clients include ZKFair, Merlin Chain, Coin98, Ultiverse, Mari1x, Fortnite (Efuse), and Viction.

Lumoz proposes the NCRC Protocol, which achieves seamless cross-chain interoperability between multiple ZK Rollups through a “Native Bridge.” User assets do not pass through any third-party protocols, ensuring the process is secure and trustless.

Lumoz adopts a dual-token economic model, where the utility token MOZ can be used for transaction fees and resource usage fees, while the equity token esMOZ is a reward for participants and can also be used to delegate zkVerifier nodes. esMOZ tokens can be exchanged for MOZ tokens at different redemption periods and rates. Currently, Lumoz has not disclosed the latest token distribution details in its whitepaper.

Looking ahead, the RaaS field has promising development prospects, and ZK Rollup will become the mainstream Rollup solution. Community operations and ecosystem building may replace technology as the main challenges in constructing Rollups. With its deep expertise in ZK technology, Lumoz is poised to continue leading the ZK RaaS field and promote the large-scale application and adoption of ZK-Rollup technology.

1. Previous Summary

1. Rollup scaling solution

Since its inception, Ethereum has continuously faced scalability issues. Scaling remains a crucial technology for achieving Web3 mass adoption.

Scalability solutions built on Ethereum without requiring any modifications to the underlying Layer 1 protocol are called Layer 2 solutions. These solutions can process transactions without interacting with the Ethereum network and anchor their security to Ethereum’s Layer 1 through smart contracts, effectively adding an extra layer of network off-chain, hence the name Layer 2. According to L2 Beat, the number of transactions processed by Layer 2 currently has reached 10 times that of the Ethereum mainnet, significantly expanding Ethereum’s limited transaction processing capacity.

Figure 1 Number of transactions processed by Layer2 https://l2beat.com/scaling/activity

As a highly decentralized public blockchain, Ethereum has become very congested, and gas fees have become extremely expensive. Therefore, an increasing number of decentralized applications, including DeFi and GameFi, are migrating their protocols to these Layer 2 solutions to optimize user experience and reduce operating costs. According to L2 Beat, as of June 16, 2024, the total value locked (TVL) in all Layer 2 solutions has reached 12.4418 million ETH, equivalent to approximately $44.363 billion. In comparison, the TVL on the Ethereum mainnet is 17.88 million ETH, equivalent to approximately $65.634 billion, meaning the TVL in all Layer 2 solutions is close to 70% of that on the Ethereum mainnet.

Figure 2 The total amount of locked positions in Layer2 https://l2beat.com/scaling/summary

Figure 3 Ethereum mainnet lock-up amount

https://defillama.com/chain/Ethereum?currency=USD

Rollup is a mainstream Layer 2 scaling solution, and its core idea is to publish “packaged” transaction data blocks on-chain, thereby reducing the difficulty of transaction validity verification. Rollup technology addresses issues previously exposed by Plasma, providing the same data availability and security as Ethereum Layer 1 (Ethereum itself), while significantly increasing network throughput and reducing per-transaction costs. In the architecture of modular blockchains, the Rollup solution essentially outsources the execution layer (and other layers) of the chain.

Figure 4 Modular Stacks Modular Stacks

https://members.delphidigital.io/reports/the-complete-guide-to-rollups

2. Two Rollup solutions: ZK Rollups vs. Optimistic Rollups

Based on their methods of data validity verification, Rollups can be further divided into Optimistic Rollups and ZK Rollups. Optimistic Rollups rely on an “optimistic” assumption that most transactions are valid, allowing challenges and rollbacks when fraudulent behavior is detected. ZK Rollups, on the other hand, use Zero Knowledge Proof (ZK) technology to ensure that transactions processed off-chain are valid and correct, providing higher security and efficiency. Below are the main advantages and disadvantages of these two Rollup solutions:

表 1 ZK Rollups vs. Optimistic Rollups

Data source: compiled by the author based on existing literature

Although ZK-Rollup has many advantages and is seen by Vitalik as a long-term scaling solution for Ethereum, it faces several technical challenges that currently limit widespread adoption. According to Defilama data as of June 16, 2024, Optimistic Rollups such as Arbitrum, Blast, Base, and Optimism continue to dominate the Rollups space.

Figure 5 TVL pie chart of Rollup track https://defillama.com/chains/Rollup

3. Pain points of ZK Rollups

Specifically, the pain points currently faced by the ZK Rollups sector are:

- The high cost of computing Zero Knowledge Proofs (ZKP), with most ZK Rollups relying on centralized Provers.

Several ZK Rollups are currently operating on the Ethereum mainnet, including Polygon zkEVM and zkSync. For a ZK-Rollup, the computation cost of ZKPs far exceeds the cost of Data Availability (DA), often accounting for more than 50% of the total cost. Moreover, many of these ZK-Rollup projects have not decentralized their proving processes. For instance, in the beta mainnet of Polygon zkEVM, reliance on trusted aggregators to submit ZKPs is prevalent, and zkSync era follows a similar approach.

Figure 6 The computing cost of mainstream ZK Rollups is very high (pink in the picture)

https://l2beat.com/scaling/costs

- The complexity of zero-knowledge technology makes building EVM-compatible ZK-Rollups difficult.

EVM compatibility refers to translating Solidity smart contract code into specific virtual machine bytecode for ZK Rollups. The EVM was not originally designed with zero-knowledge proof technology in mind. For instance, to generate valid proofs for arbitrary programs executed by the EVM using zk-SNARKs, mathematical representations and proof logic must be created for each opcode of the EVM. This requires complex cryptographic transformations and presents compatibility challenges for existing smart contracts.

- Additionally, many ZK Rollups currently use third-party bridging projects for interoperability, posing certain security risks.

In this era of multiple Rollups, the coexistence of various Layer 2 solutions makes seamless interoperability between different solutions crucial. Existing cross-Rollup bridging solutions often involve deploying new sets of inter-chain contracts on Rollup chains and leveraging multi-chain liquidity incentives to achieve cross-chain asset functionality. However, these solutions are not universally applicable for message-based cross-chain interactions and entail risks of centralization and trust. In July 2023, Binance-backed cross-chain bridge project Multichain ceased operations after its CEO was detained by authorities, with funds exceeding $265 million flowing out of Multichain according to SlowMist monitoring. The sudden collapse of a leading cross-chain bridge project underscores the significant risks of centralization and trust associated with using third-party cross-chain bridge projects.

2. Lumoz establishment background

Figure 7 Lumoz https://lumoz.org/

NanFeng, co-founder and CEO of Lumoz, graduated from Tsinghua University and previously worked at ByteDance. As a core developer, he has been deeply involved in the foundational setup and iterative development of multiple projects. He is also the founder of Trustless Labs. The core team has been dedicated to ZK technology since 2018, investing nearly five years in its development. From the outset, Lumoz has aimed to make zero-knowledge computing more efficient and accessible, encapsulated in their mission: “Making ZK-Rollup Within Reach.”

Throughout Lumoz’s development journey, the team has gradually recognized the security and centralization issues in the current Rollup landscape of cross-chain bridges and has actively worked to address them. They have also capitalized on the trend of RaaS (Rollup as a Service) development, leading to the successful launch of ZK RaaS Launch Base and expanding their business footprint accordingly.

Figure 8 Lumoz ecological related data https://lumoz.org/compute-layer

Lumoz (formerly Opside) officially launched its testnet at the end of May 2023 and smoothly operated for five months with continuous strong participation from the global community. Over 450,000 participants joined the Pre-alpha testnet, resulting in an impressive 13,580,057 transactions. The testnet saw over 140 miners and more than 28,000 nodes actively participating. Ecologically, over 100 high-quality projects applied for participation, with 14 projects successfully launching dedicated zkEVM application chains through Opside ZK-Rollup LaunchBase, which have been running steadily.

Lumoz is expected to launch its mainnet in Q3. As of now, Lumoz has processed 2 million transactions, submitted over 4.79 million ZKPs, and has more than 28,000 nodes. Additionally, over 16 projects have passed official audits and have deployed custom zkEVM application chains on the Lumoz platform.

Figure 9 Lumoz completed a strategic round of financing, with SevenUPDAO participating in the investment

