Everything You Need to Know About Scallop (SCA)

Introduction

After 2021, the rise of new public chains made lending, as a fundamental component of the DeFi financial system, a primary choice for building on-chain ecosystems. Today, lending protocols have become the second-largest DeFi sector after DEXs, with their basic models stabilizing. As congestion and rising fees on the Ethereum network persist, many lending protocols are exploring cross-chain and multi-chain solutions to improve efficiency and reduce costs. On one hand, besides deploying on other new public chains, they are using cross-chain bridge tools to achieve asset and data interoperability. On the other hand, driven by the needs and attention of the real economy and traditional finance, lending protocols are exploring the possibility of tokenizing real-world assets (RWA) to expand the scale and influence of the lending market. Some lending protocols have already experimented with tokenizing real estate, cars, invoices, and other assets and offering corresponding lending services.

Sui is a high-performance blockchain developed by the Mysten Labs team, focusing on modularity and specialization. Its mainnet was officially launched in May 2023. The team is actively developing, having established a blockchain incubator for developers and entrepreneurs in Dubai, and plans to launch a handheld gaming device, SuiPlay0X1, in 2025. Additionally, in August this year, the team introduced a new consensus engine, Mysticeti, which has partially reduced the latency of the Sui blockchain. Over the past year and a half, the Sui ecosystem’s TVL has climbed rapidly, currently ranking 5th among all public chain ecosystems. It now includes DeFi infrastructure like DEXs, lending platforms, stablecoins, and liquid staking.

With the arrival of a new bull market, the ecosystem has seen rapid growth, now encompassing over 80 projects. Scallop is the native currency and lending market of the Sui ecosystem and is the first DeFi protocol in the ecosystem to receive funding support from the Sui Foundation. Recently, it has shown excellent business performance through staking, and this article will analyze its product design logic, economic model, and current development in detail.

What is Scallop?

Scallop is a native lending market on the Sui chain. Its model draws on the design concepts of lending protocols like Compound v3, Solend, and Euler, offering on-chain lending and flash loans. It has also developed a Layer-2 SDK for professional traders, providing an arbitrage trading UI without the need for programming knowledge. The protocol was initiated by Kris Lai in 2021 and has undergone three security audits. It is the first DeFi project officially funded by the Sui Foundation.

The protocol has received investment from several well-known institutions. In March this year, it announced the completion of a $3 million strategic financing round, co-led by THE CMS and 6MV, with participation from KuCoin Labs and Blockchain Founders Fund. In October, it also secured investment from the Sui Foundation. The SCA token was officially launched in March this year. With the explosive growth of the Sui ecosystem recently, Scallop has attracted substantial capital and user activity, achieving strong business performance.

Source:scallop.io

Operating Logic

Scallop adopts a lending model based on the Compound protocol, implementing it through the tokenization of debt using sCoins (Scallop Market Coins). Depositors place their idle assets into the liquidity pool to receive sCoins, allowing them to earn interest on deposits and withdraw their funds anytime. Borrowers, on the other hand, collateralize their funds as a guarantee for loans and can borrow from the pool and repay at any time. The account will be liquidated if the collateralized assets are insufficient to support the debt.

sCoins tokenize debt, and their value is reflected in the exchange rate with the underlying assets, which increases over time to represent the interest earned on deposits. Users can also collateralize sCoins in other protocols to release idle liquidity.

