استكشاف قطاع استثمار سولانا المتبقي

نظرة عامة على إعادة رهن سولانا

مقدمة لـ سولانا ريستاكينج

تستخدم ريستاكينغ لـ سولانا الأصول المراهنة بالفعل لدعم الأمان والعمليات الإضافية عبر منصات متعددة. هذا المفهوم، الذي انتشر في الأصل على سلسلة كتل إيثريوم من خلال منصات مبتكرة مثل إيجن لاير، قد توسع فيما بعد إلى سولانا، مما يجلب إمكانيات جديدة لاستخدام الأصول. على إيثريوم، غيرت ريستاكينغ كيفية استخدام الأصول، مما يتيح لـ ETH المراهن أن يؤمن بروتوكولات متعددة، وبالتالي يعزز كفاءة رأس المال وأمان الشبكة. تم اعتماد هذا النموذج بعد ذلك من قبل سولانا، مما يدخل ريستاكينغ للمساهمة في تعزيز سيولة الأصول وتحسين أمان الشبكة.

يسمح إعادة الرهان باستخدام SOL المرهونة في عدة تطبيقات لامركزية (dApps) دون التخلي عن فوائد الرهان الأصلي. في سولانا ، تنطوي إعادة الرهان على آليات معقدة تعزز كل من فائدة الأصول وإمكانية كسبها. يمكن للموثقين استخدام جزء من SOL المرهونة لتأمين بروتوكولات أخرى أو كسب مكافآت إضافية. تدير العقود الذكية هذه الأصول تحت حماية بروتوكول إعادة الرهان.

كيف يعمل

تنفيذ تكنولوجيا إعادة الوضع الراحة لسولانا عملية معقدة تشتمل على عدة مكونات، مصممة لتحسين كفاءة رأس المال وأمان الشبكة مع توليد عوائد أعلى للمستخدمين. يبدأ العملية بإيداع المستخدمين لرموز SOL الخاصة بهم في مدير حوض إعادة الوضع الراحة، الذي يشرف على تدفق الأصول في البروتوكول. يمكن للمستخدمين إيداع رموز الوضع الراحة السائلة (LSTs) أو إيداع SOL مباشرة، حيث يتم تحويلها أولاً إلى sSOL-raw، وهي شكل وسيط لرمز الوضع الراحة السائل الصادر عن مدير حوض الوضع الراحة.

يتم تفويض رموز SOL التابعة للمستخدم إلى المدير خلال هذه العملية. بعد أن يحول المدير SOL إلى sSOL-raw، يتفاعل مع مدير حوض إعادة الرهن مرة أخرى، ليحوله في النهاية إلى sSOL، وهو رمز إعادة الرهن السائل (LRT).

في نفس الوقت، يتولى المدير توزيع الحصة عبر الموثقين ومراقبي الأصول الرقمية القابلة للتبادل (AVSs)، ويمكنه أن يفوض SOL للموثقين الذين يحققون عوائد قيمة الاستخراج المُكملة (MEV) المُحسنة. يدير حوض الرهان اختيار الموثق والعوائد المحسنة بواسطة MEV، مما يضمن استخدام أصول المستخدم بفعالية لتأمين الشبكة وتحقيق العوائد.

لتعزيز التوافق بين السلاسل العابرة، يشمل إعادة المراهنة في سولانا أيضًا شبكة المراقب المشتركة (SVN)، مما يتيح لسلاسل سولانا المستندة إلى المشاركة في الأمان. وعلاوة على ذلك، يتم حساب المكافآت خارج السلسلة خلال عملية إعادة المراهنة. على سبيل المثال، ينفذ سولاير مراقب الحالة لتتبع الإيداعات والسحوبات، بالإضافة إلى البيانات الإحالية، وتُطبق مكافآت إضافية على حسابات المستخدمين في الوقت الفعلي. يضمن هذا التصميم شفافية المكافآت وسرعتها، مع تحسين مشاركة المستخدم ورضاه.

أخيرًا ، ينطوي إعادة الاستثمار في سولانا أيضًا على جودة الخدمة المرتبطة بالحصة المرتبة وزنيًا (swQoS) ، وهي آلية تخصيص موارد الشبكة التي تخصص مساحة الكتلة وقدرة معالجة المعاملات بناءً على وزن الحصة. تضمن هذه الآلية أن المستخدمين ذوي الحصص الأكبر هم الأكثر احتمالًا أن يقدموا المعاملات ، مما يحسن من كفاءة الشبكة العامة والأمان.

فوائد إعادة الرهن

إعادة الرهان على سولانا تقدم فرص مختلفة للمستخدمين والمطورين، ليس فقط تعزيز عوائد الاستثمار ولكن أيضًا تعزيز أمان وحيوية شبكة البلوكشين. من خلال إعادة الرهان، لا يقوم المستخدمون ببساطة بركن أصولهم ولكنهم يعززون بنشاط إمكانياتها. يمكن لسول المرهون دعم مشاريع متعددة أو عقدة موثقين متعددة في نفس الوقت، مما يؤدي إلى كسب تدفقات متعددة من المكافآت. هذه الكفاءة الرأسمالية تجعل الاستثمارات أكثر قيمة.

أولاً ، يُعزز المشاركة في إعادة الاستثمار الأمان العام لشبكة سولانا. كل SOL المستثمر في إعادة الاستثمار يسهم في قوة الشبكة ، مما يجعلها أكثر مقاومة للهجمات والأخطاء. تعمل هذه الاستراتيجية لتنويع المخاطر ، التي تتيح للمستخدمين اختيار عدة عقداء تحقق وتوزيع الأصول المرهونة عبر عقدات مختلفة أو بروتوكولات ، على تقليل خطر الخسارة بسبب فشل عقدة واحدة. في الوقت نفسه ، يعزز مشاركة كل عقدة أمان الشبكة ، مما يجعل سلسلة الكتل أكثر مرونة ضد الهجمات.

ثانيًا، الرهان السائل هو ميزة أخرى مهمة لإعادة الرهان. حلول إعادة الرهان الخاصة بـ سولانا غالبًا ما توفر خيارات الرهان السائل، مما يتيح للمستخدمين الحفاظ على السيولة مع استمرار كسب مكافآت الرهان. وهذا يعني أن المستخدمين يمكنهم استخدام رموزهم بمرونة لأنشطة مالية مختلفة دون التضحية بالعوائد.

وأخيرًا، يمكن للمستخدمين تخصيص SOL المعاد تجديده إلى مشاريع ناشئة، داعمين نموها و نجاحها، وبالتالي تعزيز صحة وتنوع نظام السلسلة الكتلية. على سبيل المثال، تقدم Marinade خيارات تقسيم التقدير التقليدية والسائلة، مما يتيح للمستخدمين الاستمتاع بمكافآت التقدير وقابلية السيولة. من ناحية أخرى، يعمل Jito على تحسين كفاءة التحقق وربحية العقدة من خلال تقليل التأثير السلبي للقيمة القصوى المستخرجة (MEV). تلعب هذه المشاريع دورًا هامًا في نظام السلسلة الكتلية المعاد تجديده، محسنة عملية التحقق، وتحسين كفاءة الشبكة، وتعزيز ربحية عقدات التحقق.