https://mirror.xyz/lumozorg.eth/Fz0dF5HVMdbbI--9lzst60KuKOp5YGbb75Z0RmxiB24

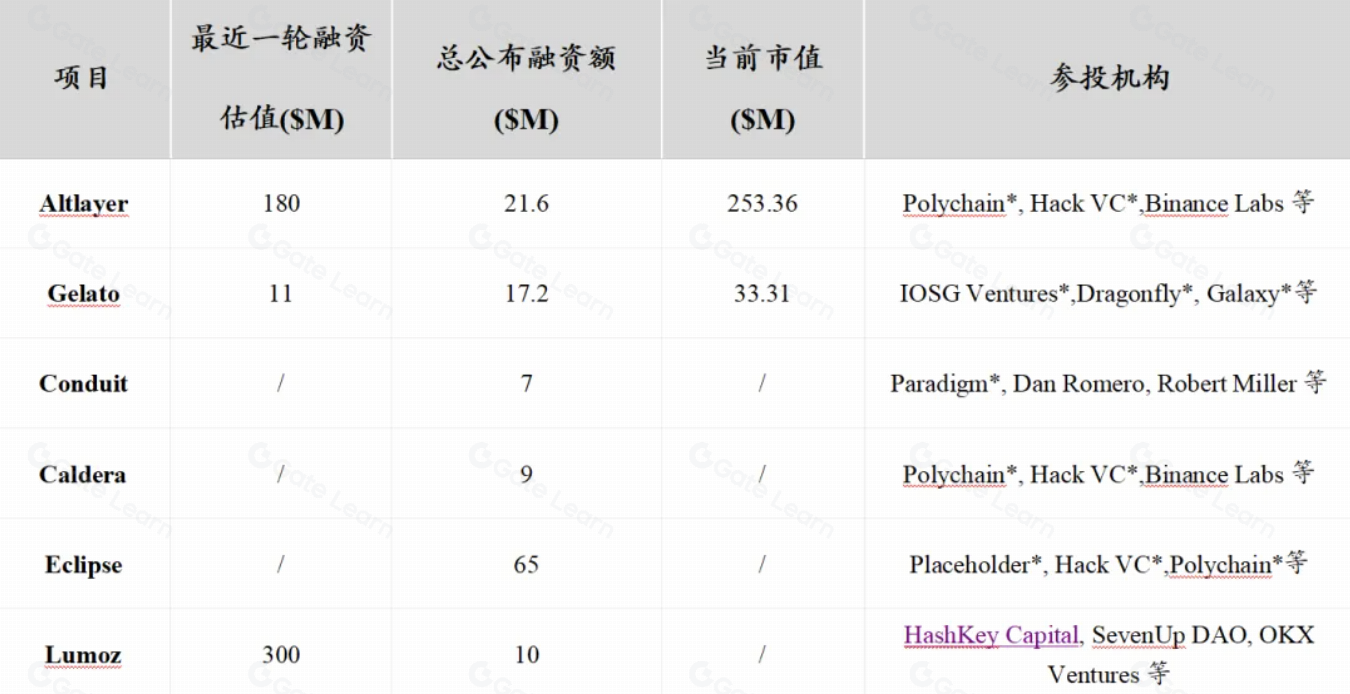

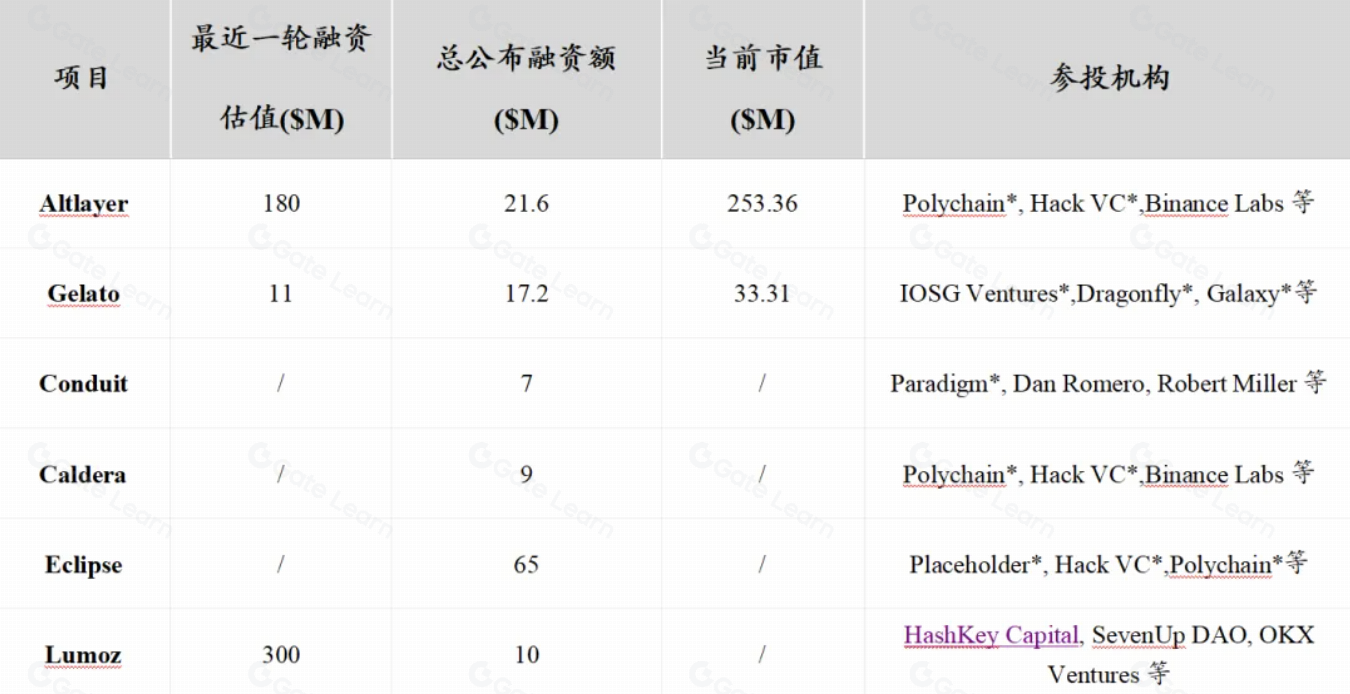

In March 2024, Lumoz, the modular computing layer and ZK-RaaS platform, conducted its first round of financing with a valuation of $120 million. On May 29, 2024, Lumoz officially announced the completion of a new strategic financing round. Investors included IDG Blockchain, SevenUpDAO, Sweep Ventures, among others. The specific amount of funding has not been disclosed. With this strategic round, Lumoz achieved a valuation of $300 million, surpassing Altlayer’s current market value of $253 million, indicating strong confidence in Lumoz’s future development prospects.

Furthermore, based on Altlayer’s current market value multiplied by a factor of 1.4 (the multiple of pre-listing financing valuation), Lumoz could potentially achieve a market value of at least $420 million upon listing. Alternatively, using Gelato’s multiplier of 3, Lumoz’s market value post-listing could exceed $900 million.

Table 2 RaaS track project financing information

Note: the data sources are primarily from Rootdata and ICO Analytics, with ‘*’ indicating lead investors, as of June 16, 2024.

3. Lumoz provides a modular computing layer for ZK Rollups

Figure 10 Lumoz as a decentralized modular computing layer

https://lumoz.org/compute-layer

Rollups typically consist of settlement layers, execution layers, consensus layers, and data availability layers. However, for ZK-Rollups, an additional core module is required, known as the Prover Layer. Currently, Lumoz is the sole provider in the modular Rollup space offering a modular Prover network. Presently, Lumoz miners provide the ZKP computational power for the Merlin Chain. With the upcoming launch of Lumoz mainnet, Merlin Chain will be connected to Lumoz’s decentralized ZK computation network. This network operates on a ZK-PoW algorithm, allowing anyone to contribute computational power to Merlin Chain and receive Lumoz token rewards.

By combining robust computing resources with EigenLayer’s re-staking mechanism, Lumoz has created an efficient and secure computing service ecosystem. The Lumoz computing layer architecture is highly integrated and collaborative, with the following key components and functionalities:

Figure 11 Lumoz computing layer architecture

https://docs.lumoz.org/understand-lumoz/the-avs-computing-layer-based-on-eigenlayer

- On Ethereum, EigenLayer standards are utilized to construct Active Verification Services (AVS), providing trust endorsements, and enhancing AVS security through the re-staking mechanism at the feature layer.

- The EVM chain (L2) supports a diverse blockchain environment compatible with Ethereum Virtual Machine (EVM), such as Polygon zkEVM, Polygon CDK, ZKStack, and Scroll, ensuring extensive compatibility and scalability.

- Lumoz AVS Oracle is responsible for retrieving and storing data from EVM-compatible chains to ensure high data availability and integrity, providing a solid data foundation for the computing layer.

- Lumoz Chain serves as the core management layer for the entire computing layer, handling task scheduling, reward distribution, and managing zkProver and zkVerifier, including the process of adding and removing nodes. zkProver nodes execute specific computing tasks, while zkVerifier nodes verify the execution results.

Lumoz employs a hybrid consensus mechanism combining PoS (Proof of Stake) and PoW (Proof of Work) in its architecture. Specifically, PoW is used for zkProver, while PoS primarily applies to zkVerifier (potentially serving as the Rollup sequencer). This article will first introduce Lumoz’s ZK-PoW algorithm in the context of PoW consensus, explaining how it addresses the current challenges faced by ZK Rollups related to the high computational costs and centralization issues of ZKP (Zero Knowledge Proofs). Subsequently, the article will delve into detailed analysis of Lumoz’s progress in the PoS consensus mechanism.

1. Lumoz’s ZK-PoW algorithm network greatly reduces the computational costs of ZKP (Zero Knowledge Proof) calculations.

To address the computational cost and centralization issues of ZKP (Zero Knowledge Proof), Lumoz has proposed the ZK-PoW algorithm. Its main features include:

PoW reward distribution mechanism

Lumoz provides a unified marketplace for ZKP computation, encouraging miners to generate ZKPs for these zk-rollups. During the Pre-Alpha testnet phase, based on the PoW algorithm, each Rollup within Opside blocks submits a sequence according to specific rules. The current block’s PoW rewards are distributed among registered Rollup slots based on the number of batches included in the sequence. Miners can freely choose to participate in ZKP computation for one or multiple Rollups. In the future, each sequence will be priced differently based on factors such as the type of ZK-Rollup, the number of Rollup transactions included, gas usage, and other estimated workload factors.

Miners must stake a corresponding amount of tokens for each Rollup in the system contract to submit ZKPs. Rewards for miners submitting ZKPs are also distributed based on their staking ratio, thereby discouraging malicious behavior of miners submitting ZKPs multiple times.

ZKP’s two-step submission algorithm

First, miners submit the Proofhash. Within a specific time window for a given sequence, multiple miners are allowed to participate in computing the ZKP. Each miner does not directly submit the original proof but computes the proof hash of (proof/address) and submits it to the contract.

Next, miners submit the ZKP. After the time window, miners submit the original proof, and it is verified against the previously submitted proof hashes. Miners whose proofs pass verification are eligible for PoW rewards, which are distributed proportionally based on the amount they have staked for participation.