Source: scallop.io

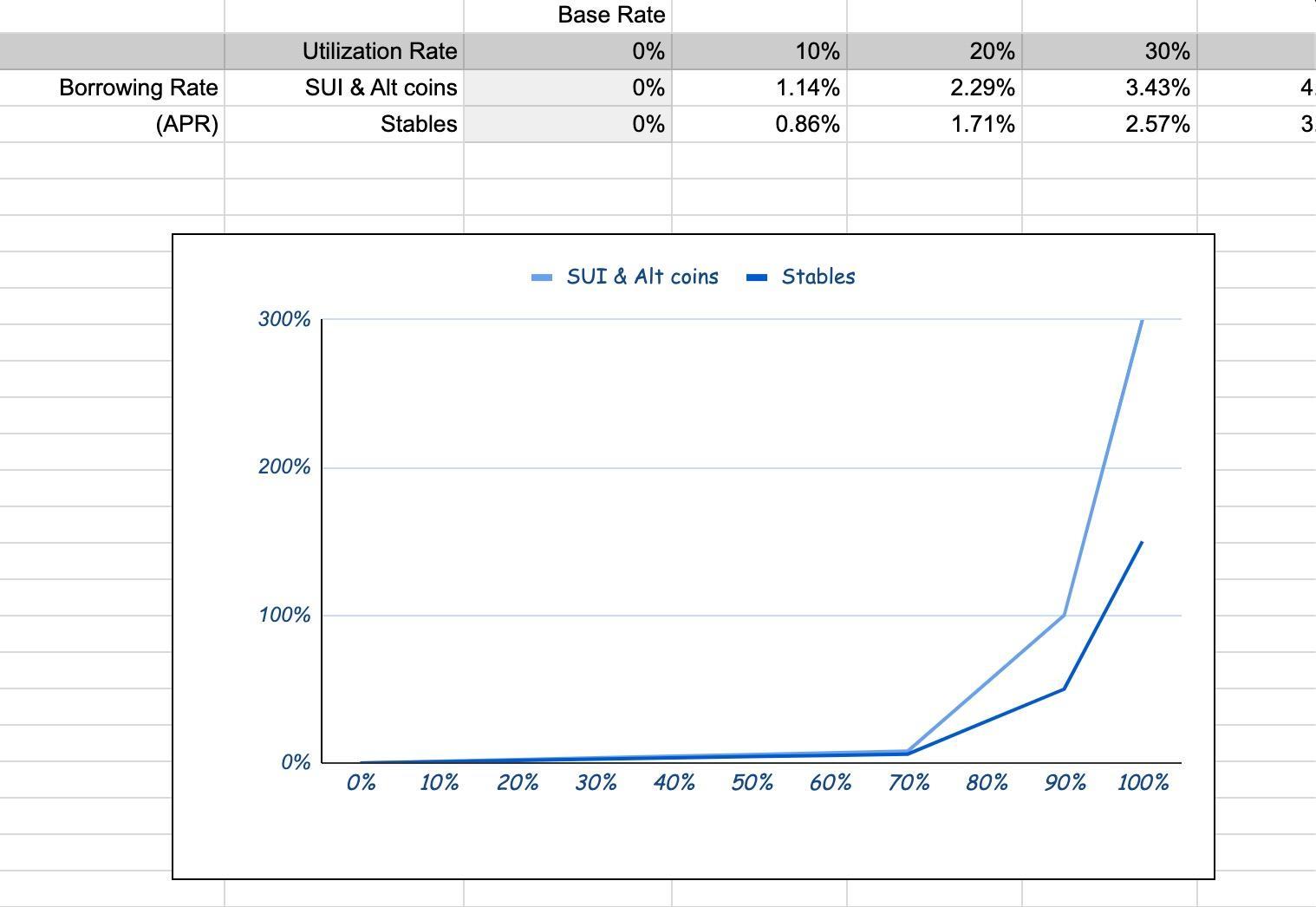

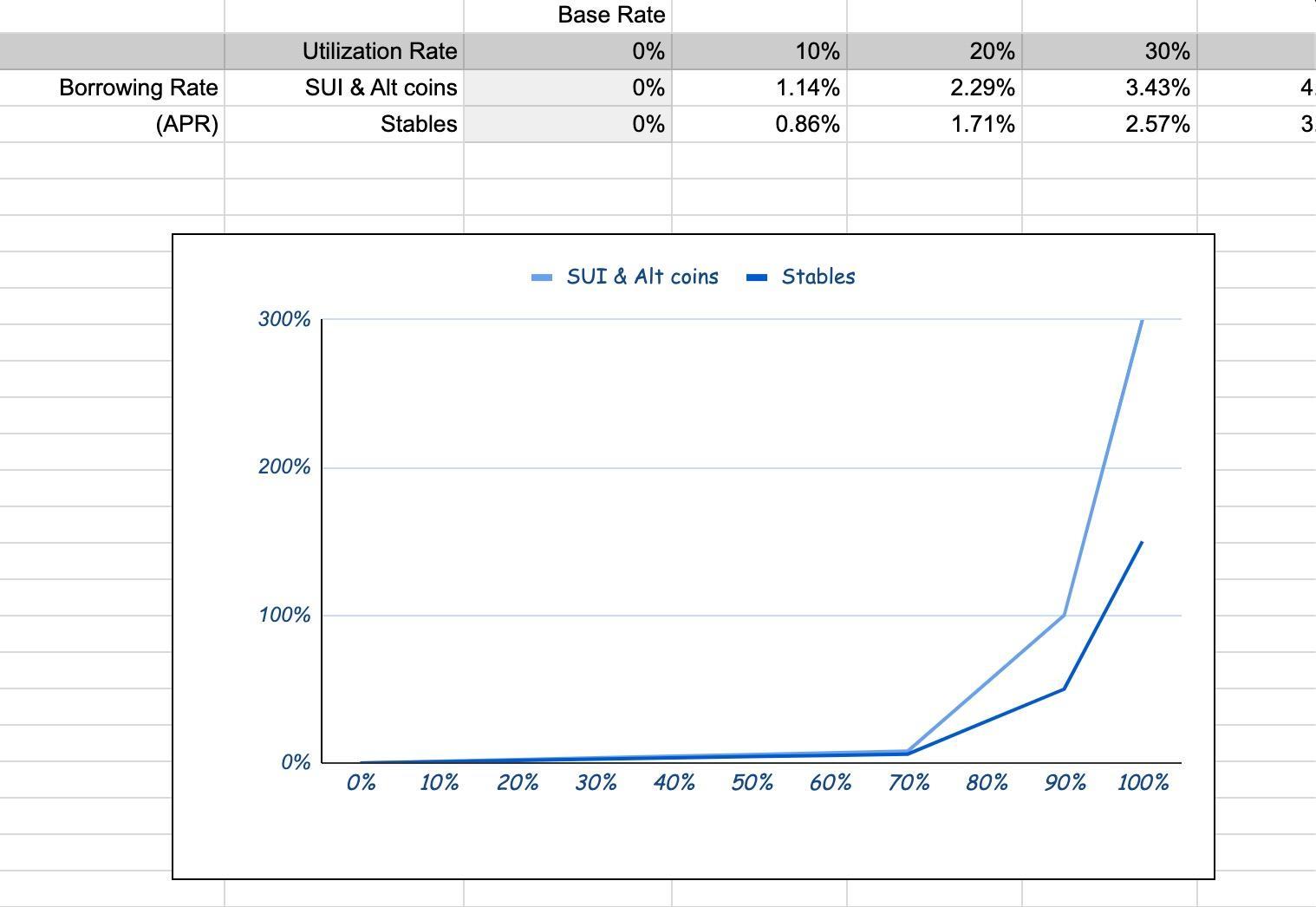

Three-Line Interest Rate Model

Similar to general lending protocols, Scallop adopts a static linear model and introduces a utilization parameter to control interest rates. Utilization refers to the ratio of borrowed assets to the total value of assets in the liquidity pool. When utilization is high, indicating strong borrowing demand, borrowers must pay higher interest rates.

The team has set a utilization threshold (optimal utilization) to manage interest rate fluctuations. When utilization is below the threshold, borrowing interest rates increase gradually as utilization rises. However, if utilization exceeds the threshold, borrowing rates spike sharply to curb demand.