استكشاف مشاريع إعادة الرهن

يعد النظام البيئي لشركة Solana مجالا نابضا بالحياة ومبتكرا ، حيث تبلغ القيمة الإجمالية الحالية (TVL) في الرهان السائل حوالي 4.51 مليار دولار. تمثل الرموز المميزة الثلاثة الأولى للتكديس السائل 72.6٪ من حصة السوق. نظرا لانخفاض حواجز الدخول والتحسين المستمر لآليات العائد داخل النظام البيئي ، فإن استعادة Solana لديها معدل نمو سنوي يبلغ 159.2٪ ، مما يدل على إمكانات النمو السريع. تعمل بروتوكولات استعادة مثل Solayer و Jito ، من خلال توفير طبقات أمان إضافية ، وتحسين تخصيص موارد الشبكة ، وتسهيل تداول الأصول ، على تشكيل نظام بيئي أكثر ترابطا وقوة. يتيح ذلك لشبكة Solana دعم التطبيقات اللامركزية عالية الحركة ومشاريع التشفير مع الحفاظ على معالجة المعاملات السريعة والآمنة والرسوم المنخفضة ، مما يمهد الطريق لتطبيقات جديدة واعتماد أوسع.

سولاير

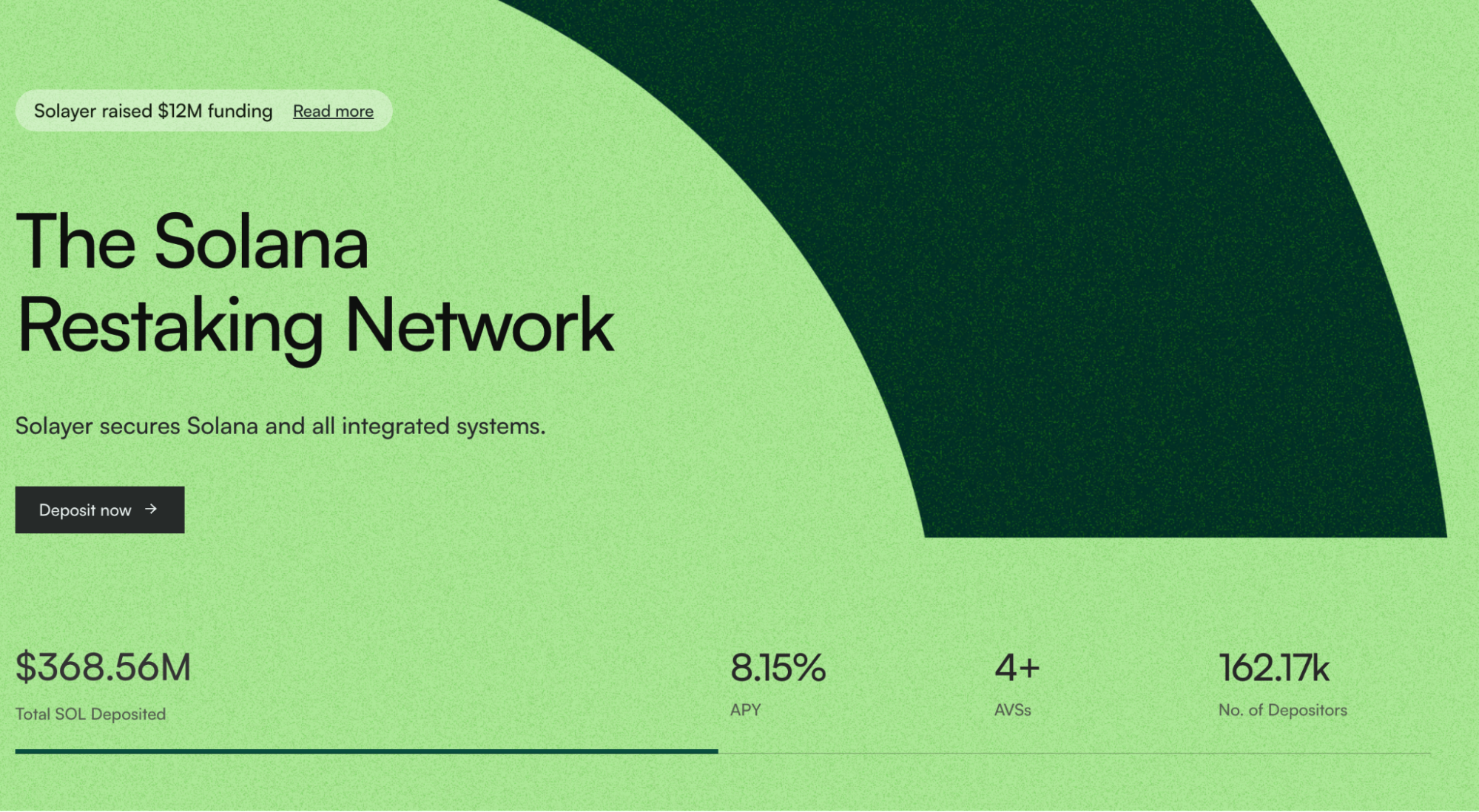

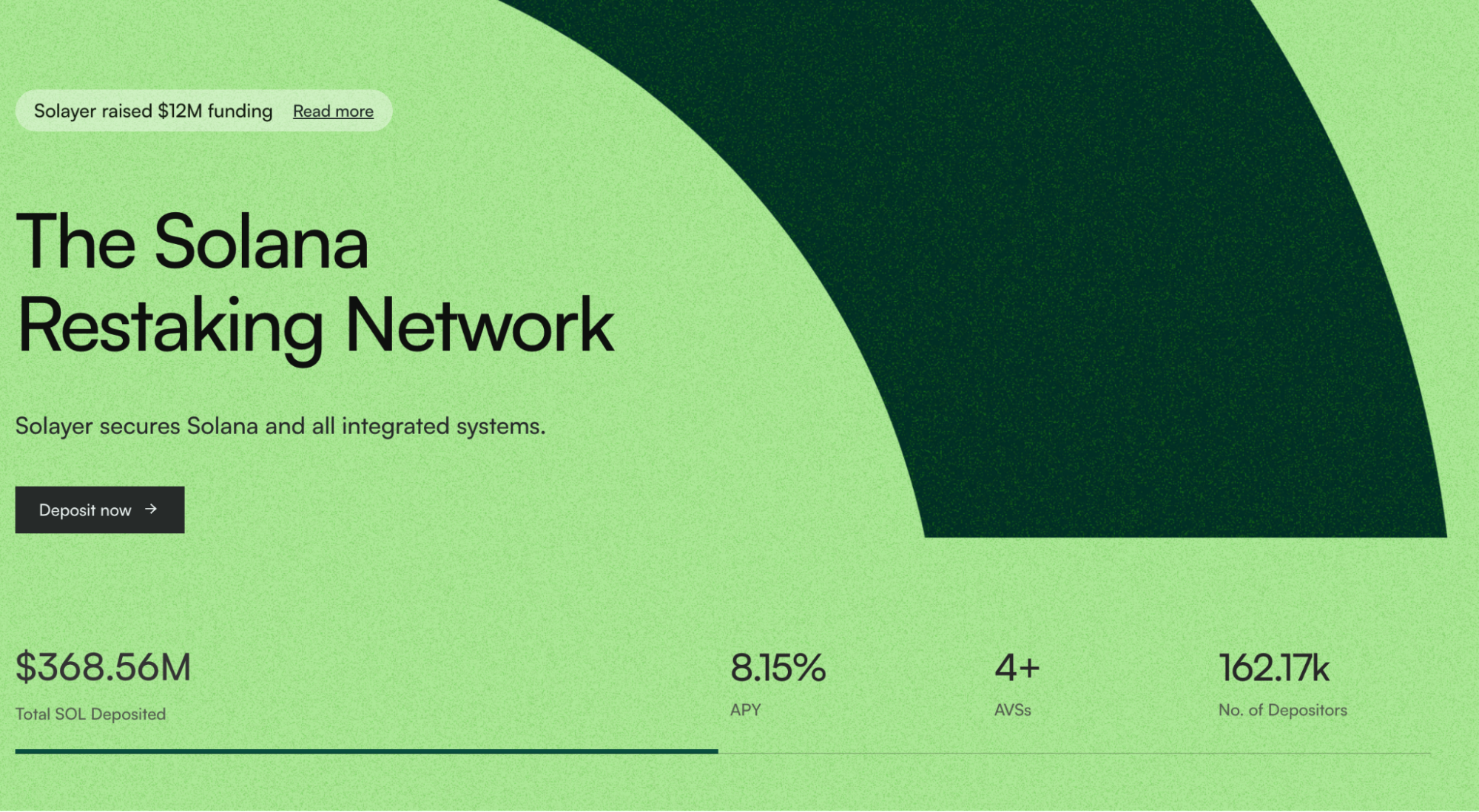

Solayer هو بروتوكول إعادة الحصة على Solana مخصص لمساعدة حاملي SOL على تحقيق أقصى عائد على الأصول الخاصة بهم. من خلال Solayer ، يمكن للمستخدمين الحصول على مكافآت PoS التقليدية والحصول على عوائد إضافية من MEV و AVS. يدعم Solayer أصول الحصة مثل SOL و mSOL و JitoSOL ، مما يتيح لحاملي الأصول توفير الأموال بأمان لمختلف البروتوكولات والتطبيقات اللامركزية داخل نظام Solana.

بالنسبة للتمويل، أنهت سولاير جولتين من التمويل:

- أجرت سولاير جولة قبل البذرة بحجم غير معلن مع مستثمرين ملائمين، بما في ذلك مؤسس سولانا أناتولي ياكوفينكو ومؤسس بوليغون سانديب نايلوال.

- أتمت Solayer جولة بذور بقيمة 12 مليون دولار بقيادة Polychain Capital، بمشاركة مستثمرين آخرين بما في ذلك Big Brain Holdings و Hack VC و Nomad Capital و Race Capital و ABCDE و مكتب عائلة آرثر هايز، Maelstrom. جلبت هذه الجولة من التمويل تقييمًا لشركة Solayer بقيمة 80 مليون دولار.

من خلال تسخير آلية الرهن الخاصة بـ سولانا، يوفر سولاير الأمان من خلال شبكة المحققين اللامركزية، مما يقلل من مخاطر الثقة المرتبطة بالخدمات المركزية أو الرموز الخاصة. كما يوفر تطبيقات اللامركزية (dApps) طريقة ملائمة لإنشاء AVS LSTs، مما يتيح لهم الاستمتاع بمكافآت الرهن الأساسية وكسب حصص إيرادات إضافية. يمكن أن تستفيد تطبيقات اللامركزية أيضًا من عمولات الرهن، وفي المستقبل، حتى تحسين العوائد من خلال تكوينات المشغل الأساسية.

