What Is Cloud Mining?

Cloud Mining is a method of mining cryptocurrencies such as Bitcoin using rented cloud computing power rather than buying, installing and directly running the hardware and related software yourself. Cloud Mining companies allow users to remotely participate in the process of cryptocurrency mining for a small fee, making it more accessible to people all over the world. Because this type of mining is done through the cloud, it eliminates issues such as equipment maintenance and direct energy costs.

Cloud miners join a mining pool where users purchase a certain amount of “hash power.” Each participant receives a pro-rata share of profits based on the amount of hashing power rented.

What Is Cloud Mining?

Cloud Mining is the process of mining cryptocurrency remotely. Users can start to earn mining outputs simply by purchasing mining contracts, without needing to purchase equipment, run or maintain a mining rig. This gives everyone a chance to mine.

Cloud mining makes use of cloud computing to generate rewards from Proof-of-Work-based cryptocurrencies. Cloud computing, in general, is one of the fastest-growing technology trends, in which services such as processing, server capacity, database services, software, and file storage are accessed remotely through the Internet. These companies charge on a usage basis, similar to how we pay for water or electricity.

On the other hand, Mining is the foundation of the cryptocurrency model, surging along with the advent of Bitcoin. It is the process of verifying and adding transactions to the public ledger known as the blockchain, and is also the method by which new coins are issued.

A combination of the two allows people in remote locations with little or no technical knowledge and hardware infrastructure to start mining crypto.

Different Types of Cloud Mining

There are several types of cloud mining, including:

Hash power leasing: This type of cloud mining involves renting a certain amount of hash power, or computing power, from a cloud mining provider. The provider sets up and maintains the mining hardware, and the customer pays a fee to use the hash power for a specific period of time.

Virtual hosted mining: With this type of cloud mining, the customer rents virtual mining hardware from a provider, which is hosted on the provider’s own hardware. The customer is responsible for setting up and configuring the virtual mining hardware and the provider handles the maintenance and operation of the physical hardware.

Physical hosted mining: In this type of cloud mining, the customer rents physical mining hardware that is hosted at a provider’s facility. The customer is responsible for setting up and configuring the hardware and the provider handles the maintenance and operation of the hardware.

What are the Pros and Cons of Cloud Mining?

There are several pros and cons to consider when it comes to cloud mining. Below are some of them:

Pros:

In most cases, there is no need to purchase and maintain hardware: One of the main benefits of cloud mining is that you don’t need to purchase and maintain your own hardware. This can save you a significant amount of money, as mining hardware can be expensive to purchase and requires ongoing maintenance.

No need to worry about electricity costs: Another benefit of cloud mining is that you don’t need to worry about electricity costs, as the provider handles this aspect of the mining process.

Cons:

Potential for scams: There have been instances of cloud mining providers engaging in fraud and not actually providing the promised hash power. It’s important to carefully research and compare different providers to minimize the risk of falling victim to a scam.

Limited control: When you use cloud mining, you are relying on the provider to properly maintain the hardware and ensure that it is working effectively. This can be a disadvantage if you prefer to have more control over the mining process.

What Is the Difference Between Cloud Mining and Hardware Mining?

Cloud mining and hardware mining are two different ways to mine cryptocurrency, which depend on people’s specific needs and goals.

Cloud mining basically involves renting computing power from a provider, which sets up and maintains the hardware. In exchange for this, the customer pays a fee to use the hardware for a specific period of time. People who don’t want to invest too much in mining might find this method quite convenient, as they don’t have to pay for the hardware expenses.

On the contrary, hardware mining involves purchasing and setting up specific mining hardware, so you would be solely responsible for maintaining the operations. It can be more profitable than cloud mining, as the customer is not paying a fee to use someone else’s hardware. However, it can be more expensive and time-consuming, as you need to purchase and maintain your own hardware.

How to Get Started With Cryptocurrency Cloud Mining

Cloud mining does not require any setup that traditional cryptocurrency mining does. You do not need to purchase specialized hardware, store it anywhere, or pay electricity bills.

Instead, you must select a profitable cloud mining pool, rent some hardware from it, and wait for the mining pool to generate revenue. You must also select a cryptocurrency, the largest mining pools are found in Ethereum, Bitcoin, and Dogecoin.