Unlike Compound’s dual-line interest rate model, Scallop’s three-line model features three distinct phases triggered by different levels of capital utilization. When utilization approaches the upper limit, the system ensures that liquidity providers are adequately compensated for increased risk while signalling borrowers to reduce their positions due to rising costs.

Source: docs.scallop.io

Oracle Mechanism

Scallop has added an extra security layer to mitigate oracle manipulation risks by adopting a multi-oracle consensus strategy. This increases the cost of price manipulation attacks, effectively preventing Oracle price manipulation. Scallop’s price module integrates components such as Pyth, Switchboard, and SupraOracles and is designed for scalability to accommodate additional oracles.

The protocol updates asset prices in real time through Oracle. System liquidation is triggered if the collateral price falls below the total debt value (a threshold set by the protocol). Liquidators repay the debt and receive a portion of the liquidation rewards.

Risk Management

Scallop imposes dynamic constraints on the total amount of loans and withdrawals allowed, which are adjustable for each asset and pool. This prevents abnormal token minting events and reduces unusual withdrawal behavior.

In addition to pool adjustments, Scallop takes full advantage of the Sui network’s unique features. Unlike common EVM addresses, Sui’s account system provides users with primary and sub-accounts. Scallop leverages this feature, allowing users to efficiently manage multiple accounts. Transfers of assets and liabilities between sub-accounts require no approval, enabling users to easily isolate collateral and debt according to their preferences.

Economic Model

SCA is Scallop’s native token, and its tokenomics were officially released in March this year. The total supply of SCA tokens is 250 million, distributed as follows:

- 45% for liquidity mining, distributed through various incentive programs.

- 15% for core contributors.

- 15% for strategic partners and investors.

- 4% for development and operations.

- 1.5% for advisors.

- 7.5% for marketing and platform growth plans (ecosystem development).

- 5% for liquidity reserves.

- 7% for the treasury.

Source: medium

Liquidity mining tokens are released monthly, with the release amount decreasing by 1.5% compared to the previous month. The initial release was 2,830,459 tokens. Tokens allocated to the treasury are fully unlocked at the TGE (Token Generation Event) to ensure liquidity. Tokens for ecosystem development are linearly unlocked over five years. Core contributor tokens are locked for one year, followed by linear unlocking over three years. Advisor tokens follow the same one-year lockup and three-year linear unlock period. Tokens for development and operations are unlocked linearly over five years, while tokens for investors are unlocked within 1-3 years.

Source: docs.scallop.io

In addition to the native token SCA, the protocol has introduced a ve-token model. Users staking SCA can obtain veSCA, with the amount of veSCA received being proportional to the staked SCA and the staking duration. Over time, the value of veSCA held by users decays to zero, at which point the corresponding SCA is released. Users can extend the staking period or increase the staking amount to enhance the value of veSCA.

Source: docs.scallop.io

Holders of veSCA earn staking rewards and participate in Scallop’s governance.

Current Development

Scallop’s current total value locked (TVL) is nearly $200 million. The protocol’s liquidity has steadily increased thanks to the recent explosion of activity within the Sui ecosystem.

Currently, the total deposits in the asset pool amount to approximately $287 million, while the total loans are less than $100 million, resulting in an asset utilization rate of 32%.

Source: app.scallop.io

Conclusion

Scallop is the native lending market of the Sui ecosystem, with product logic that does not differ significantly from general lending protocols. Based on the Compound lending model, it introduced a three-line interest rate model to optimize interest rate stability and responsiveness to market conditions.

In addition to the lending market, Scallop provides professional traders with a Layer-2 SDK and a user-friendly arbitrage trading interface. In October this year, Scallop received investment from the Sui Foundation, becoming the first project in the Sui ecosystem to attract substantial funds and users. Its future development will be partially dependent on the growth of the underlying Sui blockchain.