من حيث الهندسة المعمارية التقنية، تتضمن هندسة Solayer نهجين رئيسيين: هندسة إعادة الرهان ودعم الاندماج التقني. تشمل مكونات إعادة الرهان مدير بركة إعادة الرهان ومدير التفويض وبرك الرهان وشبكة المصادقين المشتركة (SVN). تعمل هذه المكونات بشكل مشترك على تيسير التوافق بين السلاسل المبنية على Solana، مما يتيح مشاركة الأمان وتحسين تخصيص الموارد القائم على الرهان. بالنسبة للمطورين وشركاء الاندماج، يوفر Solayer واجهة سطر الأوامر (CLI) ووثائق API شاملة وواجهات عقود ذكية محددة بشكل جيد للتفاعل مع Solayer (endoAVS وإعادة الرهان) وبناء تطبيقات متوافقة.

وقد قامت سولاير بإطلاق برنامج نقاط مصمم لتحقيق الأولوية في مكافآت للمشاركين المبكرين. في المرحلة الأولية، الحقبة 0، قدمت سولاير للمودعين المبكرين مضاعف نقاط أعلى، مما يسمح لهم بإيداع أي مبلغ من الأصول في غضون 24 ساعة لكسب APY أعلى. عند دخول الحقبة 1، تم تعيين سقف القيمة الإجمالية المقفلة (TVL) عند 50 مليون دولار. خلال هذه الفترة، يمكن للمستخدمين الذين يودعون أكثر من 10 SOL فتح رمز دعوة دائم ولديهم فرصة لكسب المزيد من النقاط من خلال إكمال ما لا يقل عن ثلاث مهام، بما في ذلك دعوة الأصدقاء، وإيداع LSTs، ووجود إيداعات لأكثر من حقبتين. حاليًا، دخلت سولاير الحقبة 3، دون سقف TVL، مما يسمح للمستخدمين بالرهان في أي وقت، وتكسب الودائع الأصلية لـ SOL المزيد من النقاط مقارنة بالرموز الأخرى.

حاليًا، وصلت قيمة SOL المودعة في Solayer إلى ما يصل إلى 397.64 مليون دولار، مع 160,000 عنوان وديعة و APY بنسبة 8.15٪.

باعتبارها بنية تحتية للسحابة غير المركزية، يمكن لـ Solayer أن تمكّن مطوري التطبيقات من تحقيق درجة أعلى من التوافق وتخصيص مساحة الكتلة، مما يسهل تطوير تطبيقات مرنة ومعقدة أكثر قابلية للتوسع.

المصدر:سولاير

كامبريان

كامبريان هو طبقة إعادة الوضع القابلة للتعديل مصممة للنظام البيئي سولانا، وتوفير أمان مشترك وعوائد إضافية للشبكات القابلة للتعديل والبرامج الوسيطة من خلال إعادة استخدام رأس مال $SOL المراهن. تكنولوجياه وهندسته مستوحاة من طبقة إيجن لإيثيريوم، بهدف تعزيز قدرة النمو والأمان والكفاءة الاقتصادية للنظام البيئي سولانا.

تتميز كامبريان بتصميمها المعماري المرن وآلية إعادة الرهن، وهي توفر حلًا للأمان المشترك لنظام سولانا. بالمقارنة مع الهياكل المتماسكة التقليدية ، يقوم التصميم المرن بتفكيك النظام إلى وحدات وظيفية مستقلة ، يمكن تطويرها ونشرها وتوسيعها بشكل مستقل ، مما يعزز المرونة والتكامل.