To begin using a cloud mining service, you must first: Create a user account, choose a cloud mining provider and a coin to mine.

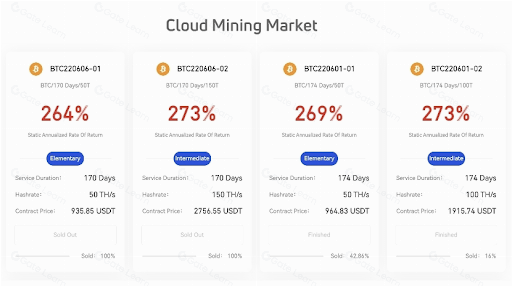

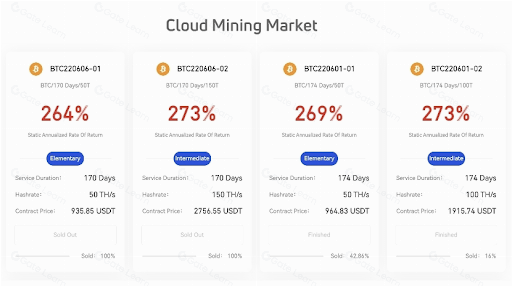

Each site is slightly different; fees vary, as do the services and miners offered. One of the best is Gate.io, the largest and most trusted crypto cloud mining site. You can begin by creating a Gate.io account. Once the account is verified and funded, find out the steps to start mining cryptocurrency, using the Gate.io cloud mining service. You will find the ideal Cloud Mining product that fits your investor needs:

Source: Gate.io

Is Cloud Mining a Profitable Investment?

Cloud mining has proven to be profitable in most scenarios. There are some upfront costs; you will have to pay to rent these miners, and mining pools may take a cut of your profit as well.

Newer miners will have better specs than older models and will likely generate higher returns, and the state of the market will determine your profit. For example, if you choose to hold your bitcoin rather than sell it for regular money, such as the US dollar, you will remain exposed to the price fluctuations of bitcoin.

Because the market for each cryptocurrency can fluctuate wildly, different tokens pose different currency risks. If you rent miners with higher hash power, all of these small differences can add up over time.

Is Cloud Mining a Risky Investment?

Cloud Mining can be risky, depending on where you invest, because you are relying on someone else to mine cryptocurrency without ever ensuring that they have the necessary hardware to mine bitcoin, or whatever coin you choose.

Many fraudulent cloud mining services claim to mine bitcoin on your behalf but only take your money. They frequently operate entirely anonymously, making it impossible to determine who manages the platform, and promise extremely high rates of return in a short period of time. Other red flags include spelling errors on the website and anonymous testimonials with stock images of people’s faces or a fictitious or non-existent company address.

Using well-known mining pools such as Gate.io will significantly reduce this risk.

As previously stated, you are dependent on the market direction. Bitcoin and other mineable cryptocurrencies are volatile, which means their prices can fluctuate dramatically in a short period of time. This poses a risk to your invested capital because the coins you earn from mining may crash.

Cloud mining also poses a significant regulatory risk. For example, a large number of cloud miners were once housed in China, because the country provided cheap electricity, and the industry also used green energy during wet seasons. However, in the spring of 2021, China cracked down on its cryptocurrency mining industry, forcing miners to close up shop or relocate. This meant that anyone who rented cloud miners from Chinese pools stopped earning rewards.

Other countries may also prohibit cryptocurrency mining. The process demands massive amounts of energy, some of which is derived from the combustion of fossil fuels, and a number of governments regard it as a scourge on the environment.

However, it is worth noting that the risks for people who cloud mine are much lower than if you bought the mining machines yourself. Specialized hardware can be quite costly, not to mention the operating and maintenance costs associated with mining. If the demand for mining is wiped out by an economic crash, the hardware you purchased to mine cryptocurrency may not be worth much.

Conclusion

Cloud mining has quickly become one of the most popular methods of mining cryptocurrencies.

In a nutshell, cloud mining is crypto mining done through the cloud rather than physical rigs that will skyrocket your electricity bill.