Figure 12 ZKP’s two-step submission algorithm

https://lumoz.org/compute-layer

Lumoz ingeniously employs a two-step submission algorithm for ZKPs, using a model of submit-first-verify-later to eliminate unnecessary proof and address aggregation calculations. Moreover, this two-step submission algorithm enables parallel ZKP computation and sequential submission, allowing miners to concurrently execute multiple ZKP generation tasks, significantly accelerating ZKP generation efficiency. The Lumoz team has also optimized the ZKP recursive aggregation algorithm, maximizing cluster resources to further enhance ZKP computation speed.

In a real stress test environment, miners operate a cluster of 20 machines, comprising 128-core CPUs and 1TB of RAM. During testing, the transaction rate stabilized around 27.8 TPS in approximately 40 minutes. Under the same conditions, Lumoz reduced the average confirmation time of transactions from about 5-6 minutes to approximately 3 minutes, thereby increasing ZKP generation efficiency by approximately 80%. Looking ahead, as more ZK-rollups and miners join the ZK computation market, Lumoz’s PoW algorithm is expected to deliver even more pronounced efficiency gains.

ZK-PoW V2.0 version further optimizes the calculation process

Compared to V1.0, version 2.0:

- The original service has been split into three sub-modules: proof generation, proof management, and proof submission, resulting in a clearer structure, lower coupling, and increased robustness.

- The proof generation module, Proof Generator, has added a

startBatchparameter to help new miners better keep up with mining progress. - The proof management module, Proof Manager, has been improved compared to the old version. It now promptly resends proofs in case of miner service restarts or other reasons causing proof submission failures, ensuring miners’ interests are protected. The resend mechanism not only addresses failed proof submissions but also handles scenarios where proofs were not submitted, ensuring the security of the Rollup chain.

- The proof submission module, Proof Sender, uses three thread-safe priority caches to implement a two-step transaction submission process. Compared to previous versions, it reduces the use of global locks, ensuring timely submission of proofs at lower heights and protecting miners’ interests. Additionally, the overall service workflow is clearer, reducing the number of threads and resource consumption during program execution.

Figure 13 ZK-PoW V2.0 Architecture

https://mirror.xyz/lumozorg.eth/zZy2munlvNY7D4DG6lpcccrx1IZTJ7yb3jXOwd1O9Hg

Pressure test results: In version 2.0, using 10 machines with 64 cores each, 566 batches of proofs were completed in 7 hours, 38 minutes, and 40 seconds, averaging 48.62 seconds per proof. In multi-miner scenarios, version 2.0 shows an overall 50% efficiency improvement in zk proof generation compared to version 1.0.

2. Introducing zkVerifier node verification mechanism, establishing a decentralized and censorship-resistant verification network.

The Lumoz network undertakes the crucial responsibility of managing the entire network’s data input and output. To ensure the security, accuracy, and decentralization of the data processing process and its outcomes, Lumoz has introduced a node verification mechanism. This mechanism involves zkVerifier nodes validating the ZKPs generated by zkProvers. The specific workflow is as follows:

Figure 14 zkVerifier node verification mechanism

https://docs.lumoz.org/zkVerifier-node-explained/how-do-zkverifier-node-work

Firstly, after the proofs generated by zkProvers are submitted to the Lumoz chain, Lumoz sends verification tasks to multiple zkVerifier nodes, which independently perform distributed verification. Secondly, consensus on the validity of the proofs is achieved when at least two-thirds of zkVerifier nodes confirm their validity, ensuring the authority and consistency of the verification results. Finally, validated proofs and their outcomes are transmitted back to the Lumoz blockchain via the Lumoz AVS Oracle, with task results recorded and responded to on the Lumoz chain through the Task Manager contract.

The hardware requirements for zkVerifier nodes are relatively modest, allowing broader participation in the Lumoz ecosystem and further enhancing the decentralization of the Lumoz network.

Figure 15 zkProver node hardware configuration requirements

https://docs.lumoz.org/purchase-zkverifier-node-and-set-up/set-up-node

zkVerifier Node Sale will open soon

Lumoz has introduced a licensing system for zkVerifier node admission: licenses serve as official recognition of zkVerifier node identities and are essential binding conditions when setting up zkVerifier nodes. These licenses exist in the form of NFTs (Non-Fungible Tokens), ensuring each license’s uniqueness and non-replicability. For those who prefer not to run nodes themselves, there is a delegation mechanism where ezMOZ tokens or licenses can be delegated to other node operators, while still receiving rewards. Licenses can also be freely transferred between users when needed.

图 16 zkVerifier Node Sale https://node.lumoz.org/

zkVerifier node licenses will officially go on sale starting June 17, 2024. Each zkVerifier node will receive 40 million Lumoz points (LP) prior to the Token Generation Event (TGE), with an additional linear unlocking of 1 million LP per day from June 25 to August 4. These LP can be exchanged for mainnet tokens post-TGE. Following the TGE, zkVerifier nodes will continue to receive empowerment, with a continuous linear unlocking of 25% of Lumoz tokens over 36 months, along with potential participation in airdrops from Lumoz ecosystem projects.

According to Lumoz’s latest policy, there will be a total of 100,000 licenses divided into 10 different price levels. They will be sold on a first-come, first-served basis, with prices increasing in later stages, incentivizing earlier purchases for higher returns. The sale will be divided into three phases: presale phase (opens on June 17, 2024, at 15:00 UTC+8), whitelist acquisition phase (also opens on June 17, 2024, at 15:00 UTC+8), whitelist sale phase (opens on June 25, 2024, at 15:00 UTC+8), and public sale phase (opens on July 3, 2024, at 15:00 UTC+8), where licenses will be available to all users.

Figure 17 Lumoz License Tiers

https://docs.lumoz.org/purchase-zkverifier-node-and-set-up/license-tiers

Team bonus system for node points activities

Figure 18 Team participation mechanism of zkVerifier node points activity

https://docs.lumoz.org/zkverifier-lumoz-points-campaign

When staking licenses, users have the option to join an existing team or create a new one, with a maximum of 50 members per team. The level of a team is determined by the total number of licenses it holds, with higher levels granting greater weight when allocating Lumoz points. Lumoz employs this fractal design to attract more users and investors to participate in their ecosystem.

Refund mechanism guarantees user interests

In addition, to maximize protection of global community users’ rights, Lumoz has established a refund mechanism. The refund window will open six months after the Token Generation Event (TGE) begins, with the duration of the window yet to be determined. If users are dissatisfied for any reason, they can apply for a refund. Lumoz will unconditionally refund 80% of the purchase node payment amount. Users must return all generated tokens and NFTs (Non-Fungible Tokens).

Important source of income before TGE

Lumoz’s zkVerifier node sale has become a crucial source of income for the project. In blockchain projects, early revenue generation is vital for sustained development and success. This not only provides necessary financial support but also enhances confidence among investors and community members. It’s important to note that blockchain projects shouldn’t rely solely on Initial Exchange Offerings (IEOs) for revenue. While IEOs are effective for fundraising, they shouldn’t be the sole avenue as over-reliance can limit financial flexibility and increase project risks in the long term.

Specifically, Lumoz’s zkVerifier node sale is expected to impact the project by demonstrating confidence and commitment to future development. By selling nodes, the project signals to the outside world that it has sufficient funds and resources to drive long-term growth. This helps attract more investors and partners to participate in the project’s success.

Furthermore, node sales reflect community value and cohesion. Purchasing nodes allows users to become part of the project’s community, fostering a closer connection with the project. This relationship not only enhances users’ sense of belonging and loyalty but also promotes communication and collaboration among community members. An active and engaged community is crucial for the project’s sustained growth and success.

4. Lumoz RaaS Launch Base is highly compatible with mainstream ZK Rollups technology stacks

Rollup as a Service (RaaS) is a product designed to launch custom Rollups for new blockchain applications. Similar to software-as-a-service (SaaS) products, users do not need to maintain or host any part of the service product, eliminating the need for complex software and hardware management.

From the perspective of whether code needs to be written, RaaS projects can be divided into 2 categories: SDK and No-Code solutions. SDK solutions provide developers with a comprehensive set of general software development kits, making deploying Rollups as straightforward as deploying smart contracts. No-Code solutions, as the name suggests, allow for deploying Rollups without writing a single line of code (one-click chain launch). Projects like OP Stack, Rollkit, Dymension, Sovereign, and Stackr fall under SDK solutions. Projects offering no-code deployment of Rollups include Lumoz, AltLayer, Eclipse, and Caldera.

Figure 19 RaaS projects can be divided into 2 categories

https://foresightnews.pro/article/detail/27089

In the RaaS space, there are already various projects like AltLayer and Gelato that enable no-code chain launching. However, Lumoz RaaS Launch Base stands out by integrating mainstream Rollup solutions in the blockchain industry such as Polygon zkEVM, zkSync, Scroll, and Starknet. It is currently the most broadly compatible project in terms of supporting the ZK Rollups technology stack. This capability allows Lumoz to address compatibility pain points between ZK technology and EVM, making it uniquely positioned in the ZK Rollup ecosystem.

Table 3 Technology stacks supported by various mainstream RaaS projects

Note: The data mainly comes from the official websites and white papers of each project, and is compiled with reference to articles on the Internet.

From the above table, it’s clear that Lumoz has established collaborations across various modules of the Rollup ecosystem. For instance, besides Layer1 integration, Lumoz has partnered with third-party DA layer projects such as Celestia, Eigenlayer, Ethstorage, Avail, and Espresso. Additionally, Lumoz collaborates with Espresso Systems, Radius, Metis, and Astria to offer decentralized sequencer options to its clients.

According to Vitalik’s standards, zkEVM can be categorized into the following types:

Figure 20 Vitalik “Different types of zkEVM”

https://learnblockchain.cn/article/6369

- Type1 zkEVM: Fully equivalent to Ethereum.

- Type2 zkEVM: Fully compatible with Ethereum Virtual Machine (EVM).

- Type3 zkEVM: Almost compatible with Ethereum Virtual Machine (EVM).