في الخلاصة، يستند مبدأ كامبريان التقني على آلية إعادة الرهان والأمان المشترك، مما يمتد أمان الاتفاق في شبكة سولانا إلى شبكات وواجهات برمجية وسيطة أخرى. يتيح ذلك للمعتمدين كسب عوائد إضافية أثناء دعم التطبيقات الجديدة، ويمكن للمطورين إطلاق شبكات موثوقة بسرعة دون الاعتماد على رموز جديدة. تعزز الهندسة المعمارية المرنة لها مرونة النظام والقابلية للتركيب، وتوفر دعمًا أساسيًا آمنًا وفعالًا للتطبيقات اللامركزية.

المصدر: كمبريان

بيكاسو

بيكاسو هو سلسلة كتل عامة تعمل على نظام البلوكشين للتجديد العامة التي تعمل بناء على منصة Cosmos SDK، وتربط سلاسل القاعدة المختلفة من خلال بروتوكول IBC، وتقوم بمعالجة الأصول المودعة وتخصيصها لخدمات التحقق النشطة (AVS). حل التجديد الخاص به مشابه لـ EigenLayer، مما يتيح لجزء من العقد في الشبكة توفير الأمان لخدمات التحقق النشطة. تقوم آليات الحكم باختيار مشغلي العقد في بيكاسو وتدعم حاليًا التجديد باستخدام LSTs و SOL الأصلية.

تحقق معمارية بيكاسو التوافق بين سولانا وسلاسل أخرى ممكّنة لبروتوكول التواصل بين السلاسل (IBC) من خلال نشر "سلسلة بلوكات الضيف" على سولانا، مما يدفع بنقلات نوعية في التشغيل المشترك بين السلاسل. تتيح هذه المعمارية لسولانا استخدام SOL الأصلية والرموز العملات الرقمية الأخرى (مثل $jitoSOL وmSOL وbSOL وما إلى ذلك) كأصول للرهان، مما يعزز أمان الشبكة من خلال طبقة الإعادة الرهنية ويمكّن الاتصال السلس لسيولة سولانا مع سلاسل مثل كوزموس وبولكادوت وكوساما.

صمم Picasso خدمات التحقق النشطة (AVS) لدعم تقاطع السلسلة الشبكية هذا ويستخدم الأنشطة مثل Mantis Games لتوجيه السيولة إلى طبقة الإعادة الأخرى. بالنسبة لتوزيع رسوم التقاطع، يتم تخصيص 20% لحاملي PICA، ويتم تخصيص 40% للمعادين. من خلال آليات التحفيز مثل توزيع مكافآت الحصة، يعزز هذا النظام مشاركة حاملي رمز PICA والمعادين، مما يمهد الطريق لدمج Solana مع شبكة IBC بشكل أعمق. بالإضافة إلى ذلك، يتعاون Picasso مع العديد من تطبيقات Solana DApps، مثل Kamino Finance و Raydium، لتعزيز توسيع رمز PICA داخل البيئة النظامية لـ Solana.

تخطط بيكاسو للتوسع إلى سلسلة كوسموس وأصول أخرى بعد إطلاق AVS على سولانا. حاليا، تشمل المنتجات المدعومة لإعادة الرهان SOL و Jito SOL و mSOL و bSOL بيكاسو)

أصول LST. واجهة القيادة الفنية لبيكاسو (المصدر:بيكاسو)

جيتو

بعد بناء أكبر بروتوكول للحصول على سيولة على سولانا بنجاح، تقود شركة جيتو لابز تطوير الصناعة مرة أخرى مع إطلاق بروتوكول جديد لإعادة الحصة - جيتو ريستاكينج. البروتوكول متاح الآن وسيتم فتح وظيفة الإيداع مع قدرة إعادة الحصة الأولية تبلغ حوالي 147,000 SOL.

واجهة إعادة التجديد في جيتو (المصدر: Jito)

يتكون جوهر جيتو ريستاكينج من برنامج ريستاكينج وبرنامج الخزينة، وهما الركائز الرئيسيتين التي تعملان معًا ضمن الإطار.

- يتولى برنامج إعادة الرهان مسؤولية إدارة مشغلي توافق العقد (NCNs)، بما في ذلك إنشاء العقد، وآليات اختيار المستخدمين، وقواعد المكافآت والعقوبات. هذا الجزء غير مرئي للمستخدمين وهو النواة الأساسية لعمل إطار إعادة الرهان، ويوفر الدعم الأمني والاستقراري للشبكة.

- برنامج الخزينة هو الواجهة الرئيسية التي يتفاعل معها المستخدمون، مسؤولة عن إدارة رموز إعادة الرهن السائلة (VRTs) وتنفيذ استراتيجيات إعادة الرهن الشخصية من خلال DAOs أو بروتوكولات مؤتمتة. يوفر برنامج الخزينة للمستخدمين مرونة، مما يتيح لهم اختيار أنسب خطة لإعادة الرهن بناءً على تفضيلاتهم مع الاستمتاع بفوائد الرموز السائلة.

في المرحلة الأولية ، يتعاون Jito Restaking مع ثلاثة مزودين لرموز Liquid Restaking Token (VRT): RenzoProtocol ($ezSOL) و Fragmetric ($fragSOL) و KyrosFi ($kySOL) ، مخصصين بشكل جماعي للحد الأولي لـ 147,000 SOL. يمكن للمستخدمين اختيار أحدهما من بين هؤلاء الثلاثة بناءً على تحمل المخاطر وتوقعات العائد لتحسين تجربة الرهن.

إدارة المخاطر: سيولة وآليات VRTs المختلفة تختلف. تتميز توكينات Renzo وKyros بسيولة أولية ومخاطر أقل، بينما تكون توكينات Fragmetric في البداية غير قابلة للتحويل، مما يؤدي إلى زيادة مخاطر السيولة.

العائد والتوزيعات المجانية: العائد السنوي المتوقع (APYs) لكل VRT مماثل، ولكن هناك اختلافات كبيرة في فرص التوزيع المجاني. لم يطلق Kyros و Fragmetric رموزهما بعد، لذا هناك المزيد من فرص التوزيع المجاني، بينما فرص توزيع رمز Renzo محدودة.

مقارنة مزود VRT (المصدر: جيتو)

مقدس

سانكتوم هو بروتوكول إعادة الرهن الابتكاري الذي يعزز كفاءة رأس المال والأمان على شبكة سولانا. يتيح للمستخدمين إعادة رهن الأصول السائلة المرهونة (مثل mSOL أو stSOL)، مما يتيح تحقيق عوائد تراكمية على أصولهم. يتيح هذا الآلية للمستخدمين مواصلة كسب المكافآت من الرهن الأصلي ويمكنهم توزيع العوائد الإضافية من خلال المشاركة في نظام سانكتوم.

إحدى النقاط البارزة في Sanctum هي Infinity، وهو بركة سائلة للرهان المتعددة الأصول (LST) تدعم التداول بين عدد غير محدود من LSTs المدرجة في القائمة البيضاء (مثل SOL، bSOL، الخ). يحدد السعر العادل لكل LST عن طريق حساب القيمة الفعلية ل SOL في حسابات الرهان، مما يقضي على الاعتماد على صيغ الإنتاج المستمر أو تبادل الاستقرار المستخدمة في برك السوائل التقليدية.