Share

Everything You Need to Know About Scallop (SCA)

Introduction

After 2021, the rise of new public chains made lending, as a fundamental component of the DeFi financial system, a primary choice for building on-chain ecosystems. Today, lending protocols have become the second-largest DeFi sector after DEXs, with their basic models stabilizing. As congestion and rising fees on the Ethereum network persist, many lending protocols are exploring cross-chain and multi-chain solutions to improve efficiency and reduce costs. On one hand, besides deploying on other new public chains, they are using cross-chain bridge tools to achieve asset and data interoperability. On the other hand, driven by the needs and attention of the real economy and traditional finance, lending protocols are exploring the possibility of tokenizing real-world assets (RWA) to expand the scale and influence of the lending market. Some lending protocols have already experimented with tokenizing real estate, cars, invoices, and other assets and offering corresponding lending services.

Sui is a high-performance blockchain developed by the Mysten Labs team, focusing on modularity and specialization. Its mainnet was officially launched in May 2023. The team is actively developing, having established a blockchain incubator for developers and entrepreneurs in Dubai, and plans to launch a handheld gaming device, SuiPlay0X1, in 2025. Additionally, in August this year, the team introduced a new consensus engine, Mysticeti, which has partially reduced the latency of the Sui blockchain. Over the past year and a half, the Sui ecosystem’s TVL has climbed rapidly, currently ranking 5th among all public chain ecosystems. It now includes DeFi infrastructure like DEXs, lending platforms, stablecoins, and liquid staking.

With the arrival of a new bull market, the ecosystem has seen rapid growth, now encompassing over 80 projects. Scallop is the native currency and lending market of the Sui ecosystem and is the first DeFi protocol in the ecosystem to receive funding support from the Sui Foundation. Recently, it has shown excellent business performance through staking, and this article will analyze its product design logic, economic model, and current development in detail.

What is Scallop?

Scallop is a native lending market on the Sui chain. Its model draws on the design concepts of lending protocols like Compound v3, Solend, and Euler, offering on-chain lending and flash loans. It has also developed a Layer-2 SDK for professional traders, providing an arbitrage trading UI without the need for programming knowledge. The protocol was initiated by Kris Lai in 2021 and has undergone three security audits. It is the first DeFi project officially funded by the Sui Foundation.

The protocol has received investment from several well-known institutions. In March this year, it announced the completion of a $3 million strategic financing round, co-led by THE CMS and 6MV, with participation from KuCoin Labs and Blockchain Founders Fund. In October, it also secured investment from the Sui Foundation. The SCA token was officially launched in March this year. With the explosive growth of the Sui ecosystem recently, Scallop has attracted substantial capital and user activity, achieving strong business performance.

Source:scallop.io

Operating Logic

Scallop adopts a lending model based on the Compound protocol, implementing it through the tokenization of debt using sCoins (Scallop Market Coins). Depositors place their idle assets into the liquidity pool to receive sCoins, allowing them to earn interest on deposits and withdraw their funds anytime. Borrowers, on the other hand, collateralize their funds as a guarantee for loans and can borrow from the pool and repay at any time. The account will be liquidated if the collateralized assets are insufficient to support the debt.

sCoins tokenize debt, and their value is reflected in the exchange rate with the underlying assets, which increases over time to represent the interest earned on deposits. Users can also collateralize sCoins in other protocols to release idle liquidity.

Source: scallop.io

Three-Line Interest Rate Model

Similar to general lending protocols, Scallop adopts a static linear model and introduces a utilization parameter to control interest rates. Utilization refers to the ratio of borrowed assets to the total value of assets in the liquidity pool. When utilization is high, indicating strong borrowing demand, borrowers must pay higher interest rates.

The team has set a utilization threshold (optimal utilization) to manage interest rate fluctuations. When utilization is below the threshold, borrowing interest rates increase gradually as utilization rises. However, if utilization exceeds the threshold, borrowing rates spike sharply to curb demand.