- Type4 zkEVM: Compatible with higher-level languages.

Lumoz’s supported frameworks precisely include these types of zkEVM, offering customers a wider range of choices.

Figure 21 Classification of mainstream ZK Rollup projects

https://learnblockchain.cn/article/6369

Figure 22 Various zkEVM mainstream projects

https://learnblockchain.cn/article/6369

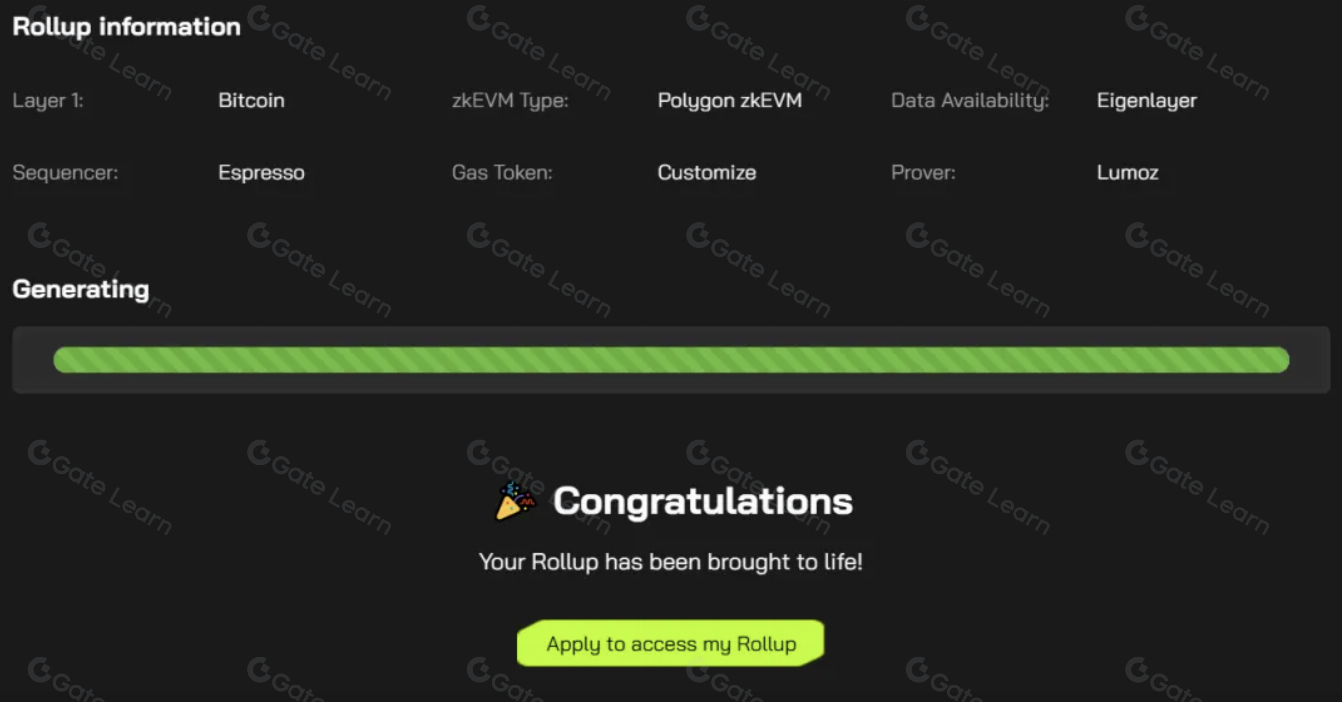

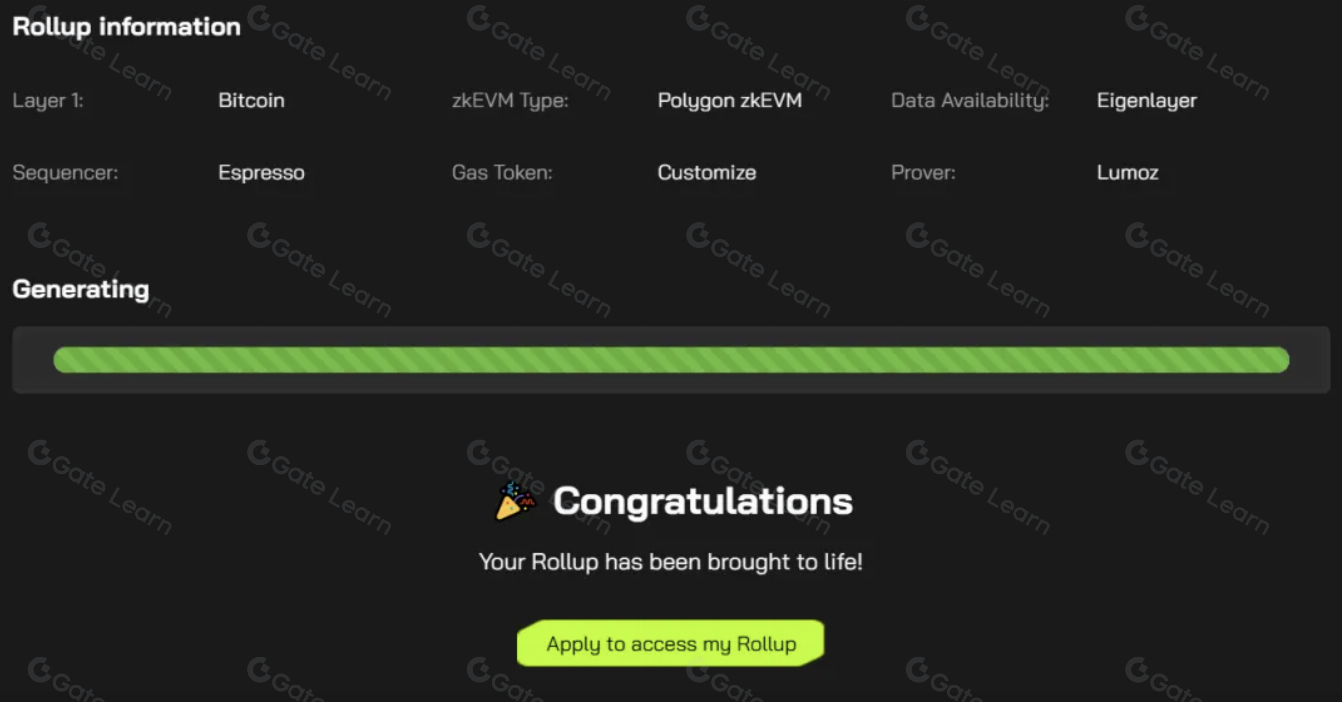

1. One-click chain launch meets the customized ZK Rollup needs of project parties

Users can independently select various components required for Layer 2 in their Launch Base, including SDKs, settlement layers, data availability layers, sequencers, and more. The process requires no code, significantly reducing the difficulty of launching ZK Rollups, allowing teams to focus on ecosystem operations and non-technical aspects.

Figure 23 Lumoz ZK-RaaS Launch Base sends the link with one click

https://lumoz.org/launchbase

For example, some of the customers currently using Lumoz RaaS services include:

- ZKFair is the first community-driven ZK-L2 based on Polygon CDK and Celestia DA, with technical support provided by ZK-RaaS provider Lumoz. ZKFair uses the stablecoin USDC as its gas token. It ensures 100% EVM compatibility, excellent performance, minimal fees, and robust security. ZKFair is a experimental L2 network that is 100% owned and driven by the community.

- Merlin Chain integrates ZK-Rollup networks, decentralized oracle networks, data availability, and on-chain BTC anti-fraud modules. It aims to empower native Bitcoin assets, protocols, and products on Layer 1 through its Layer 2 network, injecting vitality into the Bitcoin ecosystem.

2. Support Op Stack + ZK Fraud Proof Layer 2 architecture

Additionally, on April 18, 2024, Lumoz announced that its modular computation layer will support the Op Stack + ZK Fraud Proof Layer 2 architecture.

OP Stack is a generic development stack used to build L2 blockchain ecosystems.

Figure 24 Op Stack + ZK Fraud Proof Layer 2 architecture

https://mirror.xyz/lumozorg.eth/eFpFnP40loyL3idRitTT_MNB3kW8R_6arZ7bgtmoRlc

Similar to Steven Li and AltLayer’s proposal of the ZK Optimistic Rollup model, the Op Stack + ZK Fraud Proof architecture is a new design that integrates validity proofs based on zero-knowledge proofs into Optimistic Rollup technology. When challengers point out incorrect data submissions by sequencers, they submit a challenge to Layer 1. The sequencer must generate the corresponding ZK proof within a limited challenge period and submit it to the Layer 1 contract for verification. If the verification confirms the data’s validity, the challenge is invalid; otherwise, the challenge succeeds. This approach combines the advantages of Optimistic Rollup and ZK Rollup, maintaining low costs while effectively reducing waiting times.

5. NCRC Protocol implements trustless ZK-Rollup

A native cross-chain bridge

As mentioned earlier, third-party bridges may offer cheaper and faster cross-chain experiences, but they introduce additional trust costs and security risks. In fact, each ZK-Rollup comes with an L1<>L2 bridge built-in, referred to by Lumoz as a native bridge. Unlike third-party bridges based on liquidity solutions, the native bridge operates as a unique “mint-burn” cross-chain mechanism. It ensures security through zero-knowledge proofs while maintaining trustlessness. To achieve NCRC between multiple Rollups, the following two prerequisites must be met:

- These Rollups must be of the ZK-Rollup type.

- These Rollups must reside on the same L1.

Rollups meeting these conditions theoretically have the same security level as the underlying L1. Similarly, the security level of native bridges between these Rollups is equivalent, requiring no trust between them. All NCRC transactions are validated through proof of validity, which forms the basic security guarantee for NCRC.