لتحسين العوائد، يقوم Infinity بضبط نسب التوزيع المستهدفة ورسوم الصرف بشكل ديناميكي لكل LST، مما يزيد من عائدات التداول ويحافظ على حيازات الأصول الدنيا. يتيح الرمز الأصلي INF توفير السيولة المشتركة ويمكن استخدامه في بروتوكولات DeFi، حيث تتكون مصادر العائد من مكافآت LST للرهان ورسوم المعاملات.

كيف يعمل

تعتمد عملية Sanctum على العمليات الرئيسية التالية:

- دعم الأصول المستندة إلى الحصة المتسائلة: يمكن للمستخدمين إيداع الرموز المستندة إلى الحصة المتسائلة التي تم الحصول عليها من بروتوكولات مثل ماريناد أو ليدو في Sanctum.

- آلية إعادة الرهن: يقوم Sanctum بتفويض هذه الرموز السيولية المرهونة إلى عقدة المحققين، مما يحقق إعادة الرهن.

- عوائد Compound: لا يكتسب المستخدمون فقط مكافآت الرهان الأساسية ولكنهم أيضًا يحققون عوائد إضافية من خلال آلية إعادة الرهان في Sanctum، مما يعزز استخدام الأصول.

- الأمان اللامركزي: توجه Sanctum مزيدًا من رؤوس الأموال المرهونة نحو عقدة الموثقين الخاصة بـ Solana، مما يعزز أمان الشبكة واللامركزية.

تعالج Sanctum نقطتي ألم في نماذج الرهان التقليدية: مشكلات سيولة الأصول وقيود تدفق العائد الواحد. من خلال إعادة الرهان، تقدم Sanctum حلاً مبتكرًا يزيد من فرص كسب المستخدمين ويضيف دفعًا جديدًا إلى أمان Solana وتطويرها اللامركزي.

استنتاج

إعادة التجديد على سولانا هي آلية مبتكرة لتعزيز كفاءة رأس المال وأمان الشبكة عن طريق إعادة استخدام أصول SOL المجازة بالفعل لدعم بروتوكولات متعددة أو تطبيقات مفتوحة المصدر (dApps). هذا المفهوم، الذي ظهر في الأصل في بيئة Ethereum، تم تبنيه تدريجياً من قبل منصات سلسلة الكتل عالية الأداء مثل سولانا، مما يوفر للمستخدمين والمطورين إمكانيات إدارة الأصول وفرص العائد المرنة أكثر.

مبدأ عمل إعادة الرهن ينطوي على إيداع SOL في مدير، وتحويله إلى رموز الرهن السائلة (LSTs أو LRTs)، وتحقيق توزيع الموارد الفعال من خلال حمامات الرهن المعقدة وشبكات الموثقين. يزيد هذا العملية من سيولة الأصول ويعزز استقرار الشبكة ومرونتها ضد المخاطر من خلال آليات الأمان المشتركة. علاوة على ذلك، يتم دمج إعادة الرهن مع تكنولوجيا الشريطة الجانبية، مما يعزز بشكل كبير قابلية تشغيل شبكة سولانا مع سلاسل كتل أخرى.

أتاح إدخال إعادة الوضع الطموح Solana ليس فقط التفوق في الأداء العالي ولكن أيضًا تقديم إمكانيات جديدة في استخدام رأس المال والتعاون البيئي. من خلال آليات الرهان الابتكارية والبنية التحتية اللامركزية ، يعزز إعادة الوضع الكفاءة الرأسمالية والأمان وتنوع البيئة البيئية لشبكة Solana. مع التطور التدريجي للبروتوكولات مثل Solayer و Cambrian و Jito ، فإن إعادة الوضع في Solana تمهد الطريق للمستخدمين والمطورين نحو مستقبل سلسلة الكتل الأكثر فتحًا وكفاءة وأمانًا.

استكشاف قطاع استثمار سولانا المتبقي

نظرة عامة على إعادة رهن سولانا

مقدمة لـ سولانا ريستاكينج

تستخدم ريستاكينغ لـ سولانا الأصول المراهنة بالفعل لدعم الأمان والعمليات الإضافية عبر منصات متعددة. هذا المفهوم، الذي انتشر في الأصل على سلسلة كتل إيثريوم من خلال منصات مبتكرة مثل إيجن لاير، قد توسع فيما بعد إلى سولانا، مما يجلب إمكانيات جديدة لاستخدام الأصول. على إيثريوم، غيرت ريستاكينغ كيفية استخدام الأصول، مما يتيح لـ ETH المراهن أن يؤمن بروتوكولات متعددة، وبالتالي يعزز كفاءة رأس المال وأمان الشبكة. تم اعتماد هذا النموذج بعد ذلك من قبل سولانا، مما يدخل ريستاكينغ للمساهمة في تعزيز سيولة الأصول وتحسين أمان الشبكة.

يسمح إعادة الرهان باستخدام SOL المرهونة في عدة تطبيقات لامركزية (dApps) دون التخلي عن فوائد الرهان الأصلي. في سولانا ، تنطوي إعادة الرهان على آليات معقدة تعزز كل من فائدة الأصول وإمكانية كسبها. يمكن للموثقين استخدام جزء من SOL المرهونة لتأمين بروتوكولات أخرى أو كسب مكافآت إضافية. تدير العقود الذكية هذه الأصول تحت حماية بروتوكول إعادة الرهان.

كيف يعمل

تنفيذ تكنولوجيا إعادة الوضع الراحة لسولانا عملية معقدة تشتمل على عدة مكونات، مصممة لتحسين كفاءة رأس المال وأمان الشبكة مع توليد عوائد أعلى للمستخدمين. يبدأ العملية بإيداع المستخدمين لرموز SOL الخاصة بهم في مدير حوض إعادة الوضع الراحة، الذي يشرف على تدفق الأصول في البروتوكول. يمكن للمستخدمين إيداع رموز الوضع الراحة السائلة (LSTs) أو إيداع SOL مباشرة، حيث يتم تحويلها أولاً إلى sSOL-raw، وهي شكل وسيط لرمز الوضع الراحة السائل الصادر عن مدير حوض الوضع الراحة.

يتم تفويض رموز SOL التابعة للمستخدم إلى المدير خلال هذه العملية. بعد أن يحول المدير SOL إلى sSOL-raw، يتفاعل مع مدير حوض إعادة الرهن مرة أخرى، ليحوله في النهاية إلى sSOL، وهو رمز إعادة الرهن السائل (LRT).

في نفس الوقت، يتولى المدير توزيع الحصة عبر الموثقين ومراقبي الأصول الرقمية القابلة للتبادل (AVSs)، ويمكنه أن يفوض SOL للموثقين الذين يحققون عوائد قيمة الاستخراج المُكملة (MEV) المُحسنة. يدير حوض الرهان اختيار الموثق والعوائد المحسنة بواسطة MEV، مما يضمن استخدام أصول المستخدم بفعالية لتأمين الشبكة وتحقيق العوائد.