While the process still uses rigs and servers to solve hashes, third-party mining facilities operate the hardware rather than you. Participants in cloud mining would need to rent a mining rig and/or hash power from the facility.

Most cloud mining farms provide an app that allows you to easily track both your earnings and hash rates.

Author: VictorK

Translator: Yuán Yuán

Reviewer(s): Matheus, Ashley, Joyce

Share

Content

What Is Cloud Mining?

What Is Cloud Mining?

Different Types of Cloud Mining

What are the Pros and Cons of Cloud Mining?

What Is the Difference Between Cloud Mining and Hardware Mining?

How to Get Started With Cryptocurrency Cloud Mining

Is Cloud Mining a Profitable Investment?

Is Cloud Mining a Risky Investment?

Conclusion

Cloud Mining is a method of mining cryptocurrencies such as Bitcoin using rented cloud computing power rather than buying, installing and directly running the hardware and related software yourself. Cloud Mining companies allow users to remotely participate in the process of cryptocurrency mining for a small fee, making it more accessible to people all over the world. Because this type of mining is done through the cloud, it eliminates issues such as equipment maintenance and direct energy costs.

Cloud miners join a mining pool where users purchase a certain amount of “hash power.” Each participant receives a pro-rata share of profits based on the amount of hashing power rented.

What Is Cloud Mining?

Cloud Mining is the process of mining cryptocurrency remotely. Users can start to earn mining outputs simply by purchasing mining contracts, without needing to purchase equipment, run or maintain a mining rig. This gives everyone a chance to mine.

Cloud mining makes use of cloud computing to generate rewards from Proof-of-Work-based cryptocurrencies. Cloud computing, in general, is one of the fastest-growing technology trends, in which services such as processing, server capacity, database services, software, and file storage are accessed remotely through the Internet. These companies charge on a usage basis, similar to how we pay for water or electricity.

On the other hand, Mining is the foundation of the cryptocurrency model, surging along with the advent of Bitcoin. It is the process of verifying and adding transactions to the public ledger known as the blockchain, and is also the method by which new coins are issued.

A combination of the two allows people in remote locations with little or no technical knowledge and hardware infrastructure to start mining crypto.

Different Types of Cloud Mining

There are several types of cloud mining, including:

Hash power leasing: This type of cloud mining involves renting a certain amount of hash power, or computing power, from a cloud mining provider. The provider sets up and maintains the mining hardware, and the customer pays a fee to use the hash power for a specific period of time.

Virtual hosted mining: With this type of cloud mining, the customer rents virtual mining hardware from a provider, which is hosted on the provider’s own hardware. The customer is responsible for setting up and configuring the virtual mining hardware and the provider handles the maintenance and operation of the physical hardware.

Physical hosted mining: In this type of cloud mining, the customer rents physical mining hardware that is hosted at a provider’s facility. The customer is responsible for setting up and configuring the hardware and the provider handles the maintenance and operation of the hardware.

What are the Pros and Cons of Cloud Mining?

There are several pros and cons to consider when it comes to cloud mining. Below are some of them:

Pros:

In most cases, there is no need to purchase and maintain hardware: One of the main benefits of cloud mining is that you don’t need to purchase and maintain your own hardware. This can save you a significant amount of money, as mining hardware can be expensive to purchase and requires ongoing maintenance.

No need to worry about electricity costs: Another benefit of cloud mining is that you don’t need to worry about electricity costs, as the provider handles this aspect of the mining process.

Cons:

Potential for scams: There have been instances of cloud mining providers engaging in fraud and not actually providing the promised hash power. It’s important to carefully research and compare different providers to minimize the risk of falling victim to a scam.

Limited control: When you use cloud mining, you are relying on the provider to properly maintain the hardware and ensure that it is working effectively. This can be a disadvantage if you prefer to have more control over the mining process.

What Is the Difference Between Cloud Mining and Hardware Mining?

Cloud mining and hardware mining are two different ways to mine cryptocurrency, which depend on people’s specific needs and goals.

Cloud mining basically involves renting computing power from a provider, which sets up and maintains the hardware. In exchange for this, the customer pays a fee to use the hardware for a specific period of time. People who don’t want to invest too much in mining might find this method quite convenient, as they don’t have to pay for the hardware expenses.