Unlike Compound’s dual-line interest rate model, Scallop’s three-line model features three distinct phases triggered by different levels of capital utilization. When utilization approaches the upper limit, the system ensures that liquidity providers are adequately compensated for increased risk while signalling borrowers to reduce their positions due to rising costs.

Source: docs.scallop.io

Oracle Mechanism

Scallop has added an extra security layer to mitigate oracle manipulation risks by adopting a multi-oracle consensus strategy. This increases the cost of price manipulation attacks, effectively preventing Oracle price manipulation. Scallop’s price module integrates components such as Pyth, Switchboard, and SupraOracles and is designed for scalability to accommodate additional oracles.

The protocol updates asset prices in real time through Oracle. System liquidation is triggered if the collateral price falls below the total debt value (a threshold set by the protocol). Liquidators repay the debt and receive a portion of the liquidation rewards.

Risk Management

Scallop imposes dynamic constraints on the total amount of loans and withdrawals allowed, which are adjustable for each asset and pool. This prevents abnormal token minting events and reduces unusual withdrawal behavior.

In addition to pool adjustments, Scallop takes full advantage of the Sui network’s unique features. Unlike common EVM addresses, Sui’s account system provides users with primary and sub-accounts. Scallop leverages this feature, allowing users to efficiently manage multiple accounts. Transfers of assets and liabilities between sub-accounts require no approval, enabling users to easily isolate collateral and debt according to their preferences.

Economic Model

SCA is Scallop’s native token, and its tokenomics were officially released in March this year. The total supply of SCA tokens is 250 million, distributed as follows:

- 45% for liquidity mining, distributed through various incentive programs.

- 15% for core contributors.

- 15% for strategic partners and investors.

- 4% for development and operations.

- 1.5% for advisors.

- 7.5% for marketing and platform growth plans (ecosystem development).

- 5% for liquidity reserves.

- 7% for the treasury.

Source: medium

Liquidity mining tokens are released monthly, with the release amount decreasing by 1.5% compared to the previous month. The initial release was 2,830,459 tokens. Tokens allocated to the treasury are fully unlocked at the TGE (Token Generation Event) to ensure liquidity. Tokens for ecosystem development are linearly unlocked over five years. Core contributor tokens are locked for one year, followed by linear unlocking over three years. Advisor tokens follow the same one-year lockup and three-year linear unlock period. Tokens for development and operations are unlocked linearly over five years, while tokens for investors are unlocked within 1-3 years.

Source: docs.scallop.io

In addition to the native token SCA, the protocol has introduced a ve-token model. Users staking SCA can obtain veSCA, with the amount of veSCA received being proportional to the staked SCA and the staking duration. Over time, the value of veSCA held by users decays to zero, at which point the corresponding SCA is released. Users can extend the staking period or increase the staking amount to enhance the value of veSCA.

Source: docs.scallop.io

Holders of veSCA earn staking rewards and participate in Scallop’s governance.

Current Development

Scallop’s current total value locked (TVL) is nearly $200 million. The protocol’s liquidity has steadily increased thanks to the recent explosion of activity within the Sui ecosystem.

Currently, the total deposits in the asset pool amount to approximately $287 million, while the total loans are less than $100 million, resulting in an asset utilization rate of 32%.

Source: app.scallop.io

Conclusion

Scallop is the native lending market of the Sui ecosystem, with product logic that does not differ significantly from general lending protocols. Based on the Compound lending model, it introduced a three-line interest rate model to optimize interest rate stability and responsiveness to market conditions.

In addition to the lending market, Scallop provides professional traders with a Layer-2 SDK and a user-friendly arbitrage trading interface. In October this year, Scallop received investment from the Sui Foundation, becoming the first project in the Sui ecosystem to attract substantial funds and users. Its future development will be partially dependent on the growth of the underlying Sui blockchain.