لتعزيز التوافق بين السلاسل العابرة، يشمل إعادة المراهنة في سولانا أيضًا شبكة المراقب المشتركة (SVN)، مما يتيح لسلاسل سولانا المستندة إلى المشاركة في الأمان. وعلاوة على ذلك، يتم حساب المكافآت خارج السلسلة خلال عملية إعادة المراهنة. على سبيل المثال، ينفذ سولاير مراقب الحالة لتتبع الإيداعات والسحوبات، بالإضافة إلى البيانات الإحالية، وتُطبق مكافآت إضافية على حسابات المستخدمين في الوقت الفعلي. يضمن هذا التصميم شفافية المكافآت وسرعتها، مع تحسين مشاركة المستخدم ورضاه.

أخيرًا ، ينطوي إعادة الاستثمار في سولانا أيضًا على جودة الخدمة المرتبطة بالحصة المرتبة وزنيًا (swQoS) ، وهي آلية تخصيص موارد الشبكة التي تخصص مساحة الكتلة وقدرة معالجة المعاملات بناءً على وزن الحصة. تضمن هذه الآلية أن المستخدمين ذوي الحصص الأكبر هم الأكثر احتمالًا أن يقدموا المعاملات ، مما يحسن من كفاءة الشبكة العامة والأمان.

فوائد إعادة الرهن

إعادة الرهان على سولانا تقدم فرص مختلفة للمستخدمين والمطورين، ليس فقط تعزيز عوائد الاستثمار ولكن أيضًا تعزيز أمان وحيوية شبكة البلوكشين. من خلال إعادة الرهان، لا يقوم المستخدمون ببساطة بركن أصولهم ولكنهم يعززون بنشاط إمكانياتها. يمكن لسول المرهون دعم مشاريع متعددة أو عقدة موثقين متعددة في نفس الوقت، مما يؤدي إلى كسب تدفقات متعددة من المكافآت. هذه الكفاءة الرأسمالية تجعل الاستثمارات أكثر قيمة.

أولاً ، يُعزز المشاركة في إعادة الاستثمار الأمان العام لشبكة سولانا. كل SOL المستثمر في إعادة الاستثمار يسهم في قوة الشبكة ، مما يجعلها أكثر مقاومة للهجمات والأخطاء. تعمل هذه الاستراتيجية لتنويع المخاطر ، التي تتيح للمستخدمين اختيار عدة عقداء تحقق وتوزيع الأصول المرهونة عبر عقدات مختلفة أو بروتوكولات ، على تقليل خطر الخسارة بسبب فشل عقدة واحدة. في الوقت نفسه ، يعزز مشاركة كل عقدة أمان الشبكة ، مما يجعل سلسلة الكتل أكثر مرونة ضد الهجمات.

ثانيًا، الرهان السائل هو ميزة أخرى مهمة لإعادة الرهان. حلول إعادة الرهان الخاصة بـ سولانا غالبًا ما توفر خيارات الرهان السائل، مما يتيح للمستخدمين الحفاظ على السيولة مع استمرار كسب مكافآت الرهان. وهذا يعني أن المستخدمين يمكنهم استخدام رموزهم بمرونة لأنشطة مالية مختلفة دون التضحية بالعوائد.

وأخيرًا، يمكن للمستخدمين تخصيص SOL المعاد تجديده إلى مشاريع ناشئة، داعمين نموها و نجاحها، وبالتالي تعزيز صحة وتنوع نظام السلسلة الكتلية. على سبيل المثال، تقدم Marinade خيارات تقسيم التقدير التقليدية والسائلة، مما يتيح للمستخدمين الاستمتاع بمكافآت التقدير وقابلية السيولة. من ناحية أخرى، يعمل Jito على تحسين كفاءة التحقق وربحية العقدة من خلال تقليل التأثير السلبي للقيمة القصوى المستخرجة (MEV). تلعب هذه المشاريع دورًا هامًا في نظام السلسلة الكتلية المعاد تجديده، محسنة عملية التحقق، وتحسين كفاءة الشبكة، وتعزيز ربحية عقدات التحقق.

استكشاف مشاريع إعادة الرهن

يعد النظام البيئي لشركة Solana مجالا نابضا بالحياة ومبتكرا ، حيث تبلغ القيمة الإجمالية الحالية (TVL) في الرهان السائل حوالي 4.51 مليار دولار. تمثل الرموز المميزة الثلاثة الأولى للتكديس السائل 72.6٪ من حصة السوق. نظرا لانخفاض حواجز الدخول والتحسين المستمر لآليات العائد داخل النظام البيئي ، فإن استعادة Solana لديها معدل نمو سنوي يبلغ 159.2٪ ، مما يدل على إمكانات النمو السريع. تعمل بروتوكولات استعادة مثل Solayer و Jito ، من خلال توفير طبقات أمان إضافية ، وتحسين تخصيص موارد الشبكة ، وتسهيل تداول الأصول ، على تشكيل نظام بيئي أكثر ترابطا وقوة. يتيح ذلك لشبكة Solana دعم التطبيقات اللامركزية عالية الحركة ومشاريع التشفير مع الحفاظ على معالجة المعاملات السريعة والآمنة والرسوم المنخفضة ، مما يمهد الطريق لتطبيقات جديدة واعتماد أوسع.

سولاير

Solayer هو بروتوكول إعادة الحصة على Solana مخصص لمساعدة حاملي SOL على تحقيق أقصى عائد على الأصول الخاصة بهم. من خلال Solayer ، يمكن للمستخدمين الحصول على مكافآت PoS التقليدية والحصول على عوائد إضافية من MEV و AVS. يدعم Solayer أصول الحصة مثل SOL و mSOL و JitoSOL ، مما يتيح لحاملي الأصول توفير الأموال بأمان لمختلف البروتوكولات والتطبيقات اللامركزية داخل نظام Solana.

بالنسبة للتمويل، أنهت سولاير جولتين من التمويل:

- أجرت سولاير جولة قبل البذرة بحجم غير معلن مع مستثمرين ملائمين، بما في ذلك مؤسس سولانا أناتولي ياكوفينكو ومؤسس بوليغون سانديب نايلوال.

- أتمت Solayer جولة بذور بقيمة 12 مليون دولار بقيادة Polychain Capital، بمشاركة مستثمرين آخرين بما في ذلك Big Brain Holdings و Hack VC و Nomad Capital و Race Capital و ABCDE و مكتب عائلة آرثر هايز، Maelstrom. جلبت هذه الجولة من التمويل تقييمًا لشركة Solayer بقيمة 80 مليون دولار.

من خلال تسخير آلية الرهن الخاصة بـ سولانا، يوفر سولاير الأمان من خلال شبكة المحققين اللامركزية، مما يقلل من مخاطر الثقة المرتبطة بالخدمات المركزية أو الرموز الخاصة. كما يوفر تطبيقات اللامركزية (dApps) طريقة ملائمة لإنشاء AVS LSTs، مما يتيح لهم الاستمتاع بمكافآت الرهن الأساسية وكسب حصص إيرادات إضافية. يمكن أن تستفيد تطبيقات اللامركزية أيضًا من عمولات الرهن، وفي المستقبل، حتى تحسين العوائد من خلال تكوينات المشغل الأساسية.