1. The RRC contract provides data retrieval services.

The fundamental reason ZK Rollups cannot communicate with each other is because their contracts on Layer 1 (Ethereum mainnet) are unrelated. They are unaware of each other’s existence and cannot communicate directly through native Rollup bridges. To address this, Lumoz will deploy the RRC contract (Rollup Recognition Contract) on each Layer 1, enabling Rollups to discover and identify each other. The RRC manages all participating zk-rollups in the NCRC, including adding, pausing, and exiting Rollups. Each Rollup in the RRC is assigned a dedicated Rollup ID.

2. The process of native bridges for cross-Rollup transactions hides underlying complexities, optimizing user experience.

For users, NCRC operations are identical to native Rollup bridges. Throughout the cross-chain process, assets flow through the following path: Rollup1 -> Rollup1’s L1 bridge contract -> Rollup2’s L1 bridge contract -> Rollup2. In other words, users’ assets do not pass through any third-party protocols; they only require the use of Rollup’s native bridges. The entire process is secure and trustless.

Figure 25 The process of native bridge cross-rollup transaction

https://mirror.xyz/lumozorg.eth/0P5S75pYf4GtjYG4tka4whLHI7a1YC-YVS0uzgaSlzI

When users initiate cross-chain operations from Rollup1 to Rollup2, the technical process actually involves three entities: Rollup1, L1 (Layer 1), and Rollup2. However, users do not need to be aware of L1’s presence in this process; their experience is simply a direct transfer from Rollup1 to Rollup2. Behind the scenes, cross-chain assets undergo two bridging operations on L1, creating a seamless connection from Rollup1 to Rollup2 in the user’s perception. These L1 operations are handled automatically, requiring no additional actions from the user. From the user’s perspective, their current Rollup can execute cross-chain operations to L1 and any other Rollup. This design enhances user experience by smoothing out the process and hiding underlying complexities.

6. Lumoz’s dual-token economic model

If we disregard the zkVerifier’s License aspect, Lumoz adopts a dual-token economic model.

1. Functional Token MOZ

- Transaction Fees (Gas): All transactions within the Lumoz network require MOZ tokens as transaction fees, ensuring the network’s secure operation and smooth transaction processing.

- Resource Usage Fees: Users need to pay MOZ tokens as resource usage fees when utilizing Lumoz network’s zero-knowledge proof (ZKP) computations and artificial intelligence (AI) services, providing necessary economic incentives for the network.

2. Equity token esMOZ

- Incentivizing Participation: esMOZ tokens serve as rewards for nodes that contribute computing power, security, and stability to the Lumoz network, enhancing incentives and attracting participants to join the network. This incentive mechanism helps strengthen the network’s security and stability.

- Delegating zkVerifier Nodes: Users can use esMOZ tokens to participate in delegation, selecting trusted nodes for delegation voting. This promotes decentralized governance of the network and allows participants to earn rewards.

- Redemption Mechanism: esMOZ tokens can be redeemed for MOZ tokens at varying redemption periods and rates, offering users flexible redemption options. This redemption mechanism provides users with more flexibility and choice.

7. Industry Outlook

1. The prospects for RaaS development are promising

The future trend in the crypto industry includes a significant move towards applications spanning multiple chains and utilizing multiple Rollups. With an increasing number of projects seeking higher performance, lower costs, and customizable services from public chains, the rise of RaaS establishes a foundation for meeting these demands.

Firstly, from a customization perspective, RaaS facilitates the development of applications based on modular Rollups, enabling developers to flexibly meet specific business requirements and inject more innovation into the ecosystem.

Secondly, in terms of performance, Rollup technology as a Layer 2 solution significantly enhances Ethereum network throughput and reduces costs. In this context, RaaS ensures developers can deploy their applications cost-effectively and securely, benefiting from the scalability offered by Layer 2 solutions like those enabled by the Canun upgrade, which introduces “blob transactions” to store L2 transactions more efficiently and affordably, thereby improving transaction speed and throughput.

Lastly, from a business model perspective, RaaS demonstrates vast potential for development. As congestion on the Ethereum main network intensifies with the proliferation of on-chain applications, demand for Rollups and RaaS is expected to grow steadily.

2. ZK Rollup will become the mainstream solution for Rollup

Vitalik has repeatedly stated that ZK Rollup will replace Optimistic Rollup as the long-term scaling solution for Ethereum. As previously described, ZK Rollup offers distinct advantages over Optimistic Rollup, and with continuous improvements in ZK technology and better compatibility with the EVM, ZK Rollup is poised to become the mainstream Rollup solution. Of course, there is also the possibility of more hybrid scaling solutions emerging, such as OP Stack+ZK Fraud Proof, which combine the strengths of both Optimistic Rollup and ZK Rollup.

3. Community management and ecosystem development are increasingly replacing technology as the primary challenges in building Rollups.

The rise of RaaS enables developers to build and deploy Rollups more easily and quickly, reducing the technical barriers (though technology remains a crucial factor in Rollup development). Additionally, emerging Rollups like Base, Manta Pacific, and Blast have gained rapid market acceptance by leveraging existing tools for low-cost Rollup construction and focusing on ecosystem development. Analysts suggest that these emerging Rollups not only set benchmarks in the market but also provide valuable examples for traditional applications transitioning to Layer 2 solutions.

8. Facing risks

First, despite Lumoz successfully attracting widespread participation from the crypto community during the Pre-Alpha and Alpha testnet phases, the recently launched Node Sale is the first time users need to spend real money to join. If this node sale is not managed well, it could negatively impact the development of Lumoz’s ecosystem. Moreover, it is important to note that Lumoz has not yet announced an updated token distribution plan. This means there is a risk that participants might earn too little after purchasing nodes, so it’s essential to do your own research (DYOR). However, since zkVerifier nodes allow for refunds, delegation, and transfer, participants can limit their losses even if they do incur them.

9. Conclusion

Lumoz effectively addresses the three major pain points in the ZK Rollup space through its modular computing layer, ZK RaaS, and NCRC native cross-chain bridge protocol. This positions Lumoz as a pioneer and leader in the ZK Rollup industry. We are confident that Lumoz will continue to demonstrate its leadership in the future, driving the large-scale application and adoption of ZK Rollup technology.

Disclaimer:

- This article is reprinted from [SevenUp DAO]. All copyrights belong to the original author [ZeY]. If there are objections to this reprint, please contact the Gate Learn team, and they will handle it promptly.

- Liability Disclaimer: The views and opinions expressed in this article are solely those of the author and do not constitute any investment advice.

- Translations of the article into other languages are done by the Gate Learn team. Unless mentioned, copying, distributing, or plagiarizing the translated articles is prohibited.

Share

Content

Summary

1. Previous Summary

2. Lumoz establishment background

3. Lumoz provides a modular computing layer for ZK Rollups

4. Lumoz RaaS Launch Base is highly compatible with mainstream ZK Rollups technology stacks

5. NCRC Protocol implements trustless ZK-Rollup

6. Lumoz’s dual-token economic model

7. Industry Outlook

8. Facing risks

9. Conclusion

Lumoz Research Report: Modular Blockchains Greatly Reduce ZKP Computation Costs

Summary

1. Previous Summary

2. Lumoz establishment background

3. Lumoz provides a modular computing layer for ZK Rollups

4. Lumoz RaaS Launch Base is highly compatible with mainstream ZK Rollups technology stacks

5. NCRC Protocol implements trustless ZK-Rollup

6. Lumoz’s dual-token economic model

7. Industry Outlook

8. Facing risks

9. Conclusion

Summary

Since its inception, Ethereum has continuously faced scalability issues. Scaling remains a crucial technology for achieving Web3 mass adoption. Rollup is a mainstream Layer 2 scaling solution, and its core idea is to publish “packaged” transaction data blocks on-chain, thereby reducing the difficulty of transaction validity verification. Based on different data validity verification methods, Rollups can be further divided into Optimistic Rollups and ZK Rollups.

Currently, the ZK Rollups field faces three main pain points: the high cost of computing ZKPs, the reliance on centralized Provers by most zk rollups, and the complexity of zero-knowledge technology making it difficult to build ZK-rollups compatible with the EVM. Additionally, many ZK Rollups use third-party bridging projects for interactions, posing certain security risks.

Lumoz’s co-founder and CEO, NanFeng, graduated from Tsinghua University. The core team has been investing nearly five years in ZK technology since 2018. From the beginning, Lumoz has been committed to making zero-knowledge computation more efficient and accessible.

Lumoz has completed two rounds of incentivized testnets, with a total of 282K participants, 28,137 Validators, 145 PoW miners, and over 60 deployed ecosystem projects. In May 2024, Lumoz announced the completion of a new round of strategic financing, valuing the company at $300 million. To date, Lumoz has raised a total of $14 million, with investors including OKX Venture, Hashkey Capital, Polygon, Kucoin Ventures, IDG Blockchain, Gate Ventures, SevenUpDAO, and Sweep Ventures.

Lumoz provides a modular computation layer for ZK Rollup, utilizing a hybrid consensus mechanism of PoS and PoW. The ZK-PoW algorithm network significantly reduces ZKP computation costs while addressing the issue of centralized Provers. It also introduces zkVerifier to validate ZKPs generated by zkProver. The hardware requirements for zkVerifier nodes are relatively low, and the upcoming Node Sale will enhance the decentralization and censorship resistance of the verification network.

Lumoz RaaS Launch Base is highly compatible with mainstream ZK Rollups technology stacks, including Polygon zkEVM, zkSync, Scroll, and Starknet. It is currently the project with the broadest compatibility with ZK Rollups technology stacks, effectively addressing the compatibility issues between ZK technology and EVM in the ZK Rollup field. It provides customized ZK Rollup solutions with one-click chain deployment. Current clients include ZKFair, Merlin Chain, Coin98, Ultiverse, Mari1x, Fortnite (Efuse), and Viction.