On the contrary, hardware mining involves purchasing and setting up specific mining hardware, so you would be solely responsible for maintaining the operations. It can be more profitable than cloud mining, as the customer is not paying a fee to use someone else’s hardware. However, it can be more expensive and time-consuming, as you need to purchase and maintain your own hardware.

How to Get Started With Cryptocurrency Cloud Mining

Cloud mining does not require any setup that traditional cryptocurrency mining does. You do not need to purchase specialized hardware, store it anywhere, or pay electricity bills.

Instead, you must select a profitable cloud mining pool, rent some hardware from it, and wait for the mining pool to generate revenue. You must also select a cryptocurrency, the largest mining pools are found in Ethereum, Bitcoin, and Dogecoin.

To begin using a cloud mining service, you must first: Create a user account, choose a cloud mining provider and a coin to mine.

Each site is slightly different; fees vary, as do the services and miners offered. One of the best is Gate.io, the largest and most trusted crypto cloud mining site. You can begin by creating a Gate.io account. Once the account is verified and funded, find out the steps to start mining cryptocurrency, using the Gate.io cloud mining service. You will find the ideal Cloud Mining product that fits your investor needs:

Source: Gate.io

Is Cloud Mining a Profitable Investment?

Cloud mining has proven to be profitable in most scenarios. There are some upfront costs; you will have to pay to rent these miners, and mining pools may take a cut of your profit as well.

Newer miners will have better specs than older models and will likely generate higher returns, and the state of the market will determine your profit. For example, if you choose to hold your bitcoin rather than sell it for regular money, such as the US dollar, you will remain exposed to the price fluctuations of bitcoin.

Because the market for each cryptocurrency can fluctuate wildly, different tokens pose different currency risks. If you rent miners with higher hash power, all of these small differences can add up over time.

Is Cloud Mining a Risky Investment?

Cloud Mining can be risky, depending on where you invest, because you are relying on someone else to mine cryptocurrency without ever ensuring that they have the necessary hardware to mine bitcoin, or whatever coin you choose.

Many fraudulent cloud mining services claim to mine bitcoin on your behalf but only take your money. They frequently operate entirely anonymously, making it impossible to determine who manages the platform, and promise extremely high rates of return in a short period of time. Other red flags include spelling errors on the website and anonymous testimonials with stock images of people’s faces or a fictitious or non-existent company address.

Using well-known mining pools such as Gate.io will significantly reduce this risk.

As previously stated, you are dependent on the market direction. Bitcoin and other mineable cryptocurrencies are volatile, which means their prices can fluctuate dramatically in a short period of time. This poses a risk to your invested capital because the coins you earn from mining may crash.

Cloud mining also poses a significant regulatory risk. For example, a large number of cloud miners were once housed in China, because the country provided cheap electricity, and the industry also used green energy during wet seasons. However, in the spring of 2021, China cracked down on its cryptocurrency mining industry, forcing miners to close up shop or relocate. This meant that anyone who rented cloud miners from Chinese pools stopped earning rewards.

Other countries may also prohibit cryptocurrency mining. The process demands massive amounts of energy, some of which is derived from the combustion of fossil fuels, and a number of governments regard it as a scourge on the environment.

However, it is worth noting that the risks for people who cloud mine are much lower than if you bought the mining machines yourself. Specialized hardware can be quite costly, not to mention the operating and maintenance costs associated with mining. If the demand for mining is wiped out by an economic crash, the hardware you purchased to mine cryptocurrency may not be worth much.

Conclusion

Cloud mining has quickly become one of the most popular methods of mining cryptocurrencies.

In a nutshell, cloud mining is crypto mining done through the cloud rather than physical rigs that will skyrocket your electricity bill.

While the process still uses rigs and servers to solve hashes, third-party mining facilities operate the hardware rather than you. Participants in cloud mining would need to rent a mining rig and/or hash power from the facility.

Most cloud mining farms provide an app that allows you to easily track both your earnings and hash rates.

Author: VictorK

Translator: Yuán Yuán

Reviewer(s): Matheus, Ashley, Joyce