من حيث الهندسة المعمارية التقنية، تتضمن هندسة Solayer نهجين رئيسيين: هندسة إعادة الرهان ودعم الاندماج التقني. تشمل مكونات إعادة الرهان مدير بركة إعادة الرهان ومدير التفويض وبرك الرهان وشبكة المصادقين المشتركة (SVN). تعمل هذه المكونات بشكل مشترك على تيسير التوافق بين السلاسل المبنية على Solana، مما يتيح مشاركة الأمان وتحسين تخصيص الموارد القائم على الرهان. بالنسبة للمطورين وشركاء الاندماج، يوفر Solayer واجهة سطر الأوامر (CLI) ووثائق API شاملة وواجهات عقود ذكية محددة بشكل جيد للتفاعل مع Solayer (endoAVS وإعادة الرهان) وبناء تطبيقات متوافقة.

وقد قامت سولاير بإطلاق برنامج نقاط مصمم لتحقيق الأولوية في مكافآت للمشاركين المبكرين. في المرحلة الأولية، الحقبة 0، قدمت سولاير للمودعين المبكرين مضاعف نقاط أعلى، مما يسمح لهم بإيداع أي مبلغ من الأصول في غضون 24 ساعة لكسب APY أعلى. عند دخول الحقبة 1، تم تعيين سقف القيمة الإجمالية المقفلة (TVL) عند 50 مليون دولار. خلال هذه الفترة، يمكن للمستخدمين الذين يودعون أكثر من 10 SOL فتح رمز دعوة دائم ولديهم فرصة لكسب المزيد من النقاط من خلال إكمال ما لا يقل عن ثلاث مهام، بما في ذلك دعوة الأصدقاء، وإيداع LSTs، ووجود إيداعات لأكثر من حقبتين. حاليًا، دخلت سولاير الحقبة 3، دون سقف TVL، مما يسمح للمستخدمين بالرهان في أي وقت، وتكسب الودائع الأصلية لـ SOL المزيد من النقاط مقارنة بالرموز الأخرى.

حاليًا، وصلت قيمة SOL المودعة في Solayer إلى ما يصل إلى 397.64 مليون دولار، مع 160,000 عنوان وديعة و APY بنسبة 8.15٪.

باعتبارها بنية تحتية للسحابة غير المركزية، يمكن لـ Solayer أن تمكّن مطوري التطبيقات من تحقيق درجة أعلى من التوافق وتخصيص مساحة الكتلة، مما يسهل تطوير تطبيقات مرنة ومعقدة أكثر قابلية للتوسع.

المصدر:سولاير

كامبريان

كامبريان هو طبقة إعادة الوضع القابلة للتعديل مصممة للنظام البيئي سولانا، وتوفير أمان مشترك وعوائد إضافية للشبكات القابلة للتعديل والبرامج الوسيطة من خلال إعادة استخدام رأس مال $SOL المراهن. تكنولوجياه وهندسته مستوحاة من طبقة إيجن لإيثيريوم، بهدف تعزيز قدرة النمو والأمان والكفاءة الاقتصادية للنظام البيئي سولانا.

تتميز كامبريان بتصميمها المعماري المرن وآلية إعادة الرهن، وهي توفر حلًا للأمان المشترك لنظام سولانا. بالمقارنة مع الهياكل المتماسكة التقليدية ، يقوم التصميم المرن بتفكيك النظام إلى وحدات وظيفية مستقلة ، يمكن تطويرها ونشرها وتوسيعها بشكل مستقل ، مما يعزز المرونة والتكامل.

في الخلاصة، يستند مبدأ كامبريان التقني على آلية إعادة الرهان والأمان المشترك، مما يمتد أمان الاتفاق في شبكة سولانا إلى شبكات وواجهات برمجية وسيطة أخرى. يتيح ذلك للمعتمدين كسب عوائد إضافية أثناء دعم التطبيقات الجديدة، ويمكن للمطورين إطلاق شبكات موثوقة بسرعة دون الاعتماد على رموز جديدة. تعزز الهندسة المعمارية المرنة لها مرونة النظام والقابلية للتركيب، وتوفر دعمًا أساسيًا آمنًا وفعالًا للتطبيقات اللامركزية.

المصدر: كمبريان

بيكاسو

بيكاسو هو سلسلة كتل عامة تعمل على نظام البلوكشين للتجديد العامة التي تعمل بناء على منصة Cosmos SDK، وتربط سلاسل القاعدة المختلفة من خلال بروتوكول IBC، وتقوم بمعالجة الأصول المودعة وتخصيصها لخدمات التحقق النشطة (AVS). حل التجديد الخاص به مشابه لـ EigenLayer، مما يتيح لجزء من العقد في الشبكة توفير الأمان لخدمات التحقق النشطة. تقوم آليات الحكم باختيار مشغلي العقد في بيكاسو وتدعم حاليًا التجديد باستخدام LSTs و SOL الأصلية.

تحقق معمارية بيكاسو التوافق بين سولانا وسلاسل أخرى ممكّنة لبروتوكول التواصل بين السلاسل (IBC) من خلال نشر "سلسلة بلوكات الضيف" على سولانا، مما يدفع بنقلات نوعية في التشغيل المشترك بين السلاسل. تتيح هذه المعمارية لسولانا استخدام SOL الأصلية والرموز العملات الرقمية الأخرى (مثل $jitoSOL وmSOL وbSOL وما إلى ذلك) كأصول للرهان، مما يعزز أمان الشبكة من خلال طبقة الإعادة الرهنية ويمكّن الاتصال السلس لسيولة سولانا مع سلاسل مثل كوزموس وبولكادوت وكوساما.

صمم Picasso خدمات التحقق النشطة (AVS) لدعم تقاطع السلسلة الشبكية هذا ويستخدم الأنشطة مثل Mantis Games لتوجيه السيولة إلى طبقة الإعادة الأخرى. بالنسبة لتوزيع رسوم التقاطع، يتم تخصيص 20% لحاملي PICA، ويتم تخصيص 40% للمعادين. من خلال آليات التحفيز مثل توزيع مكافآت الحصة، يعزز هذا النظام مشاركة حاملي رمز PICA والمعادين، مما يمهد الطريق لدمج Solana مع شبكة IBC بشكل أعمق. بالإضافة إلى ذلك، يتعاون Picasso مع العديد من تطبيقات Solana DApps، مثل Kamino Finance و Raydium، لتعزيز توسيع رمز PICA داخل البيئة النظامية لـ Solana.

تخطط بيكاسو للتوسع إلى سلسلة كوسموس وأصول أخرى بعد إطلاق AVS على سولانا. حاليا، تشمل المنتجات المدعومة لإعادة الرهان SOL و Jito SOL و mSOL و bSOL بيكاسو)

أصول LST. واجهة القيادة الفنية لبيكاسو (المصدر:بيكاسو)

جيتو

بعد بناء أكبر بروتوكول للحصول على سيولة على سولانا بنجاح، تقود شركة جيتو لابز تطوير الصناعة مرة أخرى مع إطلاق بروتوكول جديد لإعادة الحصة - جيتو ريستاكينج. البروتوكول متاح الآن وسيتم فتح وظيفة الإيداع مع قدرة إعادة الحصة الأولية تبلغ حوالي 147,000 SOL.