Lumoz proposes the NCRC Protocol, which achieves seamless cross-chain interoperability between multiple ZK Rollups through a “Native Bridge.” User assets do not pass through any third-party protocols, ensuring the process is secure and trustless.

Lumoz adopts a dual-token economic model, where the utility token MOZ can be used for transaction fees and resource usage fees, while the equity token esMOZ is a reward for participants and can also be used to delegate zkVerifier nodes. esMOZ tokens can be exchanged for MOZ tokens at different redemption periods and rates. Currently, Lumoz has not disclosed the latest token distribution details in its whitepaper.

Looking ahead, the RaaS field has promising development prospects, and ZK Rollup will become the mainstream Rollup solution. Community operations and ecosystem building may replace technology as the main challenges in constructing Rollups. With its deep expertise in ZK technology, Lumoz is poised to continue leading the ZK RaaS field and promote the large-scale application and adoption of ZK-Rollup technology.

1. Previous Summary

1. Rollup scaling solution

Since its inception, Ethereum has continuously faced scalability issues. Scaling remains a crucial technology for achieving Web3 mass adoption.

Scalability solutions built on Ethereum without requiring any modifications to the underlying Layer 1 protocol are called Layer 2 solutions. These solutions can process transactions without interacting with the Ethereum network and anchor their security to Ethereum’s Layer 1 through smart contracts, effectively adding an extra layer of network off-chain, hence the name Layer 2. According to L2 Beat, the number of transactions processed by Layer 2 currently has reached 10 times that of the Ethereum mainnet, significantly expanding Ethereum’s limited transaction processing capacity.

Figure 1 Number of transactions processed by Layer2 https://l2beat.com/scaling/activity

As a highly decentralized public blockchain, Ethereum has become very congested, and gas fees have become extremely expensive. Therefore, an increasing number of decentralized applications, including DeFi and GameFi, are migrating their protocols to these Layer 2 solutions to optimize user experience and reduce operating costs. According to L2 Beat, as of June 16, 2024, the total value locked (TVL) in all Layer 2 solutions has reached 12.4418 million ETH, equivalent to approximately $44.363 billion. In comparison, the TVL on the Ethereum mainnet is 17.88 million ETH, equivalent to approximately $65.634 billion, meaning the TVL in all Layer 2 solutions is close to 70% of that on the Ethereum mainnet.

Figure 2 The total amount of locked positions in Layer2 https://l2beat.com/scaling/summary

Figure 3 Ethereum mainnet lock-up amount

https://defillama.com/chain/Ethereum?currency=USD

Rollup is a mainstream Layer 2 scaling solution, and its core idea is to publish “packaged” transaction data blocks on-chain, thereby reducing the difficulty of transaction validity verification. Rollup technology addresses issues previously exposed by Plasma, providing the same data availability and security as Ethereum Layer 1 (Ethereum itself), while significantly increasing network throughput and reducing per-transaction costs. In the architecture of modular blockchains, the Rollup solution essentially outsources the execution layer (and other layers) of the chain.

Figure 4 Modular Stacks Modular Stacks

https://members.delphidigital.io/reports/the-complete-guide-to-rollups

2. Two Rollup solutions: ZK Rollups vs. Optimistic Rollups

Based on their methods of data validity verification, Rollups can be further divided into Optimistic Rollups and ZK Rollups. Optimistic Rollups rely on an “optimistic” assumption that most transactions are valid, allowing challenges and rollbacks when fraudulent behavior is detected. ZK Rollups, on the other hand, use Zero Knowledge Proof (ZK) technology to ensure that transactions processed off-chain are valid and correct, providing higher security and efficiency. Below are the main advantages and disadvantages of these two Rollup solutions:

表 1 ZK Rollups vs. Optimistic Rollups

Data source: compiled by the author based on existing literature

Although ZK-Rollup has many advantages and is seen by Vitalik as a long-term scaling solution for Ethereum, it faces several technical challenges that currently limit widespread adoption. According to Defilama data as of June 16, 2024, Optimistic Rollups such as Arbitrum, Blast, Base, and Optimism continue to dominate the Rollups space.

Figure 5 TVL pie chart of Rollup track https://defillama.com/chains/Rollup

3. Pain points of ZK Rollups

Specifically, the pain points currently faced by the ZK Rollups sector are:

- The high cost of computing Zero Knowledge Proofs (ZKP), with most ZK Rollups relying on centralized Provers.

Several ZK Rollups are currently operating on the Ethereum mainnet, including Polygon zkEVM and zkSync. For a ZK-Rollup, the computation cost of ZKPs far exceeds the cost of Data Availability (DA), often accounting for more than 50% of the total cost. Moreover, many of these ZK-Rollup projects have not decentralized their proving processes. For instance, in the beta mainnet of Polygon zkEVM, reliance on trusted aggregators to submit ZKPs is prevalent, and zkSync era follows a similar approach.

Figure 6 The computing cost of mainstream ZK Rollups is very high (pink in the picture)

https://l2beat.com/scaling/costs

- The complexity of zero-knowledge technology makes building EVM-compatible ZK-Rollups difficult.

EVM compatibility refers to translating Solidity smart contract code into specific virtual machine bytecode for ZK Rollups. The EVM was not originally designed with zero-knowledge proof technology in mind. For instance, to generate valid proofs for arbitrary programs executed by the EVM using zk-SNARKs, mathematical representations and proof logic must be created for each opcode of the EVM. This requires complex cryptographic transformations and presents compatibility challenges for existing smart contracts.

- Additionally, many ZK Rollups currently use third-party bridging projects for interoperability, posing certain security risks.

In this era of multiple Rollups, the coexistence of various Layer 2 solutions makes seamless interoperability between different solutions crucial. Existing cross-Rollup bridging solutions often involve deploying new sets of inter-chain contracts on Rollup chains and leveraging multi-chain liquidity incentives to achieve cross-chain asset functionality. However, these solutions are not universally applicable for message-based cross-chain interactions and entail risks of centralization and trust. In July 2023, Binance-backed cross-chain bridge project Multichain ceased operations after its CEO was detained by authorities, with funds exceeding $265 million flowing out of Multichain according to SlowMist monitoring. The sudden collapse of a leading cross-chain bridge project underscores the significant risks of centralization and trust associated with using third-party cross-chain bridge projects.

2. Lumoz establishment background

Figure 7 Lumoz https://lumoz.org/

NanFeng, co-founder and CEO of Lumoz, graduated from Tsinghua University and previously worked at ByteDance. As a core developer, he has been deeply involved in the foundational setup and iterative development of multiple projects. He is also the founder of Trustless Labs. The core team has been dedicated to ZK technology since 2018, investing nearly five years in its development. From the outset, Lumoz has aimed to make zero-knowledge computing more efficient and accessible, encapsulated in their mission: “Making ZK-Rollup Within Reach.”

Throughout Lumoz’s development journey, the team has gradually recognized the security and centralization issues in the current Rollup landscape of cross-chain bridges and has actively worked to address them. They have also capitalized on the trend of RaaS (Rollup as a Service) development, leading to the successful launch of ZK RaaS Launch Base and expanding their business footprint accordingly.

Figure 8 Lumoz ecological related data https://lumoz.org/compute-layer

Lumoz (formerly Opside) officially launched its testnet at the end of May 2023 and smoothly operated for five months with continuous strong participation from the global community. Over 450,000 participants joined the Pre-alpha testnet, resulting in an impressive 13,580,057 transactions. The testnet saw over 140 miners and more than 28,000 nodes actively participating. Ecologically, over 100 high-quality projects applied for participation, with 14 projects successfully launching dedicated zkEVM application chains through Opside ZK-Rollup LaunchBase, which have been running steadily.

Lumoz is expected to launch its mainnet in Q3. As of now, Lumoz has processed 2 million transactions, submitted over 4.79 million ZKPs, and has more than 28,000 nodes. Additionally, over 16 projects have passed official audits and have deployed custom zkEVM application chains on the Lumoz platform.

Figure 9 Lumoz completed a strategic round of financing, with SevenUPDAO participating in the investment

https://mirror.xyz/lumozorg.eth/Fz0dF5HVMdbbI--9lzst60KuKOp5YGbb75Z0RmxiB24

In March 2024, Lumoz, the modular computing layer and ZK-RaaS platform, conducted its first round of financing with a valuation of $120 million. On May 29, 2024, Lumoz officially announced the completion of a new strategic financing round. Investors included IDG Blockchain, SevenUpDAO, Sweep Ventures, among others. The specific amount of funding has not been disclosed. With this strategic round, Lumoz achieved a valuation of $300 million, surpassing Altlayer’s current market value of $253 million, indicating strong confidence in Lumoz’s future development prospects.

Furthermore, based on Altlayer’s current market value multiplied by a factor of 1.4 (the multiple of pre-listing financing valuation), Lumoz could potentially achieve a market value of at least $420 million upon listing. Alternatively, using Gelato’s multiplier of 3, Lumoz’s market value post-listing could exceed $900 million.

Table 2 RaaS track project financing information

Note: the data sources are primarily from Rootdata and ICO Analytics, with ‘*’ indicating lead investors, as of June 16, 2024.

3. Lumoz provides a modular computing layer for ZK Rollups

Figure 10 Lumoz as a decentralized modular computing layer

https://lumoz.org/compute-layer

Rollups typically consist of settlement layers, execution layers, consensus layers, and data availability layers. However, for ZK-Rollups, an additional core module is required, known as the Prover Layer. Currently, Lumoz is the sole provider in the modular Rollup space offering a modular Prover network. Presently, Lumoz miners provide the ZKP computational power for the Merlin Chain. With the upcoming launch of Lumoz mainnet, Merlin Chain will be connected to Lumoz’s decentralized ZK computation network. This network operates on a ZK-PoW algorithm, allowing anyone to contribute computational power to Merlin Chain and receive Lumoz token rewards.

By combining robust computing resources with EigenLayer’s re-staking mechanism, Lumoz has created an efficient and secure computing service ecosystem. The Lumoz computing layer architecture is highly integrated and collaborative, with the following key components and functionalities:

Figure 11 Lumoz computing layer architecture

https://docs.lumoz.org/understand-lumoz/the-avs-computing-layer-based-on-eigenlayer

- On Ethereum, EigenLayer standards are utilized to construct Active Verification Services (AVS), providing trust endorsements, and enhancing AVS security through the re-staking mechanism at the feature layer.

- The EVM chain (L2) supports a diverse blockchain environment compatible with Ethereum Virtual Machine (EVM), such as Polygon zkEVM, Polygon CDK, ZKStack, and Scroll, ensuring extensive compatibility and scalability.

- Lumoz AVS Oracle is responsible for retrieving and storing data from EVM-compatible chains to ensure high data availability and integrity, providing a solid data foundation for the computing layer.

- Lumoz Chain serves as the core management layer for the entire computing layer, handling task scheduling, reward distribution, and managing zkProver and zkVerifier, including the process of adding and removing nodes. zkProver nodes execute specific computing tasks, while zkVerifier nodes verify the execution results.

Lumoz employs a hybrid consensus mechanism combining PoS (Proof of Stake) and PoW (Proof of Work) in its architecture. Specifically, PoW is used for zkProver, while PoS primarily applies to zkVerifier (potentially serving as the Rollup sequencer). This article will first introduce Lumoz’s ZK-PoW algorithm in the context of PoW consensus, explaining how it addresses the current challenges faced by ZK Rollups related to the high computational costs and centralization issues of ZKP (Zero Knowledge Proofs). Subsequently, the article will delve into detailed analysis of Lumoz’s progress in the PoS consensus mechanism.

1. Lumoz’s ZK-PoW algorithm network greatly reduces the computational costs of ZKP (Zero Knowledge Proof) calculations.

To address the computational cost and centralization issues of ZKP (Zero Knowledge Proof), Lumoz has proposed the ZK-PoW algorithm. Its main features include:

PoW reward distribution mechanism

Lumoz provides a unified marketplace for ZKP computation, encouraging miners to generate ZKPs for these zk-rollups. During the Pre-Alpha testnet phase, based on the PoW algorithm, each Rollup within Opside blocks submits a sequence according to specific rules. The current block’s PoW rewards are distributed among registered Rollup slots based on the number of batches included in the sequence. Miners can freely choose to participate in ZKP computation for one or multiple Rollups. In the future, each sequence will be priced differently based on factors such as the type of ZK-Rollup, the number of Rollup transactions included, gas usage, and other estimated workload factors.

Miners must stake a corresponding amount of tokens for each Rollup in the system contract to submit ZKPs. Rewards for miners submitting ZKPs are also distributed based on their staking ratio, thereby discouraging malicious behavior of miners submitting ZKPs multiple times.

ZKP’s two-step submission algorithm

First, miners submit the Proofhash. Within a specific time window for a given sequence, multiple miners are allowed to participate in computing the ZKP. Each miner does not directly submit the original proof but computes the proof hash of (proof/address) and submits it to the contract.

Next, miners submit the ZKP. After the time window, miners submit the original proof, and it is verified against the previously submitted proof hashes. Miners whose proofs pass verification are eligible for PoW rewards, which are distributed proportionally based on the amount they have staked for participation.

Figure 12 ZKP’s two-step submission algorithm

https://lumoz.org/compute-layer

Lumoz ingeniously employs a two-step submission algorithm for ZKPs, using a model of submit-first-verify-later to eliminate unnecessary proof and address aggregation calculations. Moreover, this two-step submission algorithm enables parallel ZKP computation and sequential submission, allowing miners to concurrently execute multiple ZKP generation tasks, significantly accelerating ZKP generation efficiency. The Lumoz team has also optimized the ZKP recursive aggregation algorithm, maximizing cluster resources to further enhance ZKP computation speed.

In a real stress test environment, miners operate a cluster of 20 machines, comprising 128-core CPUs and 1TB of RAM. During testing, the transaction rate stabilized around 27.8 TPS in approximately 40 minutes. Under the same conditions, Lumoz reduced the average confirmation time of transactions from about 5-6 minutes to approximately 3 minutes, thereby increasing ZKP generation efficiency by approximately 80%. Looking ahead, as more ZK-rollups and miners join the ZK computation market, Lumoz’s PoW algorithm is expected to deliver even more pronounced efficiency gains.

ZK-PoW V2.0 version further optimizes the calculation process

Compared to V1.0, version 2.0:

- The original service has been split into three sub-modules: proof generation, proof management, and proof submission, resulting in a clearer structure, lower coupling, and increased robustness.

- The proof generation module, Proof Generator, has added a

startBatchparameter to help new miners better keep up with mining progress. - The proof management module, Proof Manager, has been improved compared to the old version. It now promptly resends proofs in case of miner service restarts or other reasons causing proof submission failures, ensuring miners’ interests are protected. The resend mechanism not only addresses failed proof submissions but also handles scenarios where proofs were not submitted, ensuring the security of the Rollup chain.

- The proof submission module, Proof Sender, uses three thread-safe priority caches to implement a two-step transaction submission process. Compared to previous versions, it reduces the use of global locks, ensuring timely submission of proofs at lower heights and protecting miners’ interests. Additionally, the overall service workflow is clearer, reducing the number of threads and resource consumption during program execution.

Figure 13 ZK-PoW V2.0 Architecture

https://mirror.xyz/lumozorg.eth/zZy2munlvNY7D4DG6lpcccrx1IZTJ7yb3jXOwd1O9Hg

Pressure test results: In version 2.0, using 10 machines with 64 cores each, 566 batches of proofs were completed in 7 hours, 38 minutes, and 40 seconds, averaging 48.62 seconds per proof. In multi-miner scenarios, version 2.0 shows an overall 50% efficiency improvement in zk proof generation compared to version 1.0.

2. Introducing zkVerifier node verification mechanism, establishing a decentralized and censorship-resistant verification network.

The Lumoz network undertakes the crucial responsibility of managing the entire network’s data input and output. To ensure the security, accuracy, and decentralization of the data processing process and its outcomes, Lumoz has introduced a node verification mechanism. This mechanism involves zkVerifier nodes validating the ZKPs generated by zkProvers. The specific workflow is as follows:

Figure 14 zkVerifier node verification mechanism

https://docs.lumoz.org/zkVerifier-node-explained/how-do-zkverifier-node-work

Firstly, after the proofs generated by zkProvers are submitted to the Lumoz chain, Lumoz sends verification tasks to multiple zkVerifier nodes, which independently perform distributed verification. Secondly, consensus on the validity of the proofs is achieved when at least two-thirds of zkVerifier nodes confirm their validity, ensuring the authority and consistency of the verification results. Finally, validated proofs and their outcomes are transmitted back to the Lumoz blockchain via the Lumoz AVS Oracle, with task results recorded and responded to on the Lumoz chain through the Task Manager contract.

The hardware requirements for zkVerifier nodes are relatively modest, allowing broader participation in the Lumoz ecosystem and further enhancing the decentralization of the Lumoz network.

Figure 15 zkProver node hardware configuration requirements

https://docs.lumoz.org/purchase-zkverifier-node-and-set-up/set-up-node

zkVerifier Node Sale will open soon

Lumoz has introduced a licensing system for zkVerifier node admission: licenses serve as official recognition of zkVerifier node identities and are essential binding conditions when setting up zkVerifier nodes. These licenses exist in the form of NFTs (Non-Fungible Tokens), ensuring each license’s uniqueness and non-replicability. For those who prefer not to run nodes themselves, there is a delegation mechanism where ezMOZ tokens or licenses can be delegated to other node operators, while still receiving rewards. Licenses can also be freely transferred between users when needed.

图 16 zkVerifier Node Sale https://node.lumoz.org/

zkVerifier node licenses will officially go on sale starting June 17, 2024. Each zkVerifier node will receive 40 million Lumoz points (LP) prior to the Token Generation Event (TGE), with an additional linear unlocking of 1 million LP per day from June 25 to August 4. These LP can be exchanged for mainnet tokens post-TGE. Following the TGE, zkVerifier nodes will continue to receive empowerment, with a continuous linear unlocking of 25% of Lumoz tokens over 36 months, along with potential participation in airdrops from Lumoz ecosystem projects.

According to Lumoz’s latest policy, there will be a total of 100,000 licenses divided into 10 different price levels. They will be sold on a first-come, first-served basis, with prices increasing in later stages, incentivizing earlier purchases for higher returns. The sale will be divided into three phases: presale phase (opens on June 17, 2024, at 15:00 UTC+8), whitelist acquisition phase (also opens on June 17, 2024, at 15:00 UTC+8), whitelist sale phase (opens on June 25, 2024, at 15:00 UTC+8), and public sale phase (opens on July 3, 2024, at 15:00 UTC+8), where licenses will be available to all users.

Figure 17 Lumoz License Tiers

https://docs.lumoz.org/purchase-zkverifier-node-and-set-up/license-tiers

Team bonus system for node points activities

Figure 18 Team participation mechanism of zkVerifier node points activity

https://docs.lumoz.org/zkverifier-lumoz-points-campaign

When staking licenses, users have the option to join an existing team or create a new one, with a maximum of 50 members per team. The level of a team is determined by the total number of licenses it holds, with higher levels granting greater weight when allocating Lumoz points. Lumoz employs this fractal design to attract more users and investors to participate in their ecosystem.

Refund mechanism guarantees user interests

In addition, to maximize protection of global community users’ rights, Lumoz has established a refund mechanism. The refund window will open six months after the Token Generation Event (TGE) begins, with the duration of the window yet to be determined. If users are dissatisfied for any reason, they can apply for a refund. Lumoz will unconditionally refund 80% of the purchase node payment amount. Users must return all generated tokens and NFTs (Non-Fungible Tokens).