واجهة إعادة التجديد في جيتو (المصدر: Jito)

يتكون جوهر جيتو ريستاكينج من برنامج ريستاكينج وبرنامج الخزينة، وهما الركائز الرئيسيتين التي تعملان معًا ضمن الإطار.

- يتولى برنامج إعادة الرهان مسؤولية إدارة مشغلي توافق العقد (NCNs)، بما في ذلك إنشاء العقد، وآليات اختيار المستخدمين، وقواعد المكافآت والعقوبات. هذا الجزء غير مرئي للمستخدمين وهو النواة الأساسية لعمل إطار إعادة الرهان، ويوفر الدعم الأمني والاستقراري للشبكة.

- برنامج الخزينة هو الواجهة الرئيسية التي يتفاعل معها المستخدمون، مسؤولة عن إدارة رموز إعادة الرهن السائلة (VRTs) وتنفيذ استراتيجيات إعادة الرهن الشخصية من خلال DAOs أو بروتوكولات مؤتمتة. يوفر برنامج الخزينة للمستخدمين مرونة، مما يتيح لهم اختيار أنسب خطة لإعادة الرهن بناءً على تفضيلاتهم مع الاستمتاع بفوائد الرموز السائلة.

في المرحلة الأولية ، يتعاون Jito Restaking مع ثلاثة مزودين لرموز Liquid Restaking Token (VRT): RenzoProtocol ($ezSOL) و Fragmetric ($fragSOL) و KyrosFi ($kySOL) ، مخصصين بشكل جماعي للحد الأولي لـ 147,000 SOL. يمكن للمستخدمين اختيار أحدهما من بين هؤلاء الثلاثة بناءً على تحمل المخاطر وتوقعات العائد لتحسين تجربة الرهن.

إدارة المخاطر: سيولة وآليات VRTs المختلفة تختلف. تتميز توكينات Renzo وKyros بسيولة أولية ومخاطر أقل، بينما تكون توكينات Fragmetric في البداية غير قابلة للتحويل، مما يؤدي إلى زيادة مخاطر السيولة.

العائد والتوزيعات المجانية: العائد السنوي المتوقع (APYs) لكل VRT مماثل، ولكن هناك اختلافات كبيرة في فرص التوزيع المجاني. لم يطلق Kyros و Fragmetric رموزهما بعد، لذا هناك المزيد من فرص التوزيع المجاني، بينما فرص توزيع رمز Renzo محدودة.

مقارنة مزود VRT (المصدر: جيتو)

مقدس

سانكتوم هو بروتوكول إعادة الرهن الابتكاري الذي يعزز كفاءة رأس المال والأمان على شبكة سولانا. يتيح للمستخدمين إعادة رهن الأصول السائلة المرهونة (مثل mSOL أو stSOL)، مما يتيح تحقيق عوائد تراكمية على أصولهم. يتيح هذا الآلية للمستخدمين مواصلة كسب المكافآت من الرهن الأصلي ويمكنهم توزيع العوائد الإضافية من خلال المشاركة في نظام سانكتوم.

إحدى النقاط البارزة في Sanctum هي Infinity، وهو بركة سائلة للرهان المتعددة الأصول (LST) تدعم التداول بين عدد غير محدود من LSTs المدرجة في القائمة البيضاء (مثل SOL، bSOL، الخ). يحدد السعر العادل لكل LST عن طريق حساب القيمة الفعلية ل SOL في حسابات الرهان، مما يقضي على الاعتماد على صيغ الإنتاج المستمر أو تبادل الاستقرار المستخدمة في برك السوائل التقليدية.

لتحسين العوائد، يقوم Infinity بضبط نسب التوزيع المستهدفة ورسوم الصرف بشكل ديناميكي لكل LST، مما يزيد من عائدات التداول ويحافظ على حيازات الأصول الدنيا. يتيح الرمز الأصلي INF توفير السيولة المشتركة ويمكن استخدامه في بروتوكولات DeFi، حيث تتكون مصادر العائد من مكافآت LST للرهان ورسوم المعاملات.

كيف يعمل

تعتمد عملية Sanctum على العمليات الرئيسية التالية:

- دعم الأصول المستندة إلى الحصة المتسائلة: يمكن للمستخدمين إيداع الرموز المستندة إلى الحصة المتسائلة التي تم الحصول عليها من بروتوكولات مثل ماريناد أو ليدو في Sanctum.

- آلية إعادة الرهن: يقوم Sanctum بتفويض هذه الرموز السيولية المرهونة إلى عقدة المحققين، مما يحقق إعادة الرهن.

- عوائد Compound: لا يكتسب المستخدمون فقط مكافآت الرهان الأساسية ولكنهم أيضًا يحققون عوائد إضافية من خلال آلية إعادة الرهان في Sanctum، مما يعزز استخدام الأصول.

- الأمان اللامركزي: توجه Sanctum مزيدًا من رؤوس الأموال المرهونة نحو عقدة الموثقين الخاصة بـ Solana، مما يعزز أمان الشبكة واللامركزية.

تعالج Sanctum نقطتي ألم في نماذج الرهان التقليدية: مشكلات سيولة الأصول وقيود تدفق العائد الواحد. من خلال إعادة الرهان، تقدم Sanctum حلاً مبتكرًا يزيد من فرص كسب المستخدمين ويضيف دفعًا جديدًا إلى أمان Solana وتطويرها اللامركزي.

استنتاج

إعادة التجديد على سولانا هي آلية مبتكرة لتعزيز كفاءة رأس المال وأمان الشبكة عن طريق إعادة استخدام أصول SOL المجازة بالفعل لدعم بروتوكولات متعددة أو تطبيقات مفتوحة المصدر (dApps). هذا المفهوم، الذي ظهر في الأصل في بيئة Ethereum، تم تبنيه تدريجياً من قبل منصات سلسلة الكتل عالية الأداء مثل سولانا، مما يوفر للمستخدمين والمطورين إمكانيات إدارة الأصول وفرص العائد المرنة أكثر.

مبدأ عمل إعادة الرهن ينطوي على إيداع SOL في مدير، وتحويله إلى رموز الرهن السائلة (LSTs أو LRTs)، وتحقيق توزيع الموارد الفعال من خلال حمامات الرهن المعقدة وشبكات الموثقين. يزيد هذا العملية من سيولة الأصول ويعزز استقرار الشبكة ومرونتها ضد المخاطر من خلال آليات الأمان المشتركة. علاوة على ذلك، يتم دمج إعادة الرهن مع تكنولوجيا الشريطة الجانبية، مما يعزز بشكل كبير قابلية تشغيل شبكة سولانا مع سلاسل كتل أخرى.

أتاح إدخال إعادة الوضع الطموح Solana ليس فقط التفوق في الأداء العالي ولكن أيضًا تقديم إمكانيات جديدة في استخدام رأس المال والتعاون البيئي. من خلال آليات الرهان الابتكارية والبنية التحتية اللامركزية ، يعزز إعادة الوضع الكفاءة الرأسمالية والأمان وتنوع البيئة البيئية لشبكة Solana. مع التطور التدريجي للبروتوكولات مثل Solayer و Cambrian و Jito ، فإن إعادة الوضع في Solana تمهد الطريق للمستخدمين والمطورين نحو مستقبل سلسلة الكتل الأكثر فتحًا وكفاءة وأمانًا.