Important source of income before TGE

Lumoz’s zkVerifier node sale has become a crucial source of income for the project. In blockchain projects, early revenue generation is vital for sustained development and success. This not only provides necessary financial support but also enhances confidence among investors and community members. It’s important to note that blockchain projects shouldn’t rely solely on Initial Exchange Offerings (IEOs) for revenue. While IEOs are effective for fundraising, they shouldn’t be the sole avenue as over-reliance can limit financial flexibility and increase project risks in the long term.

Specifically, Lumoz’s zkVerifier node sale is expected to impact the project by demonstrating confidence and commitment to future development. By selling nodes, the project signals to the outside world that it has sufficient funds and resources to drive long-term growth. This helps attract more investors and partners to participate in the project’s success.

Furthermore, node sales reflect community value and cohesion. Purchasing nodes allows users to become part of the project’s community, fostering a closer connection with the project. This relationship not only enhances users’ sense of belonging and loyalty but also promotes communication and collaboration among community members. An active and engaged community is crucial for the project’s sustained growth and success.

4. Lumoz RaaS Launch Base is highly compatible with mainstream ZK Rollups technology stacks

Rollup as a Service (RaaS) is a product designed to launch custom Rollups for new blockchain applications. Similar to software-as-a-service (SaaS) products, users do not need to maintain or host any part of the service product, eliminating the need for complex software and hardware management.

From the perspective of whether code needs to be written, RaaS projects can be divided into 2 categories: SDK and No-Code solutions. SDK solutions provide developers with a comprehensive set of general software development kits, making deploying Rollups as straightforward as deploying smart contracts. No-Code solutions, as the name suggests, allow for deploying Rollups without writing a single line of code (one-click chain launch). Projects like OP Stack, Rollkit, Dymension, Sovereign, and Stackr fall under SDK solutions. Projects offering no-code deployment of Rollups include Lumoz, AltLayer, Eclipse, and Caldera.

Figure 19 RaaS projects can be divided into 2 categories

https://foresightnews.pro/article/detail/27089

In the RaaS space, there are already various projects like AltLayer and Gelato that enable no-code chain launching. However, Lumoz RaaS Launch Base stands out by integrating mainstream Rollup solutions in the blockchain industry such as Polygon zkEVM, zkSync, Scroll, and Starknet. It is currently the most broadly compatible project in terms of supporting the ZK Rollups technology stack. This capability allows Lumoz to address compatibility pain points between ZK technology and EVM, making it uniquely positioned in the ZK Rollup ecosystem.

Table 3 Technology stacks supported by various mainstream RaaS projects

Note: The data mainly comes from the official websites and white papers of each project, and is compiled with reference to articles on the Internet.

From the above table, it’s clear that Lumoz has established collaborations across various modules of the Rollup ecosystem. For instance, besides Layer1 integration, Lumoz has partnered with third-party DA layer projects such as Celestia, Eigenlayer, Ethstorage, Avail, and Espresso. Additionally, Lumoz collaborates with Espresso Systems, Radius, Metis, and Astria to offer decentralized sequencer options to its clients.

According to Vitalik’s standards, zkEVM can be categorized into the following types:

Figure 20 Vitalik “Different types of zkEVM”

https://learnblockchain.cn/article/6369

- Type1 zkEVM: Fully equivalent to Ethereum.

- Type2 zkEVM: Fully compatible with Ethereum Virtual Machine (EVM).

- Type3 zkEVM: Almost compatible with Ethereum Virtual Machine (EVM).

- Type4 zkEVM: Compatible with higher-level languages.

Lumoz’s supported frameworks precisely include these types of zkEVM, offering customers a wider range of choices.

Figure 21 Classification of mainstream ZK Rollup projects

https://learnblockchain.cn/article/6369

Figure 22 Various zkEVM mainstream projects

https://learnblockchain.cn/article/6369

1. One-click chain launch meets the customized ZK Rollup needs of project parties

Users can independently select various components required for Layer 2 in their Launch Base, including SDKs, settlement layers, data availability layers, sequencers, and more. The process requires no code, significantly reducing the difficulty of launching ZK Rollups, allowing teams to focus on ecosystem operations and non-technical aspects.

Figure 23 Lumoz ZK-RaaS Launch Base sends the link with one click

https://lumoz.org/launchbase

For example, some of the customers currently using Lumoz RaaS services include:

- ZKFair is the first community-driven ZK-L2 based on Polygon CDK and Celestia DA, with technical support provided by ZK-RaaS provider Lumoz. ZKFair uses the stablecoin USDC as its gas token. It ensures 100% EVM compatibility, excellent performance, minimal fees, and robust security. ZKFair is a experimental L2 network that is 100% owned and driven by the community.

- Merlin Chain integrates ZK-Rollup networks, decentralized oracle networks, data availability, and on-chain BTC anti-fraud modules. It aims to empower native Bitcoin assets, protocols, and products on Layer 1 through its Layer 2 network, injecting vitality into the Bitcoin ecosystem.

2. Support Op Stack + ZK Fraud Proof Layer 2 architecture

Additionally, on April 18, 2024, Lumoz announced that its modular computation layer will support the Op Stack + ZK Fraud Proof Layer 2 architecture.

OP Stack is a generic development stack used to build L2 blockchain ecosystems.

Figure 24 Op Stack + ZK Fraud Proof Layer 2 architecture

https://mirror.xyz/lumozorg.eth/eFpFnP40loyL3idRitTT_MNB3kW8R_6arZ7bgtmoRlc

Similar to Steven Li and AltLayer’s proposal of the ZK Optimistic Rollup model, the Op Stack + ZK Fraud Proof architecture is a new design that integrates validity proofs based on zero-knowledge proofs into Optimistic Rollup technology. When challengers point out incorrect data submissions by sequencers, they submit a challenge to Layer 1. The sequencer must generate the corresponding ZK proof within a limited challenge period and submit it to the Layer 1 contract for verification. If the verification confirms the data’s validity, the challenge is invalid; otherwise, the challenge succeeds. This approach combines the advantages of Optimistic Rollup and ZK Rollup, maintaining low costs while effectively reducing waiting times.

5. NCRC Protocol implements trustless ZK-Rollup

A native cross-chain bridge

As mentioned earlier, third-party bridges may offer cheaper and faster cross-chain experiences, but they introduce additional trust costs and security risks. In fact, each ZK-Rollup comes with an L1<>L2 bridge built-in, referred to by Lumoz as a native bridge. Unlike third-party bridges based on liquidity solutions, the native bridge operates as a unique “mint-burn” cross-chain mechanism. It ensures security through zero-knowledge proofs while maintaining trustlessness. To achieve NCRC between multiple Rollups, the following two prerequisites must be met:

- These Rollups must be of the ZK-Rollup type.

- These Rollups must reside on the same L1.

Rollups meeting these conditions theoretically have the same security level as the underlying L1. Similarly, the security level of native bridges between these Rollups is equivalent, requiring no trust between them. All NCRC transactions are validated through proof of validity, which forms the basic security guarantee for NCRC.

1. The RRC contract provides data retrieval services.

The fundamental reason ZK Rollups cannot communicate with each other is because their contracts on Layer 1 (Ethereum mainnet) are unrelated. They are unaware of each other’s existence and cannot communicate directly through native Rollup bridges. To address this, Lumoz will deploy the RRC contract (Rollup Recognition Contract) on each Layer 1, enabling Rollups to discover and identify each other. The RRC manages all participating zk-rollups in the NCRC, including adding, pausing, and exiting Rollups. Each Rollup in the RRC is assigned a dedicated Rollup ID.

2. The process of native bridges for cross-Rollup transactions hides underlying complexities, optimizing user experience.

For users, NCRC operations are identical to native Rollup bridges. Throughout the cross-chain process, assets flow through the following path: Rollup1 -> Rollup1’s L1 bridge contract -> Rollup2’s L1 bridge contract -> Rollup2. In other words, users’ assets do not pass through any third-party protocols; they only require the use of Rollup’s native bridges. The entire process is secure and trustless.

Figure 25 The process of native bridge cross-rollup transaction

https://mirror.xyz/lumozorg.eth/0P5S75pYf4GtjYG4tka4whLHI7a1YC-YVS0uzgaSlzI

When users initiate cross-chain operations from Rollup1 to Rollup2, the technical process actually involves three entities: Rollup1, L1 (Layer 1), and Rollup2. However, users do not need to be aware of L1’s presence in this process; their experience is simply a direct transfer from Rollup1 to Rollup2. Behind the scenes, cross-chain assets undergo two bridging operations on L1, creating a seamless connection from Rollup1 to Rollup2 in the user’s perception. These L1 operations are handled automatically, requiring no additional actions from the user. From the user’s perspective, their current Rollup can execute cross-chain operations to L1 and any other Rollup. This design enhances user experience by smoothing out the process and hiding underlying complexities.

6. Lumoz’s dual-token economic model

If we disregard the zkVerifier’s License aspect, Lumoz adopts a dual-token economic model.

1. Functional Token MOZ

- Transaction Fees (Gas): All transactions within the Lumoz network require MOZ tokens as transaction fees, ensuring the network’s secure operation and smooth transaction processing.

- Resource Usage Fees: Users need to pay MOZ tokens as resource usage fees when utilizing Lumoz network’s zero-knowledge proof (ZKP) computations and artificial intelligence (AI) services, providing necessary economic incentives for the network.

2. Equity token esMOZ

- Incentivizing Participation: esMOZ tokens serve as rewards for nodes that contribute computing power, security, and stability to the Lumoz network, enhancing incentives and attracting participants to join the network. This incentive mechanism helps strengthen the network’s security and stability.